Business Hours

Sunday to Friday: 9AM to 6PM

Address

Khalidiya, Near Khalidiya Park. Gulf Rider Building Mezzanine Floor Office 3 Abu Dhabi –UAE

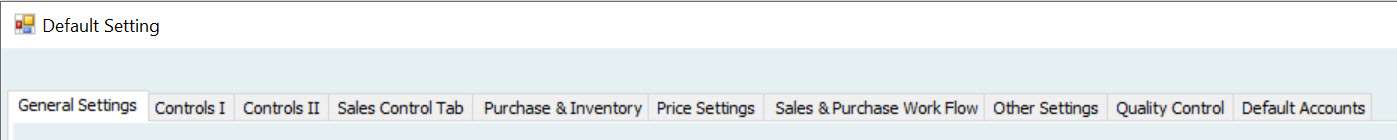

The software can deliver a comprehensive service tailored

to the client’s precise requirements. It brings an advanced set of modules.