- Home

- Software Modules

- HR & Payroll Module

- ERP Services

- Customers Support

- New Customer? The Starting Point

- Help – All Modules

- Help – HRMS & Payroll

- Important Information – Help

- Manage Employees – Help

- Leave Calculations – Help

- Absence Calculations – Help

- Loan Process – Help

- Addition \ Deduction – Help

- Air Ticket – Help

- EOS Calculations – Help

- Other Activities in HRMS – Help

- TimeSheet – Help

- Payroll – Help

- Setup – Help

- Post HRMS to Accounting – Help

- Manual of HRMS – Help

- Protect Your Data

- Remote Support

- QuickBooks integration Rules

- Certified Trainer \ Resellers

- Very Important Instructions

- Terms and Conditions

- Hinawi ERP Exams

- Accounting Module Exams

- Fixed Assets Module Exams

- Real Estate Module Exams

- School Module Exams

- Garage Module Exams

- HRMS Exams

- Leave Activity Exam

- Stop Release Activity Exam

- Loan Activity Exam

- Absence Activity Exam

- Absconded Activity Exam

- Addition Deduction Activity

- Air Ticket Activity Exam

- TimeSheet Activity Exam

- End of Service Activity Exam

- Comprehensive HRMS Exam

- Screenshot HRMS Exam

- Leave & Absence Calculation affecting in Payroll

- Leave & Absence Calculation – عربي

- Hinawi ERP Standard Exam

- Universities

- Special Offer

العربية

العربية

the Absence Calculations Help page

Setup

Feature setup is essential for setting the company’s regulations, arrangements, and control policy.

Before recording any operations, the user must set up the company file.

If these settings are not made, the customer may find that the results do not comply with its policies and need to re-enter its operations.

Therefore, settings are vital when using the software. It’s very important to understand this. The setup unit is the most important step and must be done before using the software.

Absence Calculations Help

Set the followings before starting using Absence.

- The monthly Salary calculation will be Absent days Amount deducted from Total Monthly Salary.

- Absent Days Amount will be calculated based on the Setup, Actual Month days OR Fixed 30 Days.

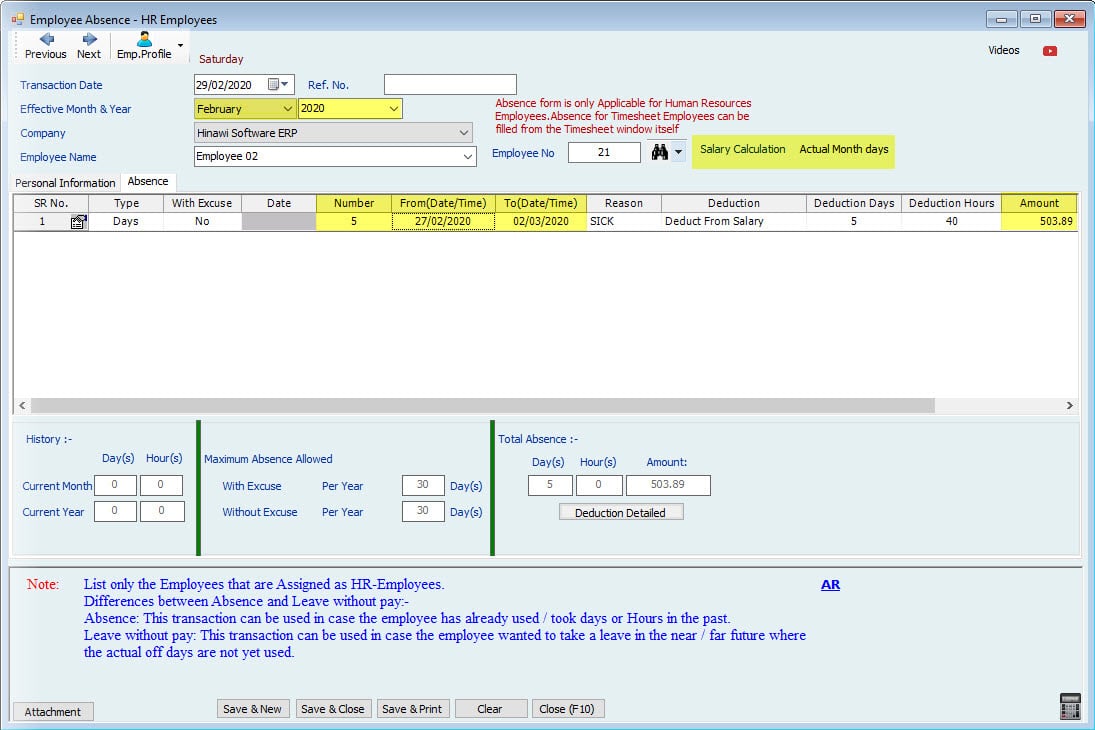

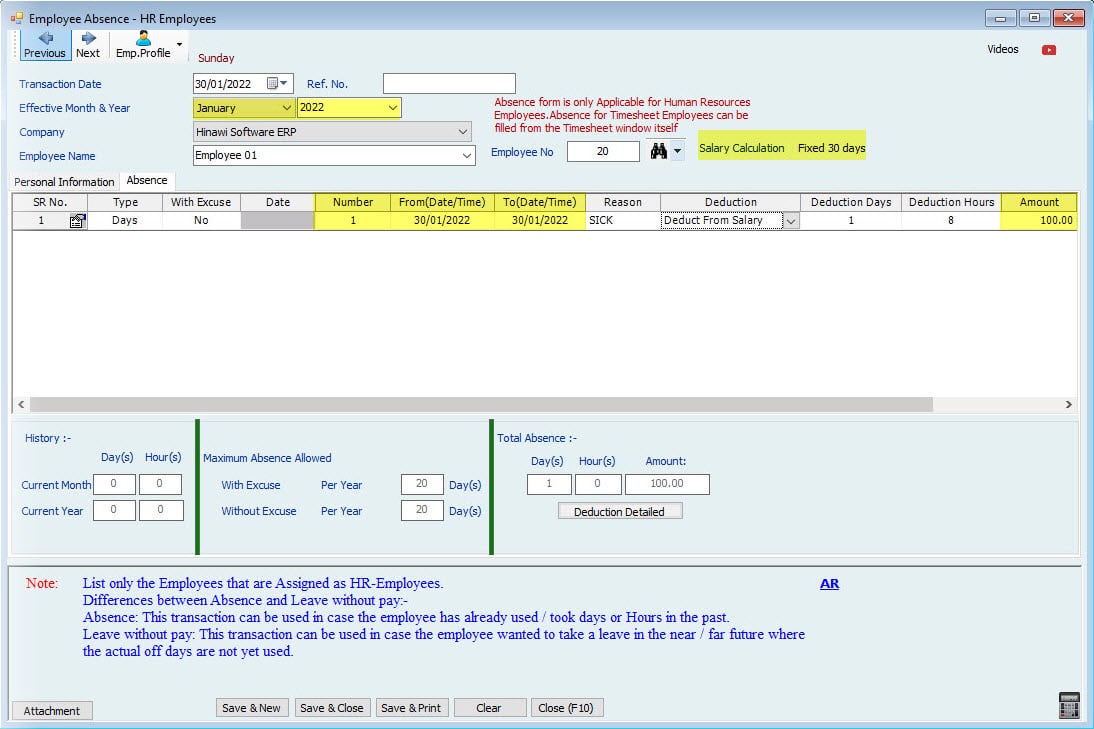

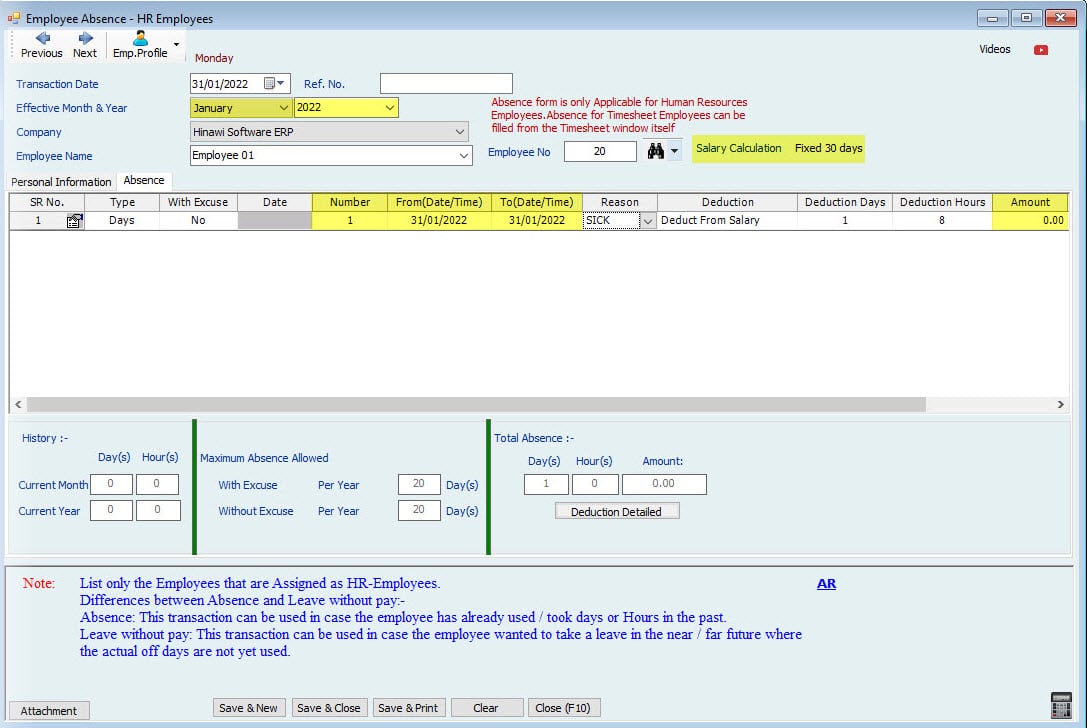

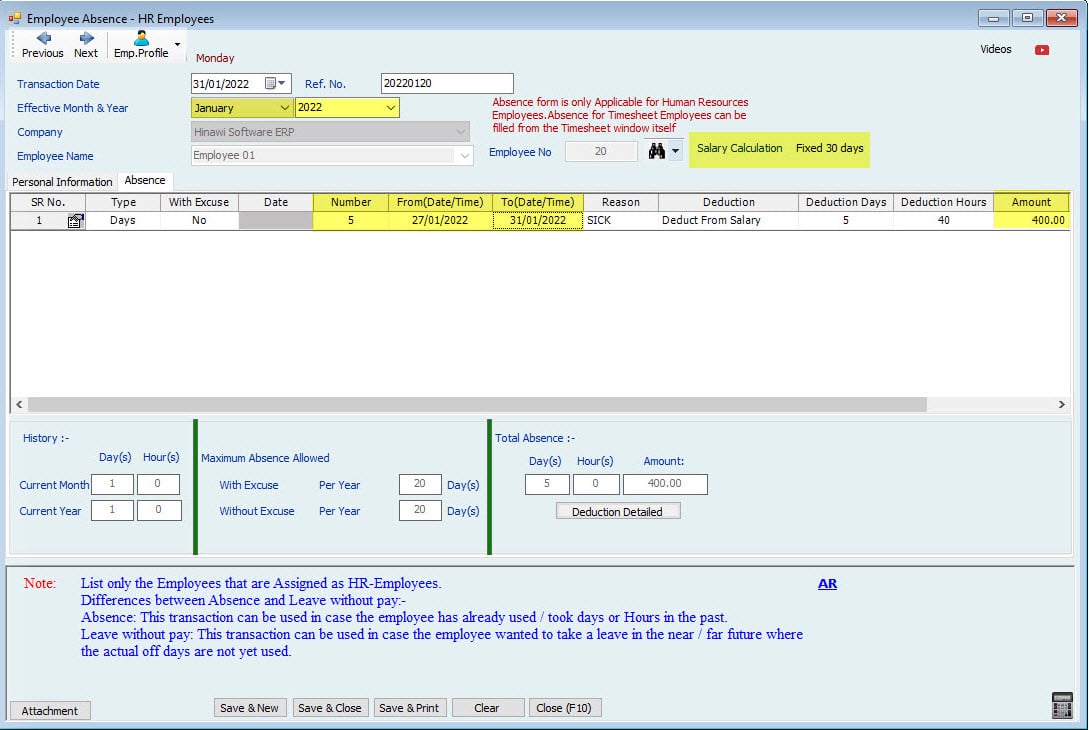

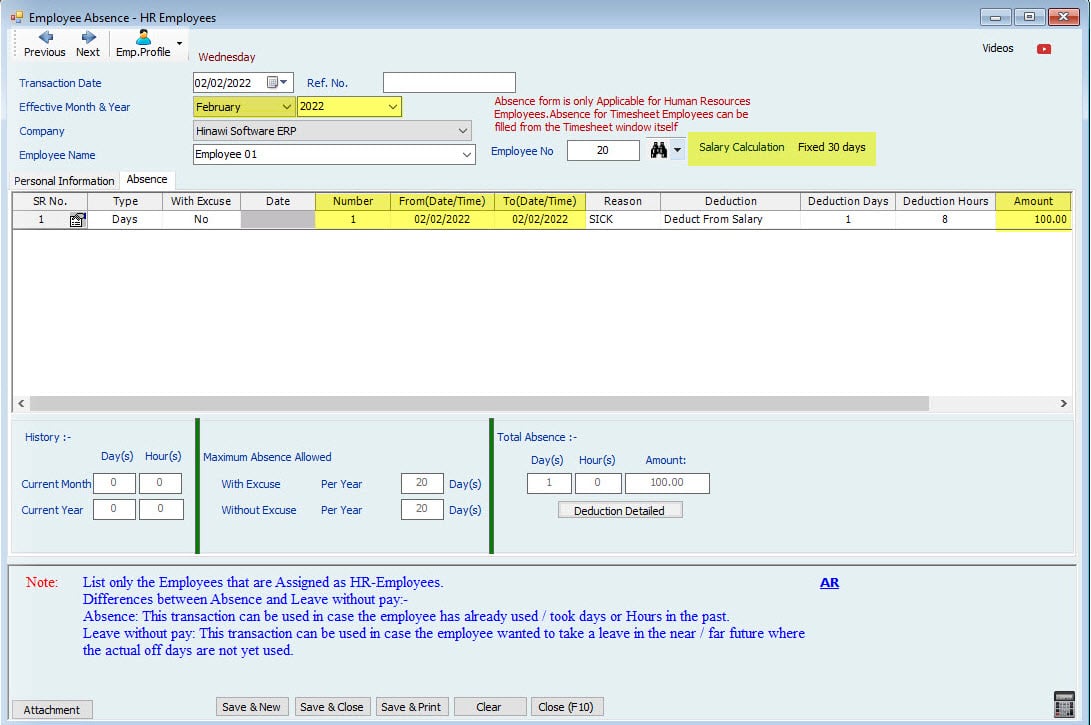

- The absence Salary will be deducted from the Effective month while creating an absence. E.g., suppose an Employee was absent from 29th Jan to 2nd Feb. In that case, this means that while making the Absence, if the effective month is selected as Feb, the absence Salary will be deducted from Feb Monthly Salary.

- The absent day’s Salary is deducted from the Effective month set while creating the Absence.

- When absent between 2 months, deduct the absence days Salary from the effective month.

- This applies only to HR Employees. Timesheet Employees create an Absence from Timesheet, deducting the Absence from the absence days Salary from the same month the Absence is made.

- When leave, Days will be deducted from Leave Balance Days.

| Salary Calculation Policy | ||||

| Employee Salary | Fixed 30 Days | Actual Month Days | 360 Days | 365 Days |

| Employee Salary: | Yes | Yes | X | X |

| Absence Amount: | Yes | Yes | X | X |

| Absence Days: | X | Yes | X | X |

| Leave Amount: | Yes | Yes | Yes | Yes |

| Leave Days: | Yes | Yes | X | X |

Note:

1. Leave Salary Calculation Basis is enabled only If the Salary calculation is Actual Month Days. When the Salary calculation is Fixed for 30 Days, this option is disabled.

2. If EOS is created for an Employee (resign or terminated), the remaining leave Salary and unpaid salaries will show in EOS for Calculate Actual Leave Days if Salary calculation is Fixed 30 Days:

e.g., If this option is checked, and an Employee takes a leave for 5 days on Feb 27, then the leave days will be 5 (27,28 & 1,2,3). If this option is not checked, the leave days calculated will be 7 (27, 28, 29, 30 & 1, 2, 3).

3. The absence Salary will be deducted from the Effective Month given while reading an absence. E.g., an Employee who was absent from 29th Jan to 2nd Feb. Therefore, while creating the absence, if the effective Month is selected as Feb, the absence day Salary will be deducted from Feb Monthly Salary.

4. Calculation of Leave Days (for all types of leaves) is always based on the ACTUAL MONTH DAYS.

Special Cases When:

1. Setup is based on a fixed 30 days. If an Employee were absent on Jan 31st, the leave would be deducted from Leave Days if the Setup is "Deduct from Leaves." An absent day Salary will be deducted if the Setup is "Deduct from Salary."

2. Setup is based on a fixed 30 days. If an Employee were absent on 28th Feb, the absent Salary would be deducted from the effective Month if the Setup is "deduct from Salary.".

3. An absence is created for an Employee, and the Setup type is deducted from:

Leaves → annual leaves, then deduct the leave days from the annual Leave Balance.

4. Setup is based on a fixed 30 days. If an Employee goes on leave on Jan 31st, the leave will be deducted from Annual Leave Days. But it will not be paid for that 1 day since it is fixed for 30 days.

5. Setup is based on a fixed 30 days. If an Employee goes for leave on the 28th, leaves will be deducted from Annual Leave Days. Salary is calculated for 27 working days + 1 day to leave Salary. For the next 2 days (29 and 30), the user must manually add Salary as a separate addition and deduction. And next Month's Salary (March) will be 30 Days and 2 days in the Addition column.

Important:

Changing between Basis of calculation:

When the user wants to change the Basis of calculation or anything else in SETUP, the activities like Leaves, absence, Salary sheet, and EOS must be approved before proceeding (if there will be no further changes on activities in the future.)

Note:

- We advise the user to approve all the activities (If there is no change later) before changing the Setup.

- We also advise users to create Salary sheets before proceeding with Setup changes. Also, to start doing changes in Setup after approving the Salary sheet.

- Activities approved before changing the policy (Setup) will remain the same and will not change after filling a new approach. I.e., There will be no effect on the calculation if there are changes between the 2 methods when activities and salaries are approved.

- The new calculation will affect the new activities reading from new changes in Setup.

- If the user wants to affect the new changes in activities created already, recreate the activities after changing the Company policy.

Exceptional:

- Calculate the First Month's Salary as Actual Days Worked:

If the Setup is fixed for 30 days and the Employee joining date is not 30, calculate the working days based on the actual Month.

Note:

By default, this option will be checked. We strongly recommend keeping this checked. e.g., Employee joined on 27/01, so total working days will be: 5 days and will be calculated as 5/30 X Total Salary.

The Employee joined on 27/02, so the total working days will be: 2 days and will be calculated as 2/30 X Total Salary.

- Include Employees in the Salary sheet who joined on or before t. This Month allows the user to include an Employee who joined the Company before the given date of the Month, and their Salary is generated in the Salary sheet.

e.g., If an Employee joins on the 20th of a month and we set the above to 22, he will be included in the Salary sheet for this Month.

- Show the Standard Salary Information in Salary Sheet Columns: If checked, the standard monthly Salary will only be seen on the Salary sheet.

- Allow to Edit Employee Salary Information even if the Salary sheet is approved: This option allows the user to change the Employee Salary Information even if the Salary Sheet is agreed upon. This option is added for employees whose salaries have increased after approving the Salary sheet. Therefore, the system allows these changes for history status purposes regarding Salary. This does not affect the Approved Salary Sheet. It will only affect the future Salary sheets.

Note:

Differences in the Salary for the previous period will be adjusted in the next Salary sheets.

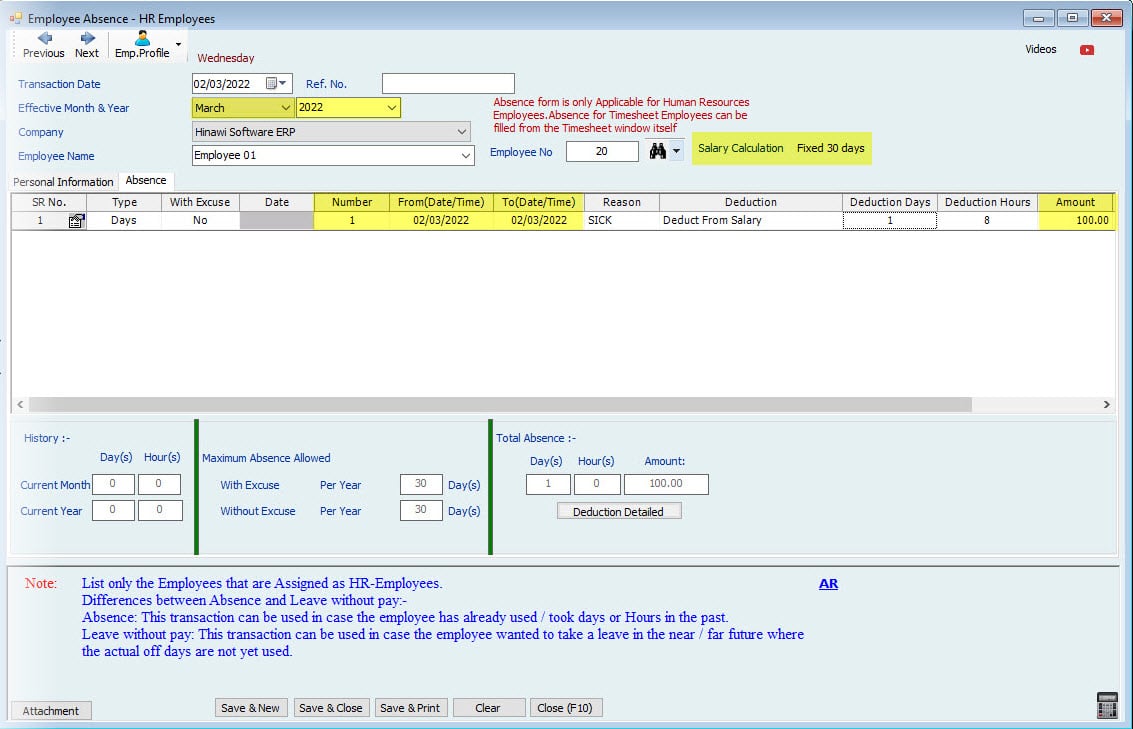

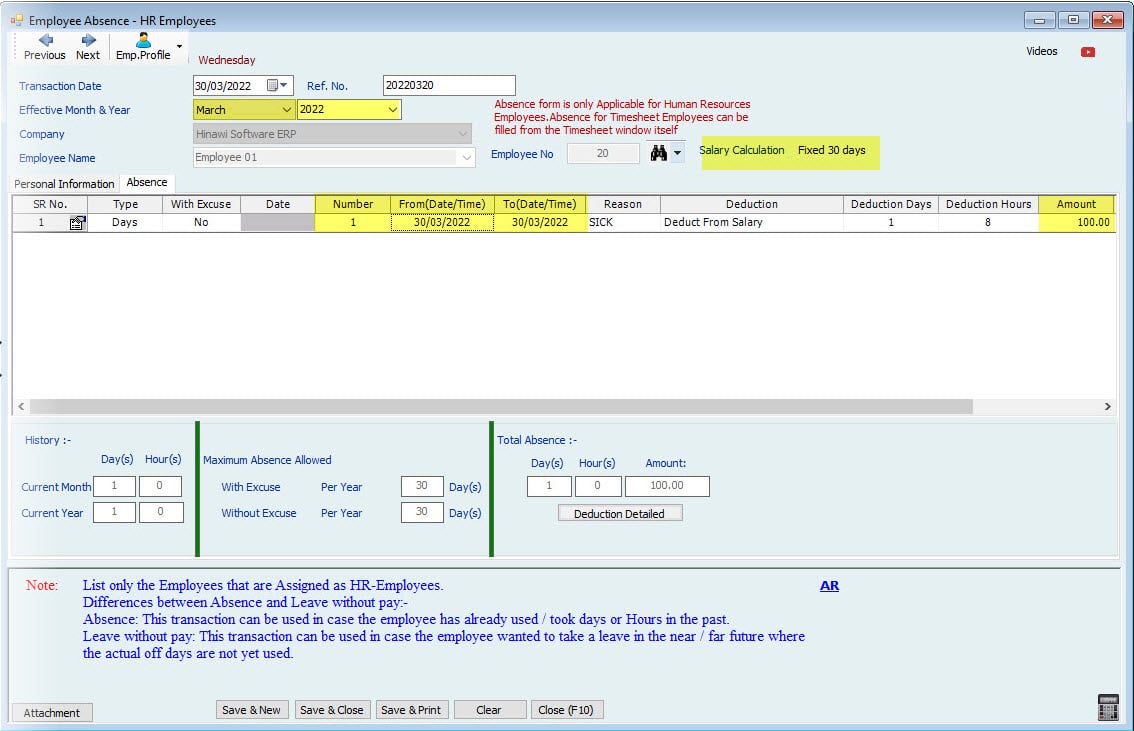

The absence Salary will be deducted from the Effective Month while creating an absence.

E.g., if an Employee was absent from 29th Jan to 2nd Feb., this means that while creating the absence, if the effective Month is selected as Feb, then the absence Salary will be deducted from Feb Monthly Salary.

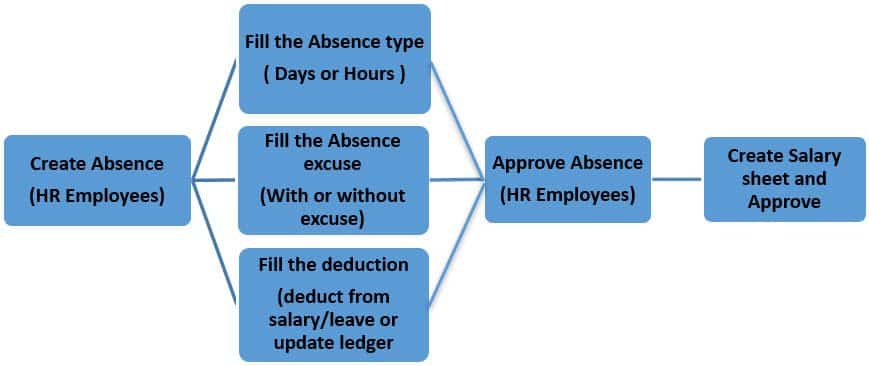

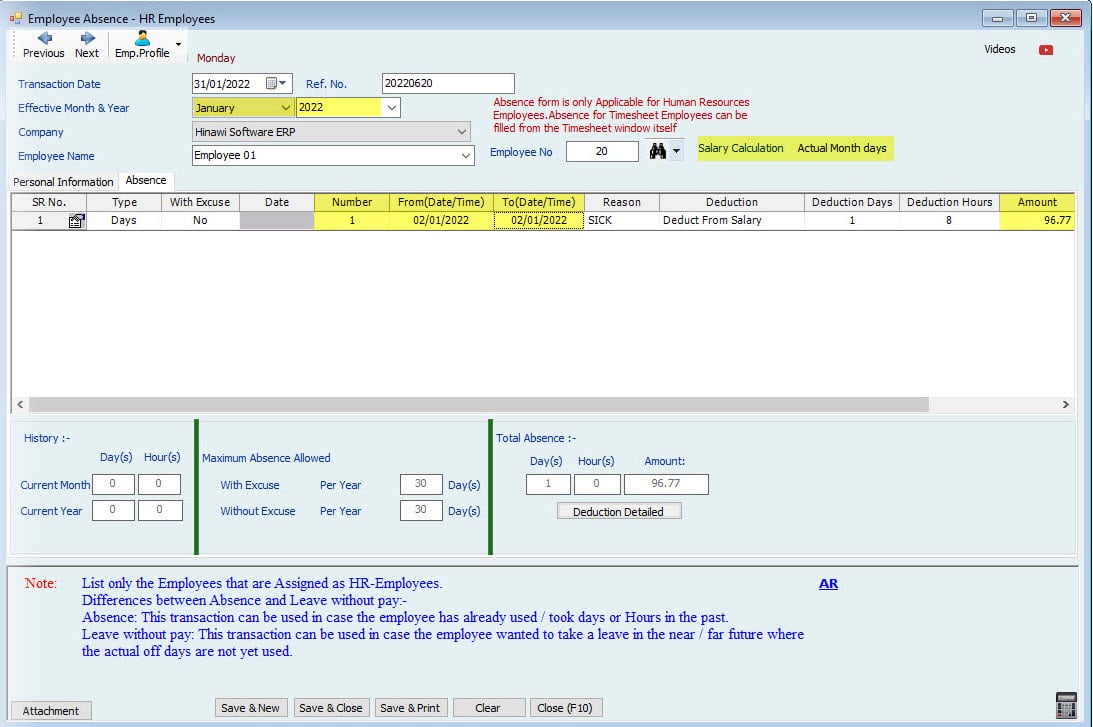

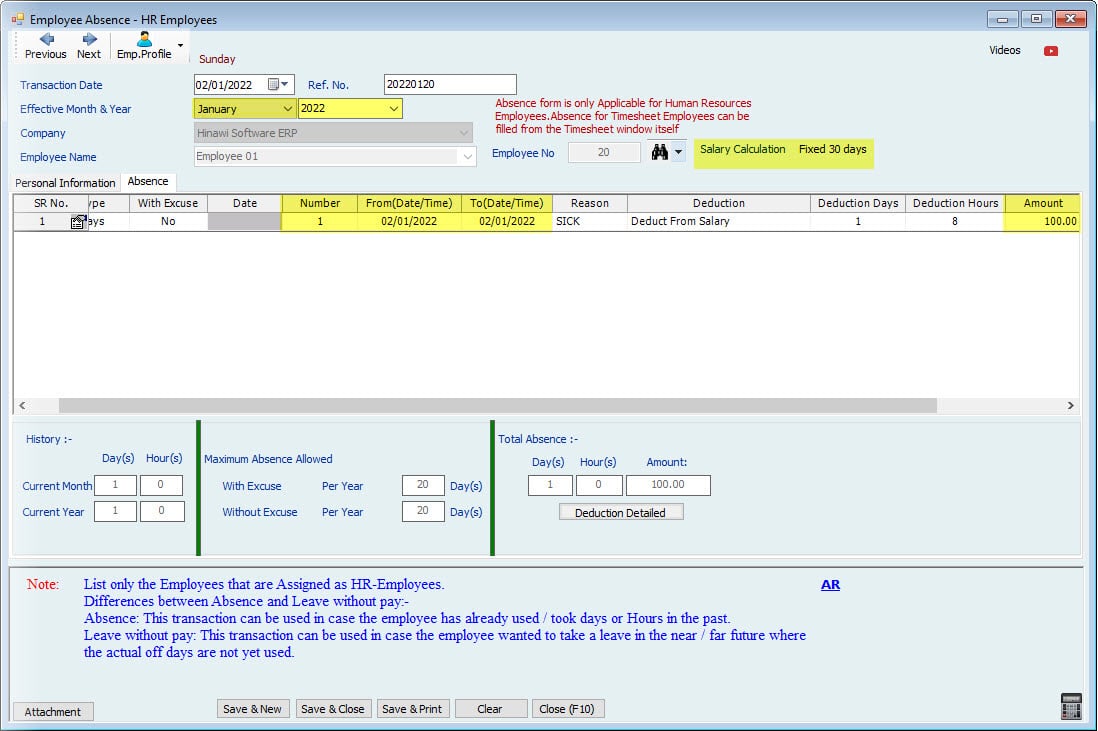

Absence Work Process for HR and Time Sheet Employees.

Kindly go to HRMS Activities Menu, then select Absence.

Activity | HR | Time Sheet Employees | Note |

Create Absence- HR Employees | Yes | Absence should be filled in the Time Sheet Form itself. | An Employee's Absence can always be deducted from the Salary Sheet for both HR and Timesheet. There is no Setup of Absence for Time Sheet Employees. |

Edit Absence- HR Employees | |||

Approve Absence- HR Employees | |||

Edit delete Absence After Approval |

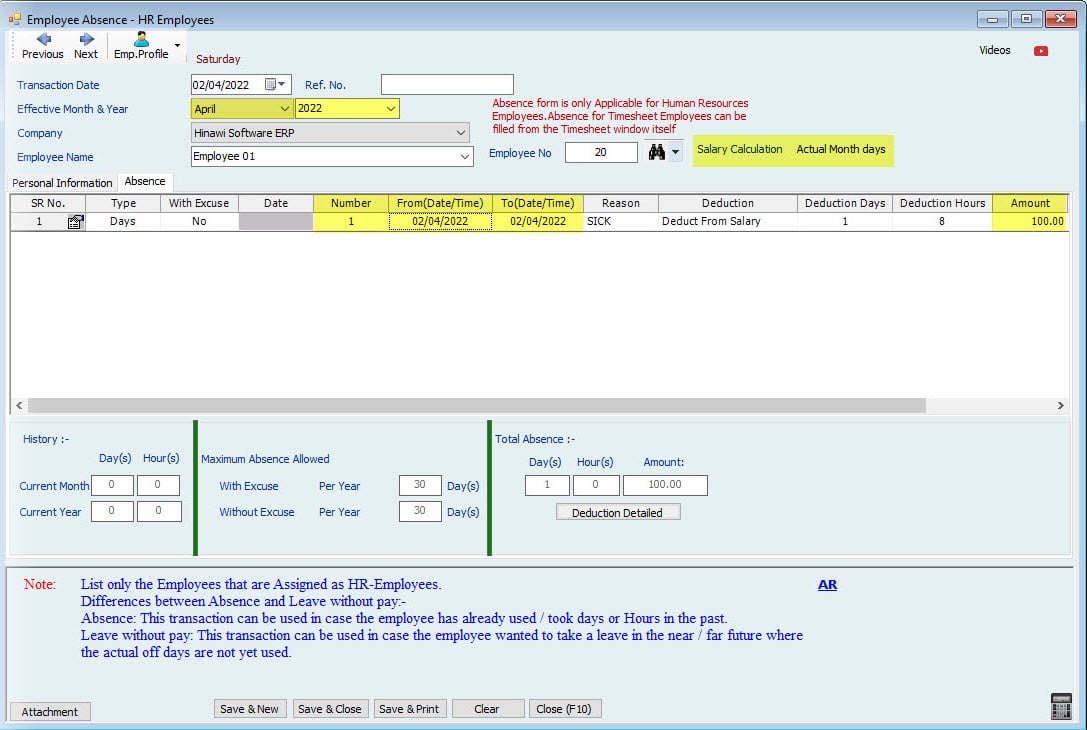

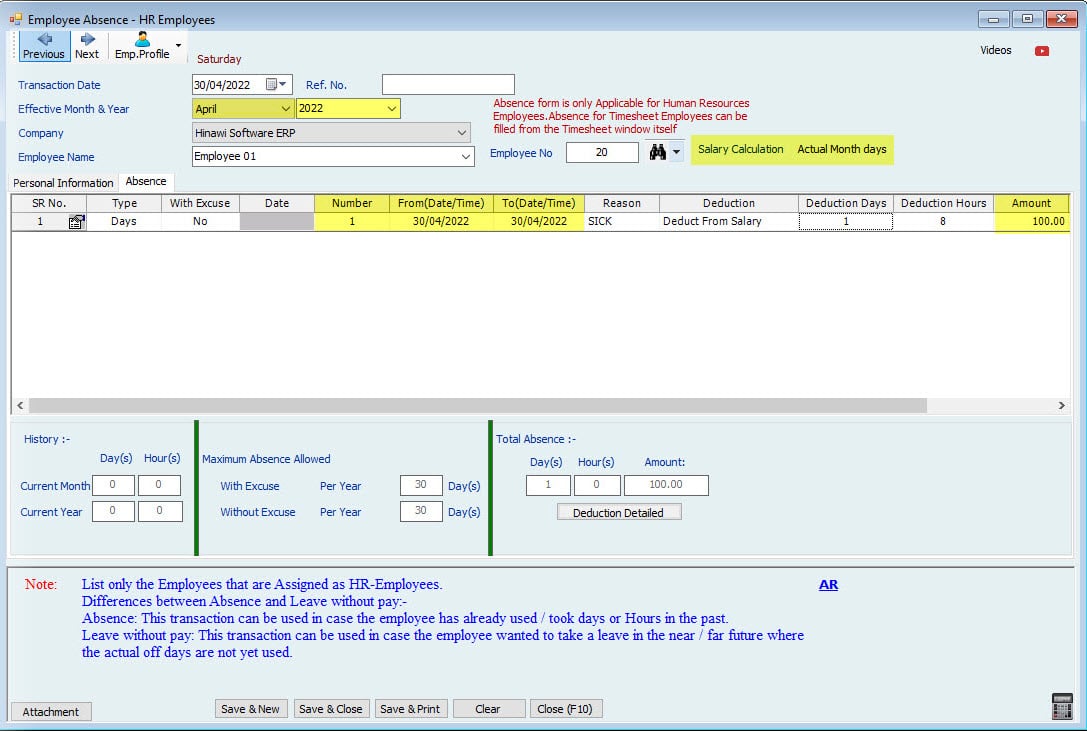

- Absence Process for HR Employees:

E.g., If Employee absence starts from the 4th of the month, the process will be:-

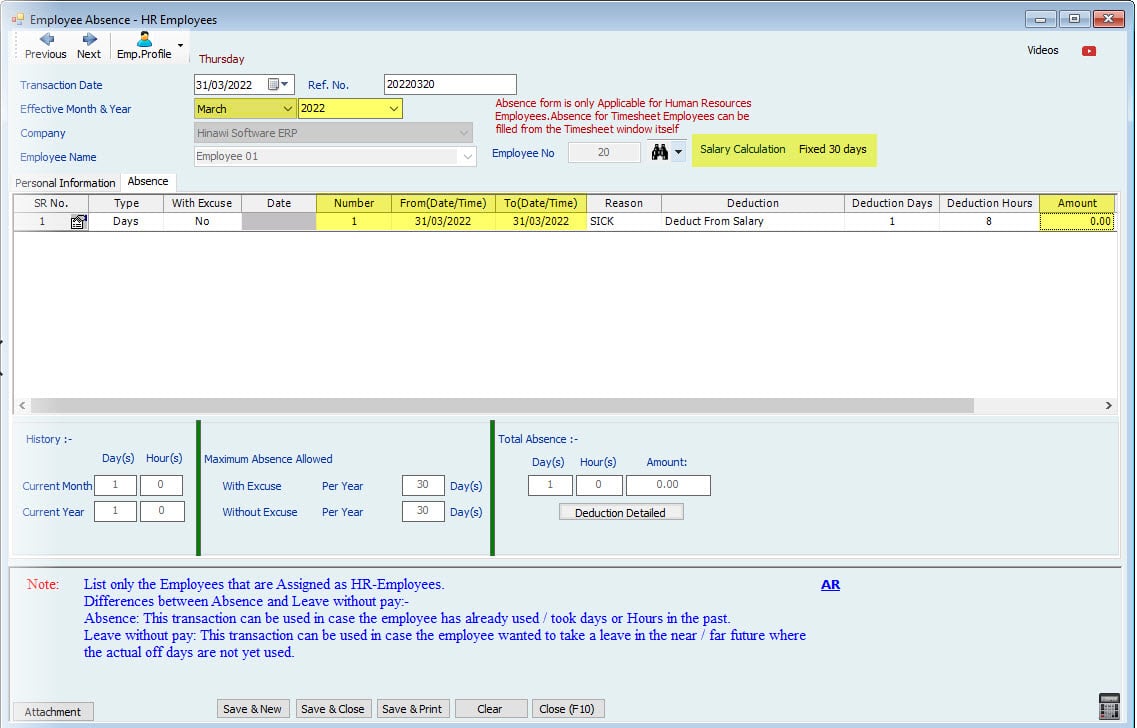

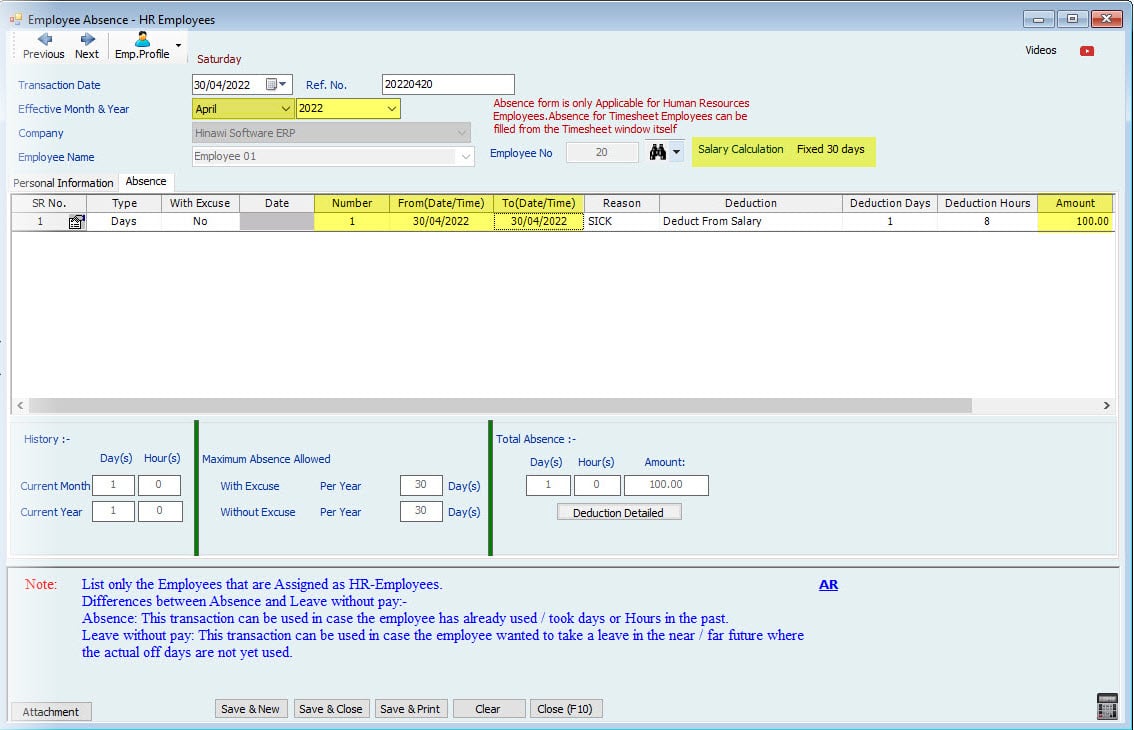

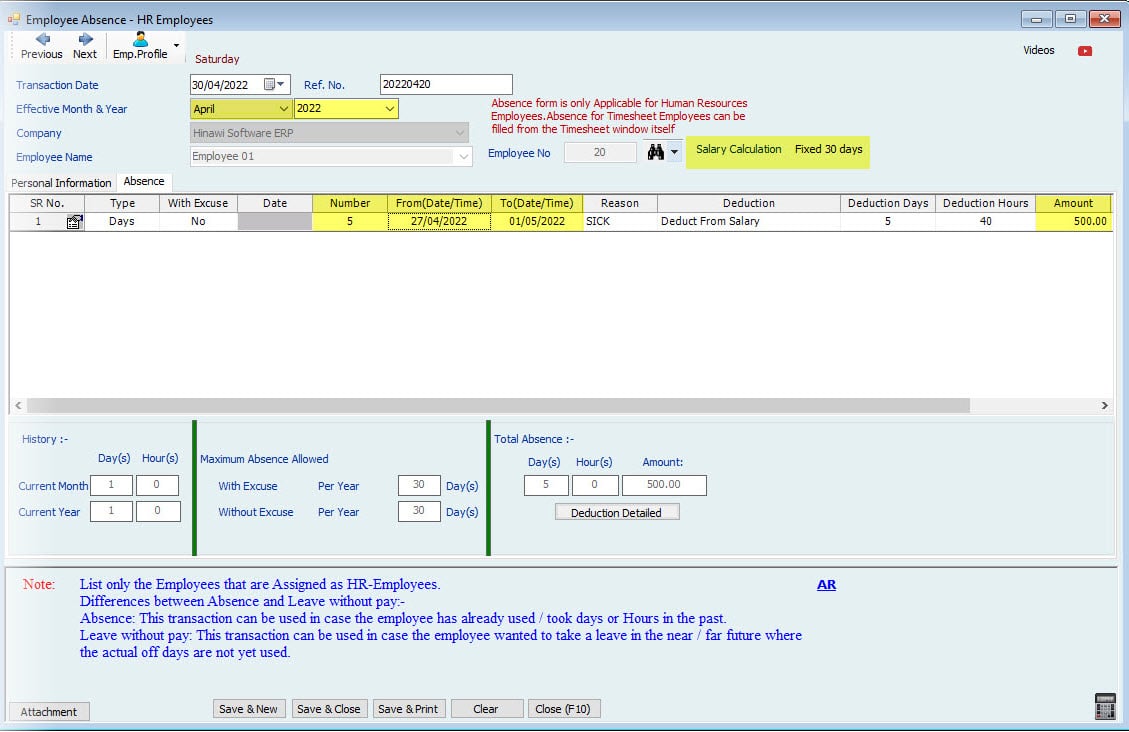

- Create Absence- HR Employees:

Create the Absence in the Absence form for the HR Employees.

- Fill in the Absence type (Days or Hours):

Fill in the Absence type (E.g., If Employee is absent for 1 or 2 days, special days, and if Employee is absent for a few hours, choose hours).

- Fill in the Absence excuse (With or without excuse):

Fill the Absence Excuse User can select an option Yes/No to set whether he has an excuse for the Absence.

- Fill in the deduction (deduct from Salary / Leave or Update Ledger):

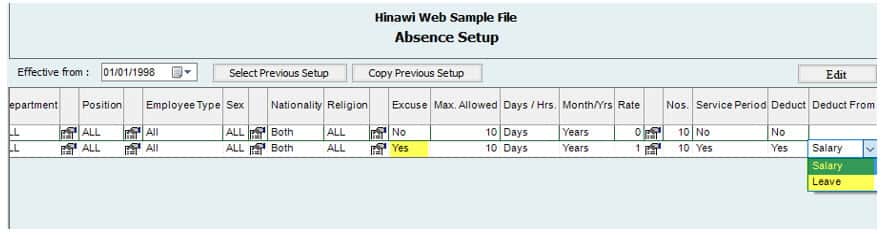

Fill the deduction (E.g., If the User selected deduct from Salary/Leave so, the Salary or leave will be deducted for the Absence reading from the Pre-define Setup of the Absence in the Absence Setting. But if the User selected only Update Ledger, only absence days will be deducted, without affecting Leave and Salary. Below is the screenshot for the Absence Set up;

Edit/ Delete Absence – HR Employees:

This option allows the User to edit or Delete the Absence after saving.

Approve Absence- HR Employees:

After Creating the Absence, save the Absence form and Approve.

Edit/ Delete Absence after Approval :

The User can edit or Delete the Absence after Approval using this option.

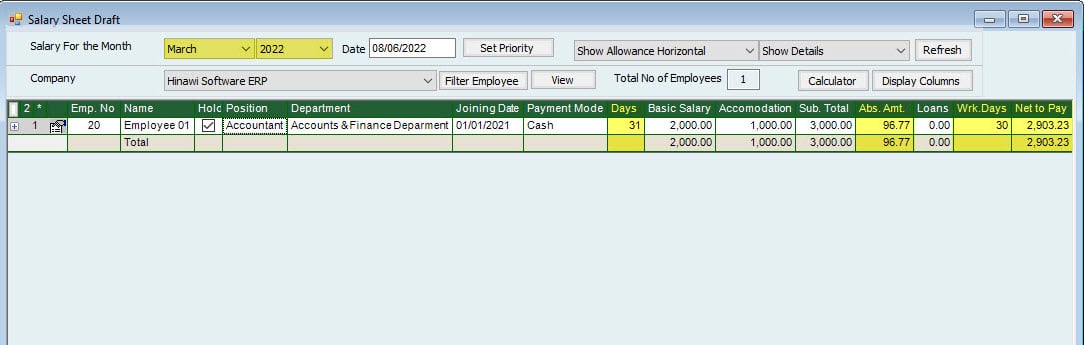

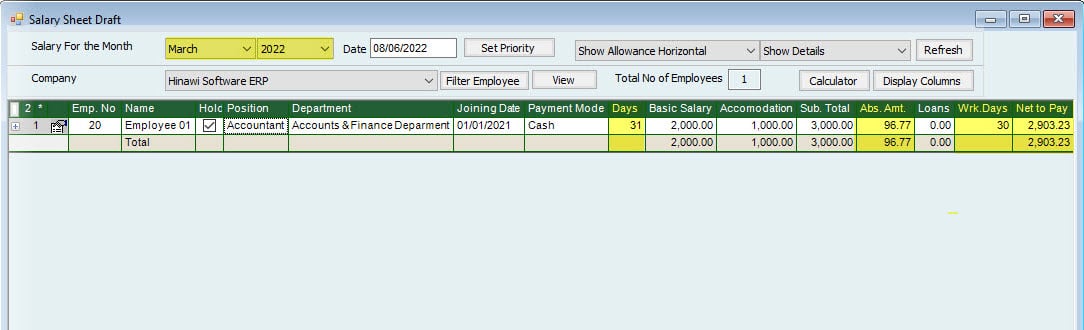

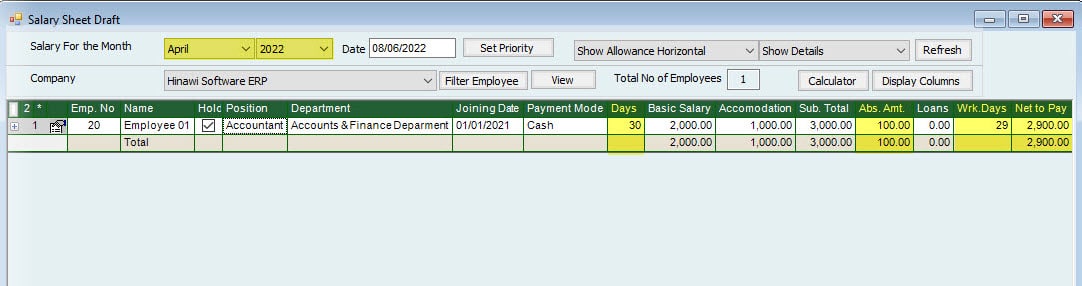

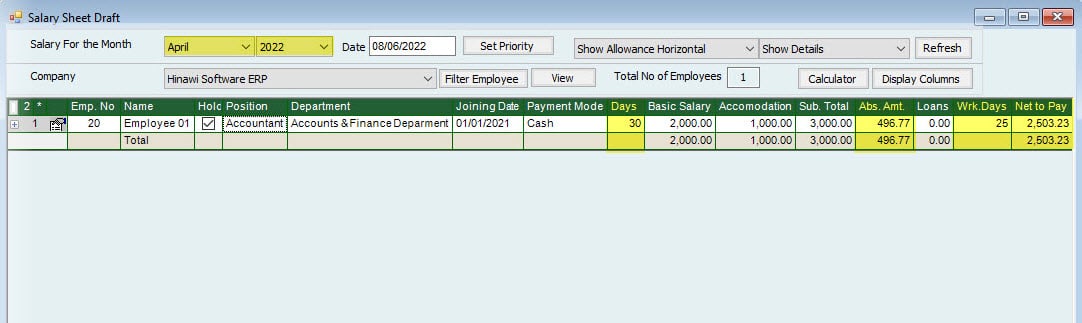

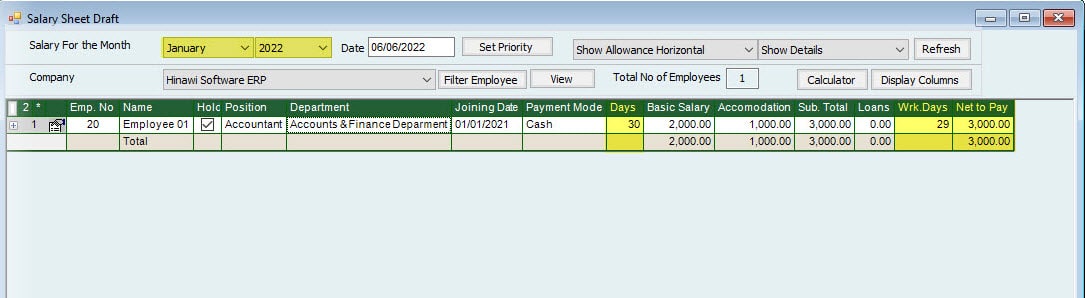

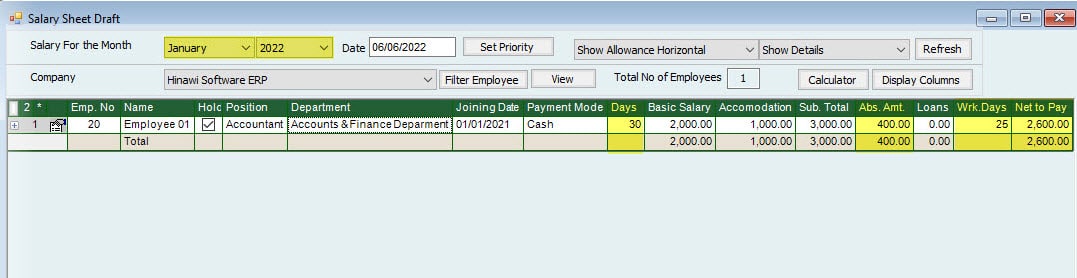

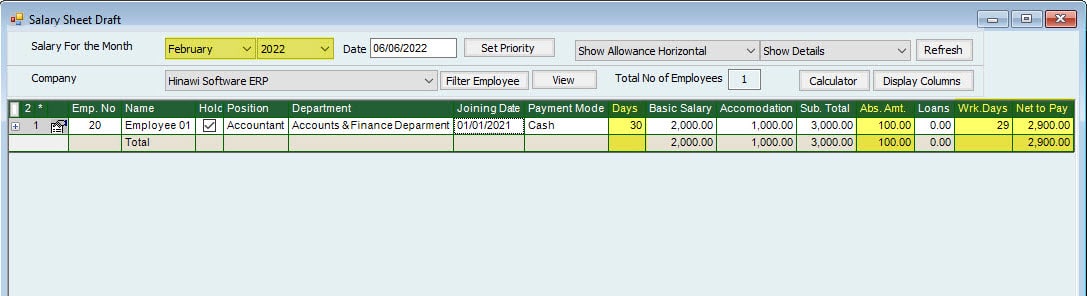

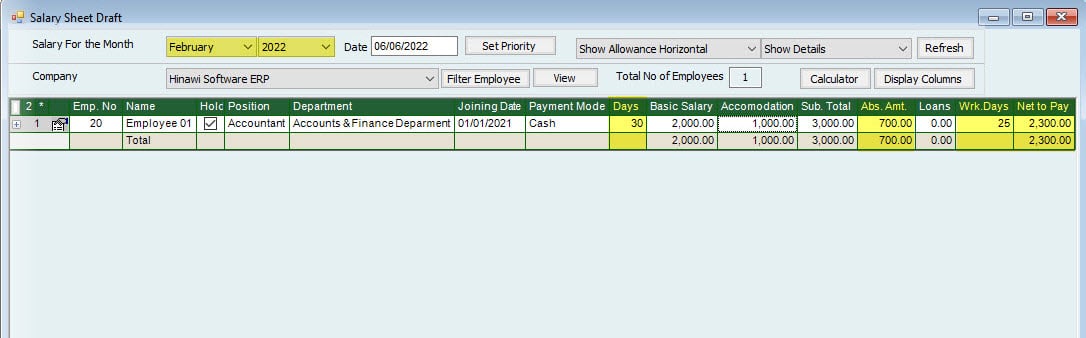

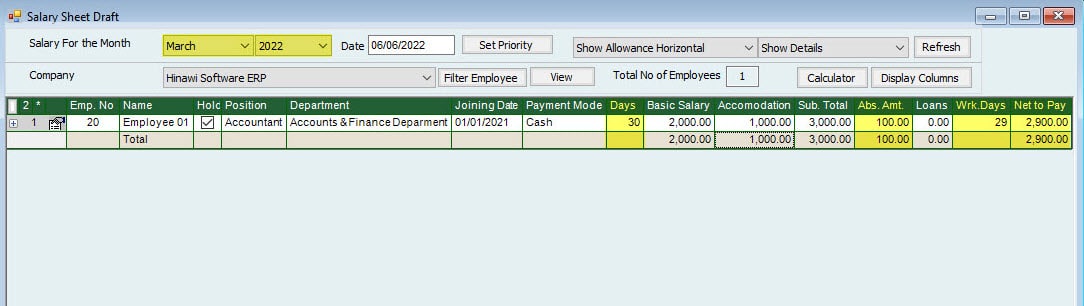

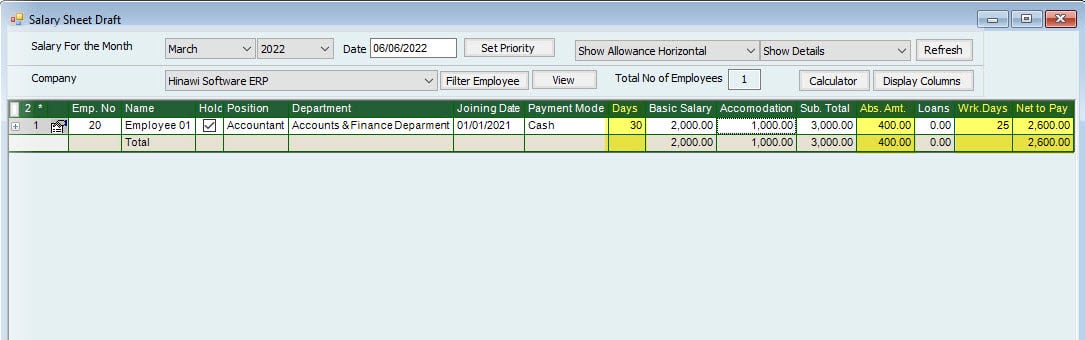

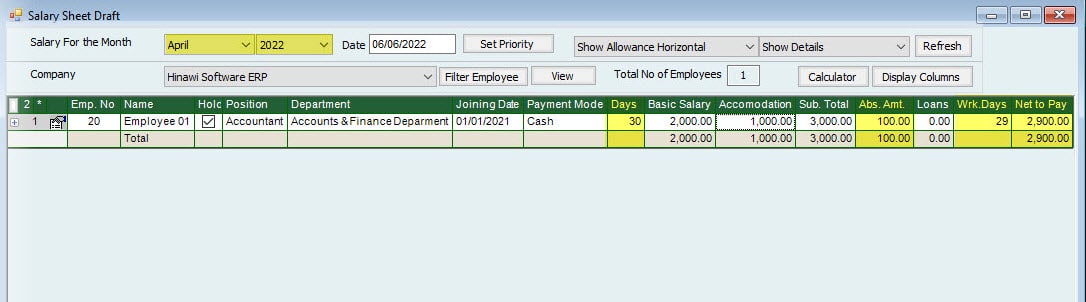

Create Salary sheet and Approve:

After approval of Absence, go to Payroll and create a Salary sheet for HR Employees; in the Salary sheet, deduction of absence days will be shown reading from the create Absence Form, then approve the Salary sheet.

Note:

In the Absence Setup, if the Setup is with Excuse and Deduction is 'Deduct from Leave,' and then while creating Absence with Excuse, 'Deduct from Leave/Salary' so, in this case, System will deduct the leaves for the Absence reading from the Absence Setup and Vice Versa.

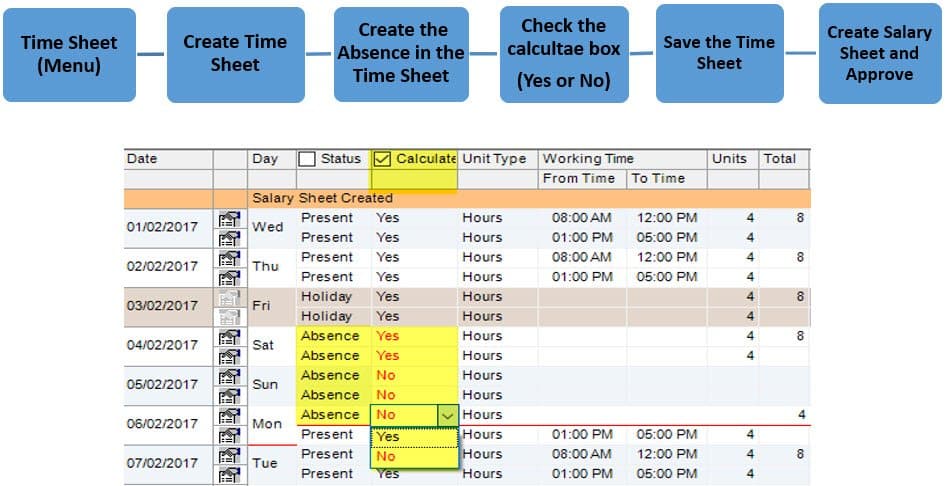

- Absence Process for Time Sheet Employees:

E.g., If an Employee is absent on the 4th of the month, the process will be

Create a Time Sheet:

Fill the Time Sheet for the Time Sheet Employees as usual. Then Create the Absence on the 4th of the month while creating the Time Sheet.

Check the calculate box (Yes or No):

When Absence is selected in the Timesheet, calculate will be set to 'No' by default.

Users can fill in the "Yes" or "No" option from the Calculate column.

If the Calculate option is "Yes," the Salary will not be deducted from the Salary Sheet. Absence days will be paid to the employees, and these Absence days will also not be affected the Total Service (Actual working days).

If the Calculate option is "No," Salary will be deducted from the Salary Sheet, and Absence days will also be deducted from the Absence Balance. These deducted Absence days will also affect the Total service (Actual Working Days).

Save the Time Sheet:

After filling in the Employee details in the Timesheet, save it.

Create Salary sheet and Approve:

Kindly go to Payroll and create a Salary sheet for the Time Sheet Employees. In the Salary sheet, the deduction of Absence days will be shown reading from the Timesheet.

Note:

For the Time Sheet Employees, there is no Setup of Absence. Whenever the User creates Absence for the Employee, it reads from the created Time Sheet.

Deduct from Salary | Deduct from Annual Leave Balance | Update Absence Ledger | ||||

Absence Ledger Amount | No | Yes | No | No | No | No |

Absence Ledger Days / Hours | Yes | Yes | Yes | Yes | Yes | Yes |

Salary Sheet Amount | No | Yes | No | No | No | No |

Salary Sheet Days / Hours | Yes | Yes | Yes | Yes | Yes | Yes |

Leave Ledger Amount | No | No | No | No | No | No |

Leave Ledger Days / Hours | No | No | No | No | No | No |

| Accounting Entries for Absence for HR Employees only. | Absence Summary Workflow | ||||

| A. Create Form | B. Approvals | C. Post to Accounting | D. Payments | Memo | |

| Create Absence | Create Absence is only for HR Employees. | Approval is required. | Post to Accounting will be done when Posting the Salary Sheet. | No Payments | Admin can make a Predefined Setup to link the Absence with the Chart of Accounts. |

| Absence Accounting Details | |||||

| A. Create Form | B & C: Accounting Entries on Approvals | Menu Location | D. Payment | Menu Location | Memo |

| Absence | Approval is a must. There is no absence to be posted to accounting, but the Post to Accounting will display only the actual working days after deducting the absence days. | Go to: HRMS Activities >>>> Absence >>>> create then Approve it. | No collection of Absence. | - | There are no accounting entries for Absence because the System is calculating and displaying only the actual working day's Salary. |

Month is Actual Month Days

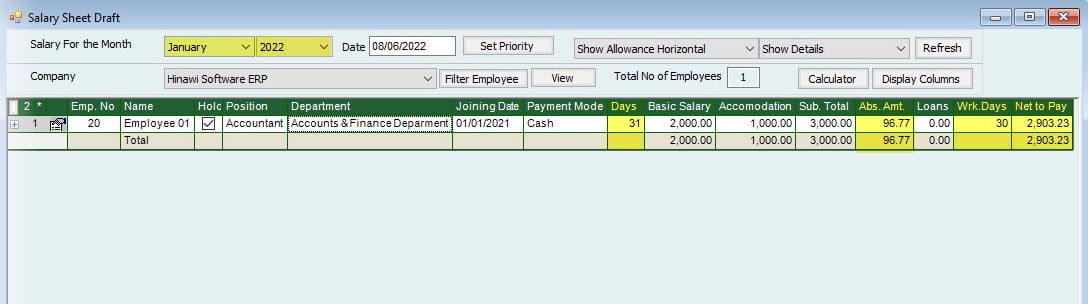

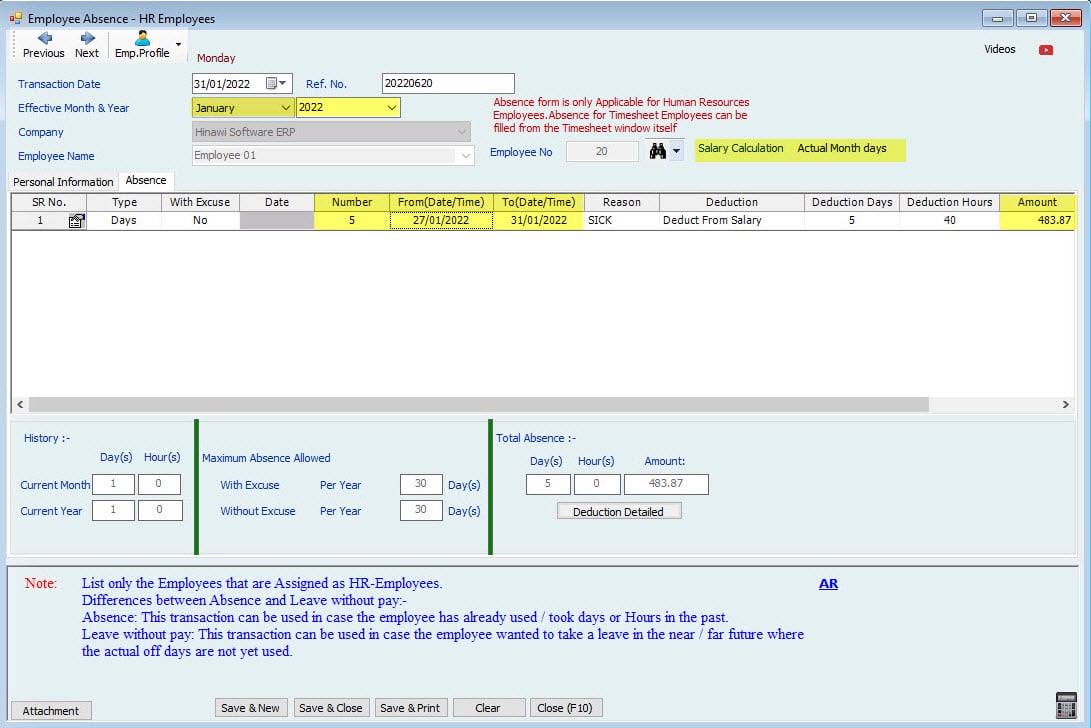

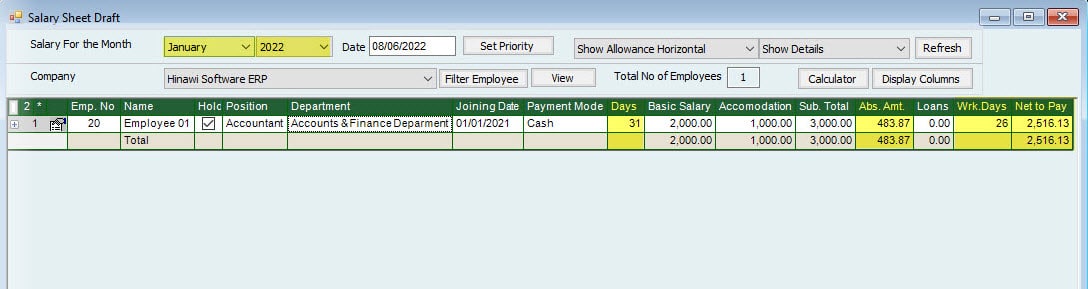

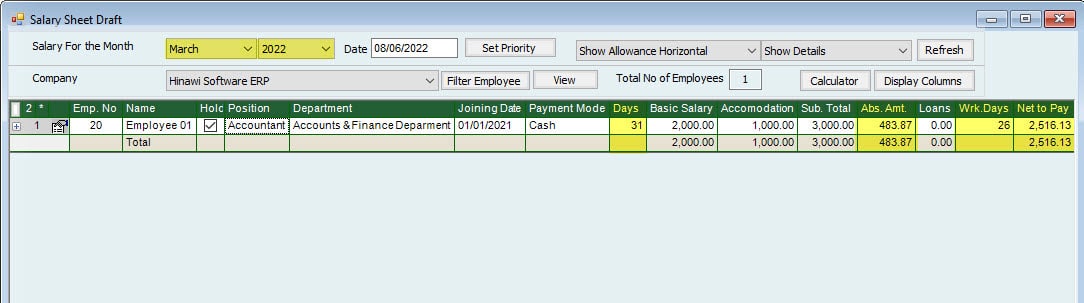

Absence Calculation Setup is: (Month is Actual Month Days - Recommended). January Example.

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 31 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will Show in the Absence Ledger report and be deducted from the total Service Period. | |

| Description | Days are: January 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 1 | 5 | ||

| Description | One Day only | One Day only | One Day only days | Days are: January 27+28+29+30+31 | ||

| Absence Amount | Total Salary / 31 X Absence days | 96.77 | 96.77 | 96.77 | 483.87 | The Absence amount will be lower if the month is 31 days. |

| Net Salary Amount | Total Salary Minus Absence Amount | 2903.23 | 2903.23 | 2903.23 | 2516.13 | |

Note:

If the Absence is 10 days, the system will calculate the 5 Days in January as (3000 / 31 * 5) and 5 days in February as (3000 / (28 or 29) * 5) = 1,019.58 in case of the non-leap year and 1,001.11 in case of leap year.

The monthly Salary calculation will be Absent days Amount deducted from Total Monthly Salary.

This applies to only HR Employees. Timesheet Employees create Absence from Timesheet, deducting the absence days Salary from the same month where Absence is created. The absent Day's Salary is deducted from the Effective month set while creating the Absence. When the Absence is between 2 months, the system will deduct the absence days Salary from the effective month.

If the Absence Days are more than 30 days, Creating Leave without pay or Split the Absence by month wise is recommended.

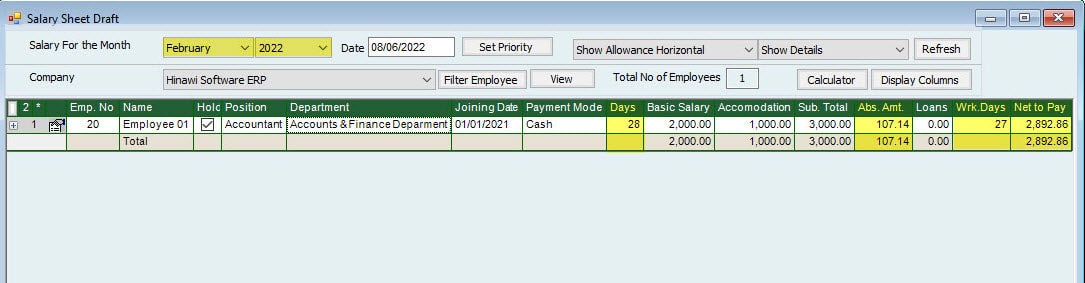

Absence Calculation Setup is: (Month is Actual Month Days)

February - The month is 28 Days (None Leap Year)

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 28) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 28 | |||||

| Actual Absence Days. | 1 | N/A | 1 | 5 | This will Show in the Absence Ledger report and be deducted from the total Service Period. | |

| Description | The days are: February: 27+28 March: 1+2+3 | |||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 5 | Days will be Split into 2 Months | |

| 2 | 2 Days in February | |||||

| 3 | 3 Days in March | |||||

| Description | One Day only | _ | One Day only days | The days are: February 27+28 March: 1+2+3 | ||

| 214.29 | Calculation of Absence Amount for February. | |||||

| 290.32 | Calculation of Absence Amount for March. | |||||

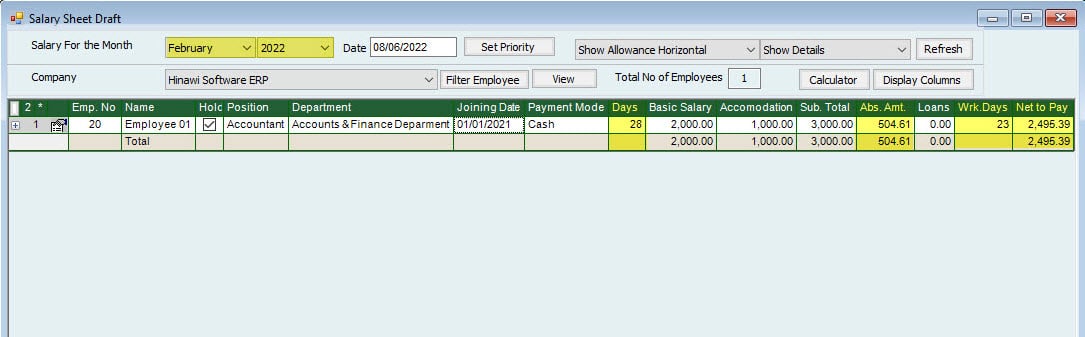

| Absence Amount | Total Salary / 28 X Absence days | 107.14 | 0 | 107.14 | 504.61 | The Absence amount will be higher if the month is 28 days. |

| Net Salary Amount | Total Salary Less Absence Amount | 2892.86 | 3000.00 | 2892.86 | 2495.39. | |

Note:

If the Absence is 10 days, the system will calculate the 2 Days in February as (3000 / 28 * 2) and 8 days in March as (3000 / 31 * 8) = 988.47

Note:

The monthly Salary calculation will be Absent days Amount deducted from Total Monthly Salary. This is applicable applies to only HR Employees. Timesheet Employees create Absence from Timesheet, which will remove the absence days Salary from the same month where Absence is created. The absent Day's Salary is deducted from the Effective month set while creating the Absence when the Absence is between 2 months; the system will deduct the absence days Salary from the effective month. If the Absence Days are more than 30 days, It is recommended to create Leave without pay or Split the Absence month-wise

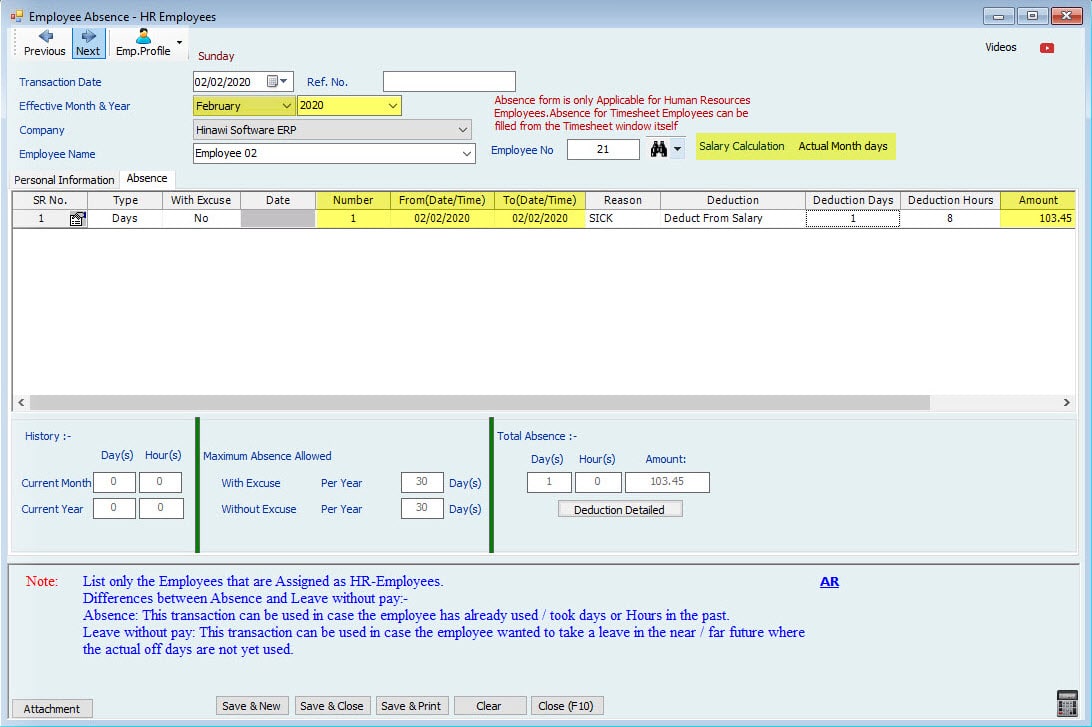

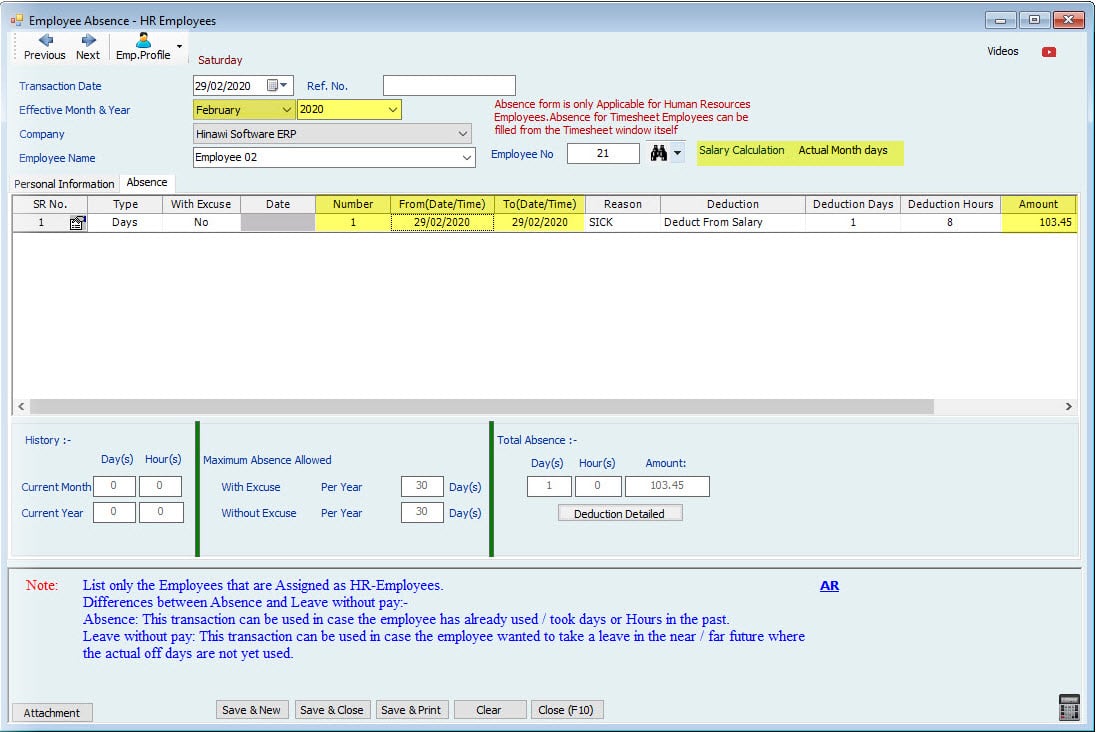

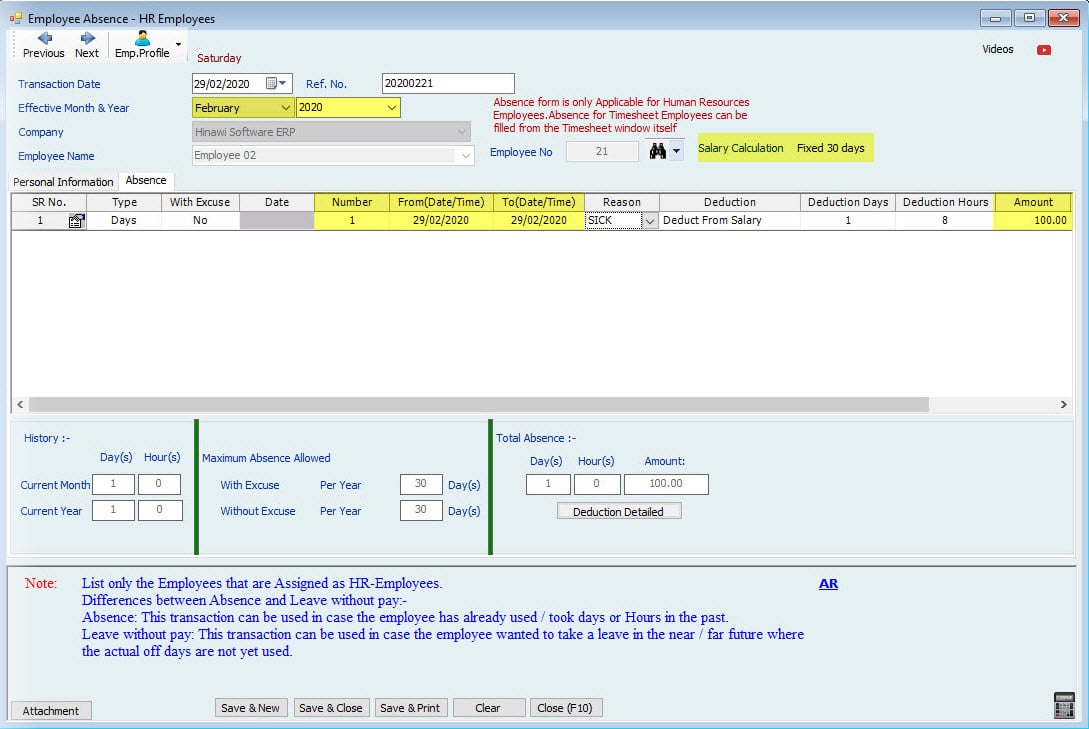

Absence Calculation Setup is: (Month is Actual Month Days).

February - The month is 29 Days (Leap Year).

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 29) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 29 | |||||

| Actual Absence Days. | 1 | N/A | 1 | 5 | This will Show in the Absence Ledger report and be deducted from the total Service Period. | |

| Description | The days are: February 27+28+29 March: 1+2 | |||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 5 | Days will be Split into 2 Months | |

| 3 | 3 Days in February | |||||

| 2 | 2 Days in March | |||||

| Description | One Day only | _ | One Day only days days | The days are: February 27+28+29 March: 1+2 | ||

| 310.34 | Calculation of Absence Amount for February. | |||||

| 193.55 | Calculation of Absence Amount for March. | |||||

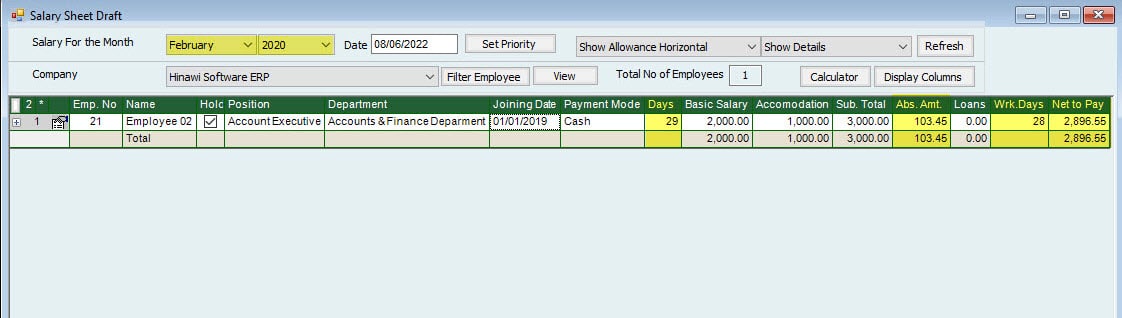

| Absence Amount | Total Salary / 29 X Absence days | 103.45 | 0.00 | 103.45 | 503.89 | The absence amount in February is higher than in other months. |

| Net Salary Amount | Total Salary Less Absence Amount | 2896.55 | 3000.00 | 2896.55 | 2496.11. | |

Note:

If the Absence is 10 days, the system will calculate the 3 Days in February as (3000 / 29 * 3) and 7 days in March as (3000 / 31 * 7) = 987.76

Note:

The monthly Salary calculation will be Absent days Amount deducted from Total Monthly Salary. This applies to only HR Employees. Timesheet Employees create Absence from Timesheet, which will remove the absence days Salary from the same month where Absence is created. The absent Day's pay is deducted from the Effective month set while making the Absence. When Absence is between 2 months, the system will remove the absence days Salary from the effective month. If the Absence Days are more than 30 days, Creating Leave without pay or Split the Absence by month wise is recommended.

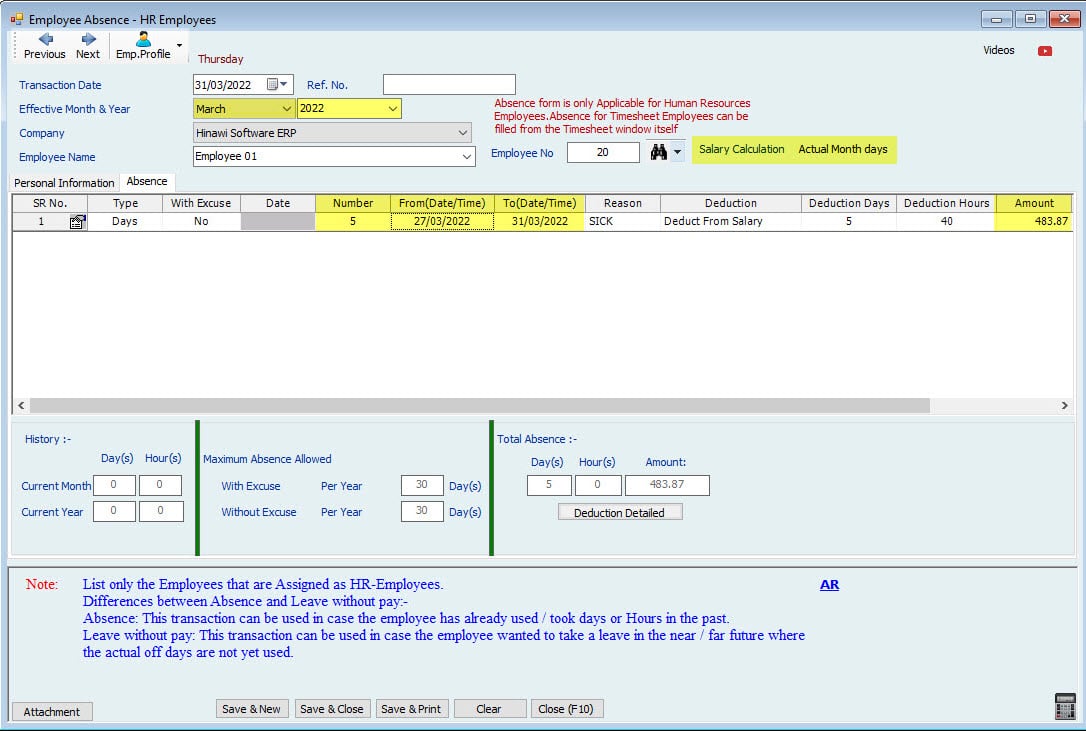

Absence Calculation Setup is:(Month is Actual Month Days).

March - The Month is 31 Days.

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 31 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will show in Absence Ledger Report and be deducted from the total Service Period. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 1 | 5 | ||

| Description | One Day online | One Day online | One Day only days days | Days are: March 27+28+29+30+31 | ||

| Absence Amount | Total Salary / 31 X Absence days | 96.77 | 96.77 | 96.77 | 483.87 | The Absence amount will be lower if the month is 31 days. |

| Net Salary Amount | Total Salary Less Absence Amount | 2903.23 | 2903.23 | 2903.23 | 2516.13. | |

Note:

If the Absence is 10 days, the system will calculate the 5 Days in March as (3000 / 31 * 5) and 5 days in April as (3000 / 30 * 5) = 983.87

Note:

The monthly Salary calculation will be Absent days Amount deducted from the Total Monthly Salary. This applies to only HR Employees. Timesheet Employees create Absence from Timesheet, deducting and removing the absence days Salary from the same month where Absence is created. The absent Day's salary is removed from the Effective month set while making the Absence. When the Absence is between 2 months, the system will remove the absence days Salary from the effective month. If the Absence Days are more than 30 days, It is recommended to create Leave without pay or Split the Absence month-wise

Absence Calculation (Month is Actual Month Days).

April - The month is 30 Days.

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | N/A | 5 | This will show in Absence Ledger Report and be deducted from the total Service Period. | |

| Description | The days are April 27+28+29+30 and May 1 Day. | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 5 | Days will be Split into 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Day in May | |||||

| Description | One Day online | One Day only April | April is 30 Days only days | Days in April are 27+28+29+30, and 1 Day in May. | ||

| 400.00 | Calculation of Absence Amount for April. | |||||

| 96.77 | Calculation of Absence Amount for May. (May is 31 Days). | |||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 496.77 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3000.00 | 2503.23 | |

Note:

The monthly Salary calculation will be Absent days Amount deducted from Total Monthly Salary. This applies to only HR Employees. Timesheet Employees create absence from Timesheet, deducting the absence days Salary from the same month where absence is created. The absent Day's Salary is deducted from the Effective month set while making the absence W. When the absence is between 2 months, the System will deduct the absence days Salary from the effective month. If the Absence Days are more than 30 days, Creating Leave without pay or Split the Absence by month wise is recommended.

Month is Fixed 30 Days

Absence Calculation Setup is: (Month is Fixed 30 Days).

January is 31 Days.

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will Show in Absence Ledger Report and be deducted from the total Service Period. | |

| Description | Days are: January 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 4 | ||

| Description | One Day online | One Day only days | Days days days after 30 will not be considered days days | Days are: 27+28+29+30 31 will not be calculated | ||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

Note:

If the Absence is 10 days, the system will calculate the 4 Days in January as (3000 / 30 * 4) and 5 days in February as (3000 / 30 * 5) [31 will not be calculated] = 900

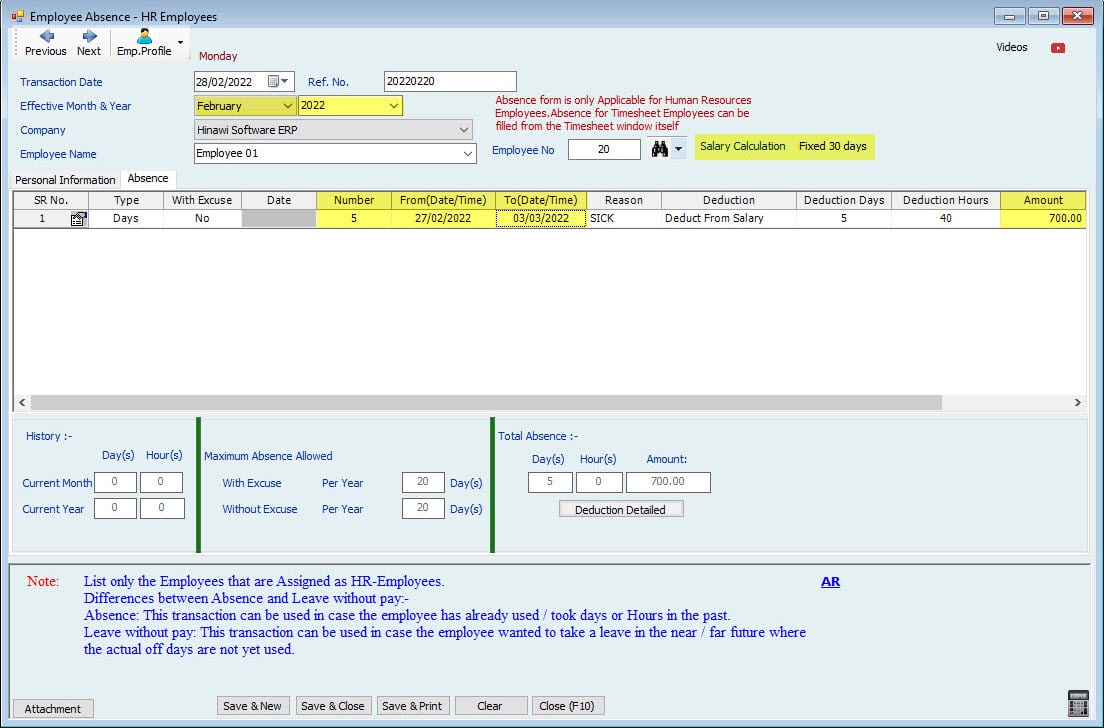

Absence Calculation Setup is: (Month is Fixed 30 Days).

February is 28 Days. None Leap Years

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 28) | 5 Days Absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | N/A | 1 | 5 | This will Show in Absence Ledger Report and be deducted from the total Service Period. | |

| Description | If the Absence is 2 days, then the deducted days will be 4 | The days are: February: 27+28 March: 1+2+3 | ||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 7 | The Absence Days will be more if the month is 28/29 days. | |

| 4 | 4 Days in February (27+28+29+30) | |||||

| 3 | 3 Days in March | |||||

| Description | One Day only | _ | One Day only days | Days are: February 27+28+29+30 March: 1+2+3 | ||

| 400 | Calculation of Absence Amount for February. | |||||

| 300 | Calculation of Absence Amount for March. | |||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 0.00 | 100.00 | 700.00 | The Absence Amount will be higher if the month is 28/29 days. |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 3000.00 | 2900.00 | 2300.00. | |

Note:

If the Absence is 10 days, the System will calculate the 4 Days in February as (3000 / 30 * 4) and 8 days in March as (3000 / 30 * 8) = 1,200

Absence Calculation Setup is: (Month is Fixed 30 Days).

February is 29 Days. Leap Year.

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 29) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | N/A | 1 | 5 | This will Show in Absence Ledger Report and be deducted from the total Service Period. | |

| Description | Days are: February: 27+28+29 March: 1+2 | |||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 6 | Days will be Split into 2 Months | |

| 4 | 4 Days in February (27+28+29+30) | |||||

| 2 | 2 Days in March | |||||

| Description | One Day only | _ | One Day only days days | Days are: February 27+28+29+30 March: 1+2 | ||

| 400 | ||||||

| 200 | ||||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 0.00 | 100.00 | 600.00 | The Absence amount will be higher if the month is 28/29 days. |

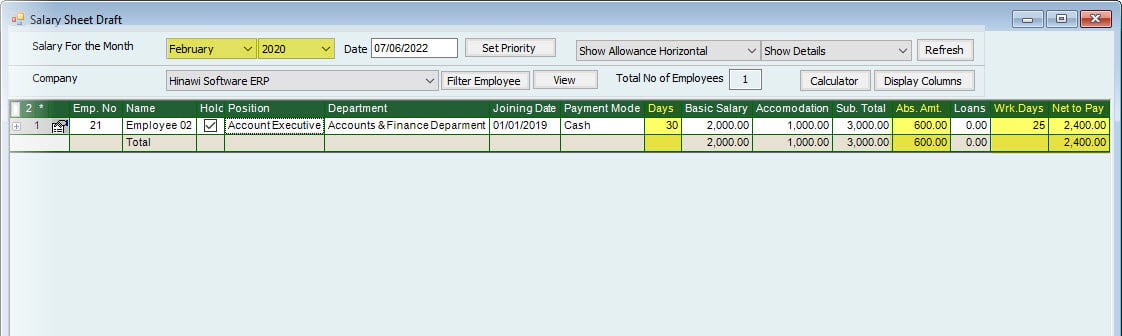

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 3000.00 | 2900.00 | 2400.00 | |

| Note: If the Absence is 10 days, the system will calculate the 4 Days in February as (3000 / 30 * 4) and 7 days in March as (3000 / 30 * 7) = 1,100 |

Note:

If the Absence is 10 days, the system will calculate the 4 Days in February as (3000 / 30 * 4) and 7 days in March as (3000 / 30 * 7) = 1,100

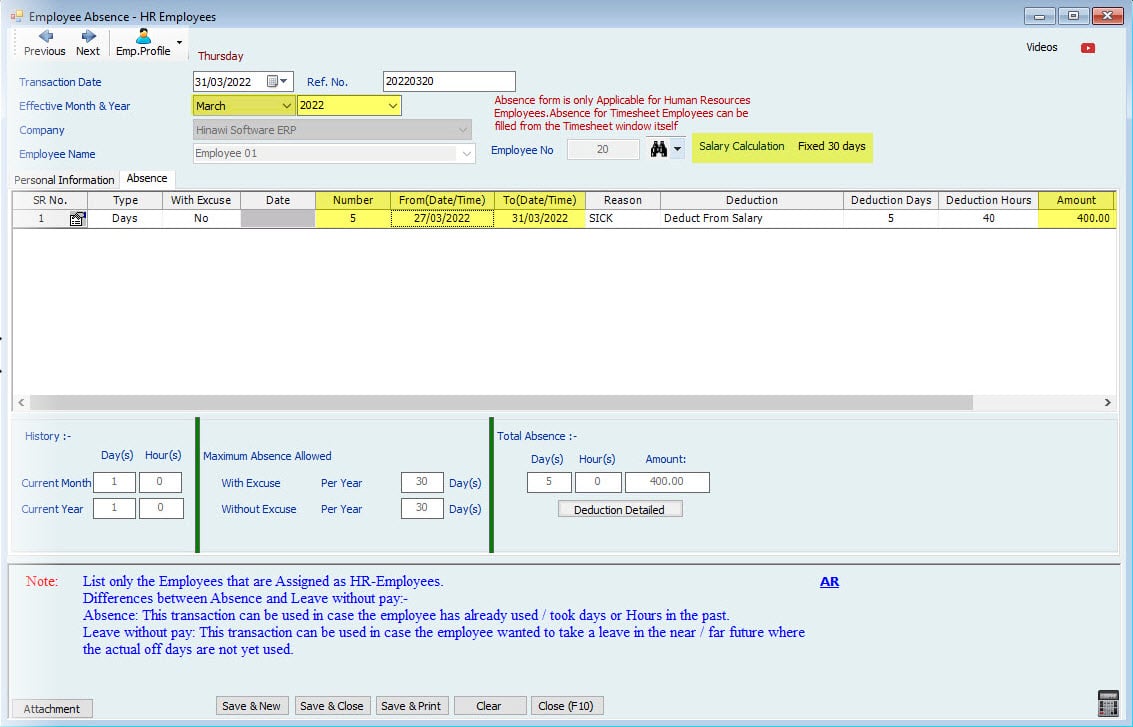

Absence Calculation Setup is: (Month is Fixed 30 Days).

March is 31 Days.

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will Show in Absence Ledger Report and be deducted from the total Service Period. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 4 | ||

| Description | One Day online | One Day only days | after 30 will not be considered days. | Days are: 27+28+29+30 31 will not be calculated | ||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

Note:

If the Absence is 10 days, the system will calculate the 4 Days in March as (3000 / 30 * 4) and 5 days in April as (3000 / 30 * 5) [31 will not be calculated] = 900

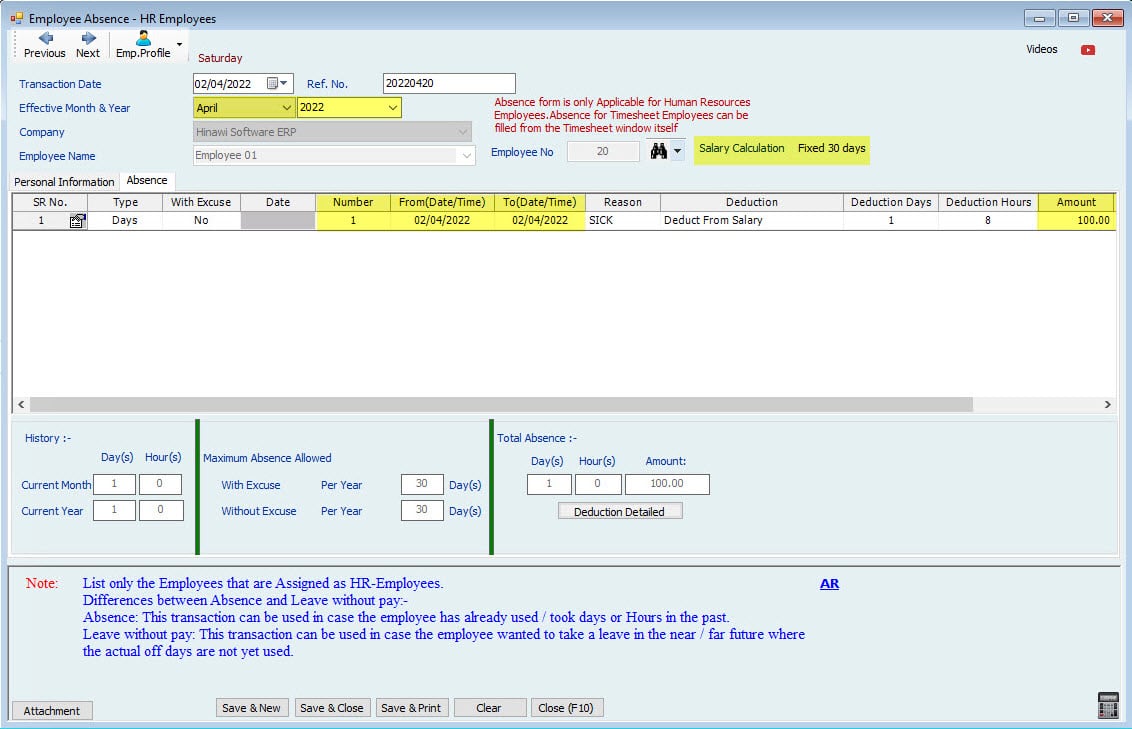

Absence Calculation Setup is: (Month is Fixed 30 Days).

April is 30 Days.

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | N/A | 5 | This will Show in Absence Ledger Report and be deducted from the total Service Period. | |

| Description | The days are April27+28+29+30 and May 1 Day. | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 5 | Days will be split into 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Day in May | |||||

| Description | One Day online | One Day only April | April is 30 Days only. | Days in April are 27+28+29+30 and 1 Day in May. | ||

| 400 | Calculation of Absence Amount for April. | |||||

| 100 | Calculation of Absence Amount for May. | |||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 500.00 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3000.00 | 2500.00 | |

Note:

If the Absence is 10 days, the system will calculate the 4 Days in April as (3000 / 30 * 4) and six days in May as (3000 / 30 * 6) = 1,000

Absence Work Process For HR and Time Sheet Employees.

Kindly go to HRMS Activities Menu, then select Absence

activity | HR | Time Sheet Employees | Note |

Create Absence- HR Employees | Yes | Absence should fill in the Time Sheet Form. | For both HR and Timesheet, an Employee's Absence can always be deducted from the Salary Sheet. There is no Setup of Absence for Time Sheet Employees. |

Edit Absence- HR Employees | |||

Approve Absence- HR Employees | |||

Edit delete Absence after Approval |

- Absence Process for HR Employees:

E.g., If an Employee's absence starts from the 4th of the month, so the process will be

- Create Absence- HR Employees:

Create the absence in the Absence form for the HR Employees.

- Fill the Absence type (Days or Hours):

Fill the Absence type (E.g., If Employee is absent for 1 or 2daysyspecialt days, and if Employee is missing for a few hours, select hours).

- Fill the Absence excuse (With or without excuse):

Fill the Absence Excuse Us user can select the option Yes/No to set whether he has an excuse for the absence or not.

- Fill the deduction (deduct from Salary / Leave or update ledger):

Fill the deduction (E.g., If the User selected deducts from Salary/Leave, the Salary or leave will be deducted for the absence reading from the Pre-define Setup of the Absence in the Absence Setting. But if the user selected only Update Lonely only absence days will be deducted, and no effect on Leave and Salary. Below is the screenshot for the Absence Set up;

- Edit/ Delete Absence – HR Employees:

Using this option, the User can Edit or Delete the Absence after saving.

- Approve Absence- HR Employees:

After Creating the Absence, save the Absence form and Approve.

- Edit/ Delete Absence after Approval :

Using this option, the User can edit or Delete the Absence after Approval.

- Create Salary sheet and Approve:

After approval of Absence, go to Payroll and create Salary sheet for HR Employees; in the Salary sheet, deduction of absence days will be shown reading from the create Absence Form, then approve the Salary sheet.

Note:

In the Absence Setup, if the Setup is with Excuse and Deduction is ‘Deduct from Leave,’ and then while creating absence with Excuse, ‘Deduct from Leave/Salary’ so in this case system will deduct the leaves for the absence reading from the Absence Setup and Vice Versa.

- Absence Process for Time Sheet Employees:

E.g., If Employee is absent on the 4th of the month, so the process will be

- Create Time Sheet:

Fill the Time Sheet for the Time Sheet Employees as usual. Then Create the Absence on the 4th of the month while creating the Time Sheet.

- Check the calculate box (Yes or No):

When Absence is selected in the Timesheet, calculate will be set to ‘No’ by default.

Users can fill the option “Yes” or “No” from the Calculate column.

- If the Calculate option is “Yes,” Salary will not be deducted from the Salary Sheet, and Absence days will be paid to the employees. These Absence days will also not be affected the Total Service (Actual working days).

- If the Calculate option is “No,” Salary will be deducted from the Salary Sheet, and Absence days will also be deducted from the Absence Balance, and these removed Absence days will also be affected on the Total service (Actual Working Days).

- Save the Time Sheet:

After filling the Employee details in the Timesheet, save it.

- Create Salary sheet and Approve:

Kindly go to Payroll and create a Salary sheet for the Time Sheet Employees. In the Salary sheet, deduction of Absence days will be shown reading from the Timesheet.

Note:

For the Time Sheet Employees, there is no Setup of Absence. Whenever the user creates Absence for the Employee, it is always reading from the create Time Sheet.

Deduct from Salary | Deduct from Annual Leave Balance | Update Absence Ledger | ||||

Absence Ledger Amount | No | Yes | No | No | No | No |

Absence Ledger Days / Hours | Yes | Yes | Yes | Yes | Yes | Yes |

Salary Sheet Amount | No | Yes | No | No | No | No |

Salary Sheet Days / Hours | Yes | Yes | Yes | Yes | Yes | Yes |

Leave Ledger Amount | No | No | No | No | No | No |

Leave Ledger Days / Hours | No | No | No | No | No | No |