Manual for Human resources, Timesheet, payroll, taxes and wps

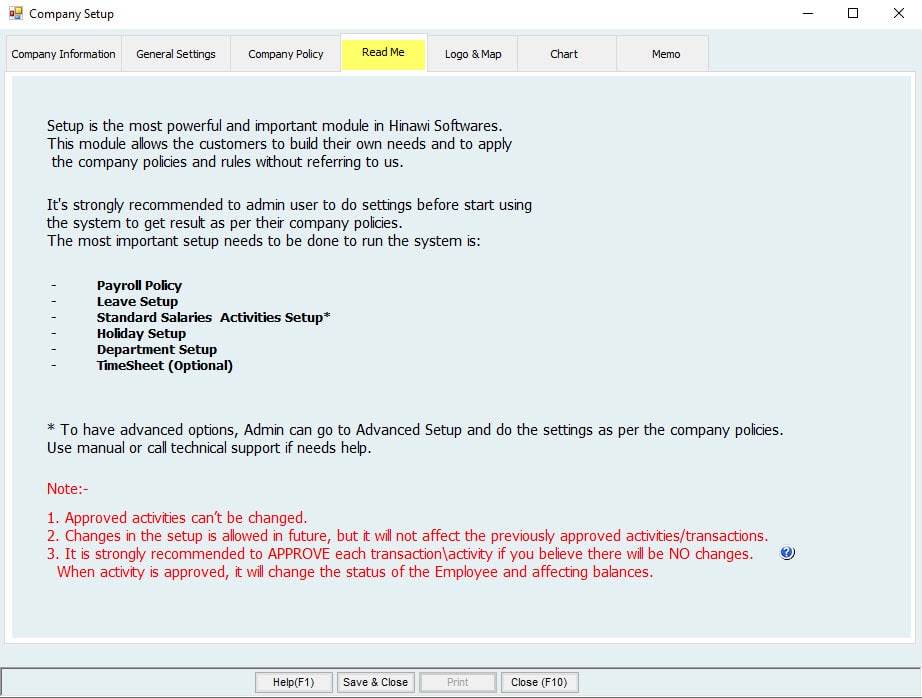

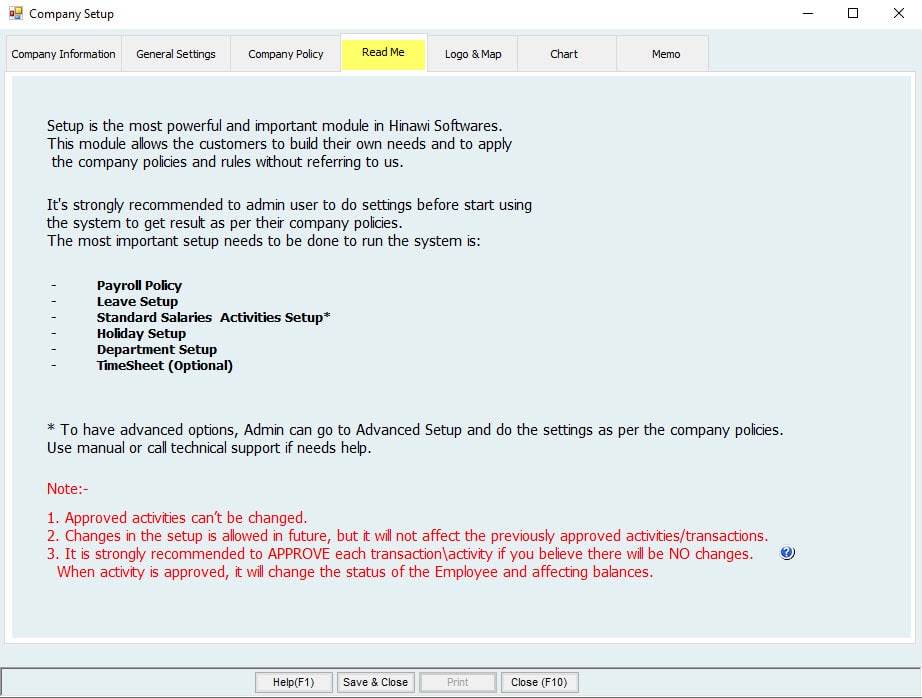

Introduction:

This is manual for Human Resources, TimeSheet, Payroll, Taxes and WPS Module. We added the maximum information in this page.

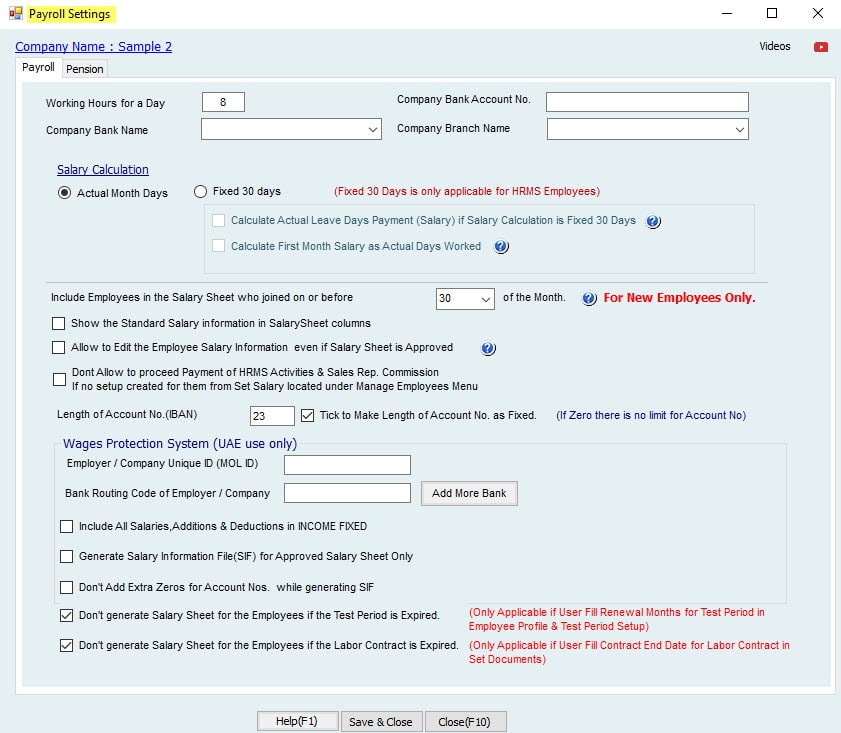

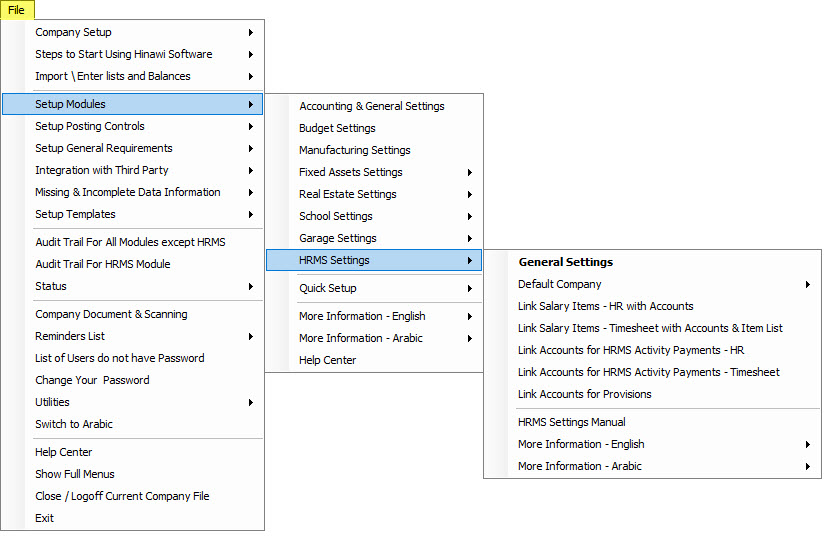

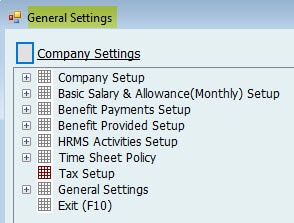

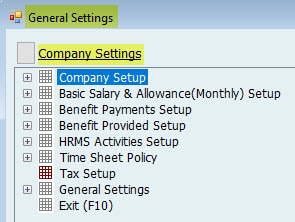

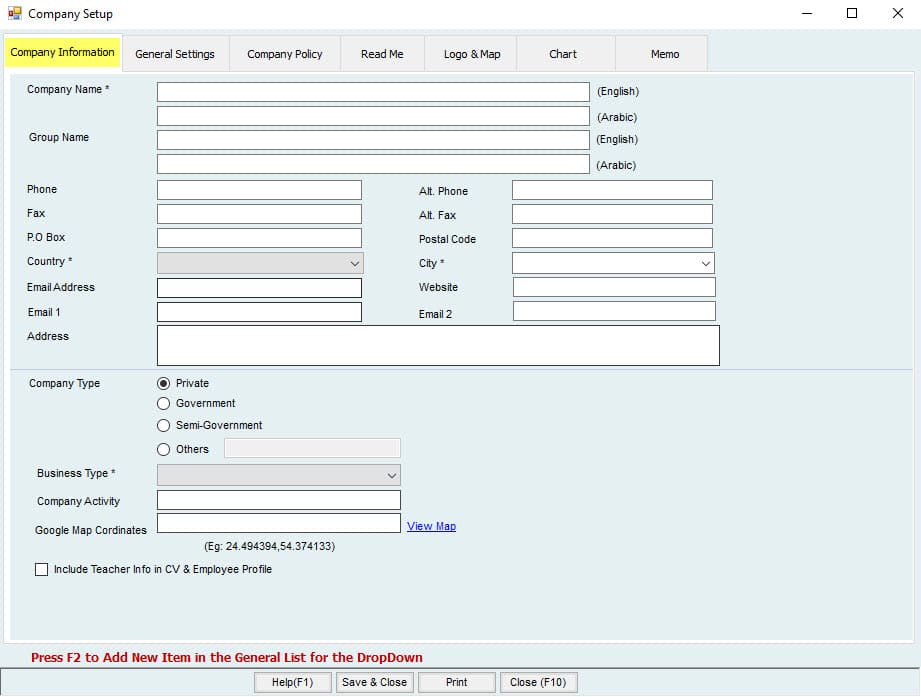

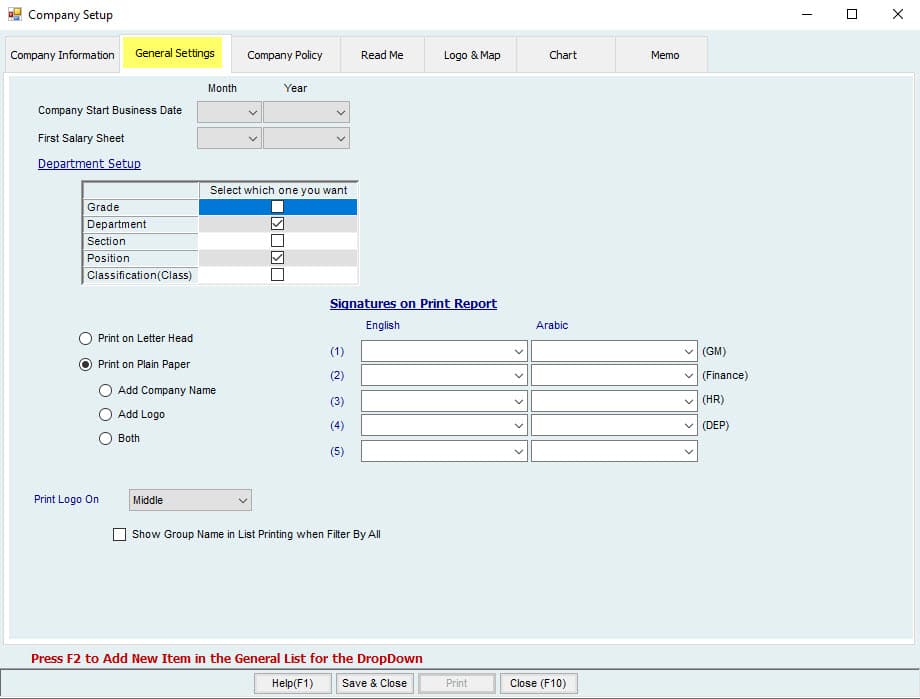

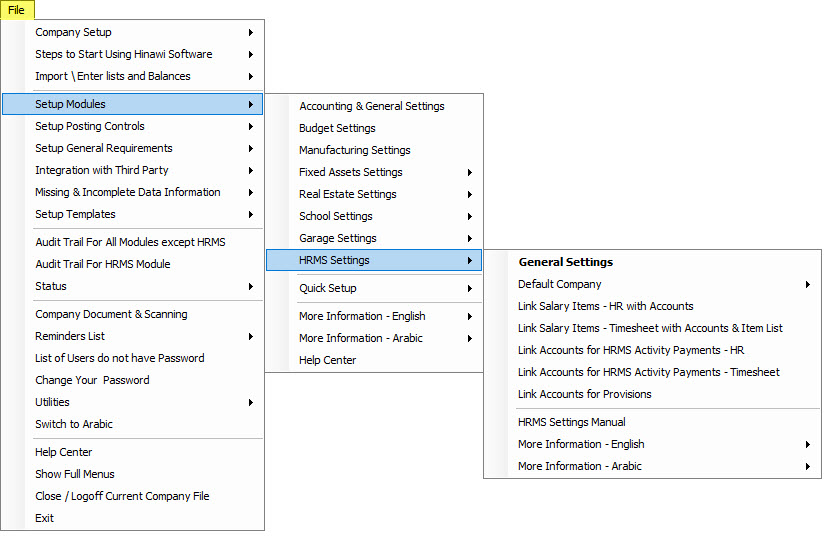

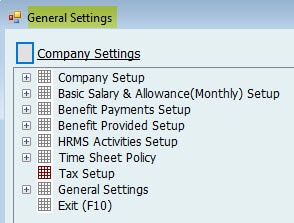

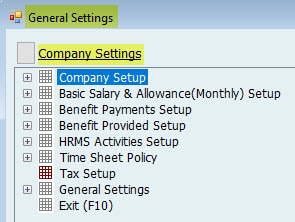

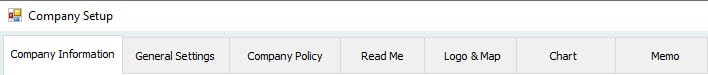

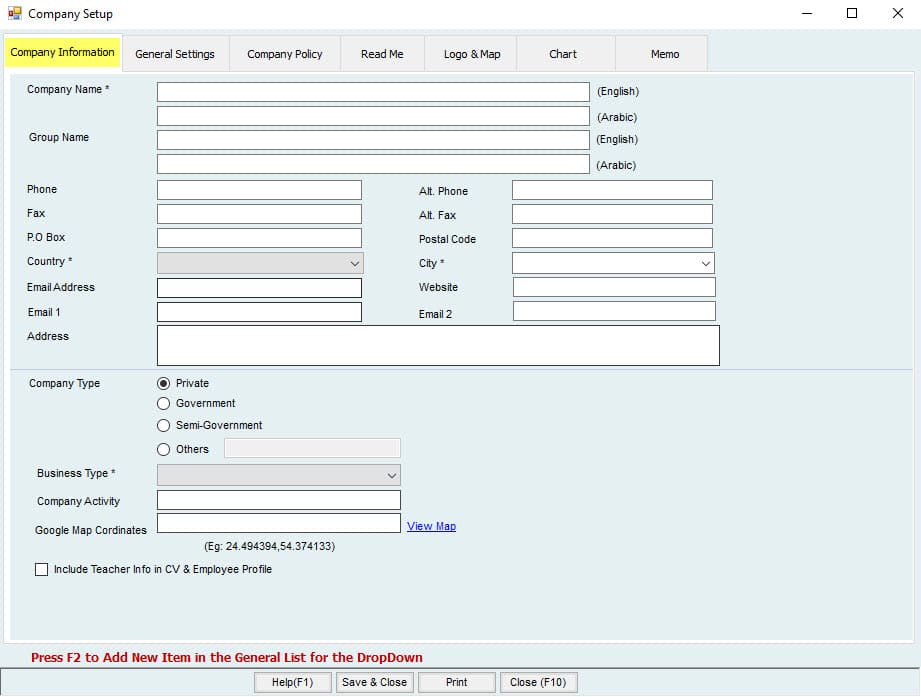

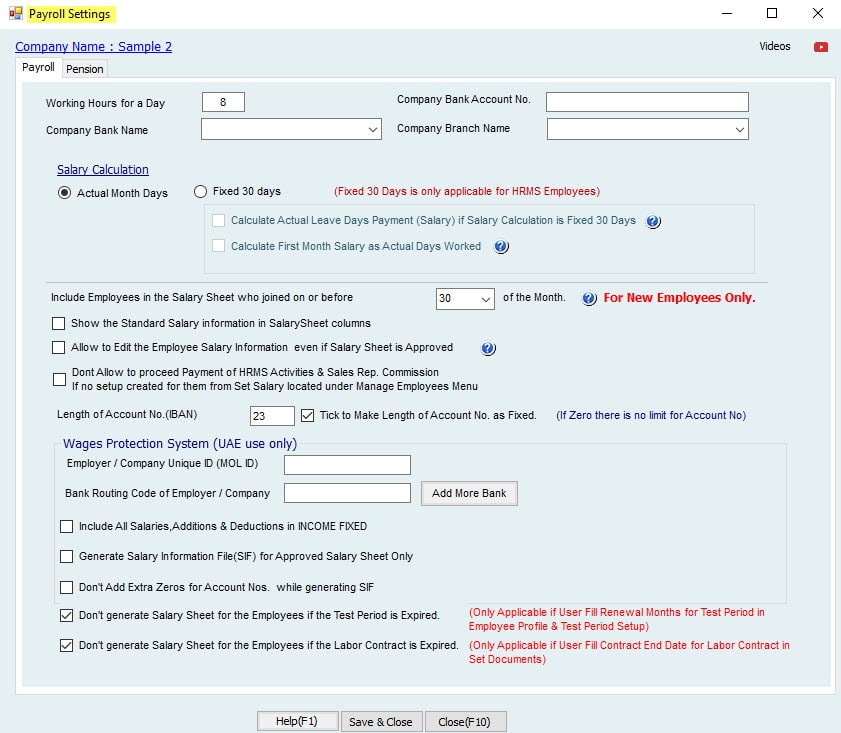

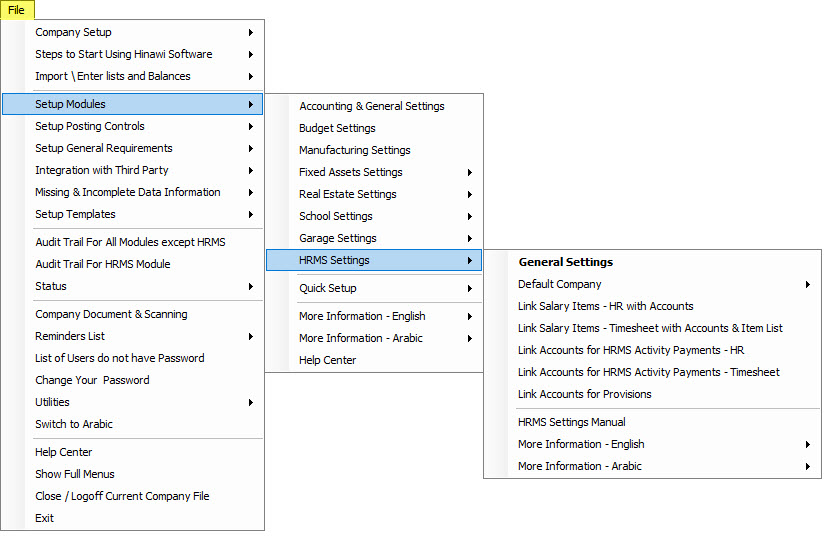

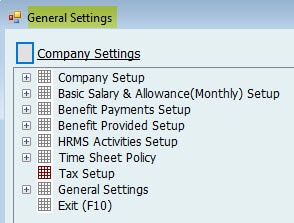

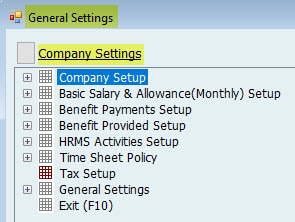

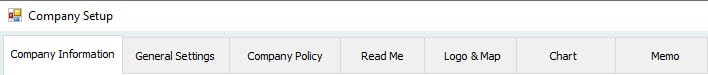

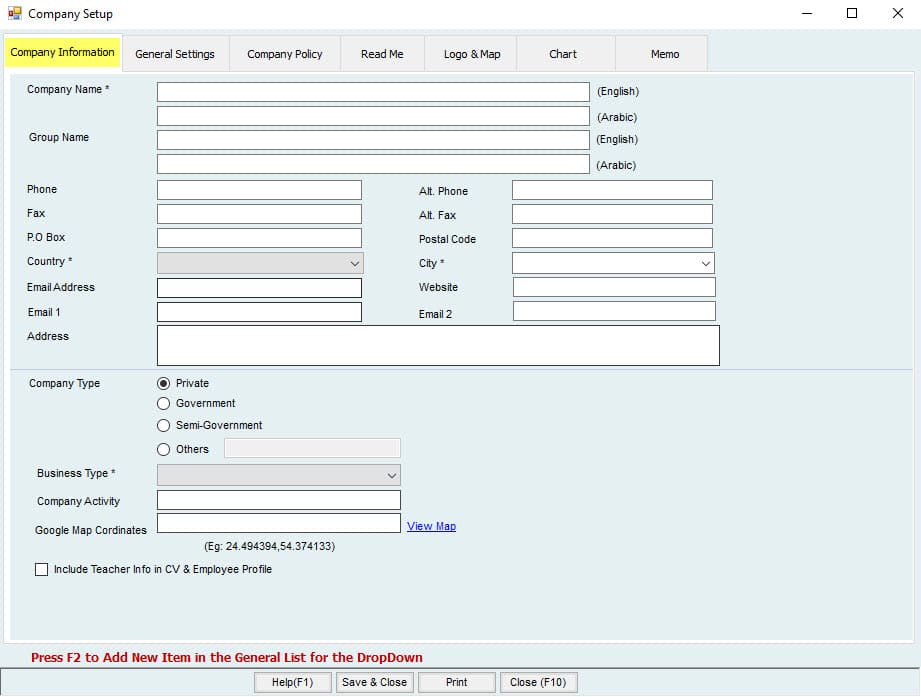

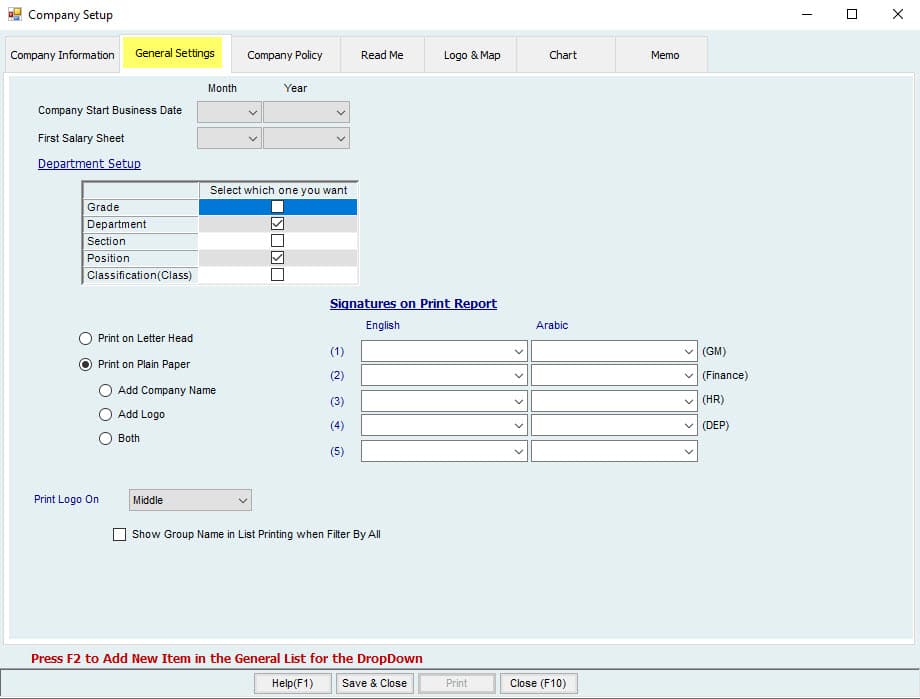

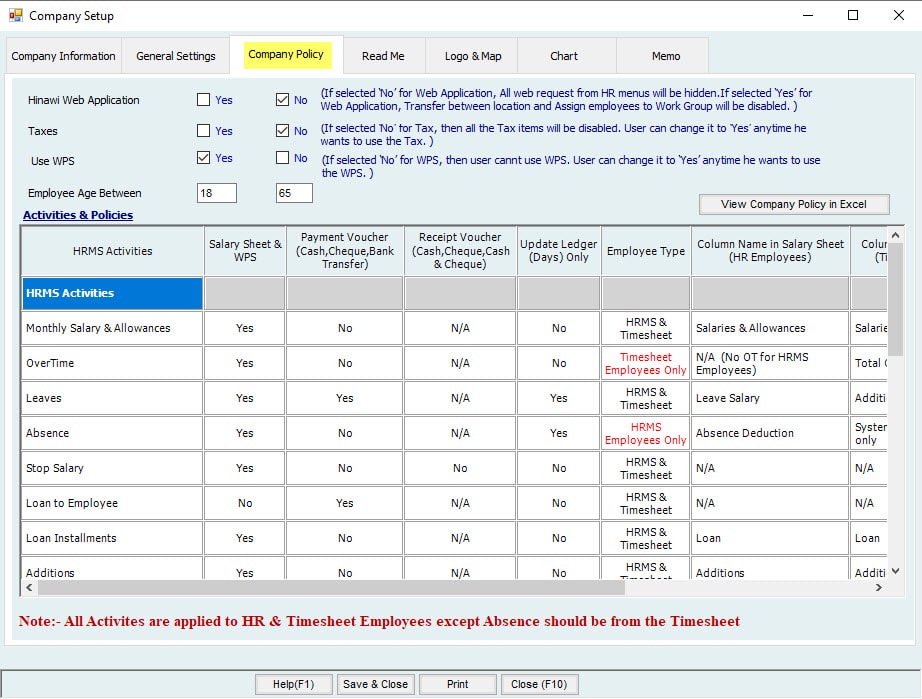

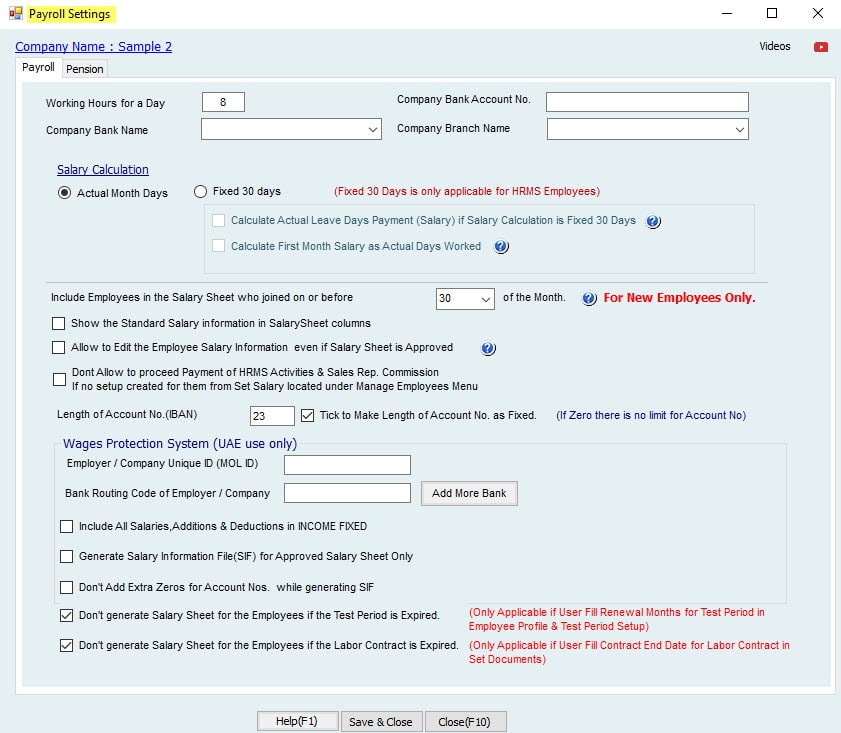

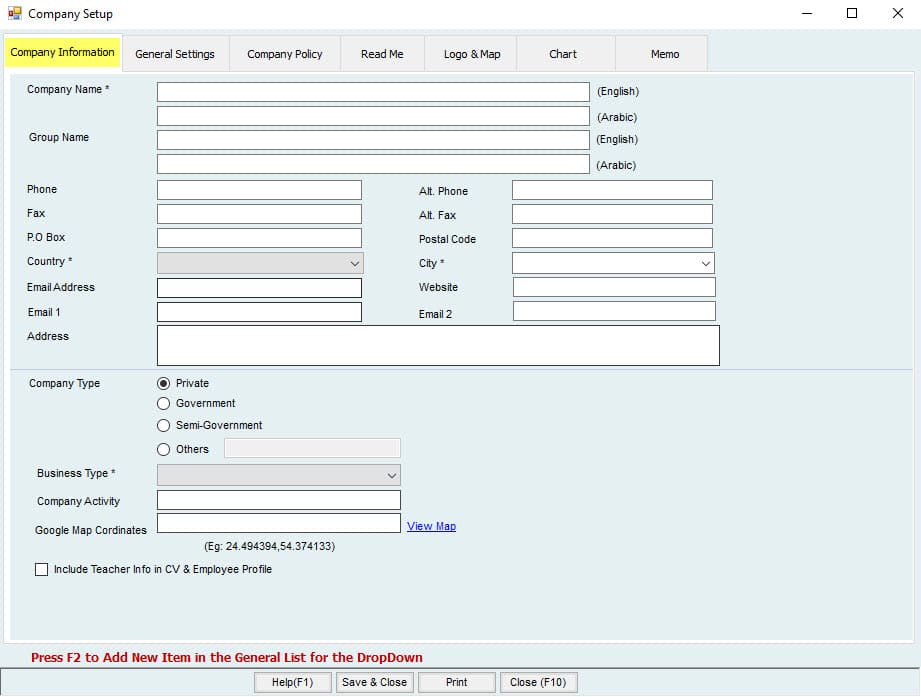

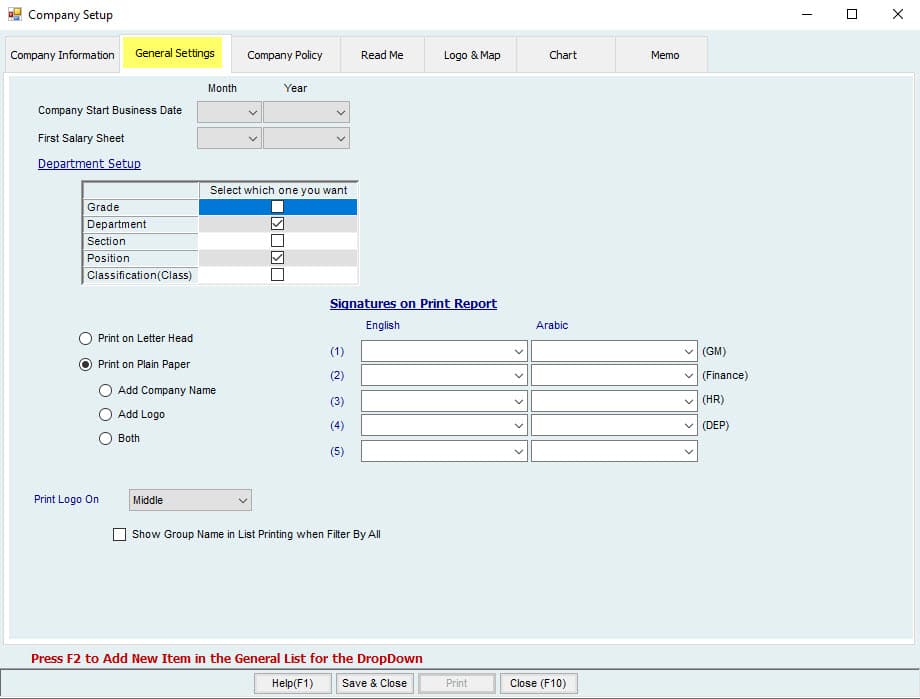

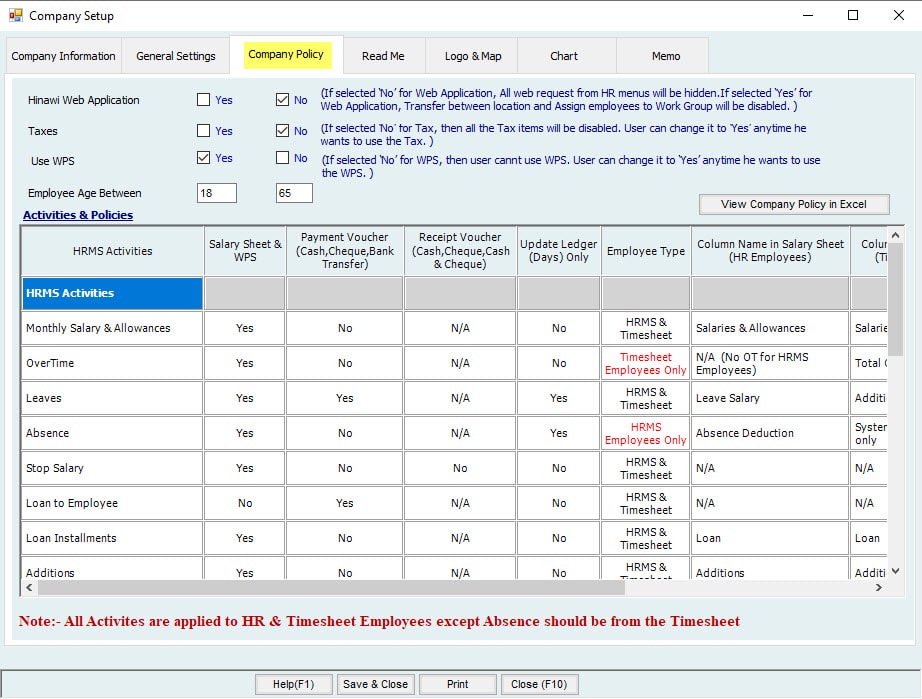

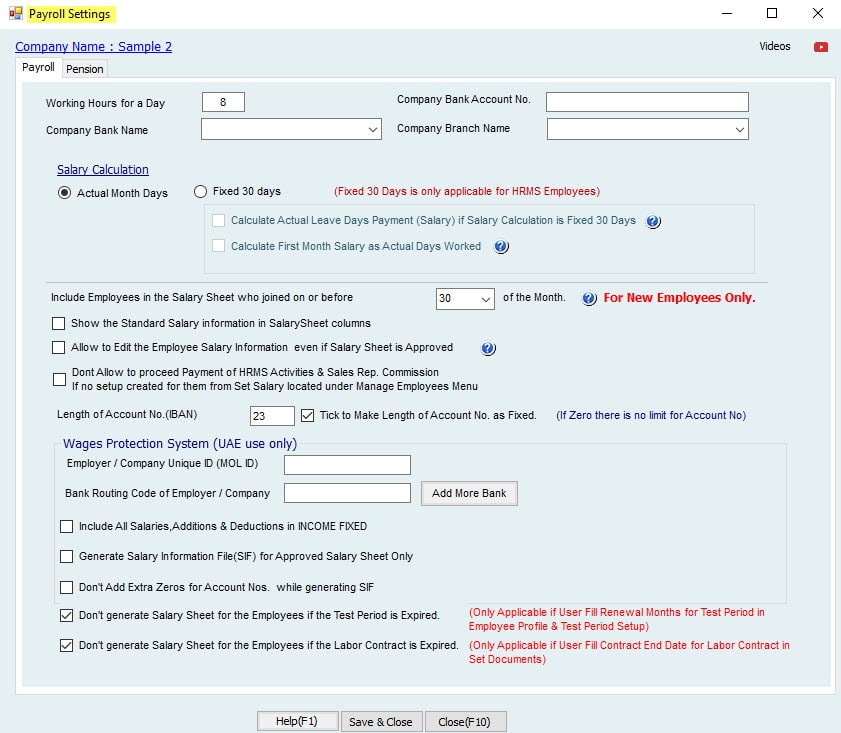

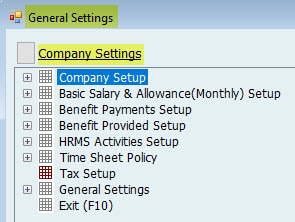

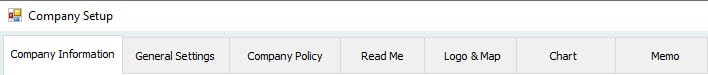

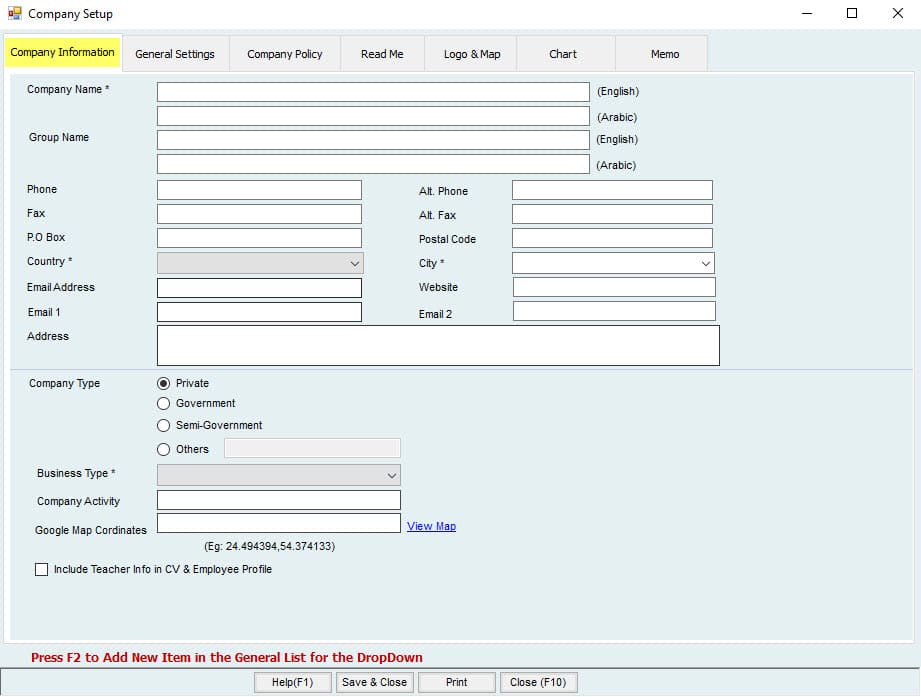

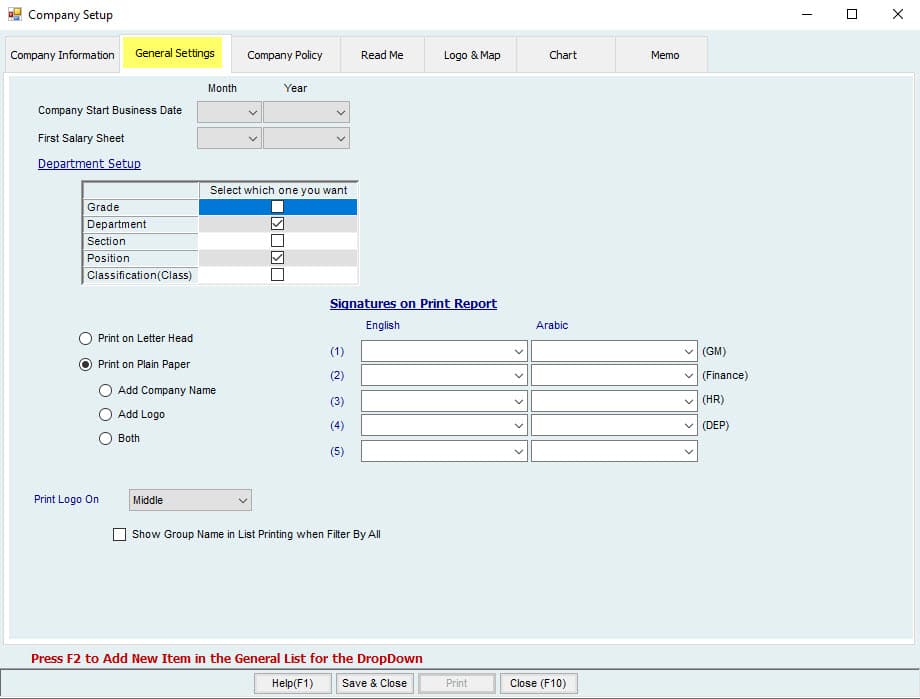

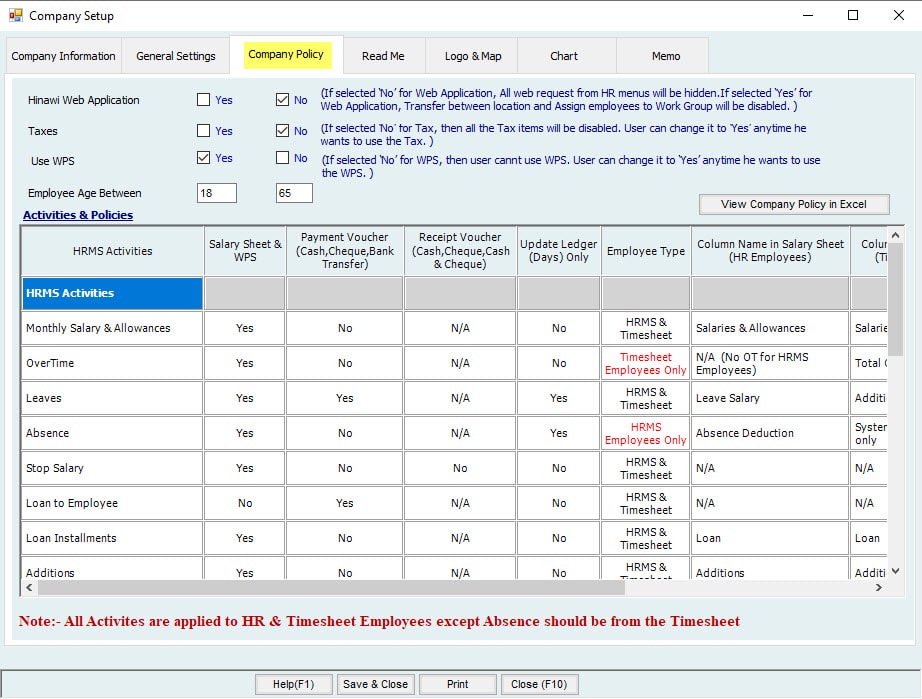

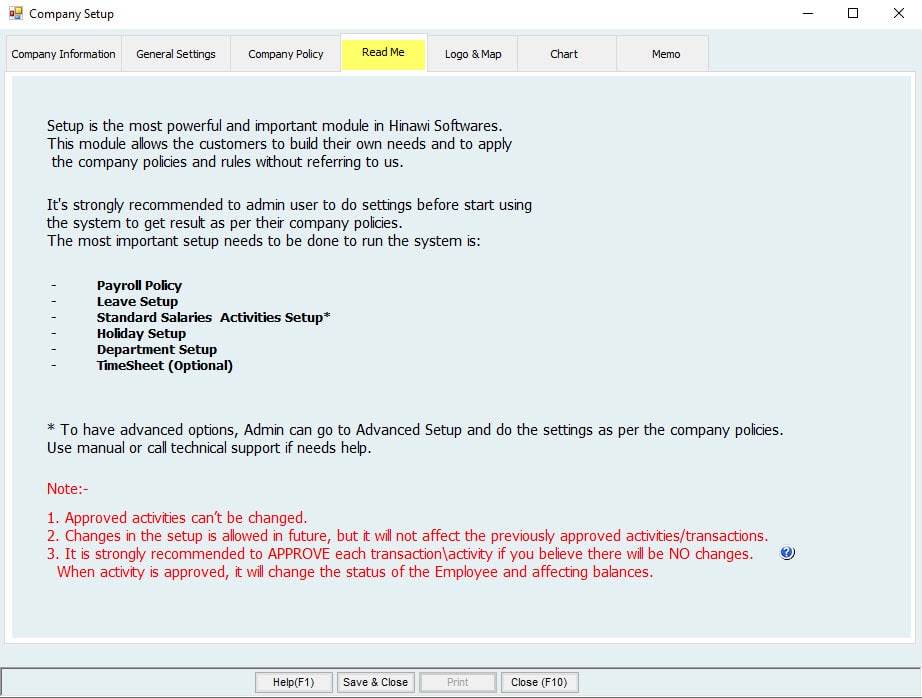

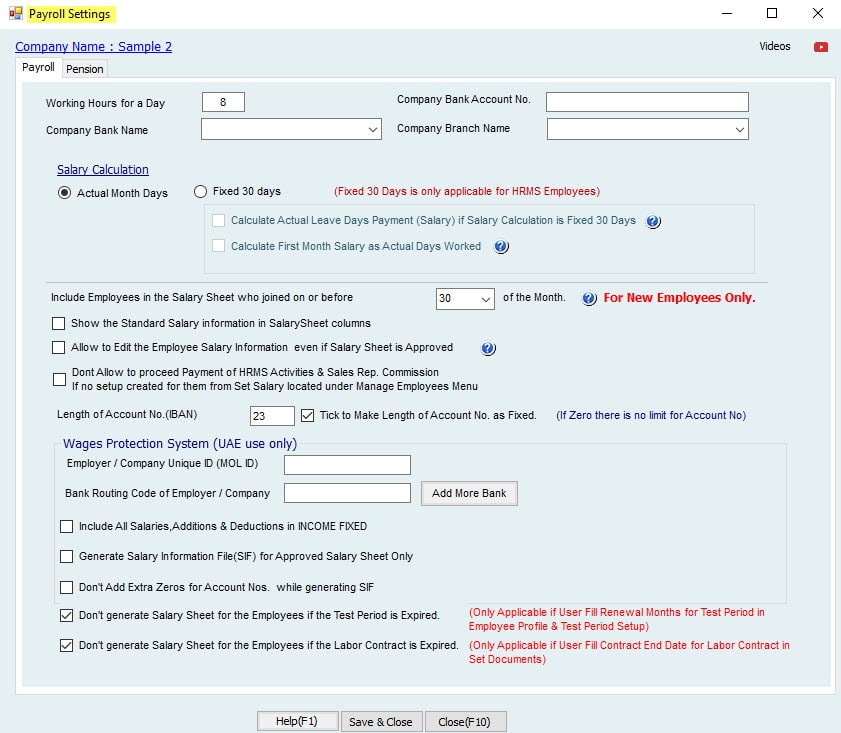

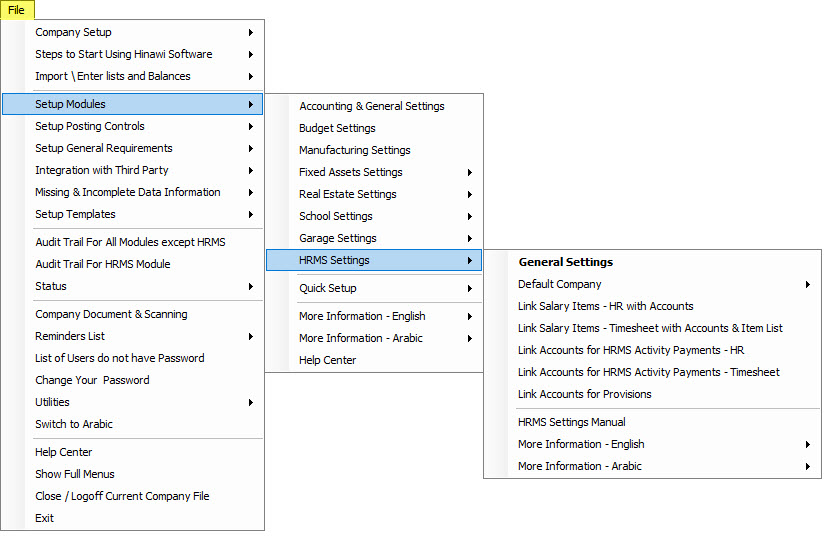

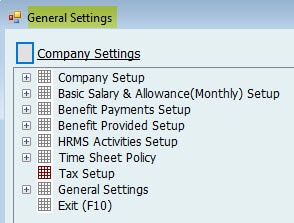

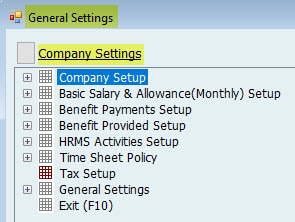

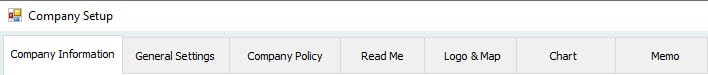

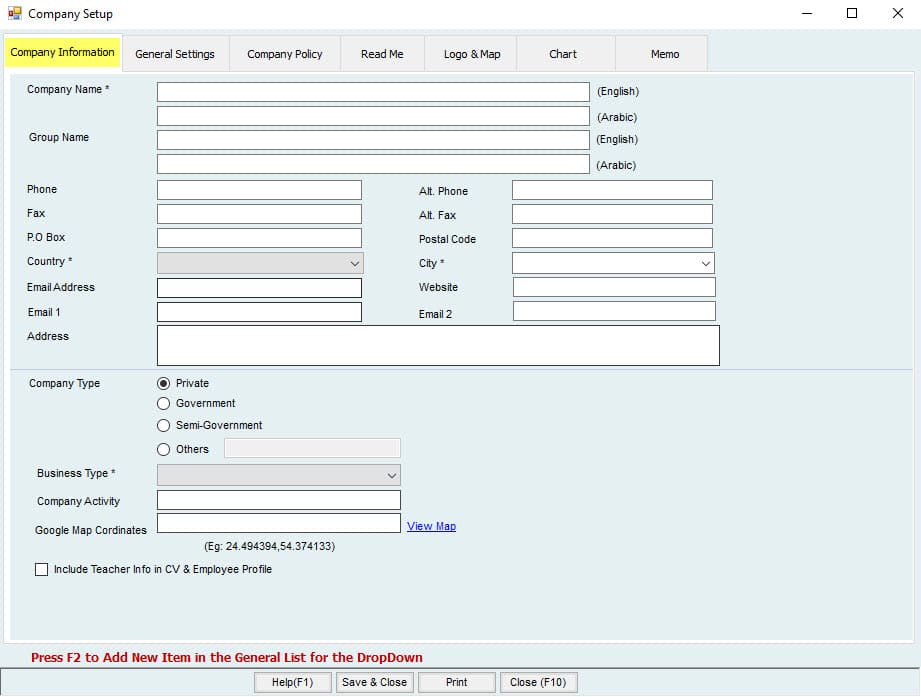

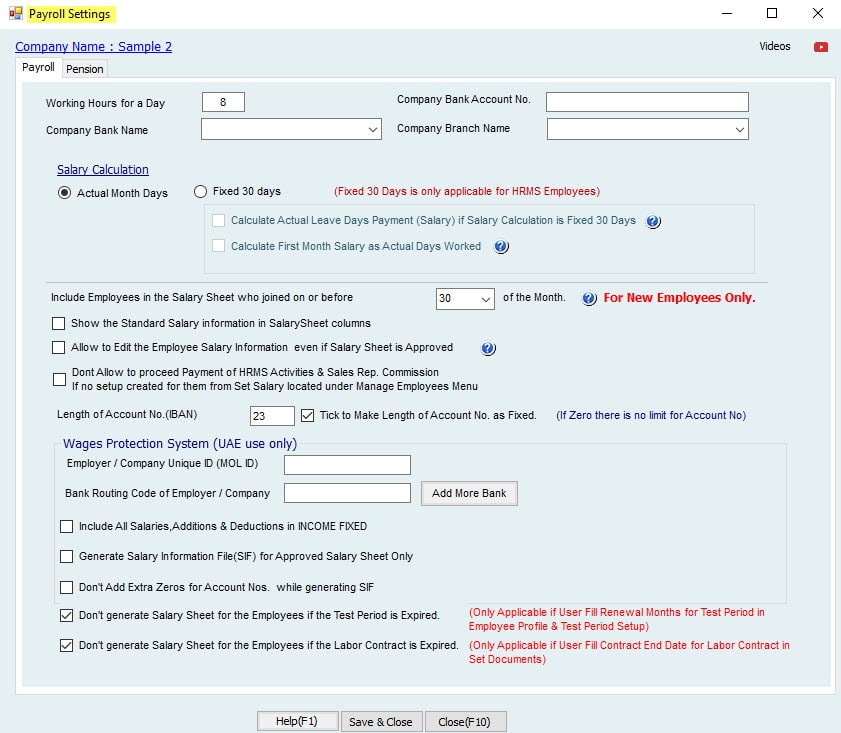

02. Payroll Settings:

Company Settings → Company set up → Payroll Policy.

Payroll Tab:

- Total working hours for a day: User can define the total working hours for the company in a day

Note:

Can vary from company to company: say 8 hours or 9 hours. This will be affected onlyborn HR Employees.

- Company Bank Account No: Provides the bank accompanies bank account number.

- Company Bank Name: Provides the bank name.

- Company Branch Name: Provides the branch name.

Salary Calculation:

It’s important for the user to understand the method of salary calculation of the employee and the relatedness with other activities such as absence, leave and so on. In this part, we will explain the process in detail for better understanding.

Hinawi Software has 2 ways of calculation basis: –

➔ Fixed 30 Days

In this basis, the system considers all months as fixed 30 days regardless if the month is January, February or April.

➔ Actual Month Days

In this basis the system calculates the number of days in the month. Therefore, January is:31 days, February is: 28/29 days, and April is: 30 days.

Note:

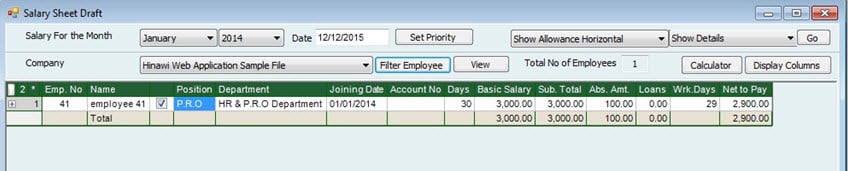

Net to pay the amount in Salary sheet is rounding and no decimal points.

e.g. 29.22 will be ,2903 and 2892.86 ,will be 2893 as shown in the above table.,

i.e. 0.5 and more will be consonedered, as 1 and less than .5 will be ignored.

The user can do the settings from Additional Settings.

Both affect the calculations of monthly salary for the following activities cases: Absence and Leave.

Case 1:

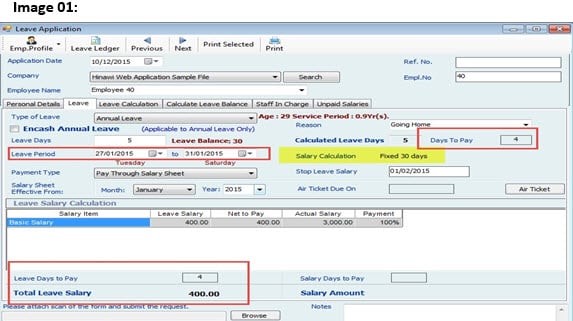

STANDARD Case. Employee Monthly Salary is 3000 AED, All Salary Item included for Leave calculation, no pension for Non- Locals, Leave Salary Calculation basis on 0 (zero) days, Absence setup is Deduct from Salary, No first month.

Case 2:

Employee Monthly Salary is 3000 AED, All Salary Items included for Leave calculation, no pension for Non- Locals, Leave Salary Calculation Basis on 0 (ZERO) Days, no first month, Setup is Fixed 30 days; Calculate Actual Leave Days if Salary Calculation basis is Fixed 30 Days box is checked.

Case 3:

Employee Monthly Salary is 3000 AED, All Salary Items included for Leave calculation, No pension for Non- Locals, Setup is Actual Month Days; Leave Salary Calculation Basis on 360 Days.

Important Information to help the user

Salary Calculation Policy:- | ||||

| Employee Salary | Fixed 30 Days | Actual Month Days | 360 Days | 365 Days |

| Employee Salary: | Yes | Yes | X | X |

| Absence Amount: | Yes | Yes | X | X |

| Absence Days: | X | Yes | X | X |

| Leave Amount leave | Yes | Yes | Yes | Y es |

| Leave Days: | Yes | Yes | X | X |

Actual Month Days:

On this basis, the system calculates the number of days in the month. Therefore, January is 31 days,

February is: 28/2,9 days and April is: 30 days.

Fixed 30 Days:

On this basis, the system considers all months as fixed 30 days regardless of the month is January, February, or April.

Below are details of explanations for different cases:

| Absence Calculation (Month is Actual Month Days) Recommended | ||||||

| January | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 31 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will Absence Ledger report and will be deducted from total Service Period. | |

| Description | Days are: January 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 1 | 5 | ||

| Description | One Day only | One Day only | One Day only | Days are: January 27+28+29+30+31 | ||

| Absence Amount | Total Salary / 31 X Absence days | 96.77 | 96.77 | 96.77 | 483.87 | The Absence amount will be lower if the month is 31 days. |

| Net Salary Amount | Total Salary Minus Absence Amount | 2903.23 | 2903.23 | 2903.23 | 2516.13 | |

Note: If the Absence is 10 days, system will calculate the 5 Days in January as (3000 / 31 * 5) and 5 days in February as (3000 / (28 or 29) * 5) = 1,019.58 in case of non leap year and 1,001.11 in case of leap year | ||||||

| February- Month is 28 Days (None Leap Year) | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 28) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 28 | |||||

| Actual Absence Days. | 1 | N/A | 1 | 5 | the is will Show in Absence Ledger report and will be deducted from total Service Period. | |

| Description | Days are: February: 27+28 March: 1+2+3 | |||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 5 | Days will be Split in to 2 Months | |

| 2 | 2 Days in February | |||||

| 3 | 3 Days in March | |||||

| Description | One Day only | _ | One Day only | Days are: February 27+28 March: 1+2+3 | ||

| 214.29 | Calculation of Absence Amount for February. | |||||

| 290.32 | Calculation of Absence Amount for March. | |||||

| Absence Amount | Total Salary / 28 X Absence days | 107.14 | 0 | 107.14 | 504.61 | The Absence amount will be higher if the month is 28 days. |

| Net Salary Amount | Total Salary Less Absence Amount | 2892.86 | 3000.00 | 2892.86 | 2495.39 | |

Note: If the the Absence is 10 days, system will calculate the 2 Days in February as (3000 / 28 * 2) and 8 days in March as (3000 / 31 * 8) = 988.47 | ||||||

| February – Month is 29 Days (Leap Year) | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 29) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 29 | |||||

| Actual Absence Days. | 1 | N/A | 1 | 5 | This will Show the in Absence Ledger report and will be deducted from total Service Period. | |

| Description | Days are: February 27+28+29 March: 1+2 | |||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 5 | Days will be Split in to 2 Months | |

| 3 | 3 Days in February | |||||

| 2 | 2 Days in March | |||||

| Description | One Day only | _ | One Day only | Days are: February 27+28+29 March: 1+2 | ||

| 310.34 | Calculation of Absence Amount for February. | |||||

| 193.55 | Calculation of A bsence Amount for March. | |||||

| Absence Amount | Total Salary / 29 X Absence days | 103.45 | 0.00 | 103.45 | 503.89 | Absence amount in February is highr from other months. |

| Net Salary Amount | Total Salary Less Absence Amount | 2896.55 | 3000.00 | 2896.55 | 2496.11 | |

Note: If the Absence is 10 days, system will calculate the 3 Days in February as (3000 / 29 * 3) and 7 days in March as (3000 / 31 * 7) = 987.76 | ||||||

| March | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 31 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will Absence Absense Ledger Report and will be deducted f rom total Service Period. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 1 | 5 | ||

| Description | One Day only | One Day only | One Day only | Days are: March 27+28+29+30+31 | ||

| Absence Amount | Total Salary / 31 X Absence days | 96.77 | 96.77 | 96.77 | 483.87 | The Absence amount will be lower if the month is 31 days. |

| Net Salary Amount | Total Salary Less Absence Amount | 2903.23 | 2903.23 | 2903.23 | 2516.13 | |

Note: If the Absence is 10 days, system will calculate the 5 Days in March as (3000 / 31 * 5) and 5 days in April as (3000 / 30 * 5) = 983.87 | ||||||

| April | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Actual Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | N/A | 5 | This will Show in Absence Ledger Report and will be deducted from total Service Period. | |

| Description | Days are: April27+28+29+30 and May 1 Day. | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 5 | Days will be Split into 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Days in May | |||||

| Description | One Day only | One Day only | April is 30 Days only | Days in April are: 27.+28+29+30 and 1 Day on May | ||

| 400.00 | Calculation of Absence Amount for April. | |||||

| 96.77 | Calculation of Absence Amount for May. (May is 31 Days). | |||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 496.77 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3000.00 | 2503.23 | |

Note: If the Absence is 10 days, the system will calculate the 4 Days in April as (3000 / 30 * 4) and 6 days in May as (3000 / 31 * 5) = 883.87 | ||||||

| Absence Calculation (Month is Fixed 30 Days) | ||||||

| January | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will Show in Absense Ledger Report and will be deducted from total Service Period. | |

| D escription | Days are: January 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 4 | ||

| Description | One Day only | One Day only | Days after 30 will not be considered | Days are: 27+28+29+30 31 will not calculated | ||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

Note: If the Absence is 10 days, system will calculate the 4 Days in January as (3000 / 30 * 4) and 5 days in February as (3000 / 30 * 5) [31 will not be calculated] = 900 | ||||||

| February – Month is 28 Days (Non-Leap Year) | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 28) | 5 Days Absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence DaysAbsence | 1 | N/A | 1 | 5 | This will Show in Absence Ledger Report and will be deducted from total Service Period. | |

| Description | If the Absence is 2 daye then the deducted days will be 4 | Days are: February: 27+28 March: 1+2+3 | ||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 7 | The Absence Days will be more if the month is 28/29 days. | |

| 4 | 4 Days in February (27+28+29+30) | |||||

| 3 | 3 Days in March | |||||

| Description | One Day only | _ | One Day only | Days are: February 27+28+29+30 March: 1+2+3 | ||

| 400 | Calculation of Absence Amount for February. | |||||

| 300 | Calculation of Absence Amount for March. | |||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 0.00 | 100.00 | 700.00 | The Absence amount will be higher if the month is 28/29 days. |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 3000.00 | 2900.00 | 2300.00 | |

Note: If the Absence is 10 days, system will calculate the 4 Days in Feightbruary as (3000 / 30 * 4) and 8 days in March as (3000 / 30 * 8) = 1,200 | ||||||

| February – Month is 29 Days (Leap Year) | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 29) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | N/A | 1 | 5 | This will Show in Absencee Ledger Report and will be deducted from total Service Period. | |

| Description | Days are: February: 27+28+29 March: 1+2 | |||||

| Calculated Deductions Absence days | 1 | 0 | 1 | 6 | Days will be Split in to 2 Months | |

| 4 | 4 Days in February (27+28+29+30) | |||||

| 2 | 2 Days in March | |||||

| Description | One Day only | _ | One Day only | Days are: February 27+28+29+30 March: 1+2 | ||

| 400 | ||||||

| 200 | ||||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 0.00 | 100.00 | 600.00 | The Absence amount will be higher if the month is 28/29 days. |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 3000.00 | 2900.00 | 2400.00 | |

Note: If the Absence is 10 days, the system will calculate the 4 Days in February as (3000 / 30 * 4) and 7 days in March as (3000 / 30 * 7) = 1,100 | ||||||

| March | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | 1 | 5 | This will Show in Absence Ledger Report and will be deducted from total Service Period. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 4 | ||

| Description | One Day only | One Day only | Days after 30 will not be considerd | Days are: 27+28+29+30 31 will not calculated | ||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3000.0the | 2600.00 | |

Note: If the Absence is 10 days, system will calculate the 4 Days in March as (3000 / 30 * 4) and 5 days in April as (3000 / 30 * 5) [31 will not be calculated] = 900 | ||||||

| April | ||||||

| Salary | 3000 | 1 Day Absence During the month | 1 Day Absence 30 of the month | 1 Day Absence at the end of the month (On 31) | 5 Days absence from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Absence Days. | 1 | 1 | N/A | 5 | This will Show in Absense Ledger Report and will be deducted from total Service Period. | |

| Description | Days are: April27+28+29+30 and May 1 Day. | |||||

| Calculated Deductions Absence days | 1 | 1 | 0 | 5 | Days will be Split in to 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Days in May | |||||

| Description | One Day only | One Day only | April is 30 Days only | Days in April are: 27+28+29+30 an 1 Day on May | ||

| 400 | Calculation of Absence Amount for April. | |||||

| 100 | Calculation of Absence Amount for May. | |||||

| Absence Amount | Total Salary / 30 X Absence days | 100.00 | 100.00 | 0.00 | 500.00 | |

| Net Salary Amount | Total Salary Less Absence Amount | 2900.00 | 2900.00 | 3ten0.00 | 2500.00 | |

Note: If the Absence is 10 days, system will calculate the 4 Days in April as (3000 / 30 * 4) and 6 days in May as (3000 / 30 * 6) = 1,000 | ||||||

| Leave Calculation (Month is Actual Month Days) | ||||||

| January | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave on 30th of the month | 1 Day Leave at the end of the month (On 31) | 5 Days Leave from 27th of the month | Note |

| Actual Month Days | 31 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will Show in Leave Ledger Report . | |

| Description | Days are: January 27+28+29+30+31 | |||||

| Calculate Leave days | 1 | 1 | 1 | 5 | ||

| Calculate Working Days | 30 | 30 | 30 | 26 | ||

| Description | One Day Leave only | One Day Leave only | One Day Leave only | Days are: January 27+28+29+30+31 | ||

| Leave Amount | Total Salary / 31 X Leave days | 96.77 | 96.77 | 96.77 | 483.87 | |

| Working Days Salary | Total Salary / 31 X Working days | 2903.23 | 2903.23 | 2903.23 | 2516.13 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 30ten.00 | 3000.00 | |

Note: If the Leave is the 10 days, system will calculate the 5 Days in January as (3000 / 31 * 5) and 5 days in February as (3000 / (28 or 29) * 5) | ||||||

| February – Month is 28 Days (None Leap Year) | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 28) | 5 Days Leave from 27 of the month | |

| Actual Month Days | 28 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: February: 27+28 March: 1+2+3 | |||||

| Calculated Leave days | 1 | 0 | 1 | 5 | Days will be Split in to 2 Months | |

| 2 | 2 Days in February | |||||

| 3 | 3 Days in March | |||||

| Working Days | 27 | 28 | 27 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only | Days are: February 27+28 March: 1+2+3 | ||

| 214.29 | Calculation of Leave Amount for February. | |||||

| 290.32 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 28 X Leave days | 107.14 | 0 | 107.14 | 504.61 | |

| Working Days Salary | Total Salary / 28 X Working days | 2892.86 | 3000.00 | 2892.86 | 2785.71 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3290.32 | The Leave Salary of 3 days of March will also be included with this Month In March Employee will get 28 Days salary. |

Note: If the Leave is ten days, system will calculate the 2 Deightys in February as (3000 / 28 * 2) and 8 days in March as (3000 / 31 * 8) | ||||||

| February – Month is 29 Days (Leap Year) | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 29) | 5 Days Leave from 27 of the month | |

| Actual Month Days | 29 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: February 27+28+29 March: 1+2 | |||||

| Calculated Leave days | 1 | 0 | 1 | 5 | Days will be Split in 2 Months | |

| 3 | 3 Days in February | |||||

| 2 | 2 Days in March | |||||

| Calculate Working Days | 28 | 29 | 28 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only | Days are: February 27+28+29 March: 1+2 | ||

| 310.34 | Calculation of Leave Amount for February. | |||||

| 193.55 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 29 X Leave days | 103.45 | 0.00 | 103.45 | 503.89 | |

| Working Days Salary | Total Salary / 29 X Working days | 2896.55 | 3000.00 | 2896.55 | 2689.66 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3193.55 | The Leave Salary of 2 days of March will be also included with this Month. In March Employee will get 29 Days salary. |

Note: If the Leave is 10 days, the system will calculate the 3 Days in February as (3000 / 29 * 3) and 7 days in March as (3000 / 31 * 7) | ||||||

| March | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 31) | 5 Days Leave from 27 of the month | |

| Actual Month Days | 31 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Leave days | 1 | 1 | 1 | 5 | ||

| Calculate Working Days | 30 | 30 | 30 | 26 | ||

| Description | One Day Leave only | One Day Leave only | One Day Leave only | Days are: March 27+28+29+30+31 | ||

| Leave Amount | Total Salary / 31 X Leave days | 96.77 | 96.77 | 96.77 | 483.87 | |

| Working Days Salary | Total Salary / 31 X Working days | 2903.23 | 2903.23 | 2903.23 | 2516.13 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 300the 0.00 | 3000.00 | |

Note: If the Leave 10 days, system will calculate the 5 Days in March as (3000 / 31 * 5) and 5 days in April as (3000 / 30 * 5) | ||||||

| April | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 31) | 5 Days Leave from 27 of the month | |

| Actual Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | N/A | 5 | This will Show in Leave Ledger Re port. | |

| Description | Days are: April 27+28+29+30 and May 1 Day. | |||||

| Calculated Leave days | 1 | 1 | 0 | 5 | Days will be into in to 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Days in May | |||||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave only | One Day Leave only | April is 30 Days only. | Days in April are: 27+28+29+30 and 1 Day o.n May | ||

| 400.00 | Calculation of Leave Amount for April. | |||||

| 96.77 | Calculation of Leave Amount for May. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 496.77 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3096.77 | The Leave Salary of 1 day of May will be also included with this Month. In May Employee will get 30 Days salary. |

Note: If the Leave is 10 days, system will calculate the 4 Days in April as (3000 / 30 * 4)six and 6 days in May as (3000 / 31 * 5) | ||||||

| Leave Calculation (Month is Fixed 30 Days) | ||||||

| January | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 31) | 5 Days Leave from 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: January 27+28+29+30+31 | |||||

| Calculated Leave days | 1 | 1 | 0 | 4 | ||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave considered days | One Day Leave only | Days after 30 will not be considered | Days are: 27+28+29+30 31 will not calculated | ||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3000.00 | |

| Note: If the Leave is 10 days, system will calculate the 4 Days in January as (3000 / 30 * 4) and 5 days in February as (3000 / 30 * 5) [31 will not be calculated] | ||||||

| February – Month is 28 Days (Non-Leap Year) | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 28) | 5 Days Leave from 27 of the month | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: February: 27+28 March: 1+2+3 | |||||

| Calculated Leave days | 1 | 0 | 1 | 7 | Days will be Split in to 2 Months | |

| 4 | 4 Days in February | |||||

| 3 | 3 Days in March | |||||

| Working Days | 29 | 30 | 29 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only | Days are: February 27+28+29+30 March: 1+2+3 | Tan here is option available in Payroll Settings to Calculate Actual Leave Days if Payroll Policy is Fixed 30 days. If user Tick this option System will Calculate only 27+28+1+2+3 ( 5 Days) .In the case Leave Amount will be 500 | |

| 400 | Calculation of Leave Amount for February. | |||||

| 300 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 0.00 | 100.00 | 700.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 3000.00 | 2900.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3300.00 | The Leave salary of 3 days of March will be also included with this Month. In March Employee will get 27 Days salary. |

| Note: If the Leave ithe s 10 days, system wileight calculate the 4 Days in February as (3000 / 30 * 4) and 8 days in March as (3000 / 30 * 8) | ||||||

| February – Month is 29 Days (Leap Year) | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 29) | 5 Days Leave from 27 of the month | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: February: 27+28+29 March: 1+2 | |||||

| Calculated Leave days | 1 | 0 | 1 | 6 | Days will be Split in to 2 Months | |

| 4 | 4 Days in February | |||||

| 2 | 2 Days in March | |||||

| Calculate Working Days | 29 | 30 | 29 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only | Days are: February 27+28+29+30 March: 1+2 | There is option available in Payroll Settings to Calculate Actual Leave Days if Payrol Calculateis Fixed 30 days. If user Tick this option System will Calculate only 27+28+1+2+3this5 Days) .In the case Leave Amount will be 500 | |

| 400 | Calculation of Leave Amount for February. | |||||

| 200 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 0.00 | 100.00 | 600.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 3000.00 | 2900.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3200.00 | The Leave Salary of 2 days of March will be also included with this Month. In March Employee will get 28 Days salary. |

| Note: If the Leave is 10 days, system will calculate the 4 Days in February as (3000 / 30 * 4) and 7 days in March as (3000 / 30 * 7) | ||||||

| March | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 31) | 5 Days Leave from 27 of the month | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Leave days | 1 | 1 | 0 | 4 | ||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave only | One Day Leave only | Days after 30 will not be considered | Days are: 27+28+29+30 31 will not calculated | ||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3000.00 | |

| Note: If the Leave is 10 days, system will calculate the 4 Days in March as (3000 / 30 * 4) and 5 days in April as (3000 / 30 * 5) [31 will not be calculated] | ||||||

| April | ||||||

| Salary | 3000 | 1 Day Leave During the month | 1 Day Leave 30 of the month | 1 Day Leave at the end of the month (On 31) | 5 Days Leave from 27 of the month | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | N/A | 5 | This will Show in Leave Ledger Report. | |

| Description | Days are: April 27+28+29+30intoMay 1 Day. | |||||

| Calculated Leave days | 1 | 1 | 0 | 5 | Days will be Split in to 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Days in May | |||||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave only | One Day Leave only | April is 30 Days only | Days in April are: 27+28+29+30 and 1 Day on May | ||

| 400 | Calculation of Leave Amount for April. | |||||

| 100 | Calculation of Leave Amount for May. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 500.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3100.00 | The Leave Salary of 1 day of May will be also included with this Month. In May Employee will get 29 Days salary. |

| Note: If the Leave is 10 days, system will calculate the 4 Days in April as (3000 / 30 * 4) and 6 days in May as (3000 / 30 * 6) | ||||||

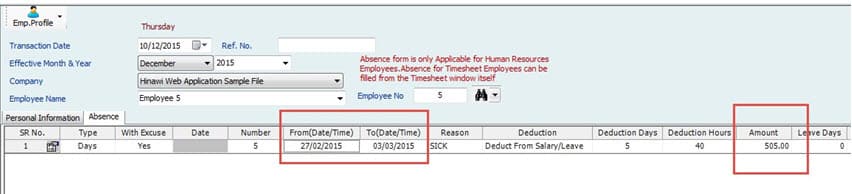

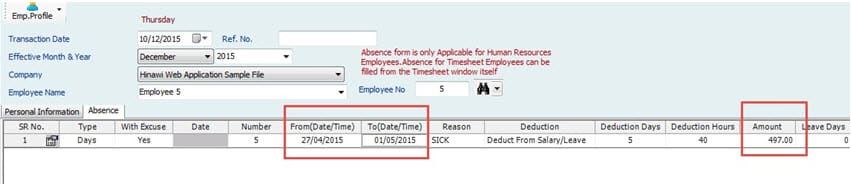

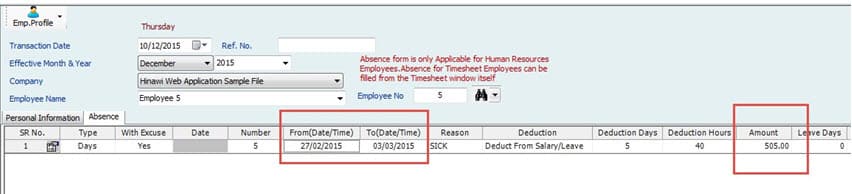

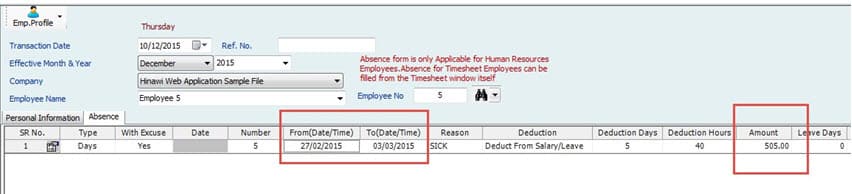

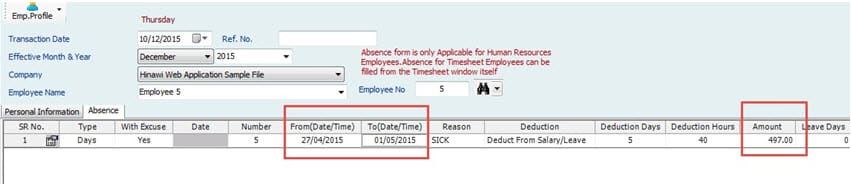

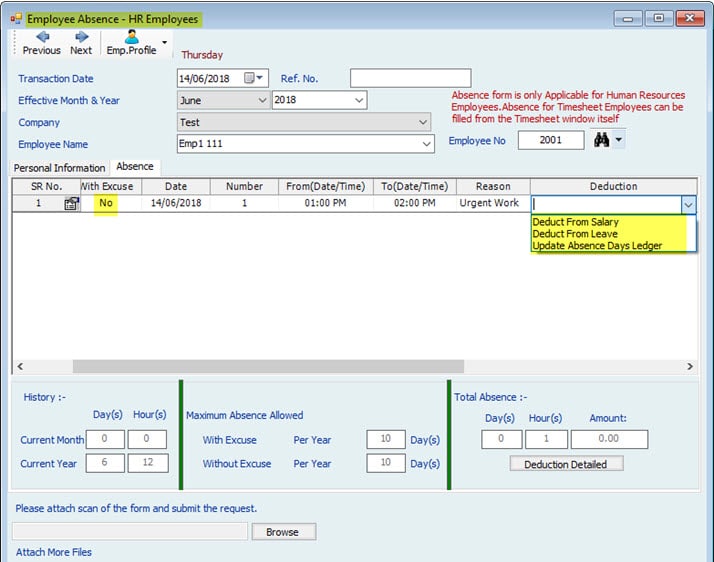

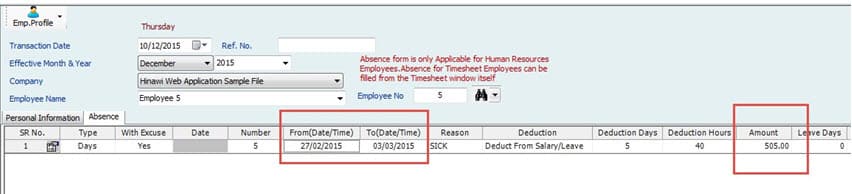

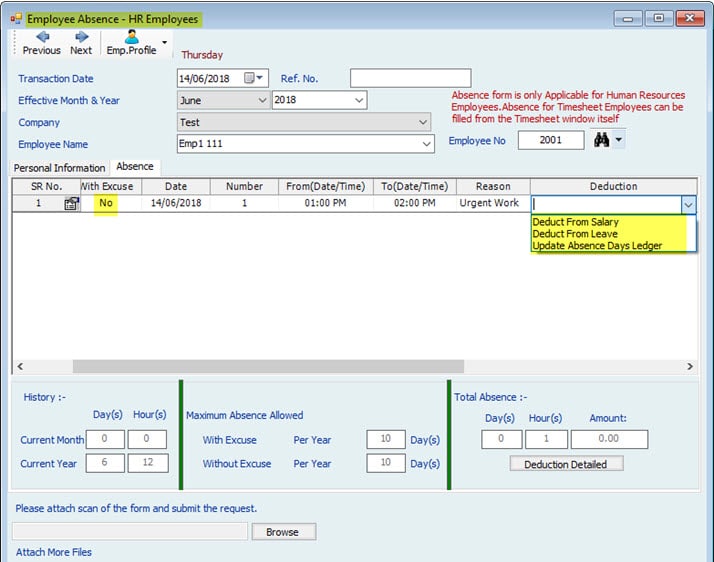

Note:

The absence salary will be deducted from the Effective month while creating an absence. E.g., if an employee making from 29th Jan to 2nd Feb. this means that while creating the absence, if the effective month is selected as Feb, then the absence salary will be deducted from Feb Monthly Salary.

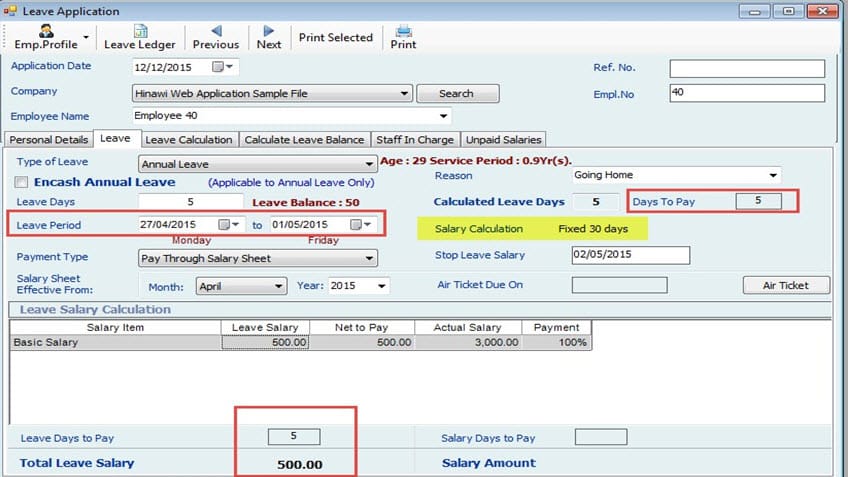

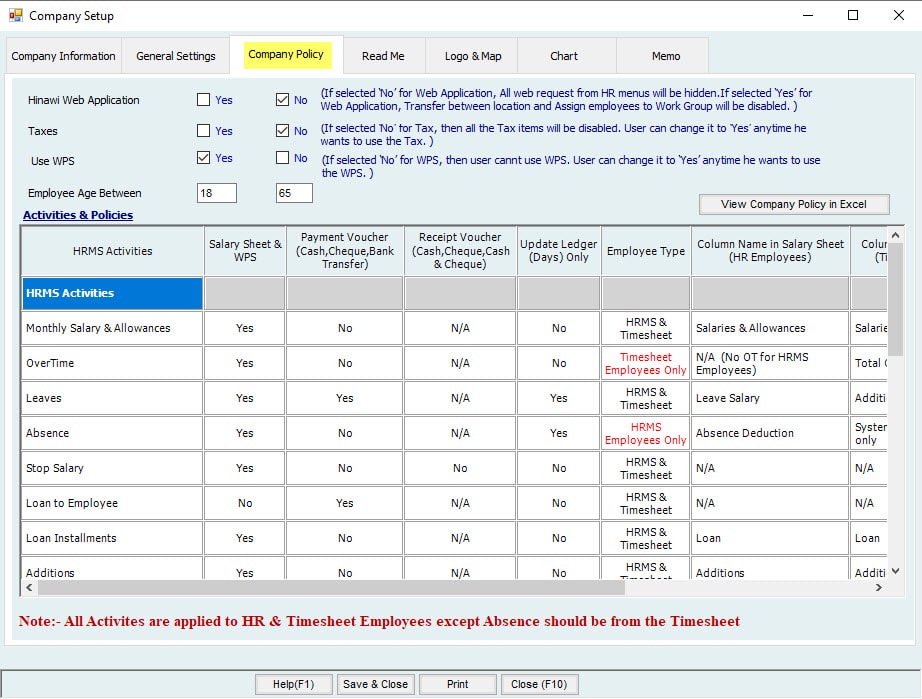

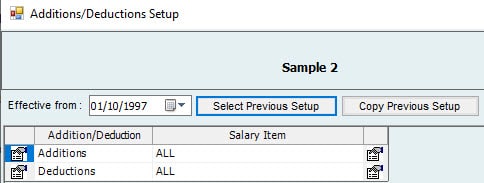

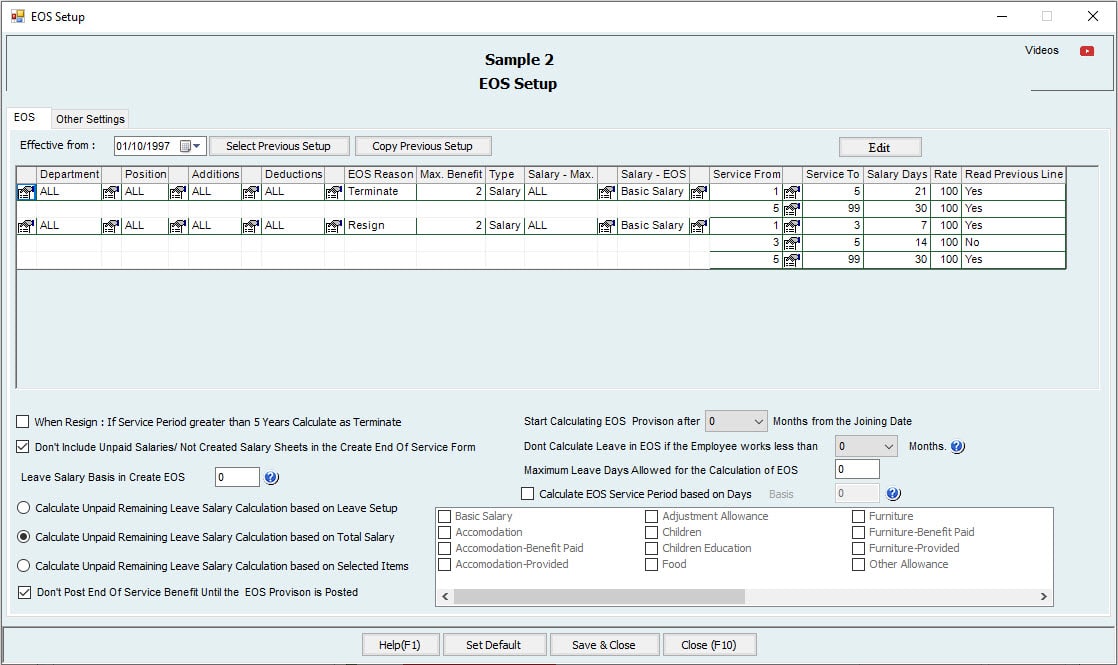

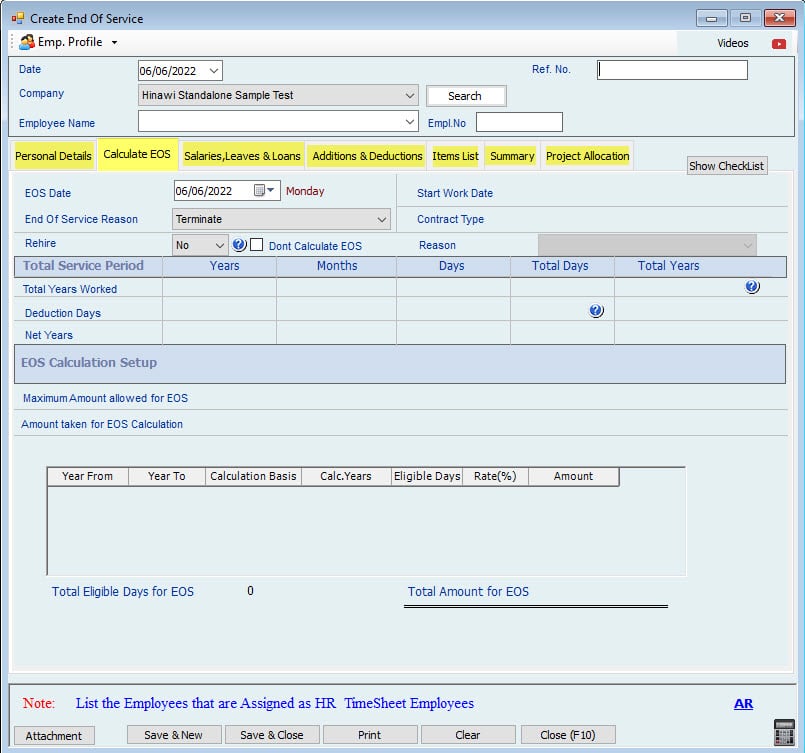

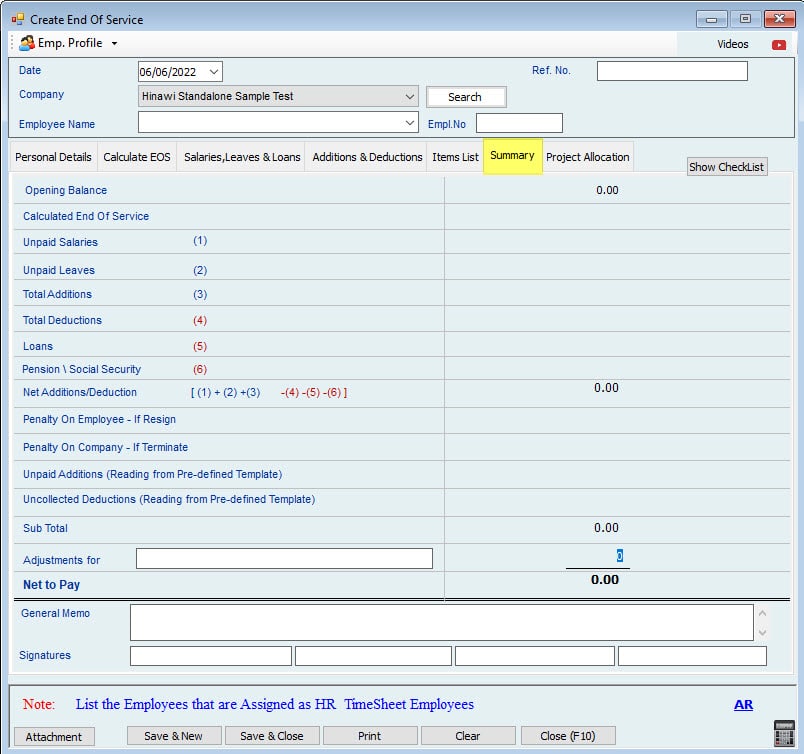

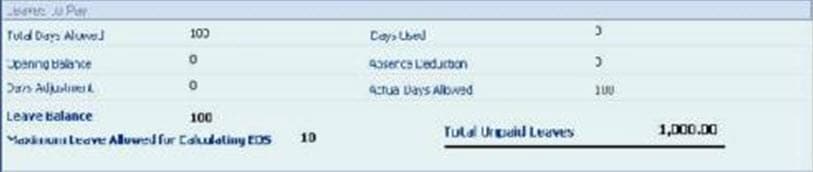

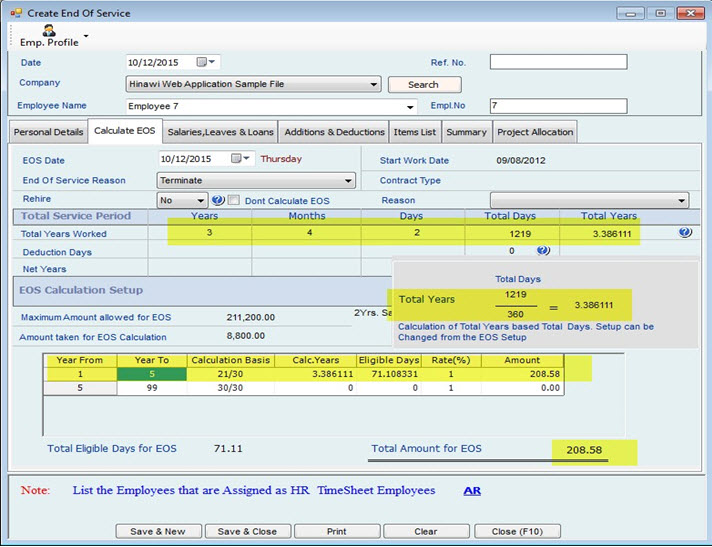

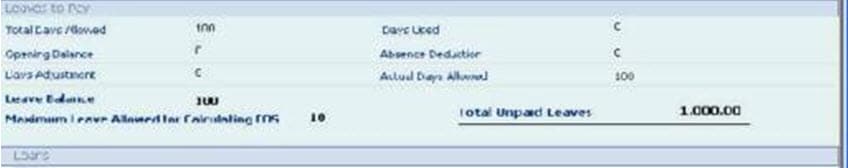

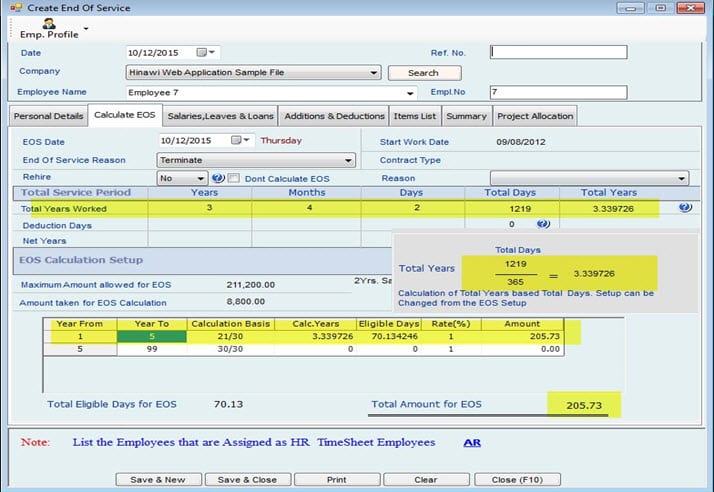

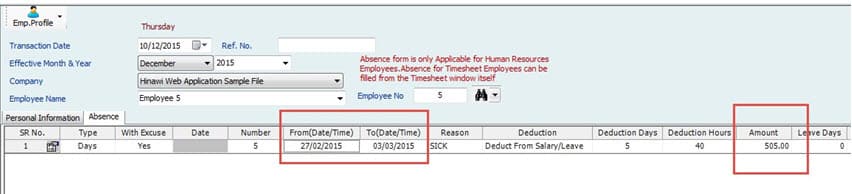

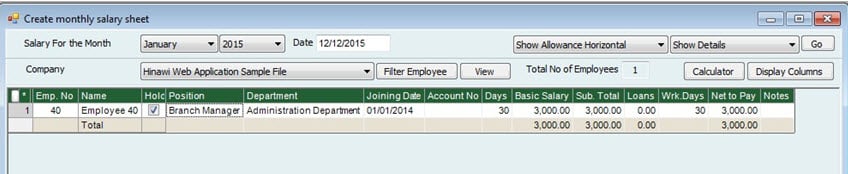

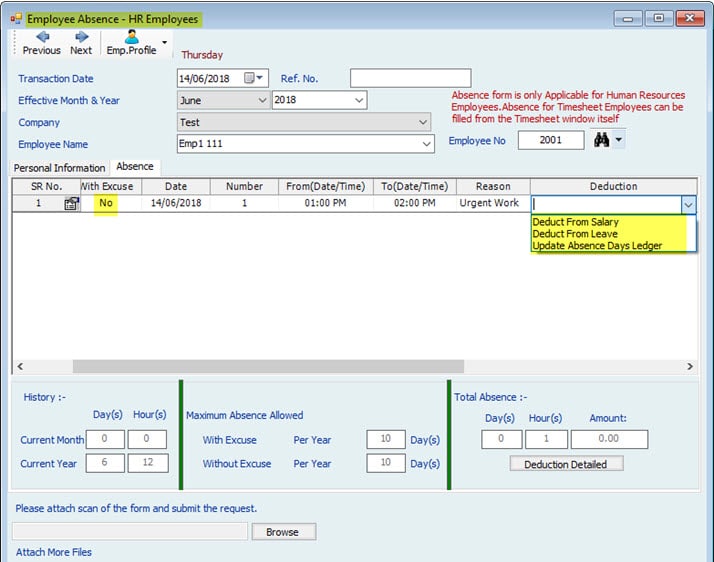

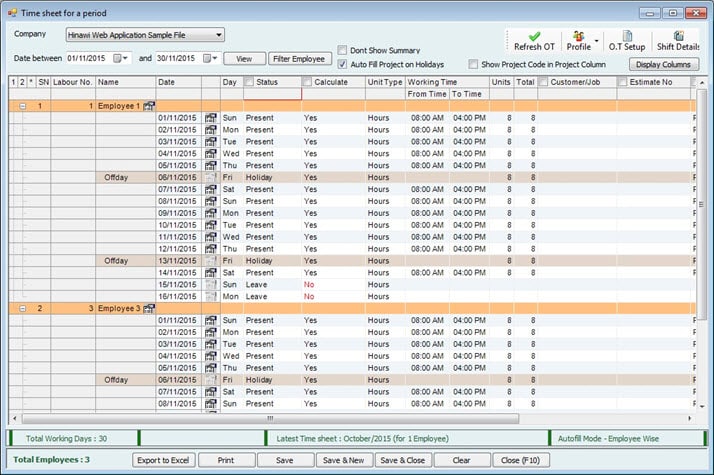

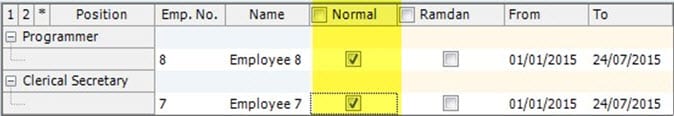

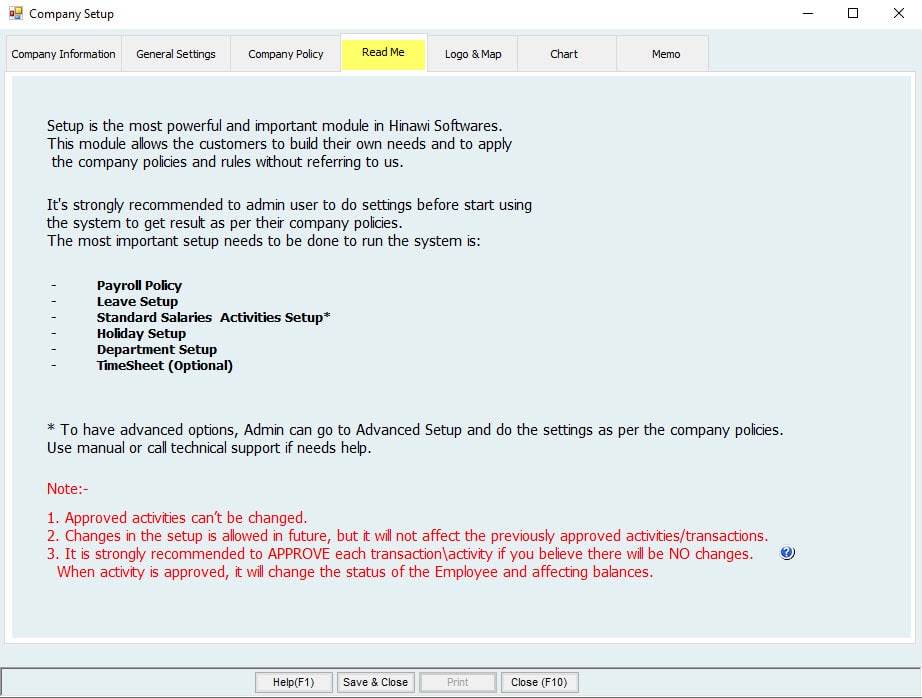

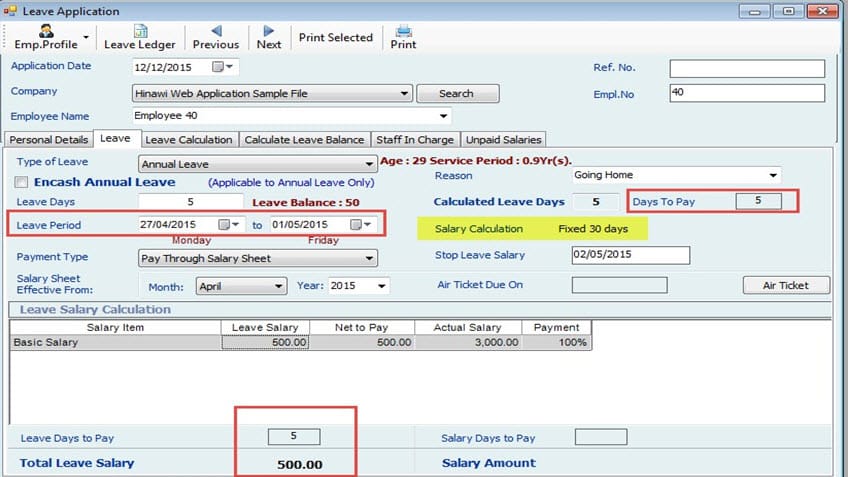

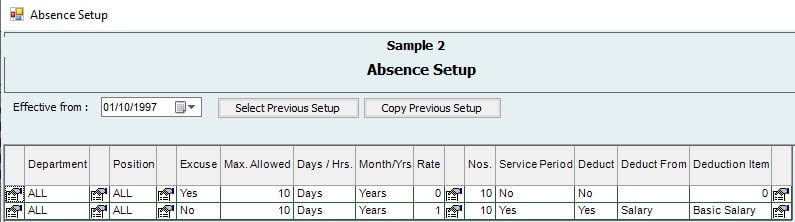

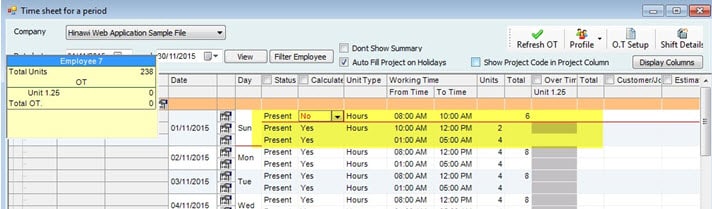

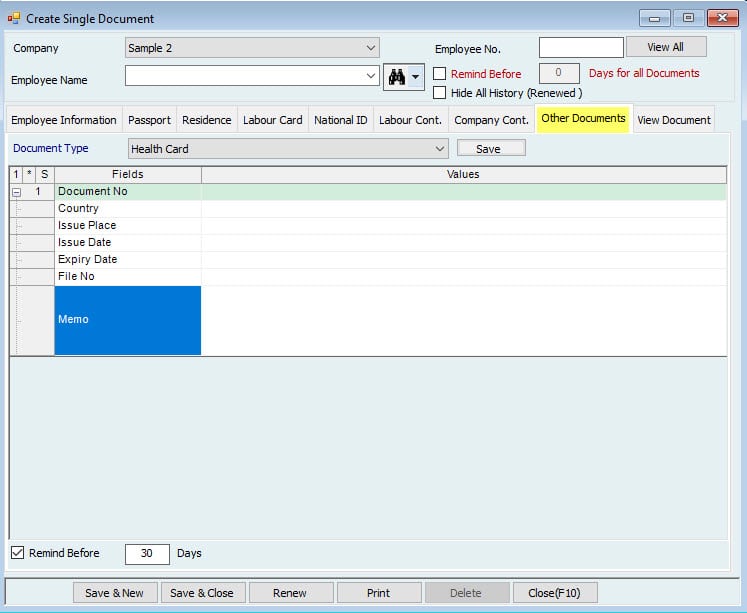

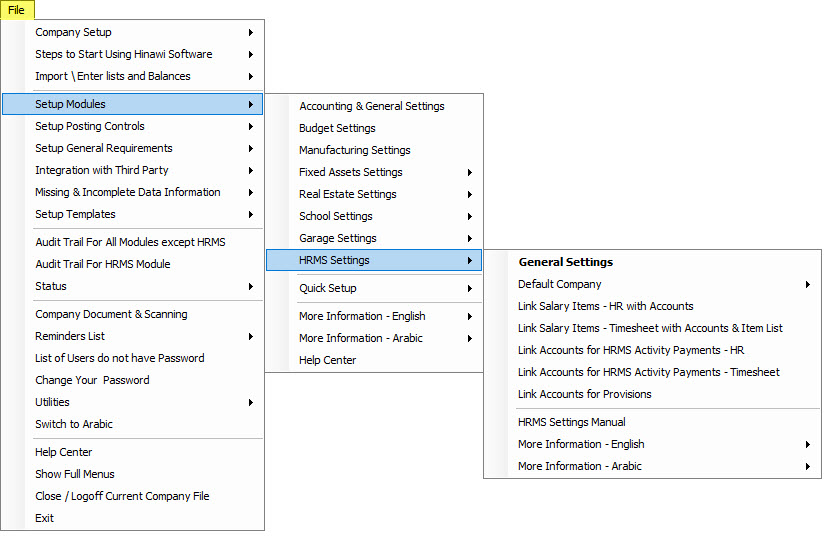

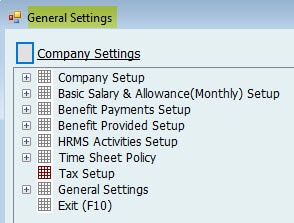

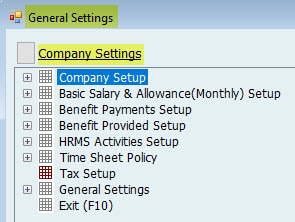

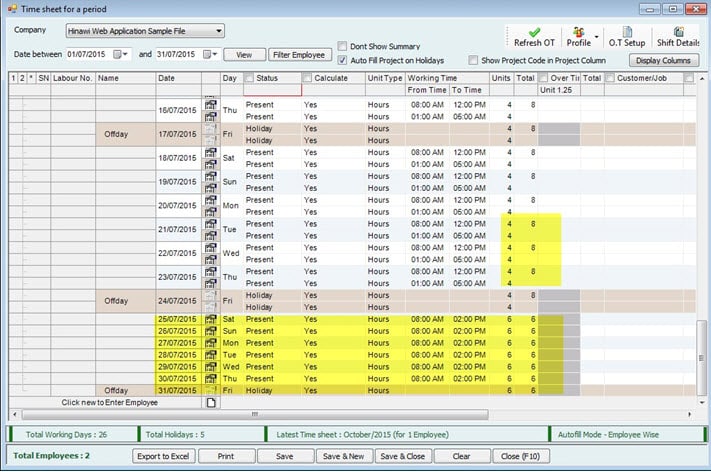

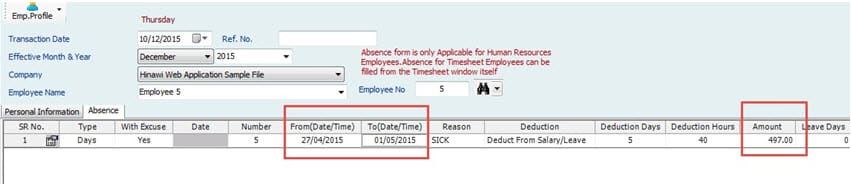

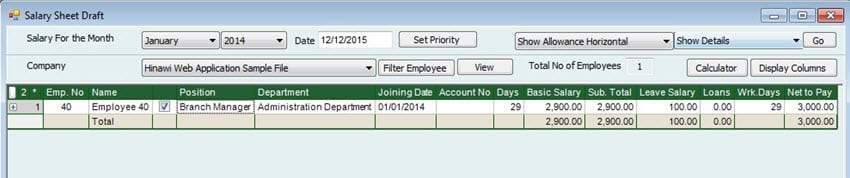

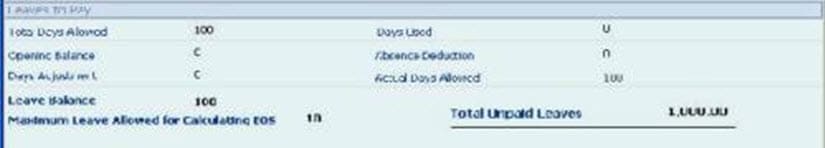

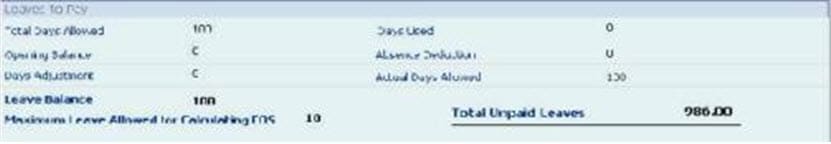

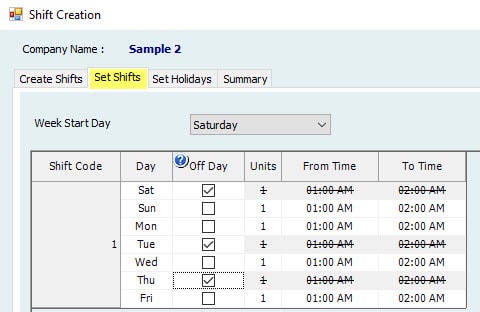

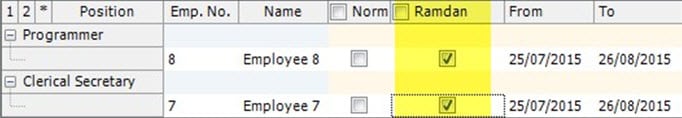

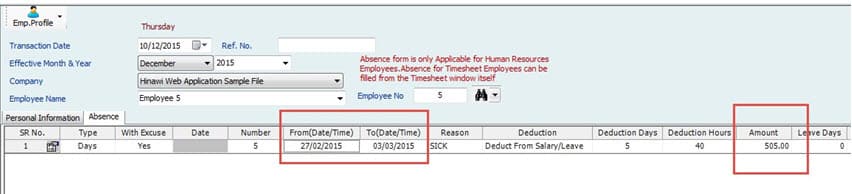

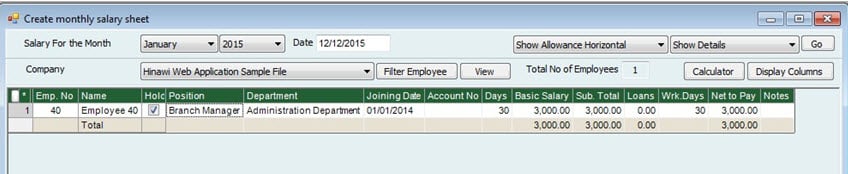

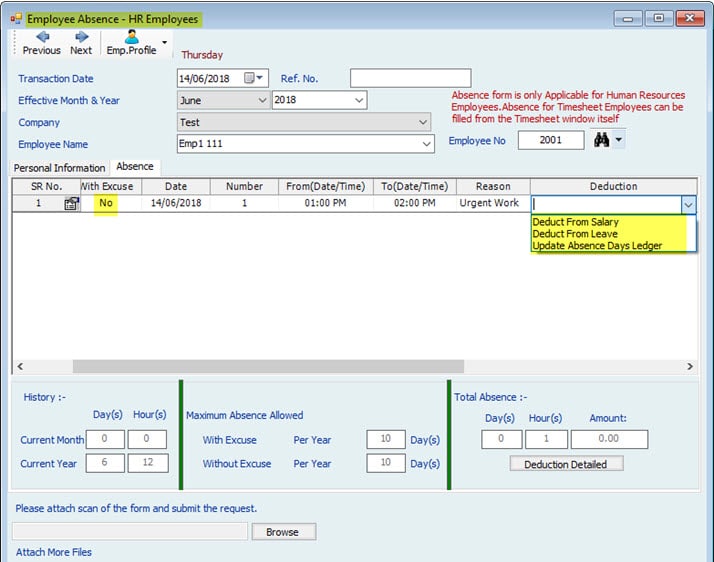

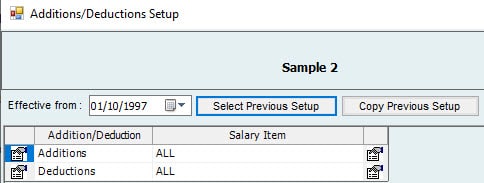

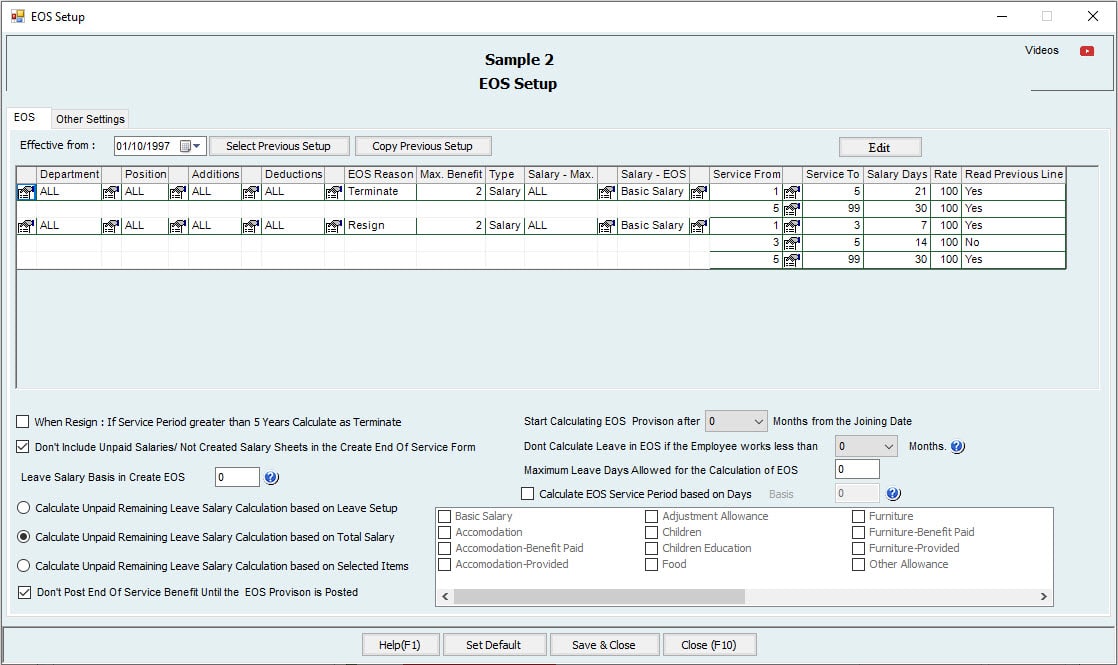

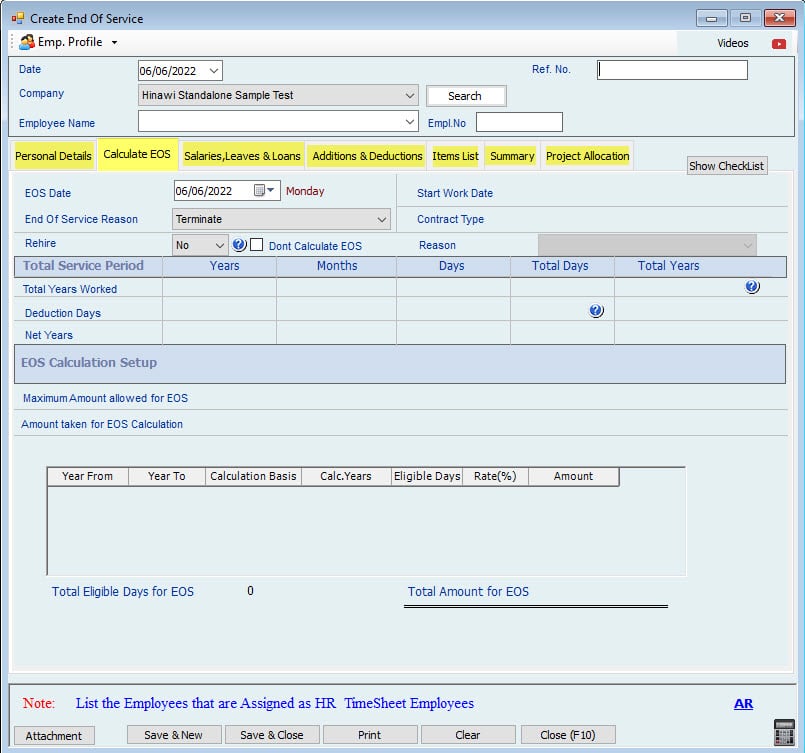

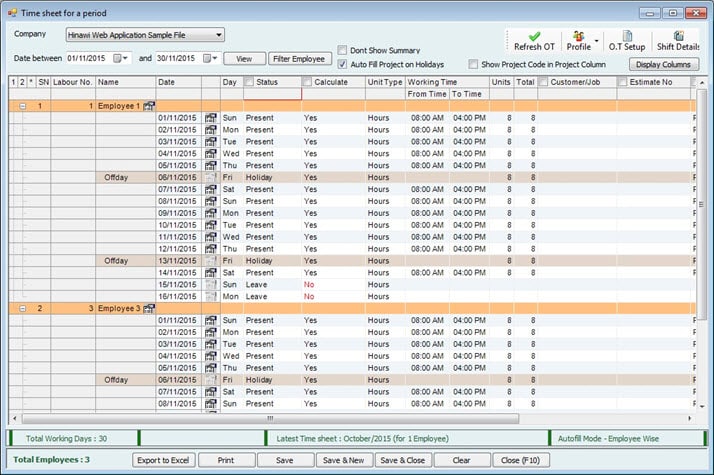

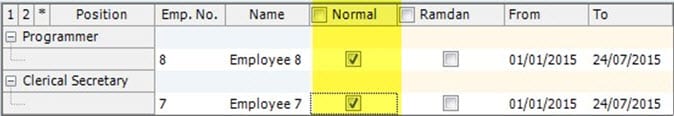

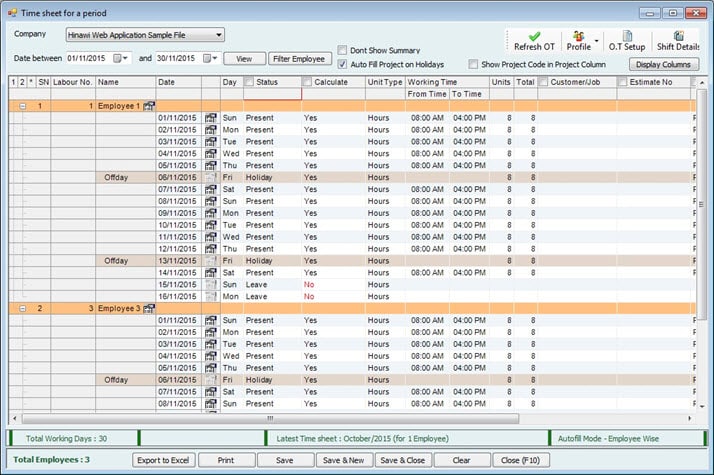

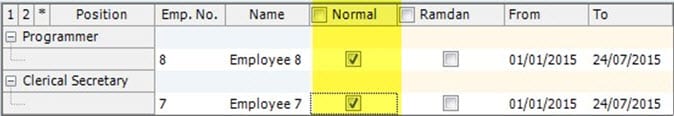

Image A:

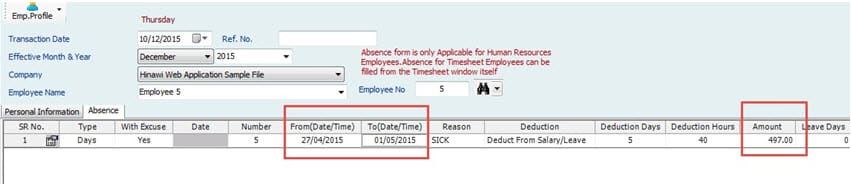

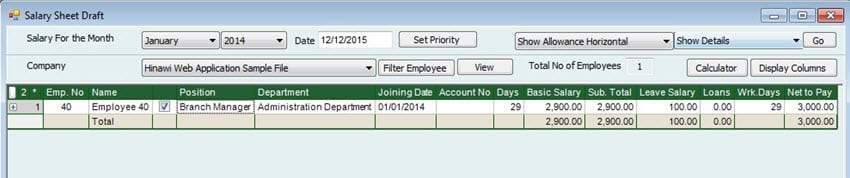

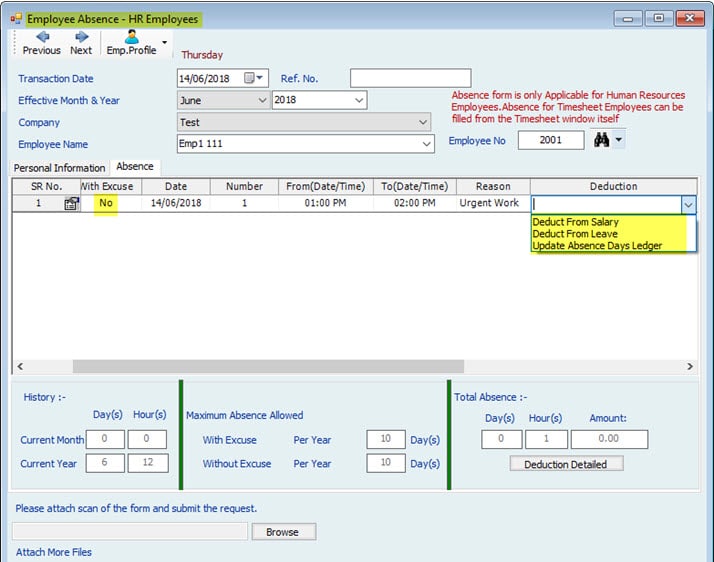

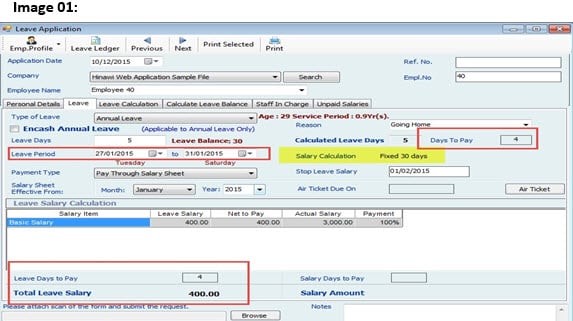

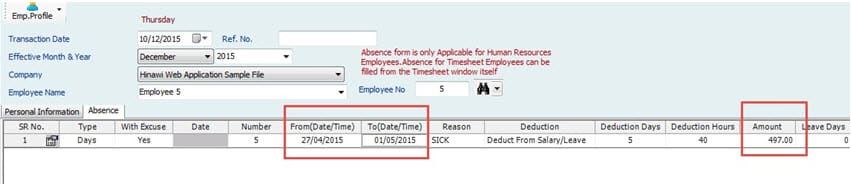

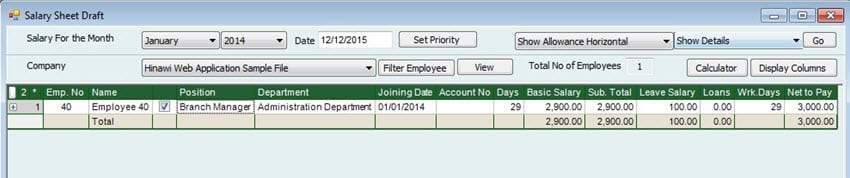

Image B:

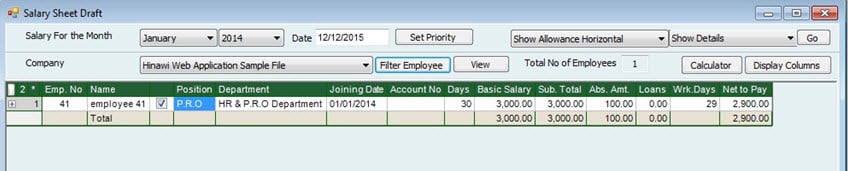

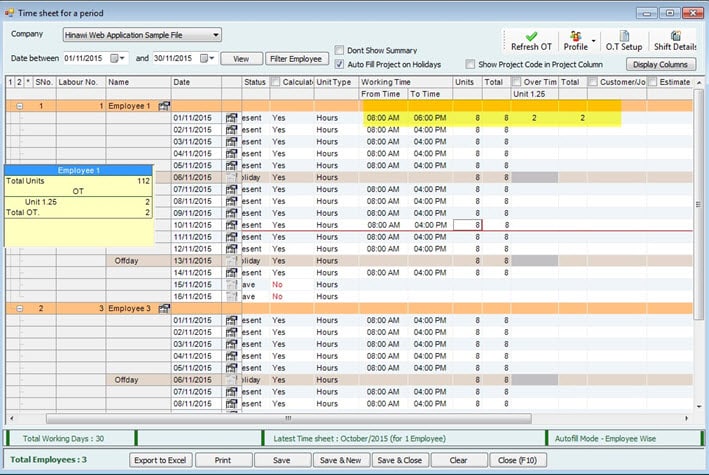

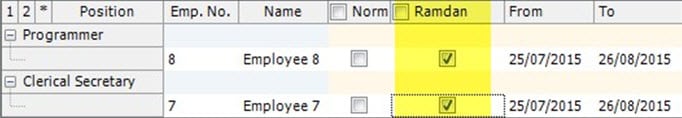

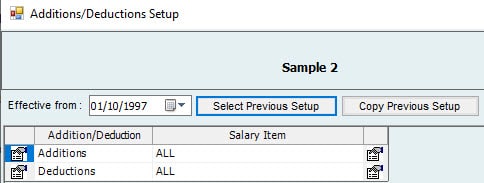

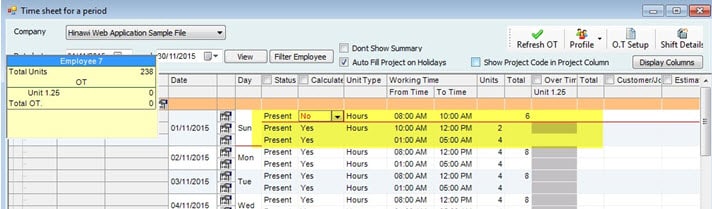

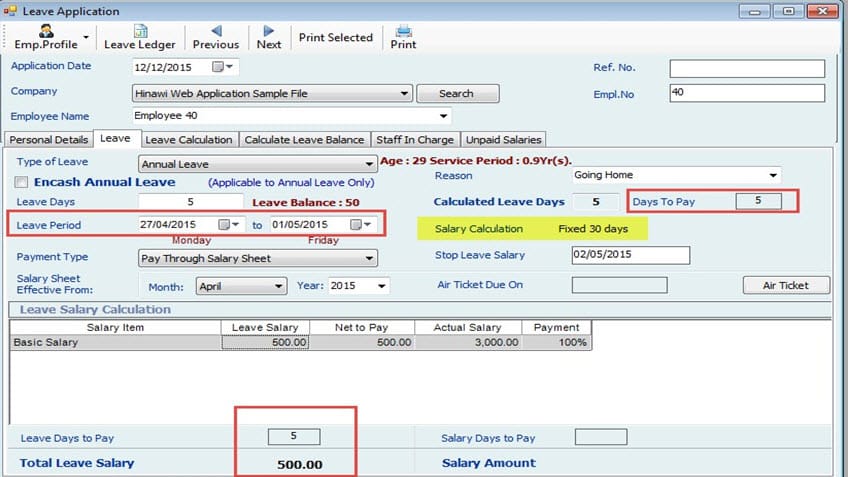

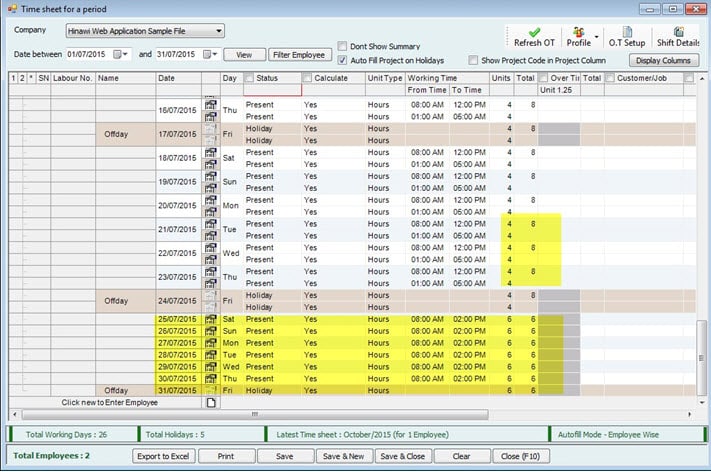

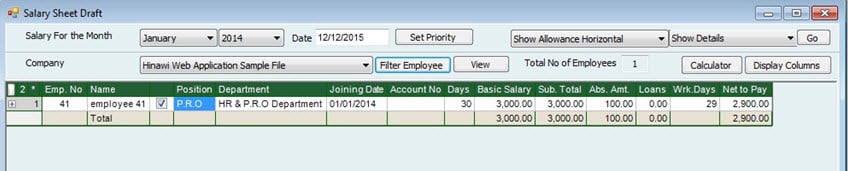

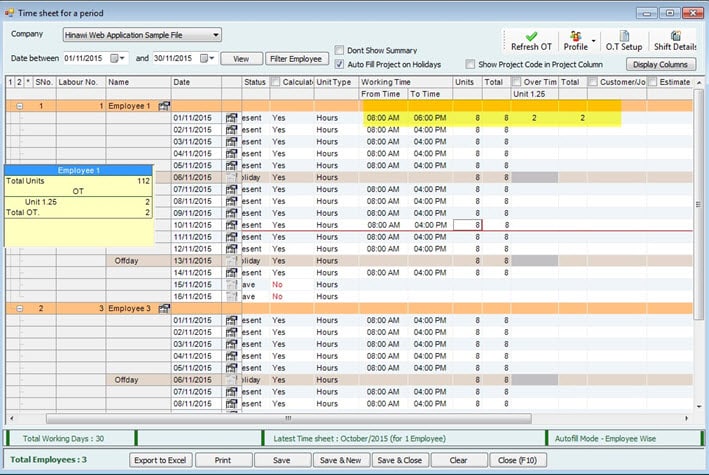

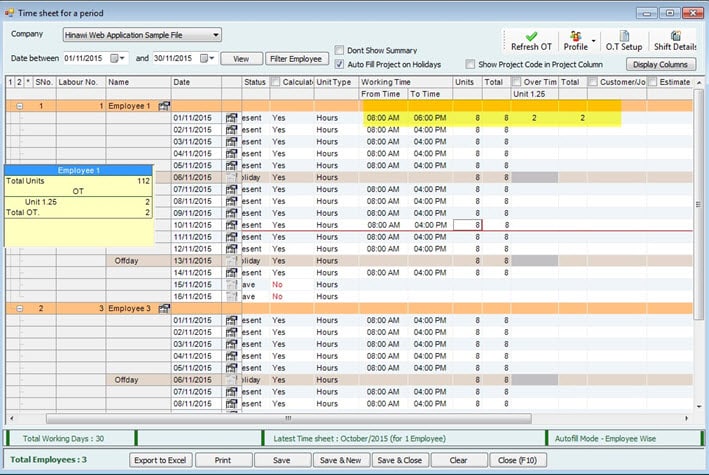

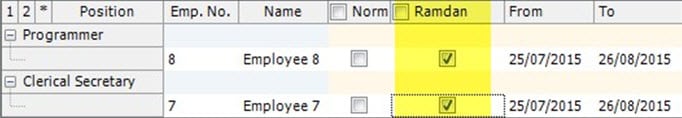

Image C:

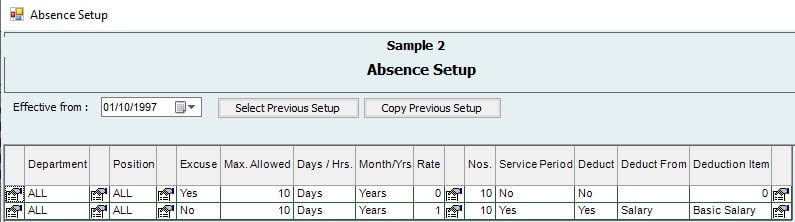

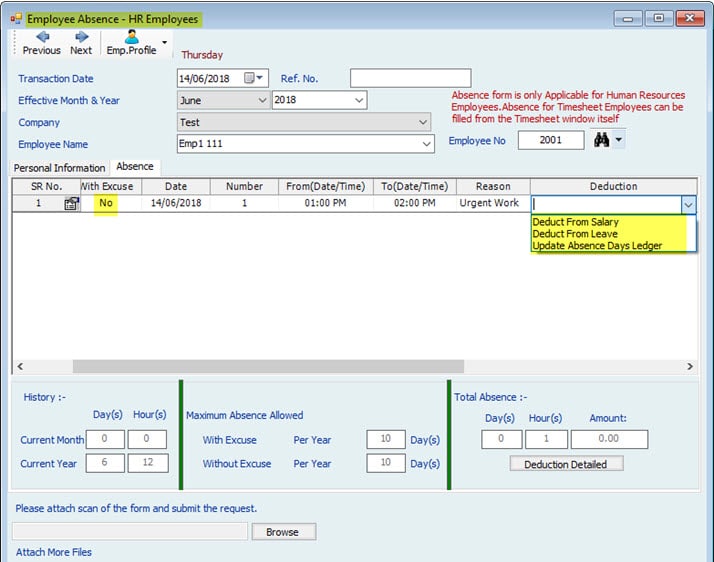

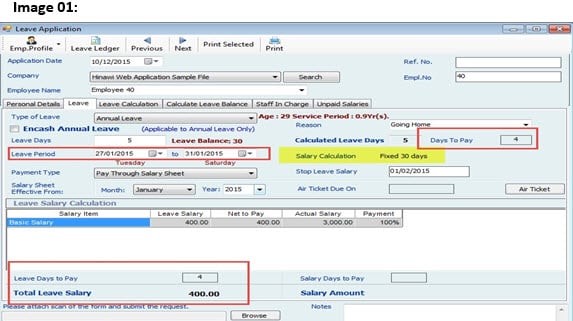

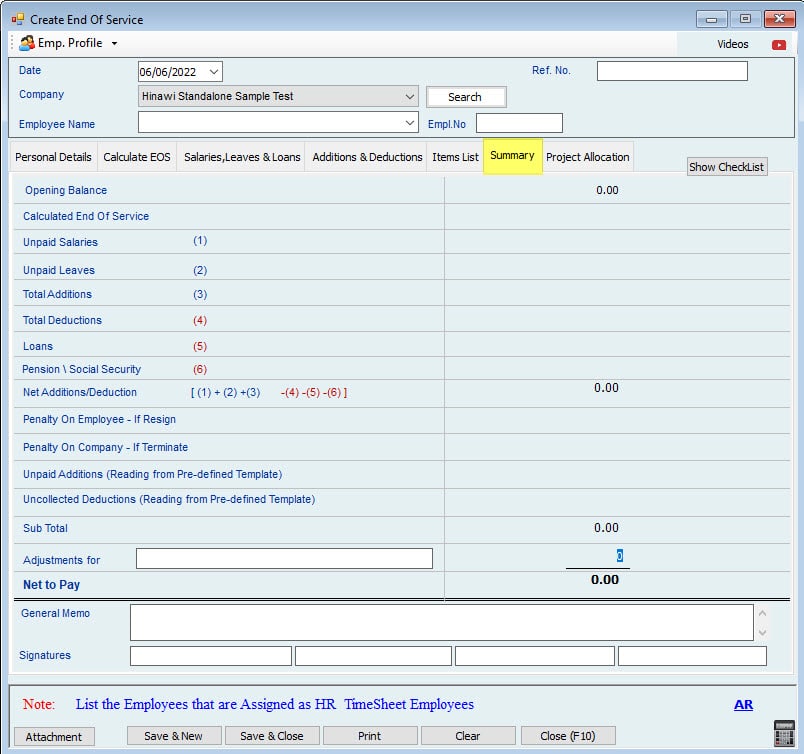

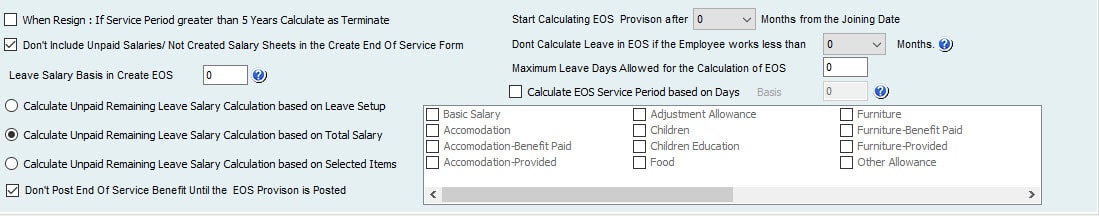

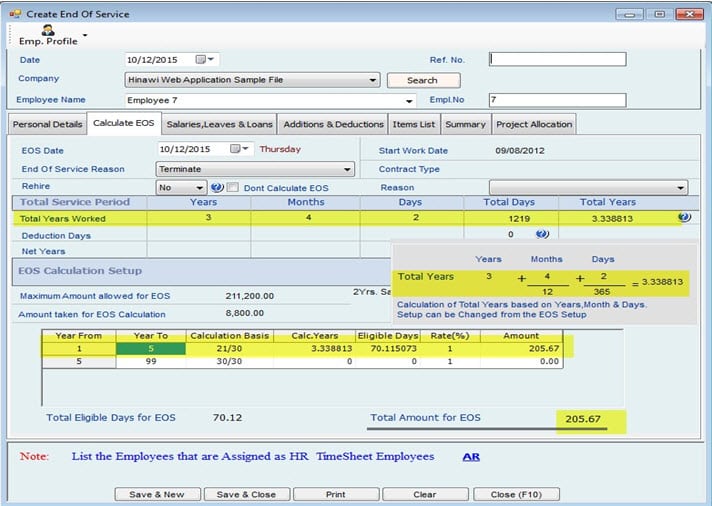

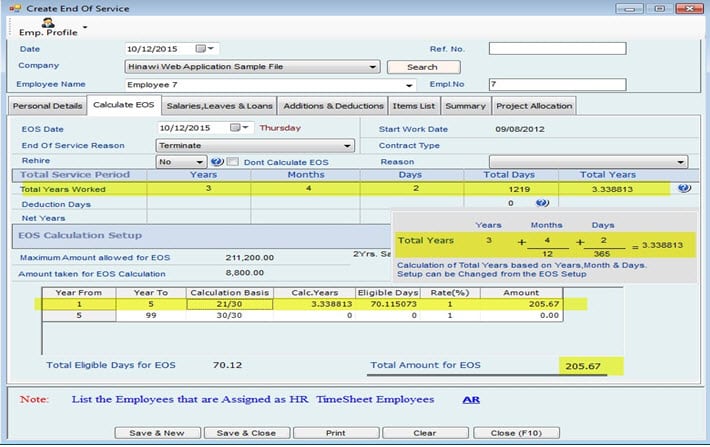

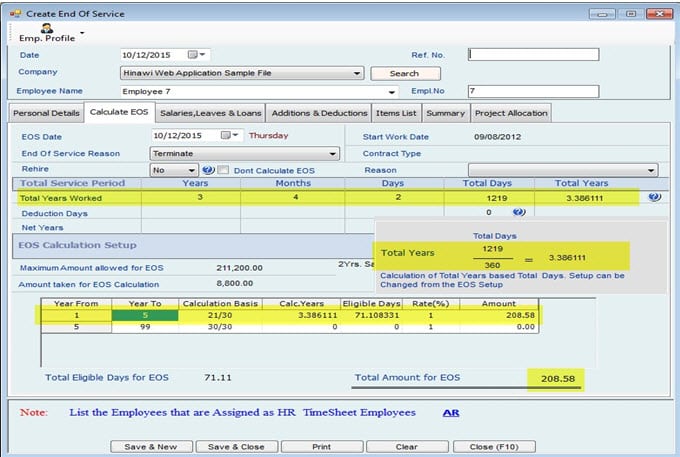

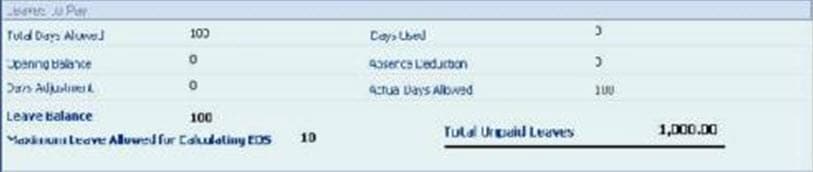

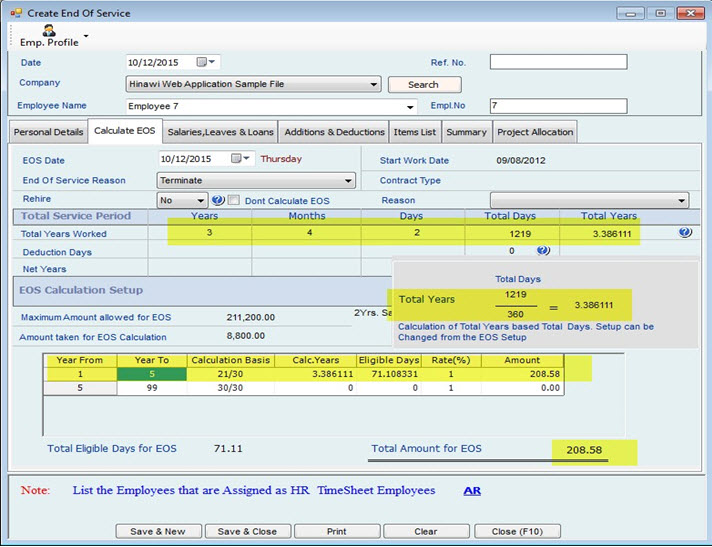

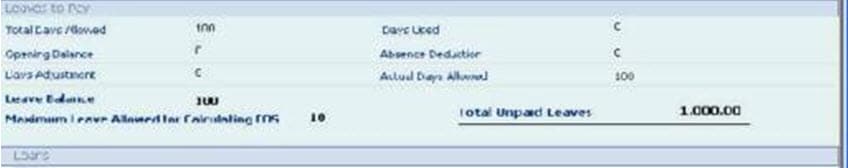

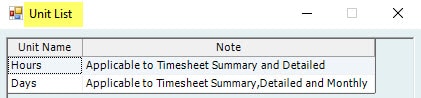

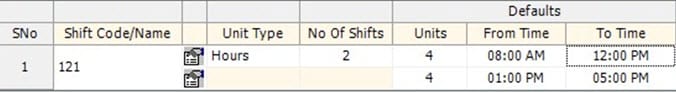

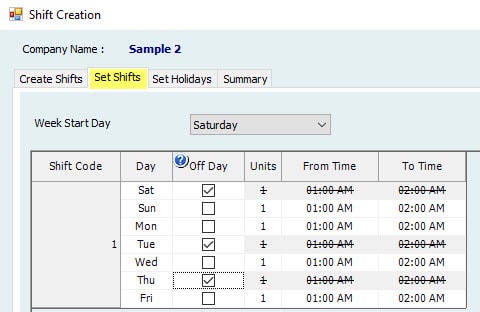

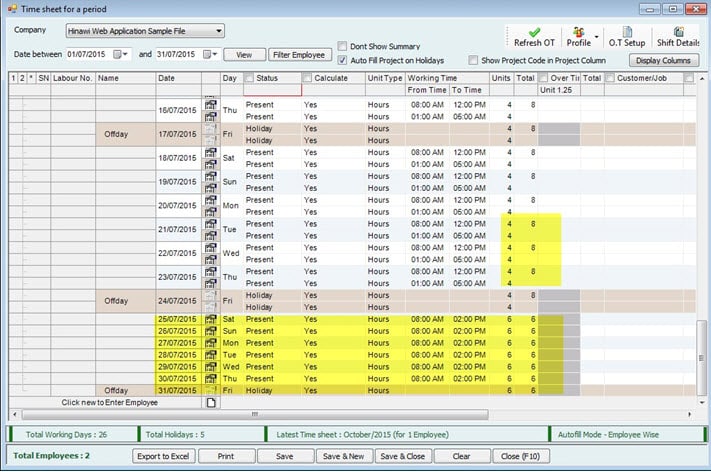

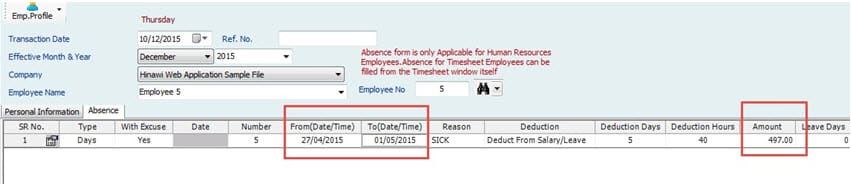

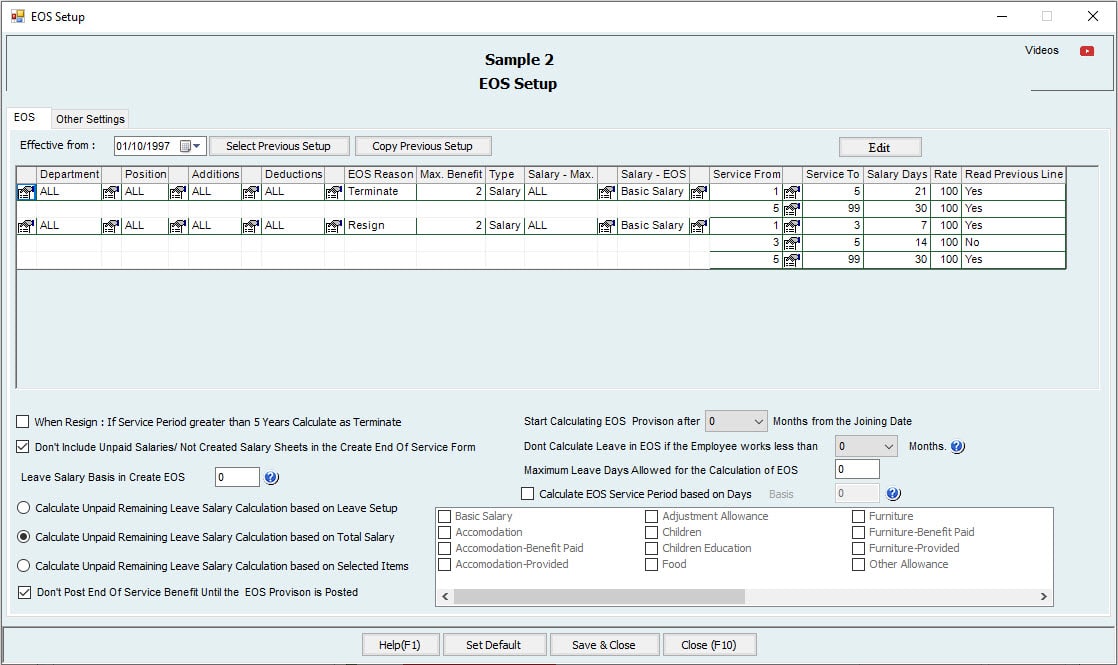

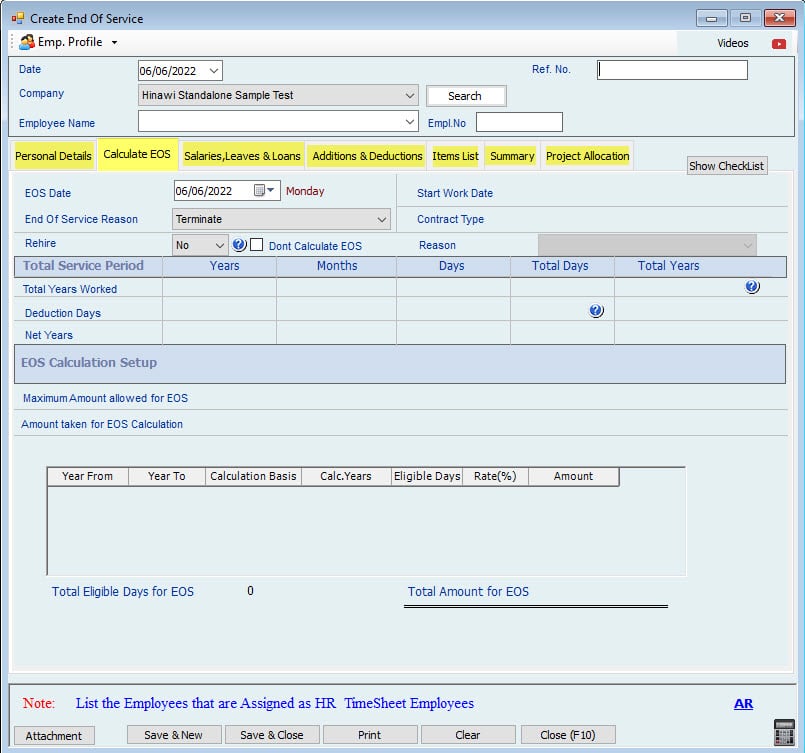

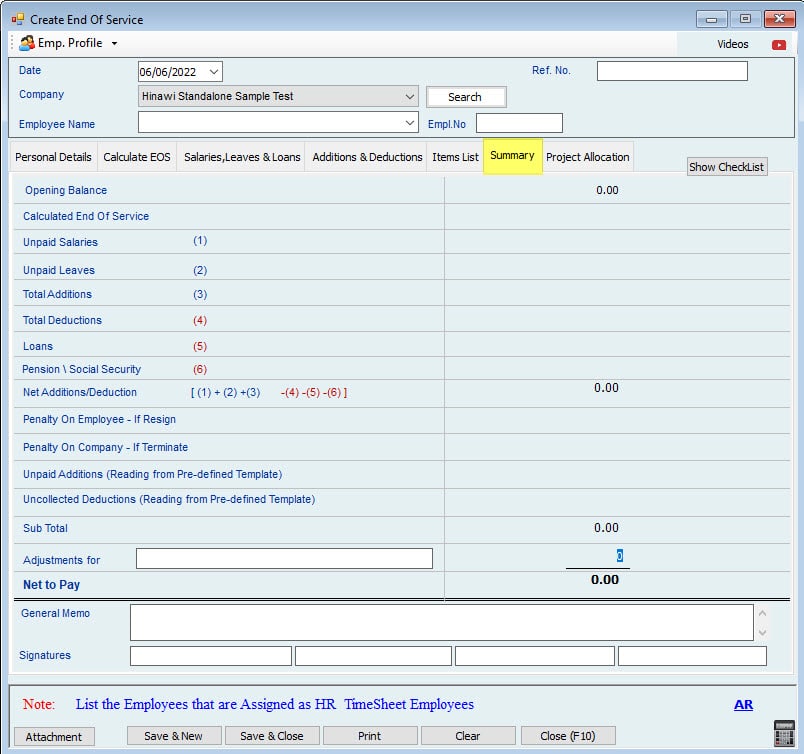

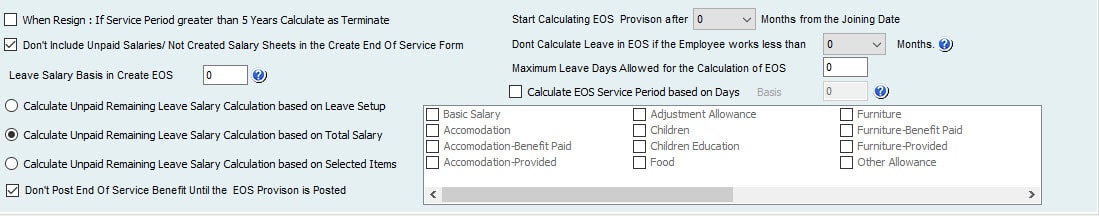

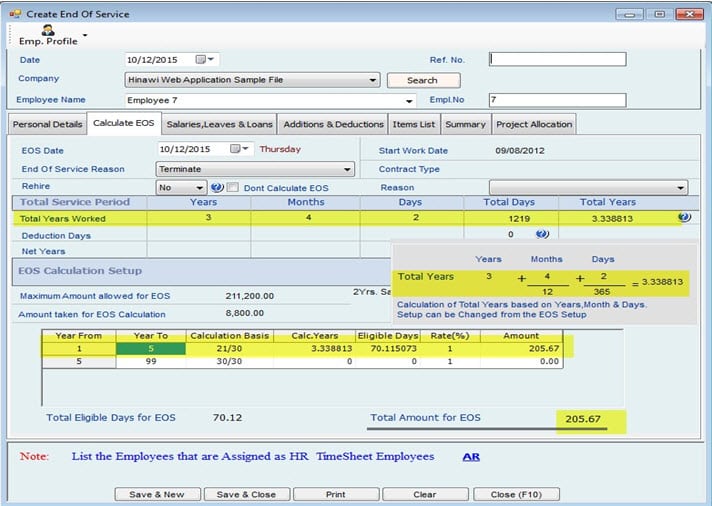

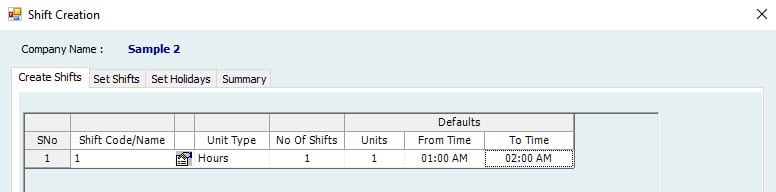

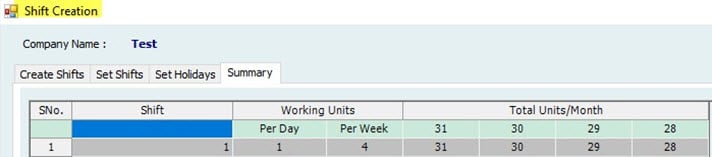

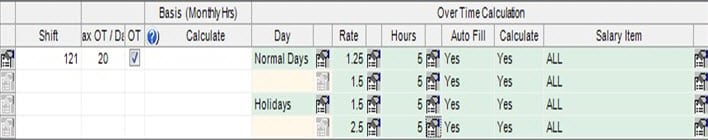

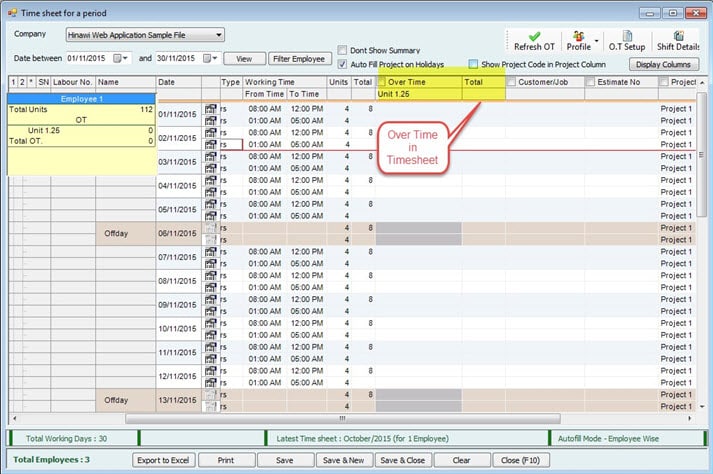

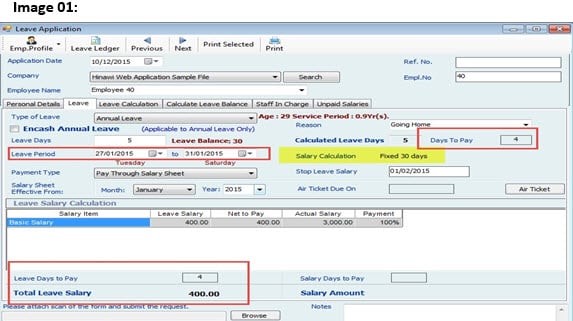

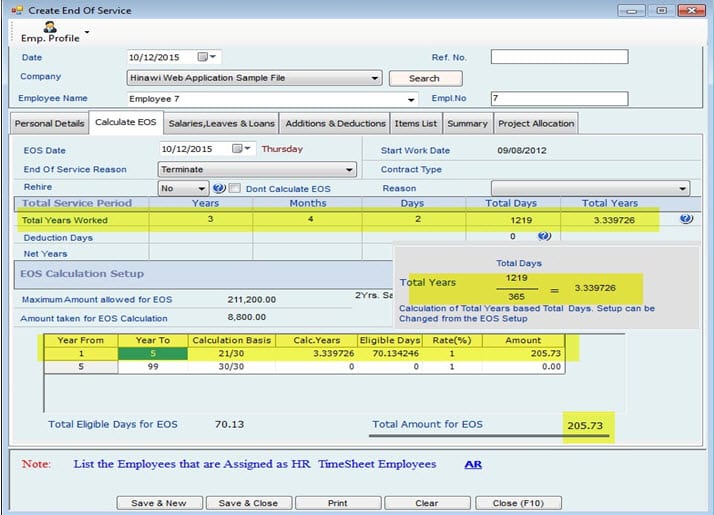

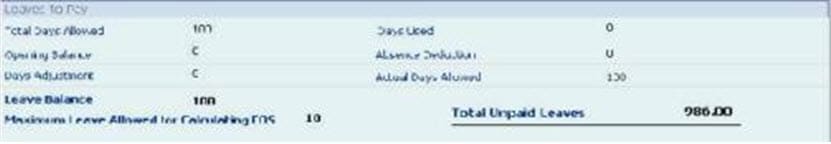

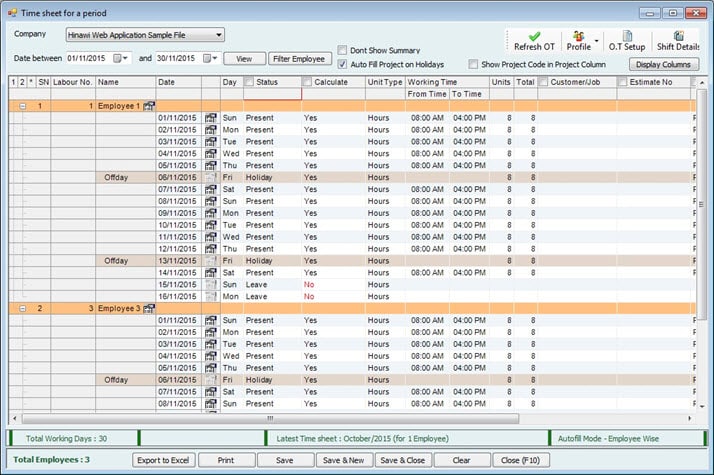

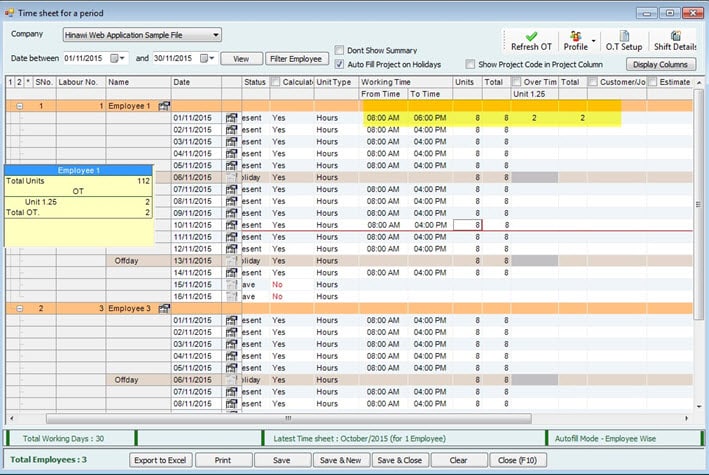

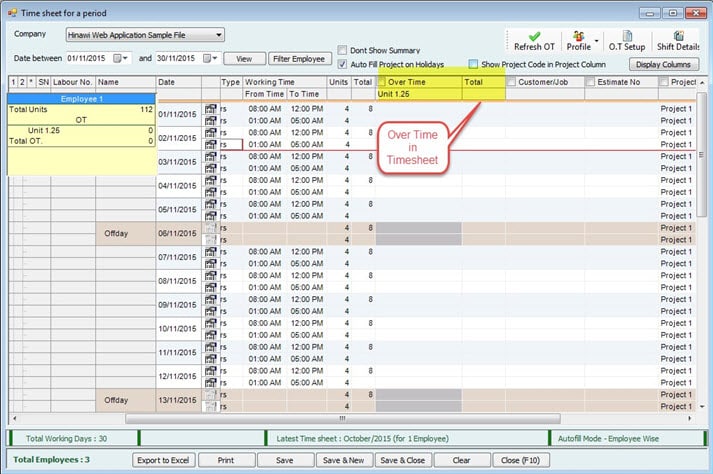

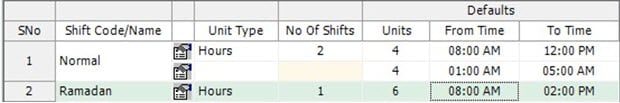

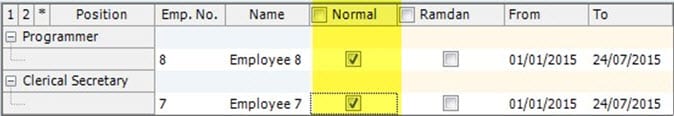

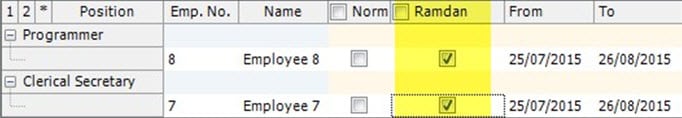

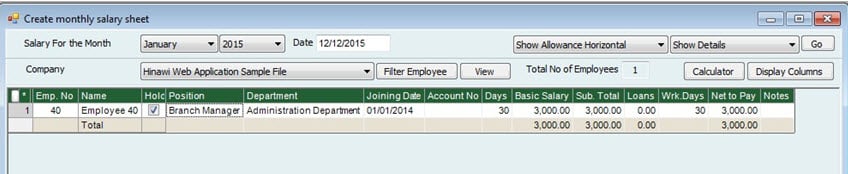

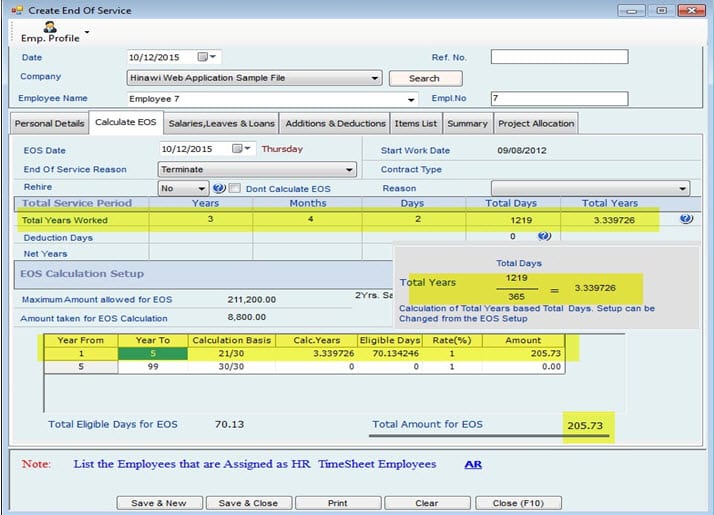

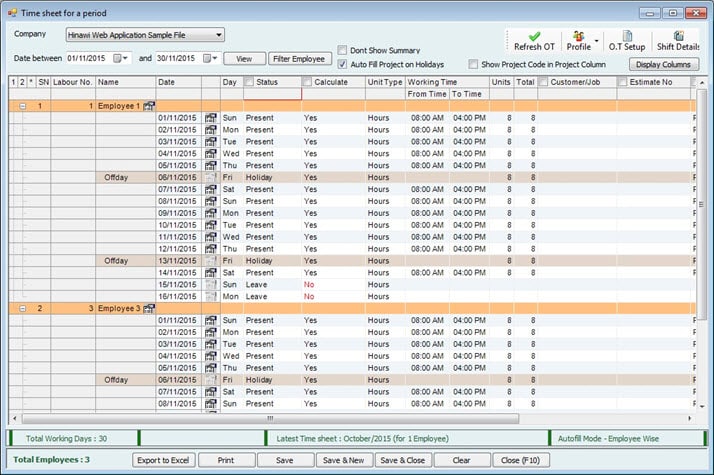

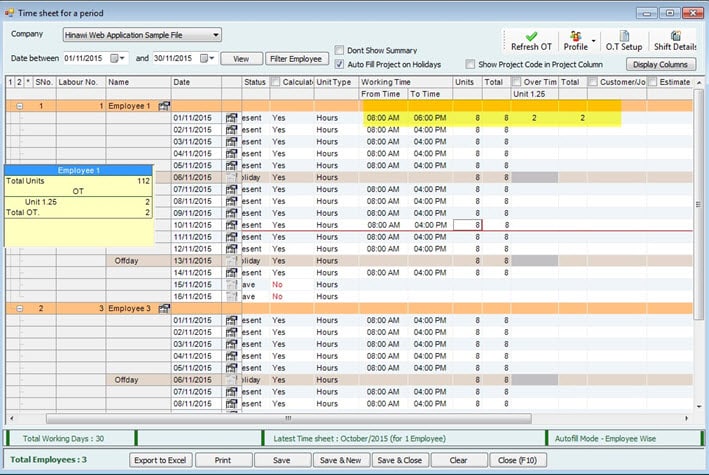

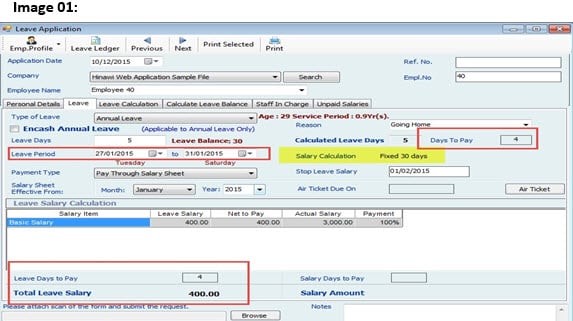

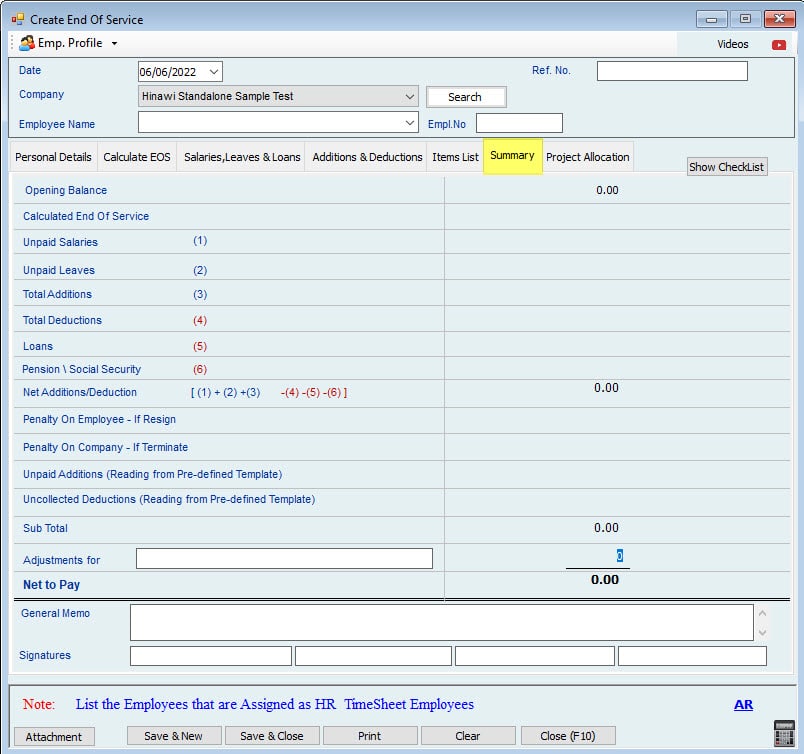

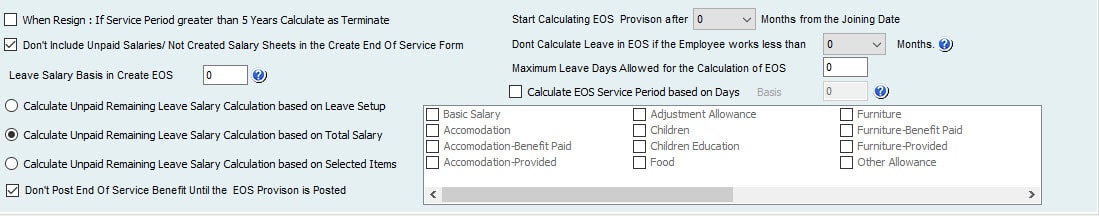

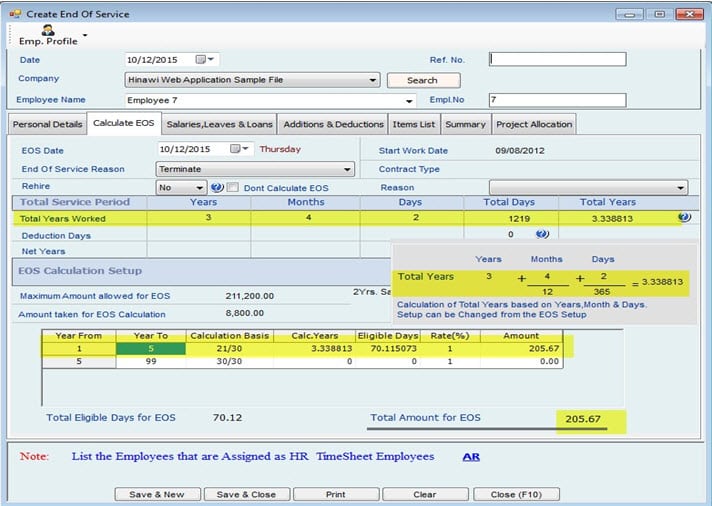

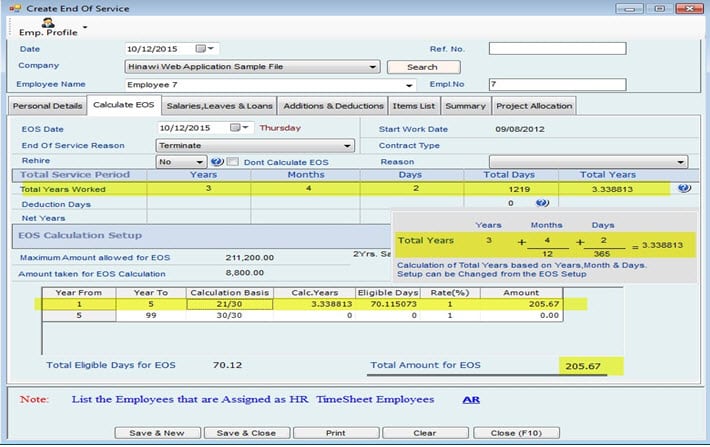

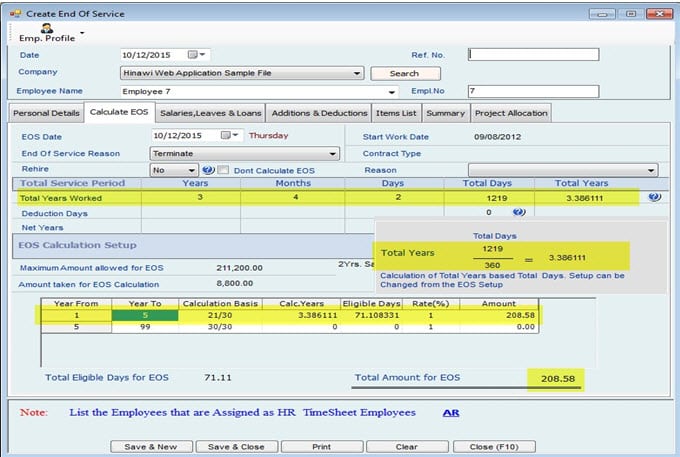

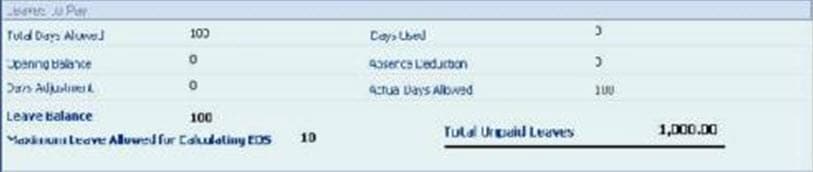

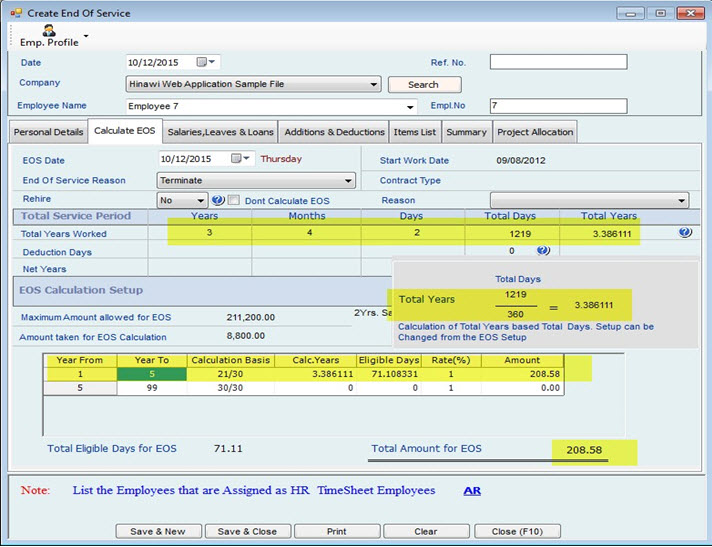

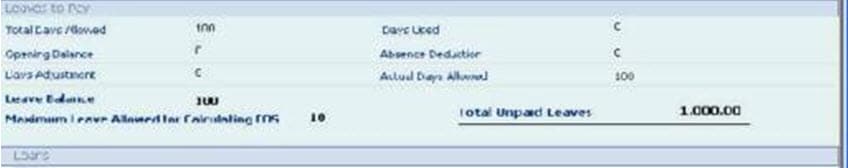

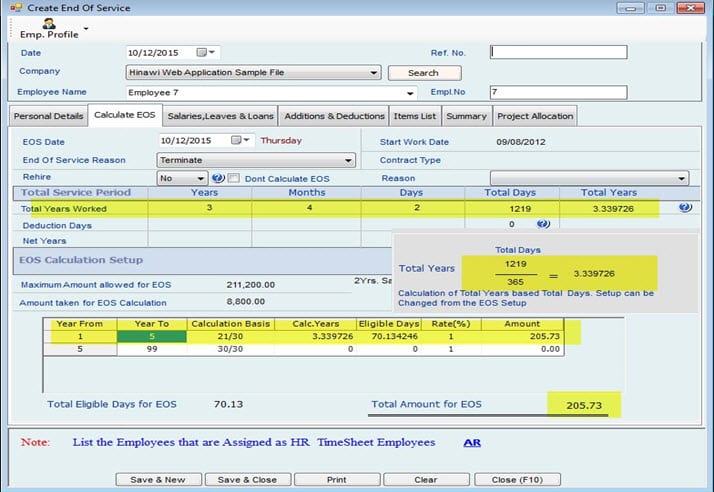

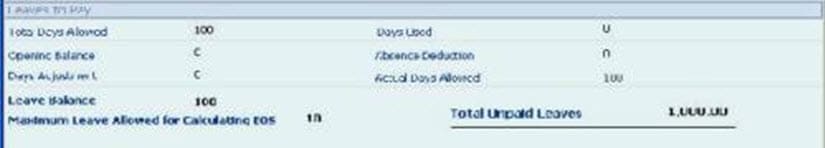

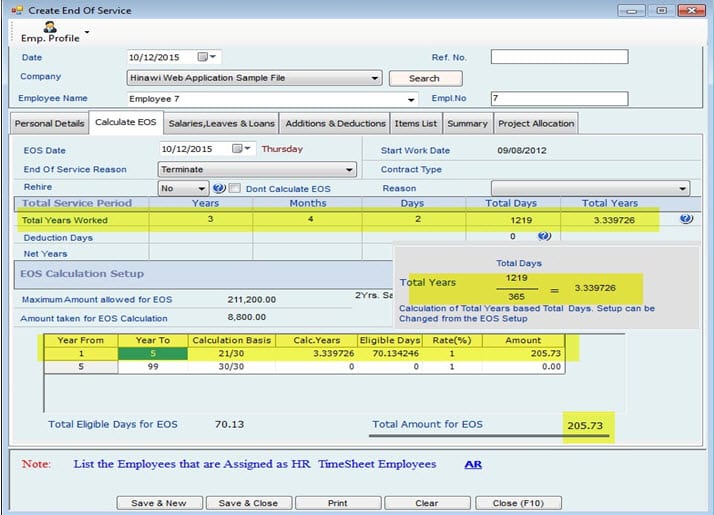

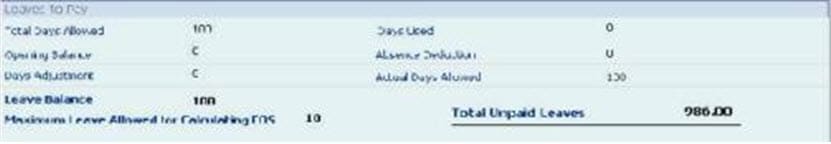

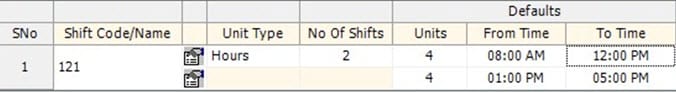

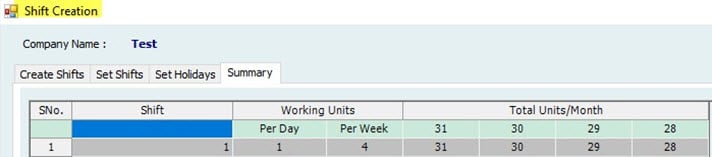

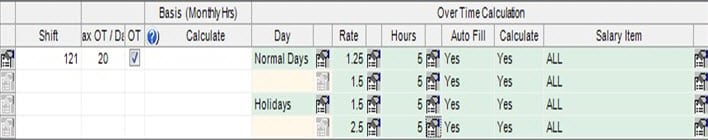

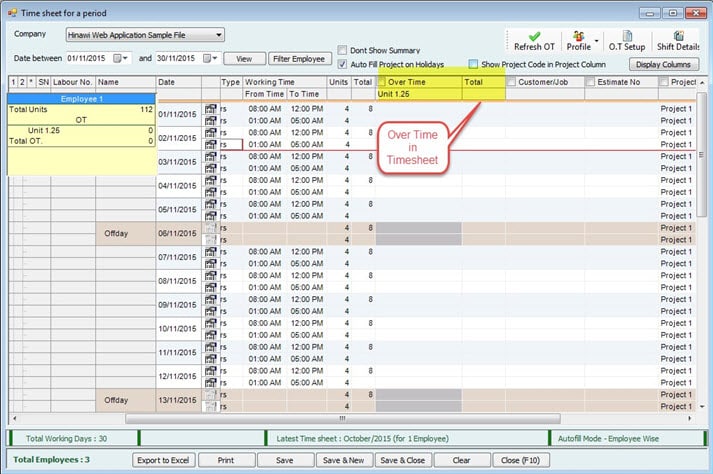

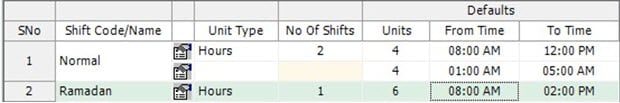

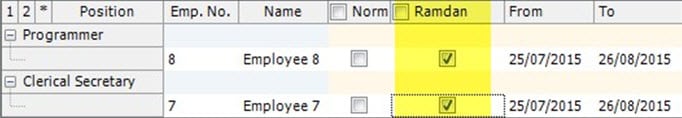

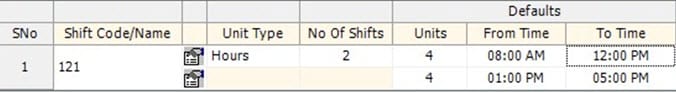

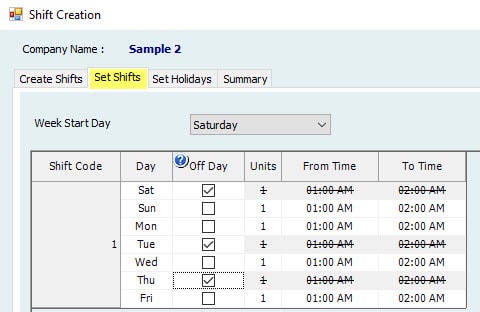

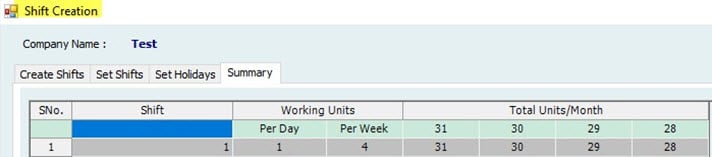

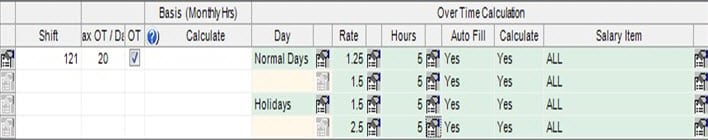

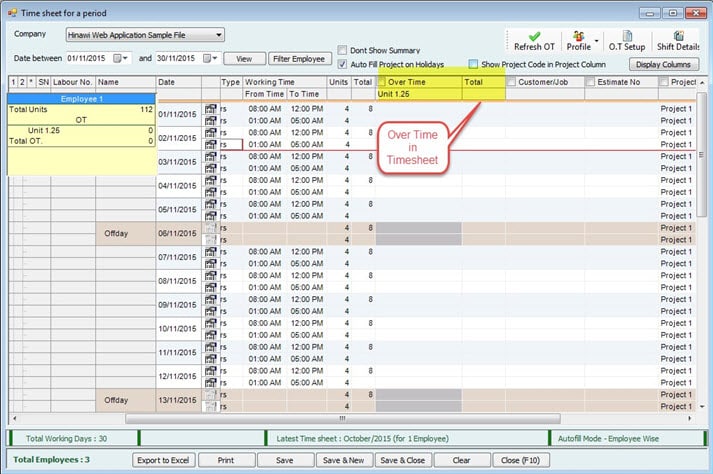

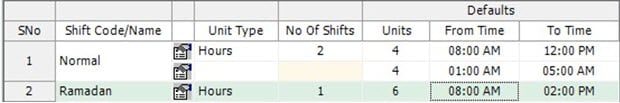

Image 01:

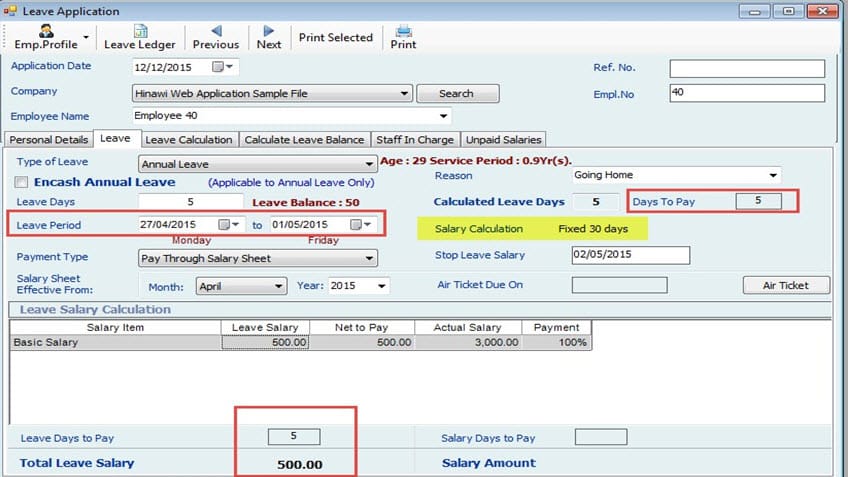

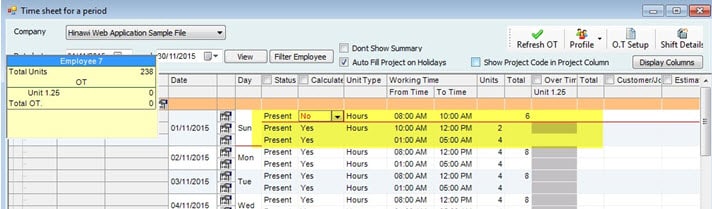

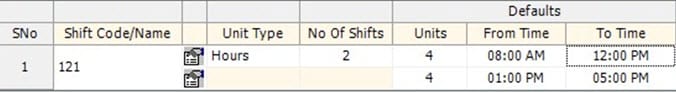

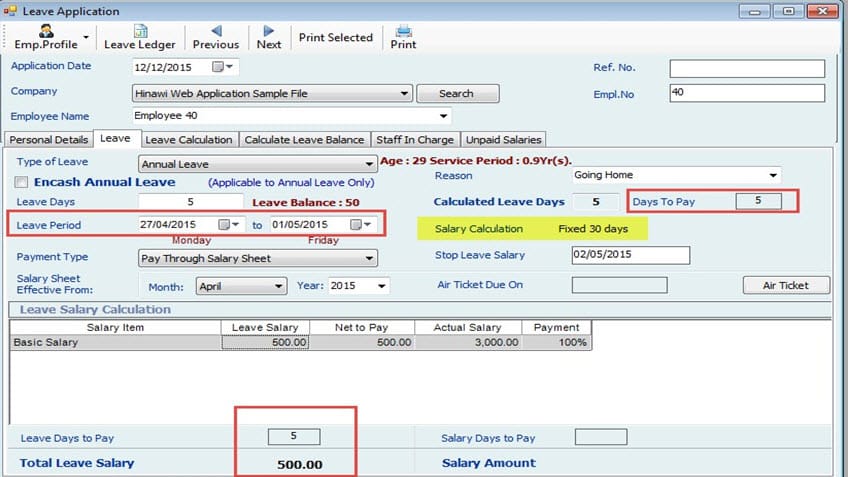

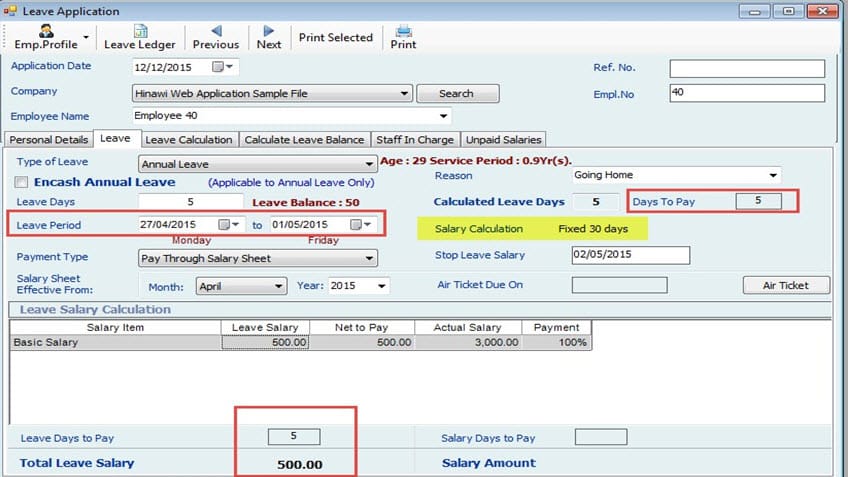

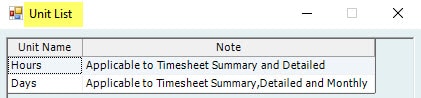

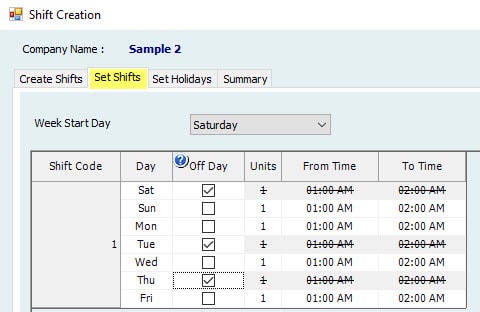

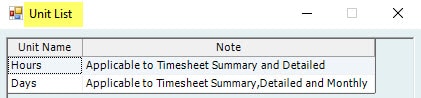

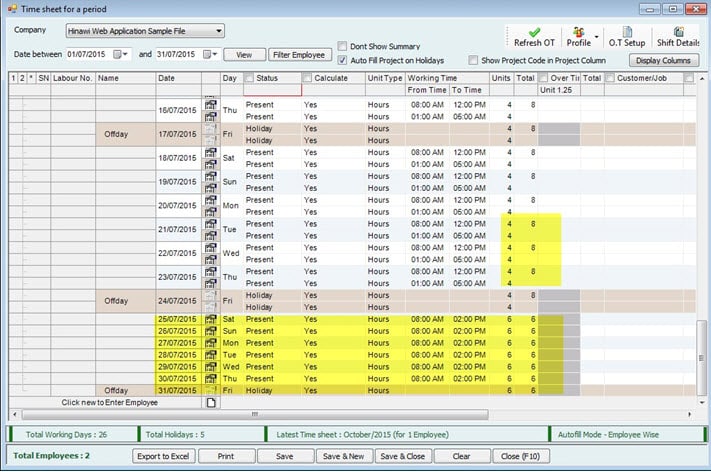

Image 02:

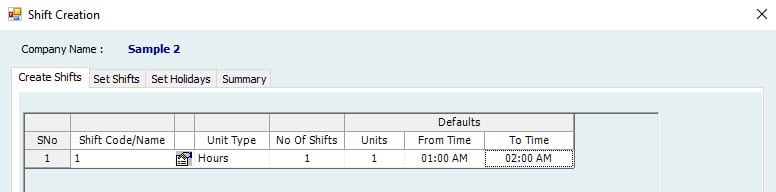

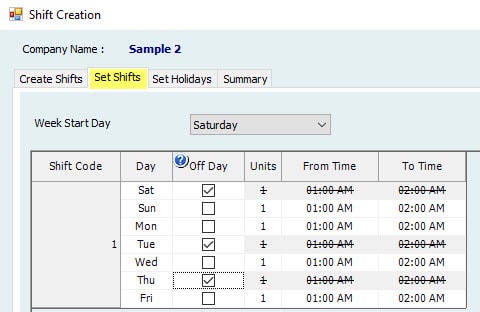

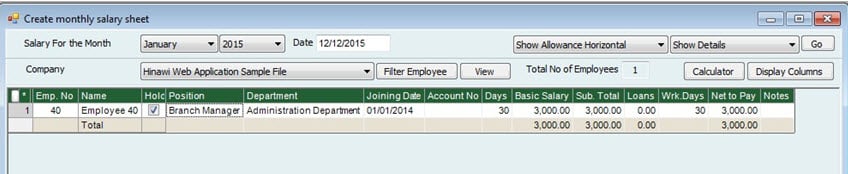

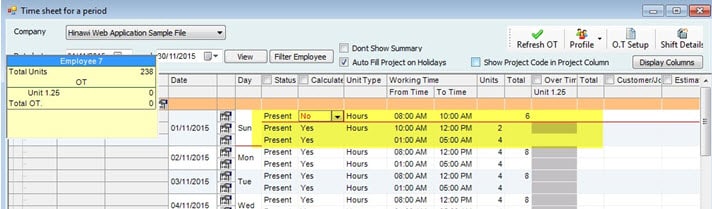

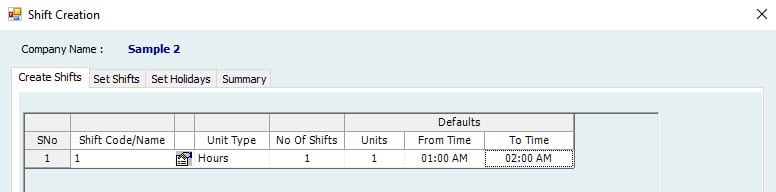

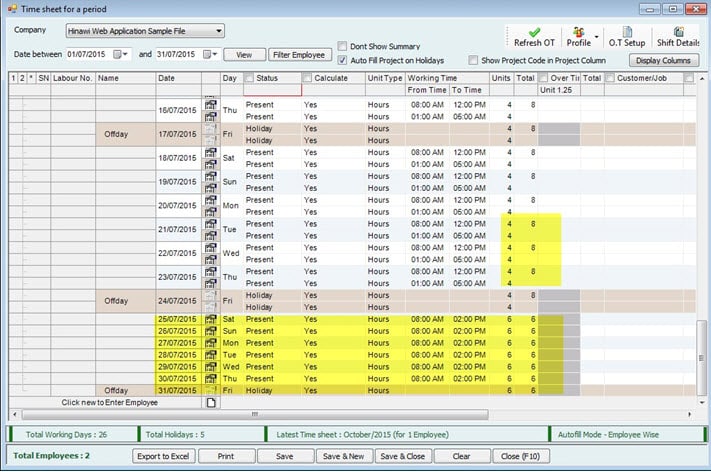

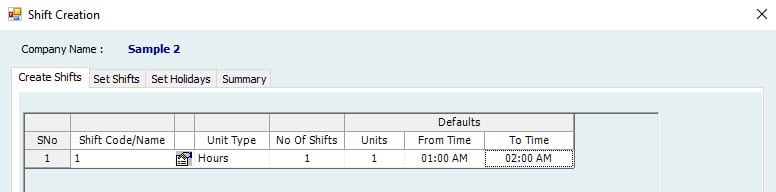

Image 03:

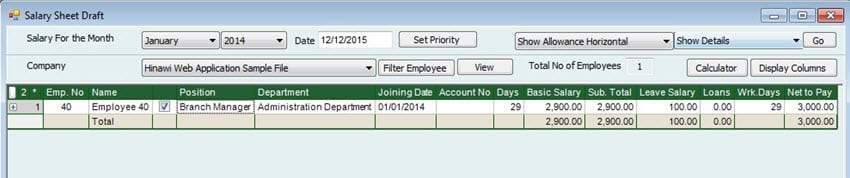

Image 04:

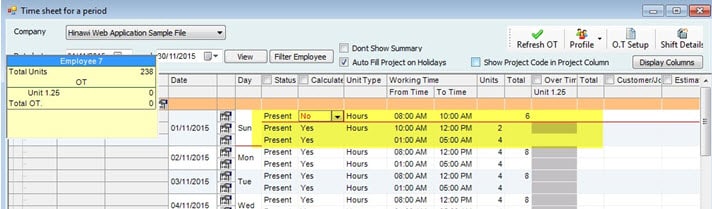

Image 05:

Image 06:

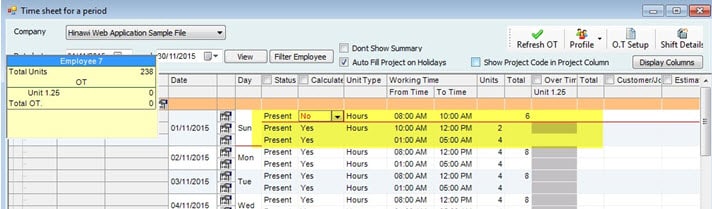

Fixed 30 days:

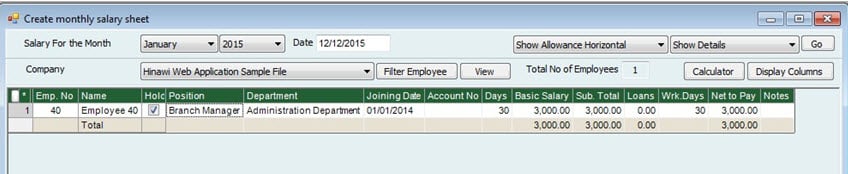

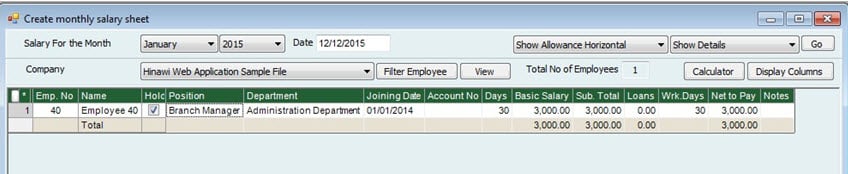

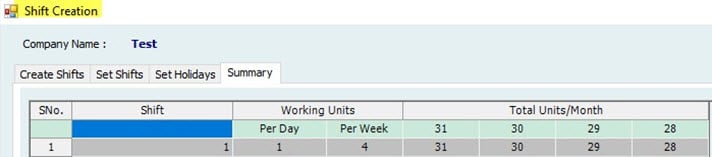

Salary sheet when there is No Absence and leave:

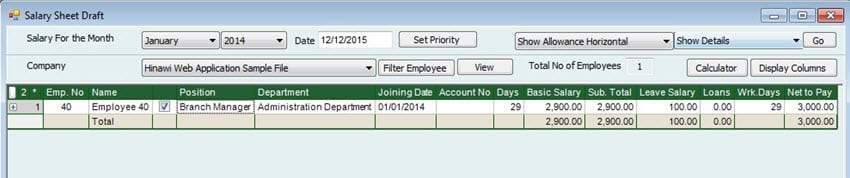

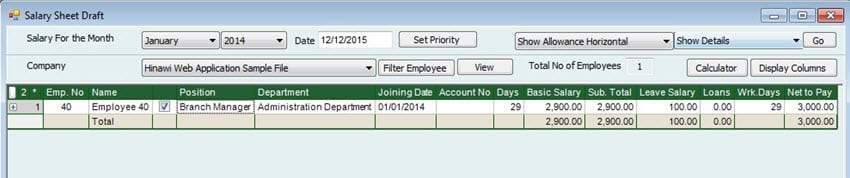

When there is 1 Day Leave:

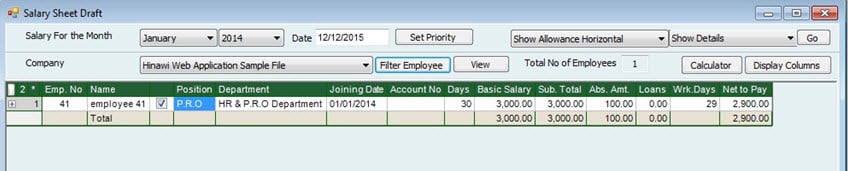

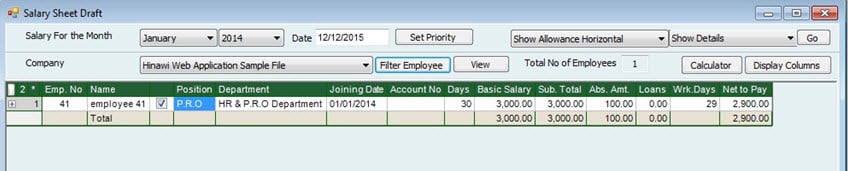

When there is 1 Day Absent:

Note:

1. Leave Salary Calculation Basis is enabled only If the salary calculation is Actual

Month Days. When salary calculation is Fixed 30 Days, this option is disabled.

2. If EOS is created for an employee (resign or terminated), the remaining of leave salary and unpaid salaries will show in EOS for

Calculate Actual Leave Days if salary calculation is Fixed 30 Days:

e.g.: If this option is checked, and an Employee takes a leave for 5 days on Feb 27, then the leave days will be 5 (27,28 & 1,2,3). If this option is not checked, the leave days calculated will be 7 (27, 28, 29, 30 & 1, 2, 3).

Note:

- The absence salary will be deducted from the Effective month given while reading an absence. E.g., an employee was absent from 29th Jan to 2nd Feb. Therefore, while creating the absence, if the effective month is selected as Feb, then the absence day salary will be deducted from Feb Monthly Salary.

- Calculation of Leave Days (for all types of leaves) is always based on the ACTUAL MONTH DAYS.

Special Cases When:

1. Setup is based on fixed 30 days. If an Employee was absent on Jan 31st, leave will be deducted from Leave Days if the setup is “Deduct from Leaves”. And absent day salary will be deducted if the setup is “Deduct from Salary”.

2. Setup is based on fixed 30 days. If an Employee was absent on 28th Feb, then absent salary will be deducted from the effective month if the setup is “deduct from salary”.

3. An absence is created for an employee, and the setup type is deducted from:

leaves → annual leaves, then it will deduct the leave days from the annual Leave Balance.

4. Setup is based on fixed 30 days. If an Employee goes for leave on Jan 31st, leave will be deducted from Annual Leave Days. But will not be paid for that 1 day since it is fixed 30 days.

5. Setup is based on fixed 30 days. If an Employee goes for leave on 28th, leaves will be deducted from Annual Leave Days. Salary is calculated for 27 working days to + 1 day leave salary. For the next 2 days (29 and 30) salary needs to be added as separate in addition and deduction manually by the user. And next month salary (March) will be fotwo 30 Days and 2 days salary in the Addition column.

Important:

Changing between Basis of calculation:

When the user wants to change the Basis of calculation or anything else in SETUP, the activities like Leaves, absence, salary sheet and EOS must be approved before proceeding (if there will not be any further changes on activities in the future.)

Note:

- We advise the user to approve all the activities (If there is no change later)

before changing the setup.

- We also advise users to create salary sheet before proceeding with changes in the setup. Also, to start doing changes in setup after approving the salary sheet.

- Activities approved before changing the policy (Setup) will remain the same and will not change after filling a new policy. I.e., There will be no effect on the calculation if there are changes between 2 methods when activities and salaries are approved.

- New calculation will affect the new activities reading from new changes in setup.

- If the user wants to affect the new changes in activities created already, then recreate the activities after changing the company policy.

Exceptional:

- Calculate First Month Salary as Actual Days Worked:

If thefor setup is fixed 30 days and the employee joining date is not 30 days month, calculate the working days based on the actual month.

Note:

By Default, this option will be checked. We strongly reclaimed keeping this checked. e.g. Employee joined on 27/01 so total working days will be: 5 days and will be calculated as 5/30 X Total Salary.

Employee joined on 27/02 so total working days will be: 2 days and will be calculated as 2/30 X Total Salary.

- Include Employees in the salary sheet who joined on or before of the Month this allows the user to include an employee who joined the company before the given datheirhe month and his/her salary is generated in the salary sheet.

e.g.: If an employee joins on 20th of a month and we set the above to 22, then he will be included in the salary sheet of this month.

- Show the Standard Salary Information in Salary Sheet Columns: If checked, the standard monthly salary will be seen in salary sheet as information only.

- Allow to Edit Employee salary Information even if the salary sheet is approved: This option Allows user to change the Employee Salary Information even if the Salary Sheet is approved. This option is added for employees whose salaries have increased after approving the salary sheet. Therefore, the system allows these changes for history status purposes regarding salary. This does not affect the Approved Salary Sheet. It will only affect the future salary sheets.

Note:

Differences the in the salary for previous period will be adjusted in the next salary sheets.

Wages Protection System (UAE Use Only):

Employer Unique Id: The user can provide the ID of the Employer here.

Bank Code of Employer: This is the bank code of the Employer and the user can add more banks here.

Includes All Salaries, Additions & Deductions in INCOME Fixed: This is a checkbox

Salary Information File (SIF) for Approved Salary Sheet Only: This is a checkbox.

Pension Settings Tab:

- Include Pension for Non-Locals

The user checks this option in case he/she wants to set pension for Non-Locals. Pension for Locals can be set from Default setup/Advanced Setup.

The user can check the option ‘Show the pension for Non-Locals in Separate column in Salary sheet’ if he/she wants the pension to be in separate column of the salary sheet.

The user can change the column name in Salary Sheet by giving a name in ‘Change the Column name in Salary Sheet as’

Deduct Company pension from Employees for Absence Days Locals % Non-Locals % The user can set the pension to be deducted from Employees for Absence Days.

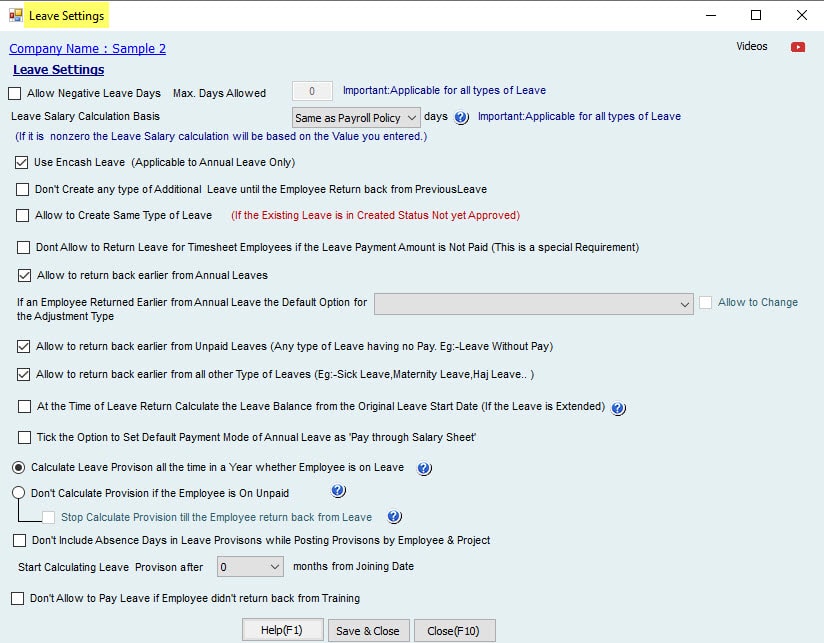

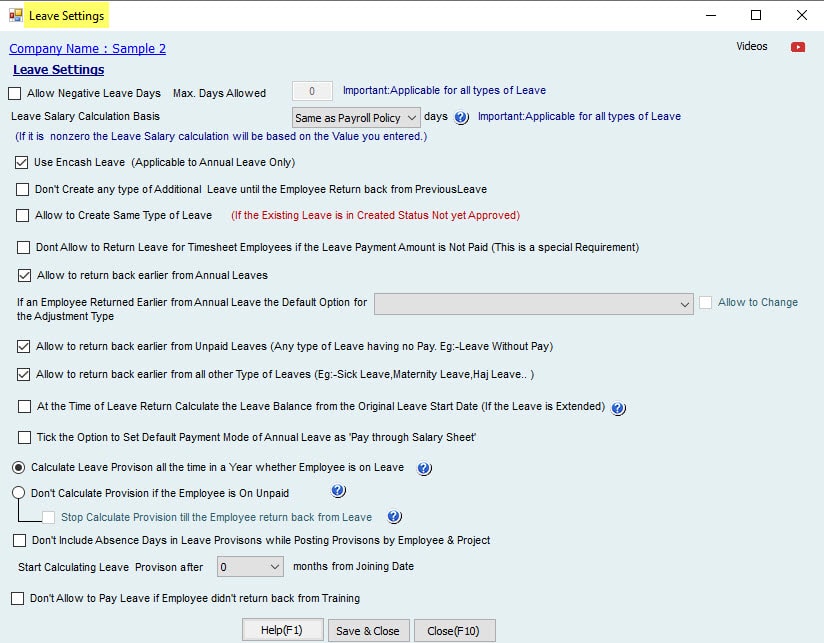

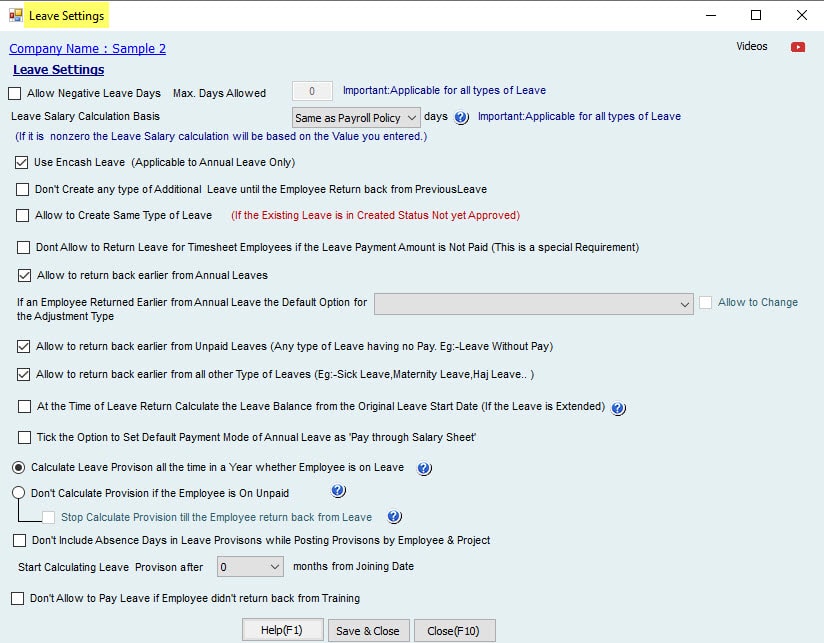

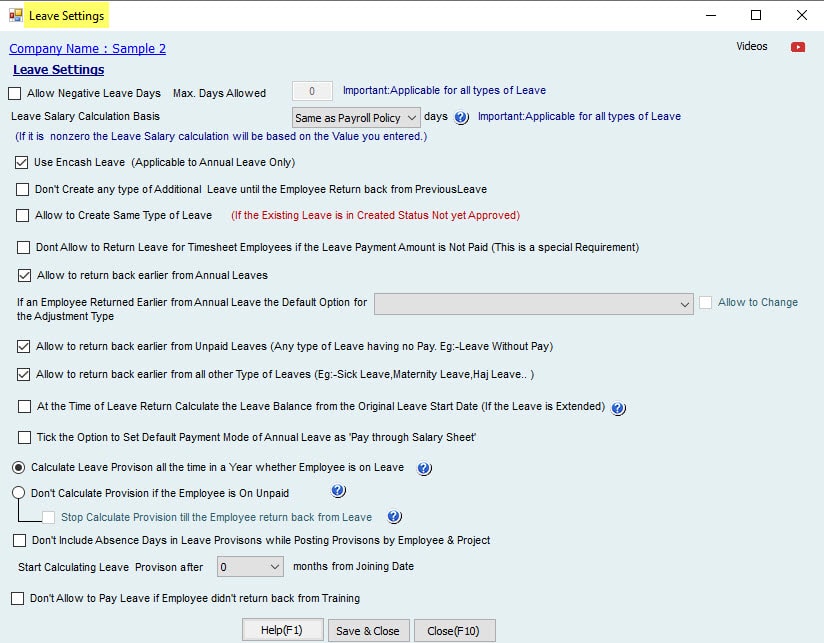

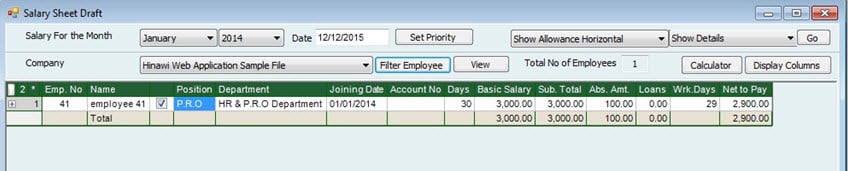

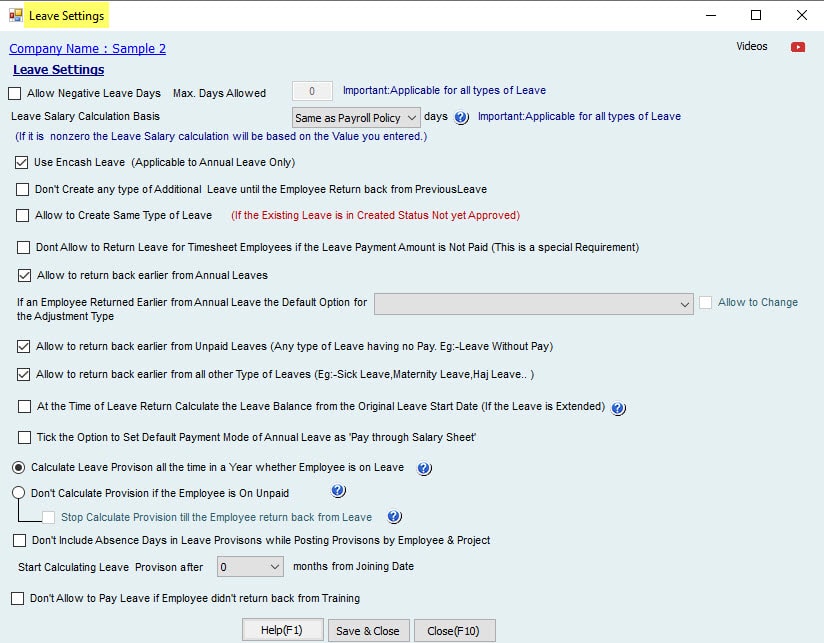

03. Leave Settings:

Leave Policy is one of the most important screens in the system. Kindly read carefully. You can contact us (End of Manual) for any further clarifications.

Company Settings → Company Setup → Leave Policy

Leave Settings

- Allow Negative Leave Days:

Allows creating Leaves More than the available Balance

Note:

if Negative Leave Days is filled in with the following value: 5, an Employee has Leave Balance of 15 days; then the system will allow creating a leave for 20 days as Negative days are filled. And this is Applicable for All types of leaves.

When “Allow Negative Leave Days” is checked and the value is zero, it will allow creating leaves only as per the Leave balance. i.e., it simply means as if this option is not checked when the value is zero.

If the leave balance is zero or minus, the user should add Admin password to allow the negative days.

This applies to both Timesheet and HR Employees.

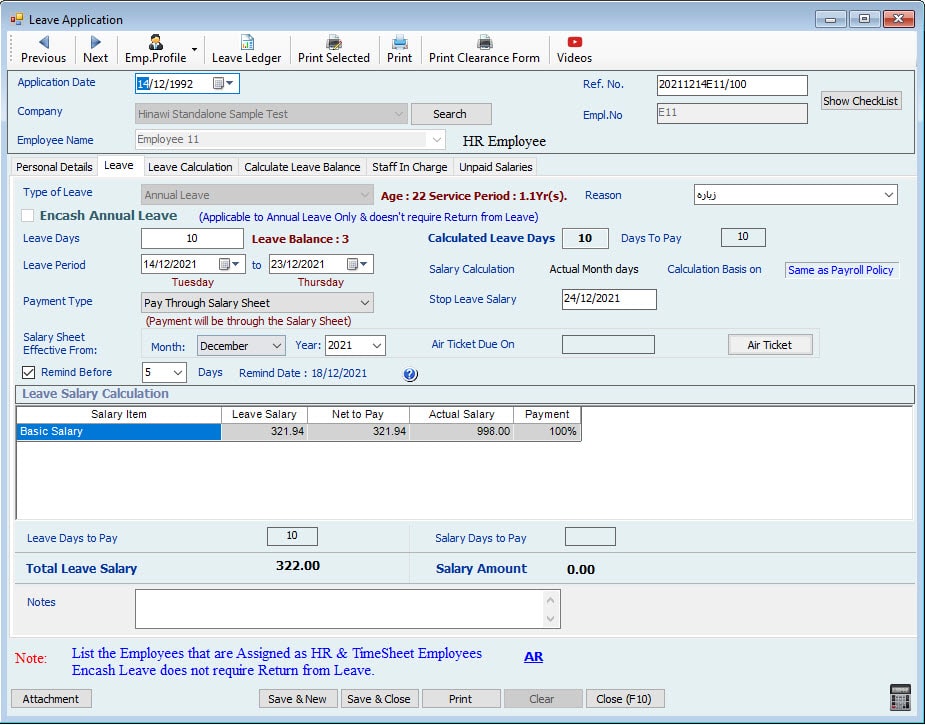

- Leave salary calculation basis on:

As default (zero here) it is reading from Payroll settings: Fixed 30 days or Actual month days.

If the user selects any value, the system will ignore reading from the Payroll Settings and reads from here as mentioned below:

If the user selects 360, the system will calculate Leave Salary through the following method:

{(Monthly Salary x 12)/360} x Leave Days

If 365, then as follows:

{(Monthly Salary x 12)/365} x Leave Days

This applies to both Timesheet and HR Employees.

Note:

– The user can change the basis of calculation only if the setup is Actual Month Days.

– If the setup is Fixed 30 days, this option will be disabled.

- Add Leave salary amount in the “Addition” Column of the Salary Sheet:

This is applicable only for Time Sheet Employees and the payment type of leave is Pay Through Salary Sheet; when the user applies it, the system will calculate the leave salaries and add to the additions and deduction form in the Timesheet software and it will be added to the salaries in the “Addition” column. If this option is not selected, no payment of leave will take place in the Salary sheet. This is per company policy.

- Pay Leave Salary separate for Time Sheet Employees:

If this option is checked, Leave Salary is paid separately as Cheque or Cash, and Leave salary will not be added in the salary sheet for Time Sheet Employees.

Note:

If an employee is on leave for 10 days, that 10 days salary will be added in the Additions and Deductions form in the salary sheet if the option ‘Add Leave salary amount in Addition Column of Salary Sheet’ is checked.

If this option is not checked, there will be no payment of leave in the salary sheet. This is per company’s policy.

- Use Encash Leave

Allows to Encash the Leave Days Balance for Annual Leave. For example, an Employee has Annual Leave balance of 20 days and he/she doesn’t want to go home. He/she can take Cash for that leave balance. If the Employee takes encashment for 10 Days Leave, then the next time he/she creates a “Leave”, his/her Leave Balance will show as 10 only. There are settings for selection of allowances for Encashment in the advanced setup.

The user can select Encash Leave Items from the list in the advanced setup.

When ‘Encash Leave’ is checked in the leave’s creation activity dialog, the number of leave days will be encashed as per the setup. Leave Days will be deducted from the Leave balance.

Note:

Negative Leave Days will not be Encashed.

This applies to both Timesheet and HR Employees.

- Don’t create any type of leave until the employee returns from leave

If this box is checked, the employee on leave cannot extend or take any leaves until he/she returns from leave.

To create any leave, user must return from the previous leave. This applies to both Timesheet and HR Employees.

- If an Employee Returned Earlier than expected from Annual Leave, the Default option for the Adjustment type:

Create Loan:

e.g.: An employee goes on 20 days paid leave and he/she comes back after 10 days, days leave back.

He/she must refund the leave salary for 10 days and get the 10

Deduct the leave days only:

e.g.: Employee goes on 20 days leave and he/she comes back after 10 days, so if this option is selected He doesn’t have to refund the money, but his 10 days leaves will be deducted.

Keep the Balance Leave Days:

E.g. Employee goes for 20 days leave and he comes back by 10 (If the company calls him back due to urgent work), if this option is selected He doesn’t have to refund the money and Company will not deduct the leave balance from his leaves.

This applies to both Timesheet and HR Employees.

NOTE:

In all the above cases Employee will get salary.

- At the time of “Leave return”, Calculate the leave Balance from the Leave Start

Date (if the Leave is Extended):

e.g.: An Employee goes on leave for 15 days and he extends leave for 5 days, the system will calculate the Leave Balance from the Leave start date, i.e., 20 days if this option is checked.

If not checked, his leave balance will be calculated from the extended leave. [Clarification]

- Calculate leave Provision

✓ Calculate the provision for working (Present) Days

✓ Calculate leave provision in all paid days (paid salaries + paid any type of leave)

✓ Calculate provision whole year regardless of availability or not (sick , annual leave , absence , paid or unpaid leave)

- Don’t calculate leave provision

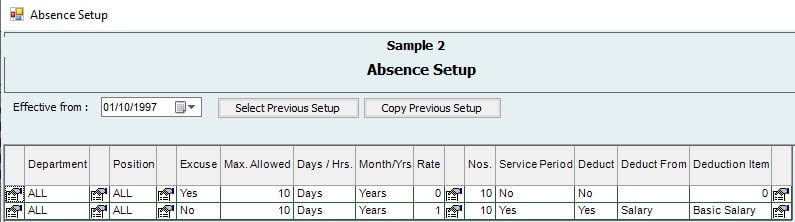

04. More Activities Settings:

Holiday Settings:

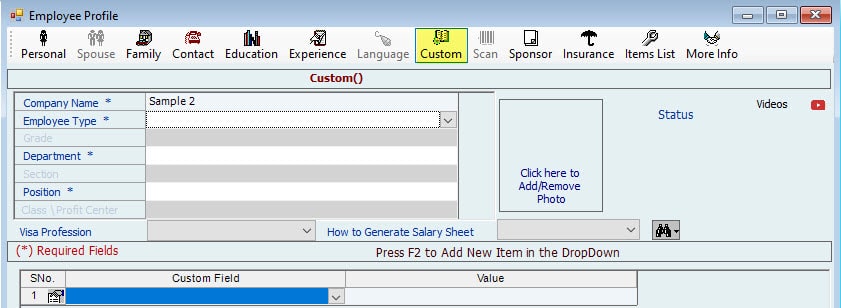

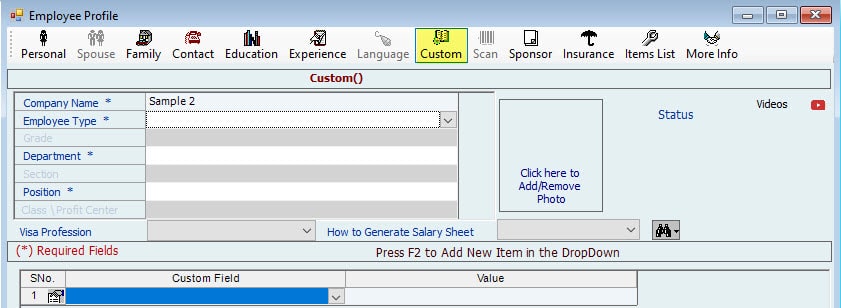

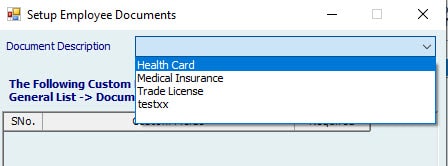

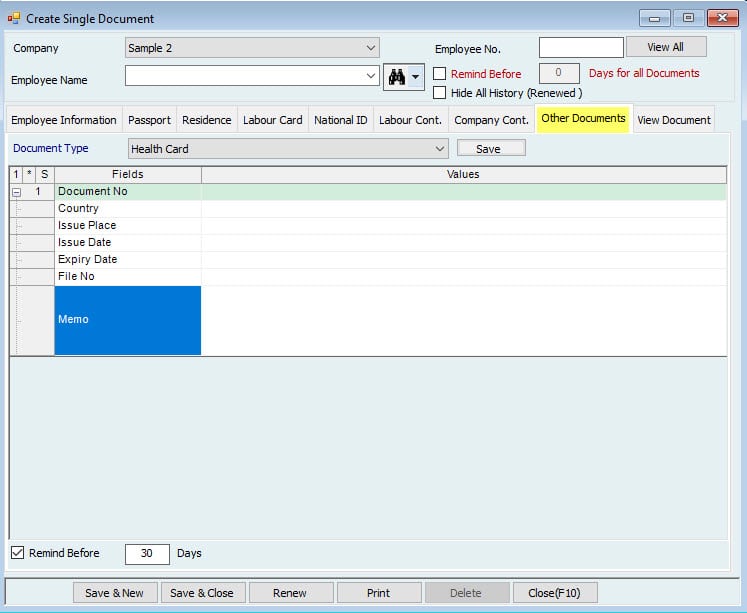

Employee Profile Setup:

Department Setup:

Budget – Salary Setup:

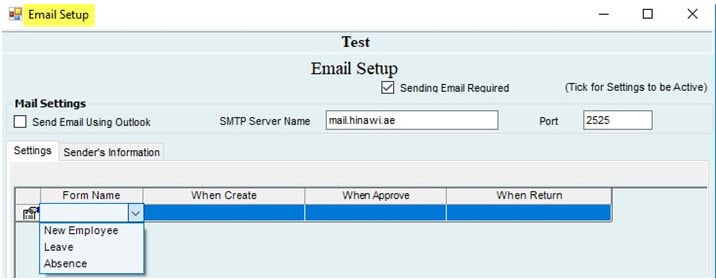

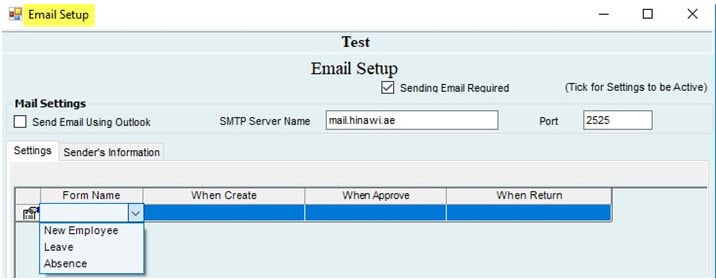

Email Setup:

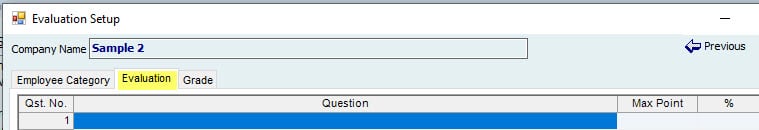

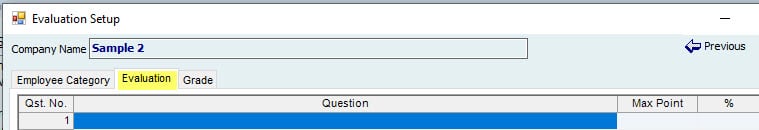

Evaluation Setup:

Additional Setup:

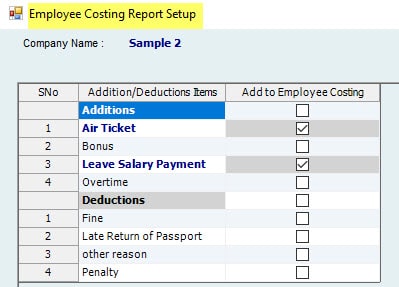

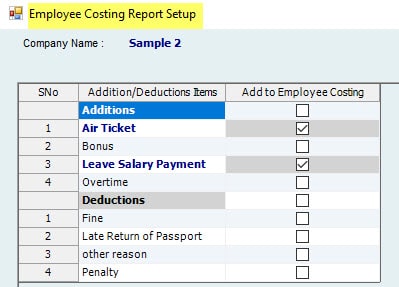

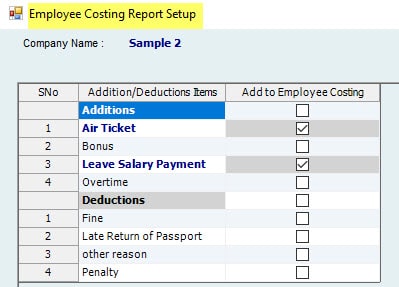

Employee Costing Setup:

Report Format Setup:

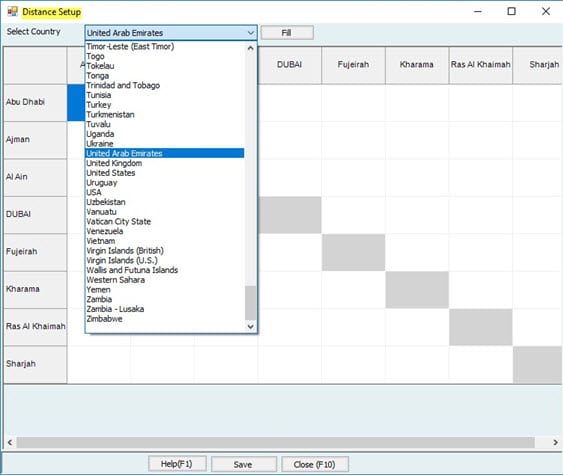

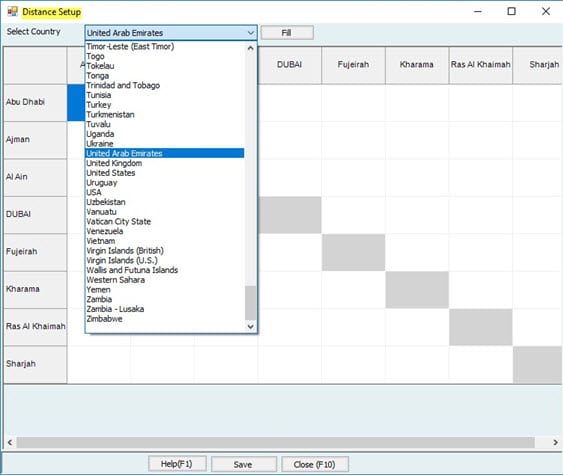

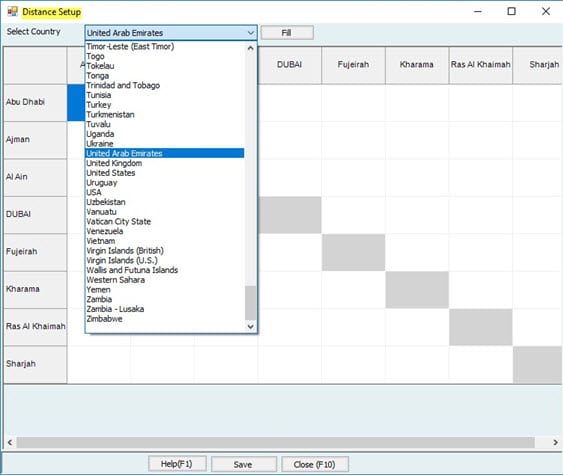

Distance Setup:

Below is the explanation for each one

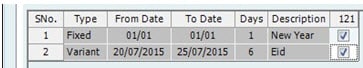

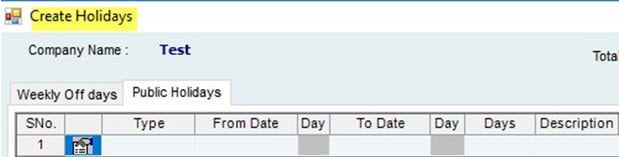

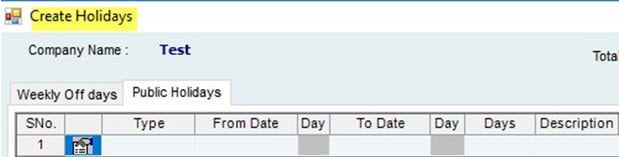

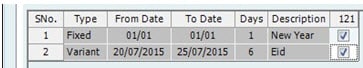

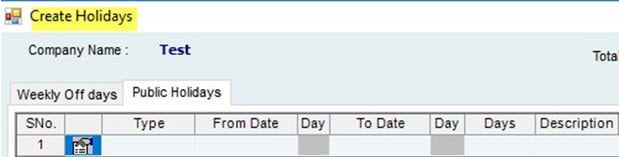

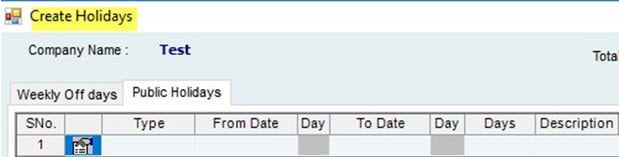

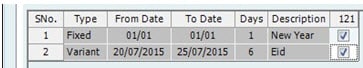

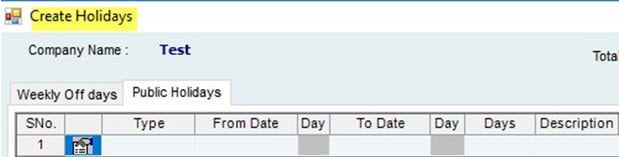

Holiday Settings

Company Settings–> Company set up–>Holidays Setup

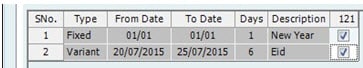

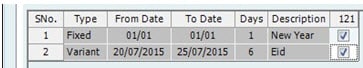

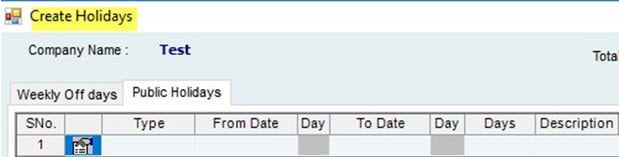

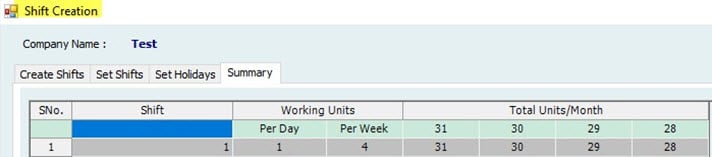

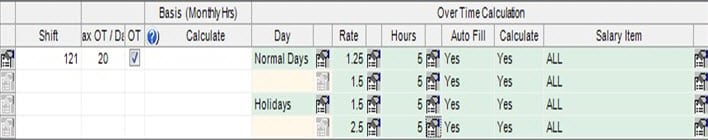

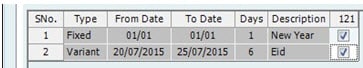

Weekly off days tab: Here, the user can select what days represent the weekly day offs. Public Holidays tab: Here, the user can select the public holidays: it can be fixed or variable.

e.g.: Fixed: January 1 is New Year which is a public holiday. Variable: Eid can be set as variable holiday.

Note:

Holidays setup affects calculations in many activities such as: salaries, leave, Time sheet, shift etc. This depends on the setup of each activity.

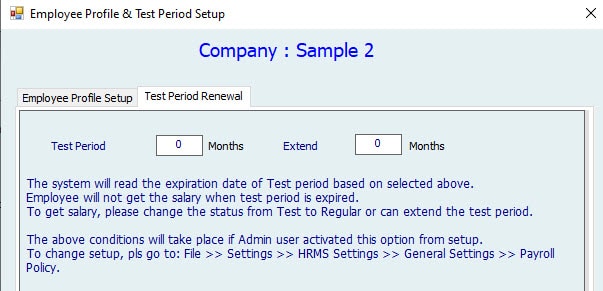

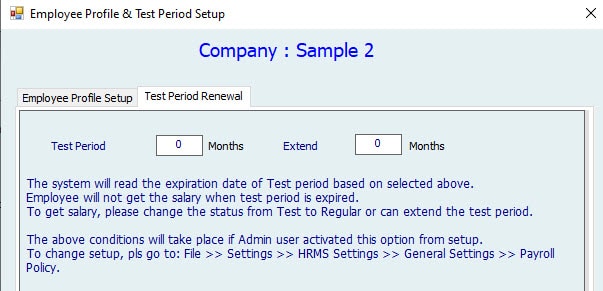

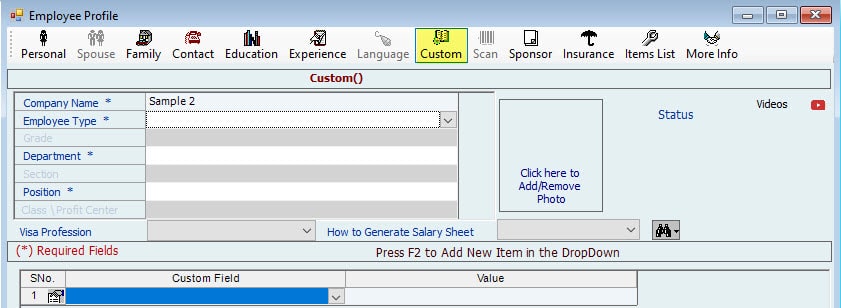

Employee Profile Setup:

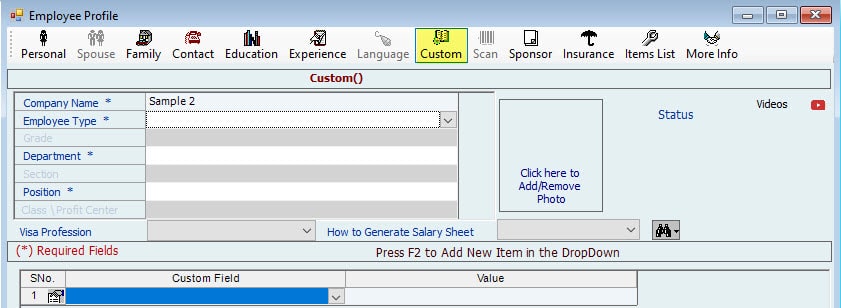

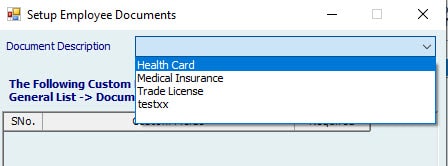

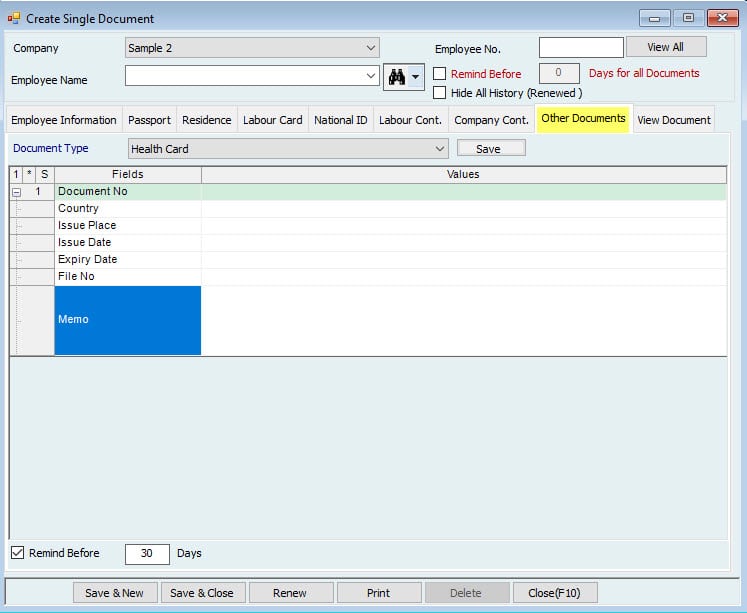

Company Settings–>Employee set up–>Employee Profile Setup

Employee Profile Setup: Here, the user can setup the employee information that are required in his/her profile where the user has three options (required but optional, required and mandatory, not required). The user can select whether the information is

required or not by checking Y or N. Also, the user can set the filled to be mandatory by checking the “Must fill” in the Data entry checkbox.

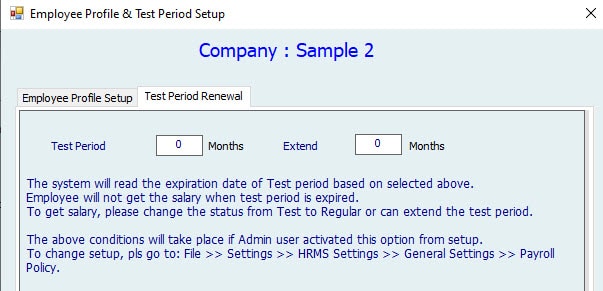

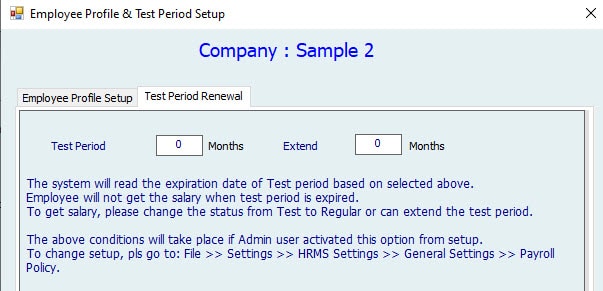

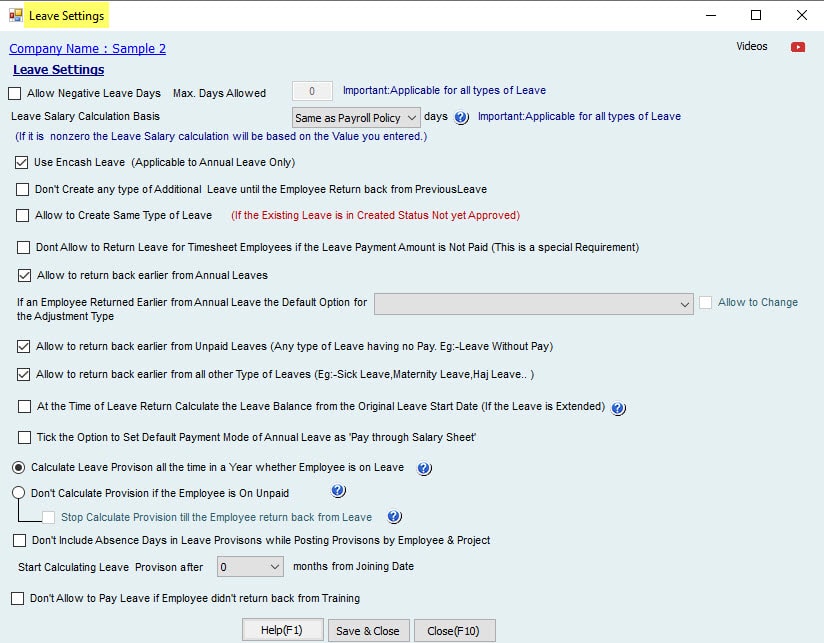

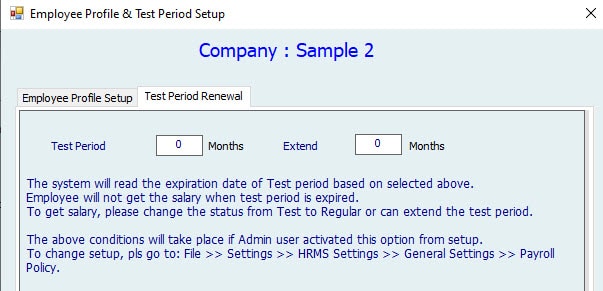

Test Period Renewal:

The user can setup the renewal period from “Employee Profile Setup”.

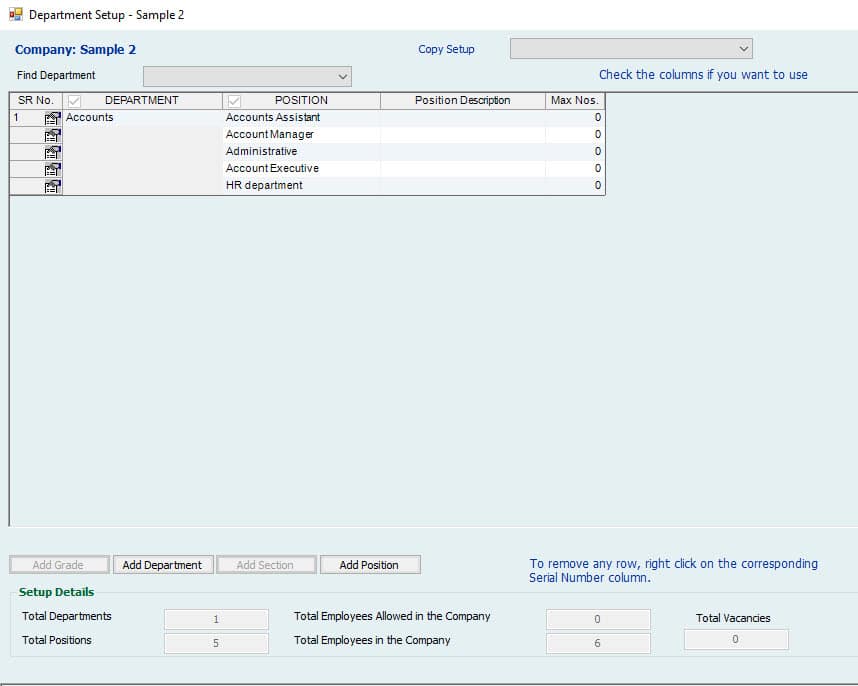

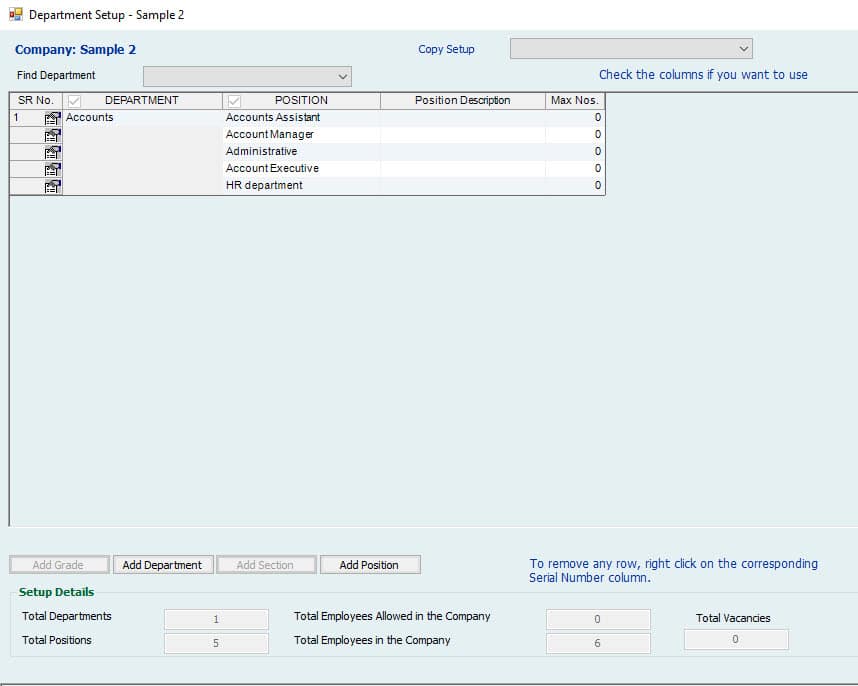

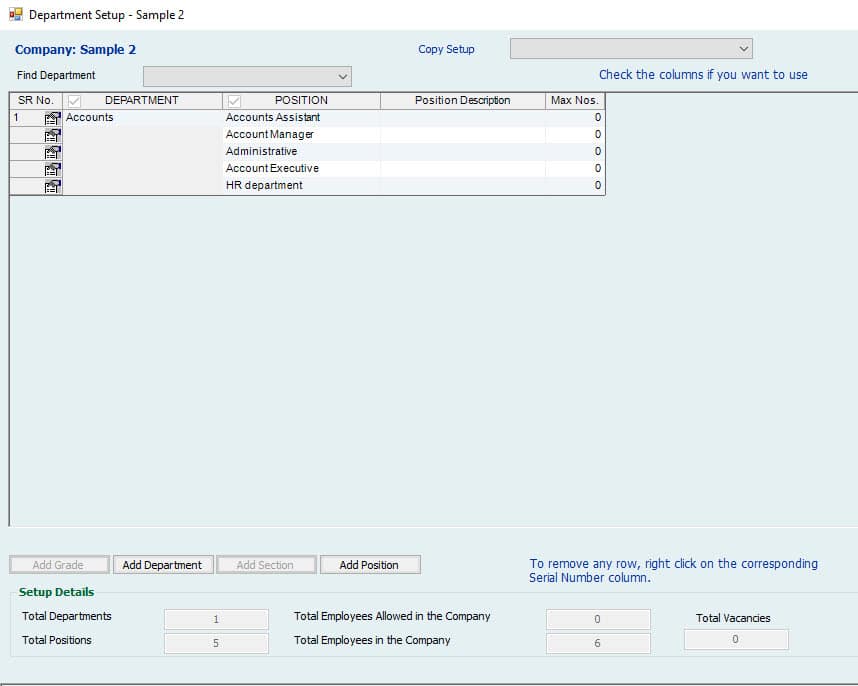

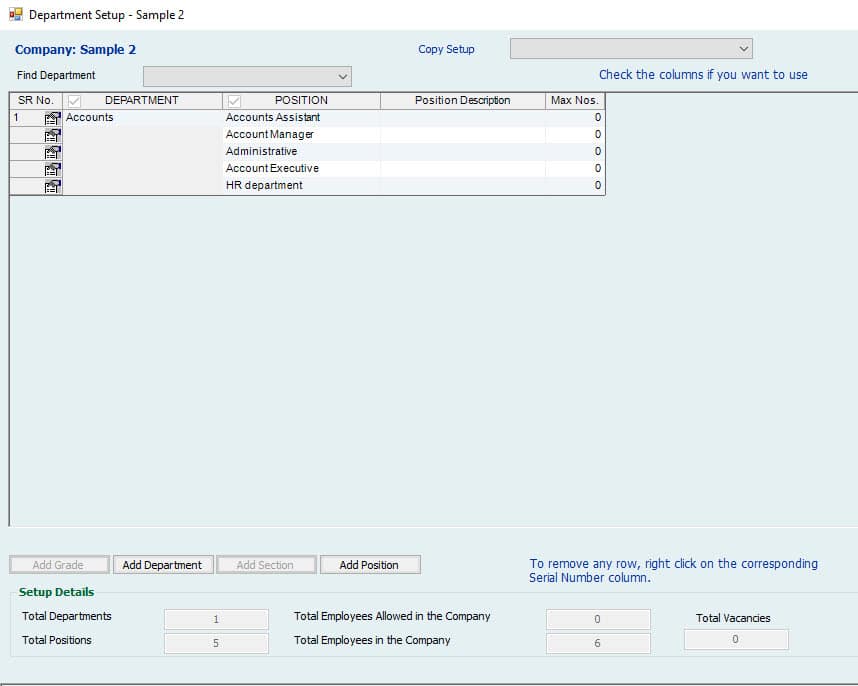

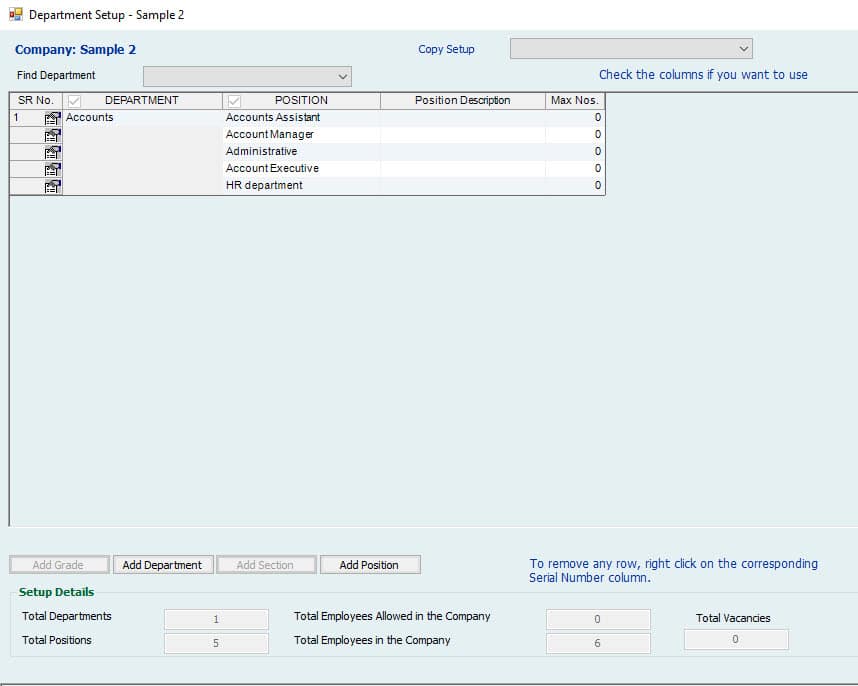

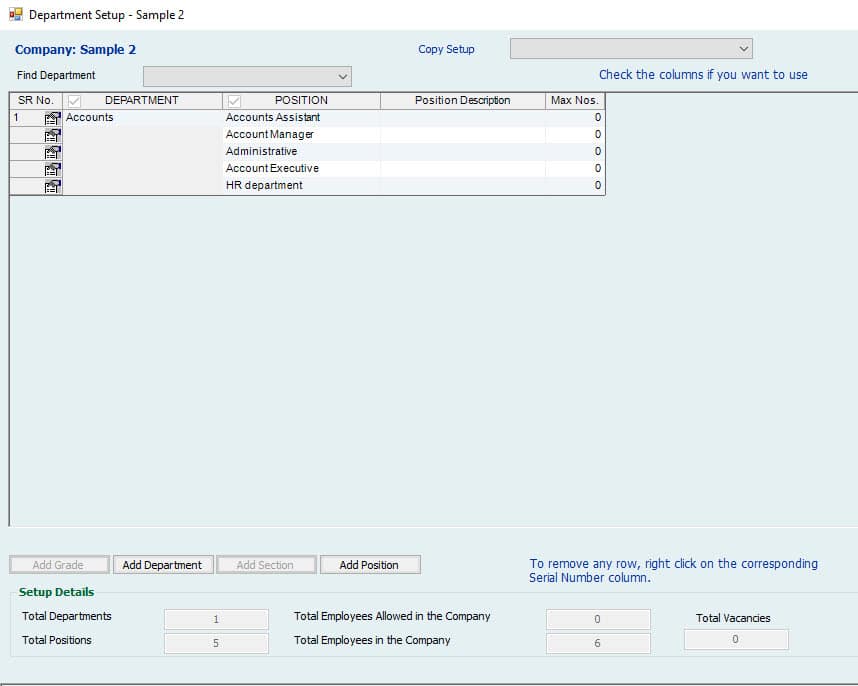

Department Setup:

Company Settings → Company Setup → Department Setup

Here, the user can add different levels for Employees in the company. The user will be able to add the levels which are set on the Company Setup→General Setting By default, the user can add levels: Department and Position.

Find Department: The user can find the Departments added quickly whenever there are many number of Departments.

The user can add a Department using “Add Department” option and can add Position to the Department. e.g.: The user can add the Department ‘Sales Department’ and Position ‘IT Assist Manager’ and Max no. of Employees with the position ‘IT Assist Manager’ in

the Department.

The Options “Add Grade” and “Add Section” will be enabled only if these levels are set in the General Settings.

Setup Details: The user can see the details as per added in the above table. Copy Setup from: The user can copy the setup from other companies.

Remember: Whatever level you add in the department setup will be seen in all the system.

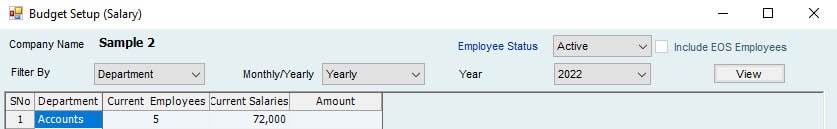

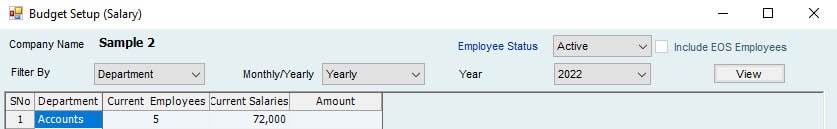

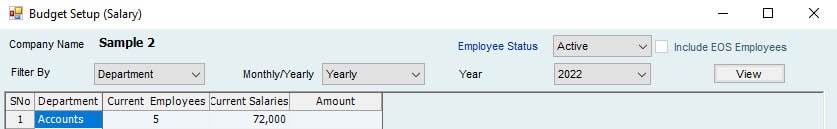

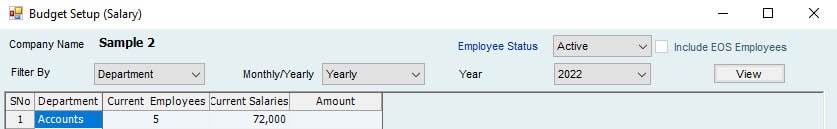

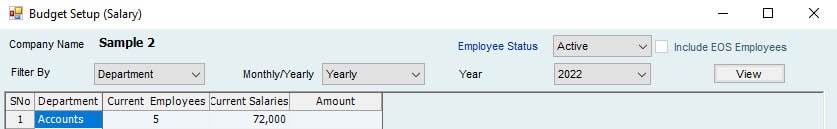

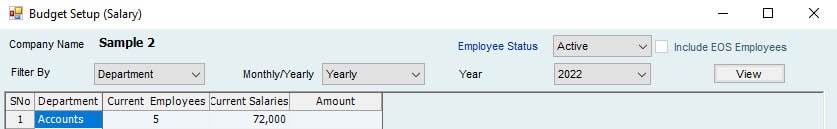

Budget – Salary Setup:

Company Settings → Company Setup → Budget – Salary Setup

Here, the user can set the budget for levels (Department, Position etc.) on a monthly or yearly basis. It will list information as the selected level. E.g. If a Department is selected, it will list all the departments added for the company. Select any department where the user can assign the value for budget in the amount column.

Note: There is a report for every activity.

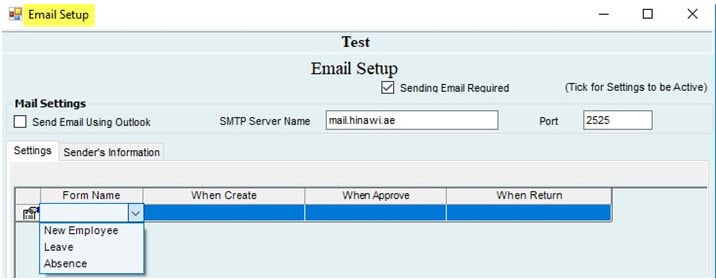

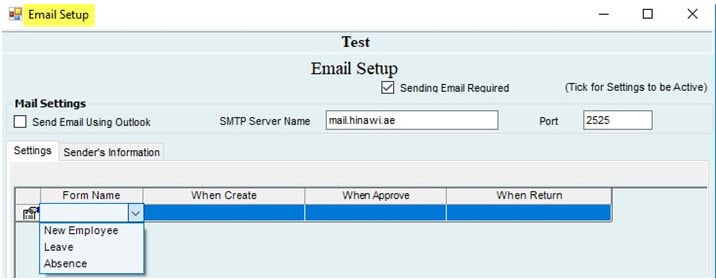

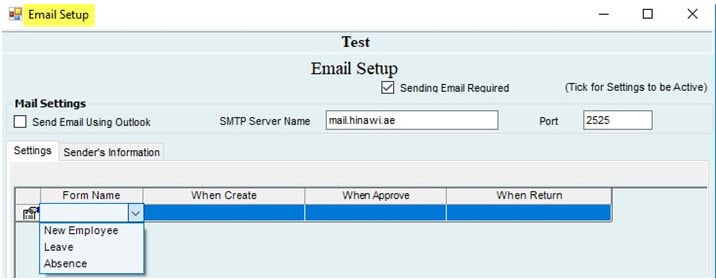

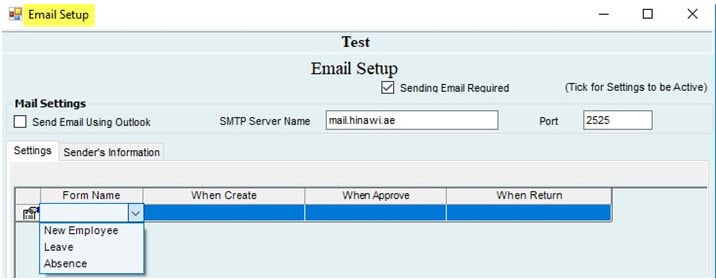

Email Setup:

Company Settings → Company Setup → Email Setup

Here, the software provides an option for the user to send an email to the management when creating a new employee or leave (create, approve, return), and for create, by sending emails from outlook.

email.

Send Email Required: Check the box if the user wants to set the Send Email Using Outlook: Check this box if the user wants to send a mail using outlook. If checked, SMTP Server Name and Port will be disabled. The SMTP Server Name will be specific to the company.

Settings: The user can select the Form name:

New Employee: If an Employee Joins the company. Absent: If an Employee is absent.

Leave: If an Employee is on Leave.

If an Employee is on Leave:

When created: Shows the created date. When Approved: Shows the approved Date. When Return: Shows the returning Date. Sender’s Information:

Provide the Senders information and Send By (Signature)

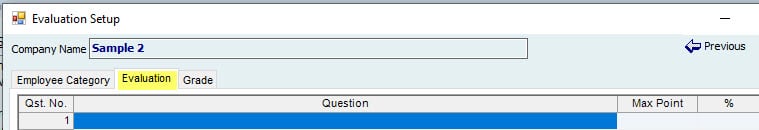

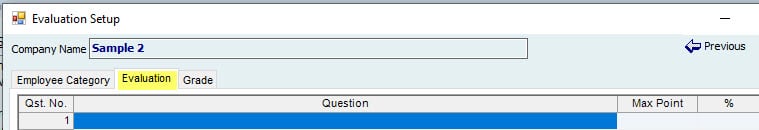

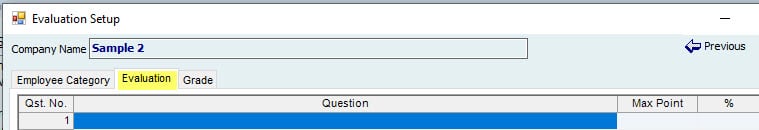

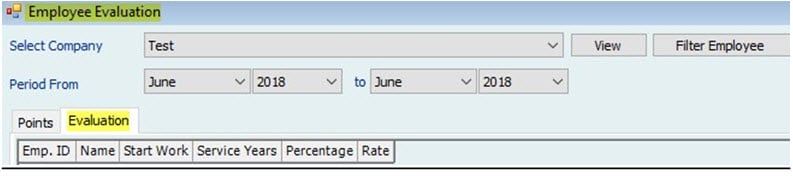

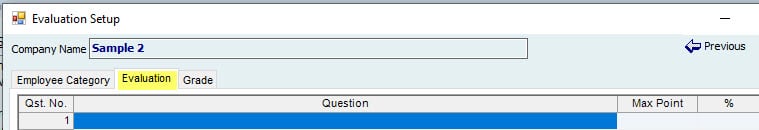

Evaluation Setup:

Company Settings→ Company Set Up→Evaluation Setup

For Employee Evaluation, this can be used. But it is not a Comprehensive Appraisal / Evaluation.

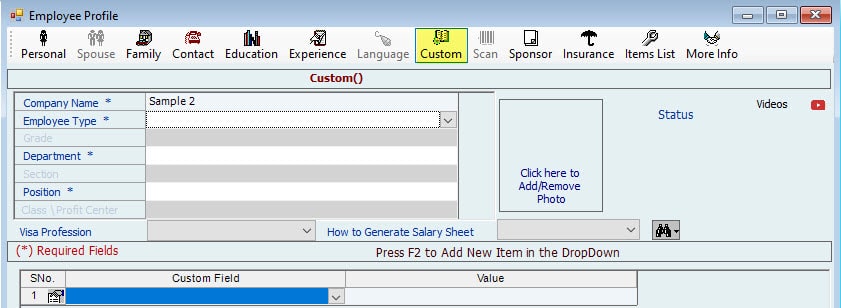

Image 1:

Image 2:

Image 3:

Here, you can just define Different Evaluation Questions based on the Department and Positions.

In the system, you’ll be able to enter the Values regarding each of the Question first to get the Result.

Employee Category: Description is for the “Name of Evaluation”.

By clicking on the icon at the left, you can more add Departments and Positions.

Note:

The user will be able to add the levels which are set in the Company Setup→General Setting.

Evaluation: The user can add Questions for the Evaluation and specify the maximum points employees can reach in each question.

Grade: Define Grades by Assigning Marks Percentage.

Check the option “Show Results” to be able to view it in the “Data Entry” Screen.

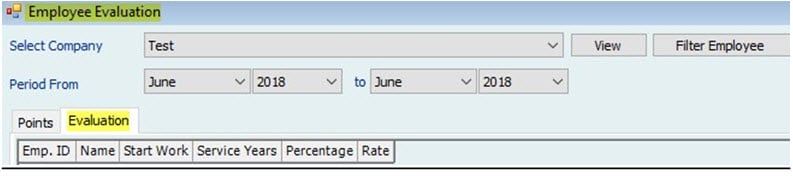

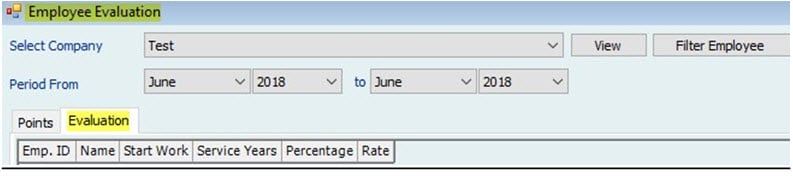

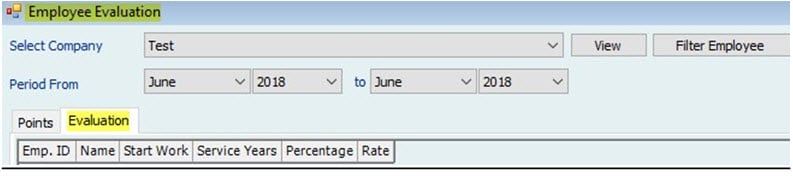

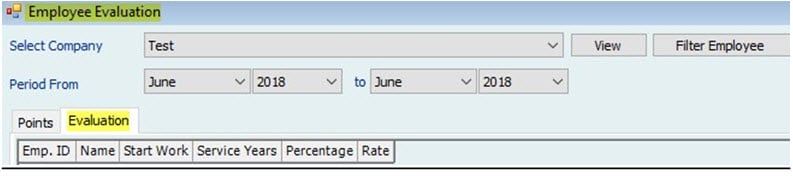

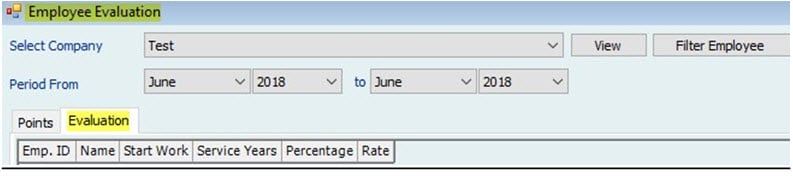

After setting up Evaluation, Go to Manage Employees → Other

Manage Employees → Employee Evaluation. Filter the employees you want to evaluate and select them. “Evaluation Tab” will Show the Results.

Image 1:

Image 2:

Additional Setup:

Company Settings → Company Setup → Additional Settings

Here, the user can select how employee’s numbers are generated for companies. If “Generate one Employee serial number for all companies” is selected, employee’s serial number will be: company 1: 1,2,3… Company 2: 4,5,6…

If “Generate serial number by company” is selected, employee’s serial number will be:

company 1: 1,2,3… Company 2: 1,2,3…

Setup digits after decimal points and rounding: Here, users can set how many digits required to be displayed after the decimal points; it’s also used for rounding in the Total amount.

Rounding Required: Users can select whether he/she wants to round the salary’s amount. If Yes, increase number by 1 in case the next digit is 5 or more.

Archiving of Timesheet Salary Sheets Required:

If this option is checked, then all the Timesheet salary sheets will be archived.

Use Multicurrency:

If this option is checked, the user will be able to set the currency for Salary. When the user checks it for the first time, it will display the message “No default currency Selected”. You must go to “currency list” to set the default currency. The user can add any number of currencies and make one default. Once a currency is set as Default, it cannot be changed later.

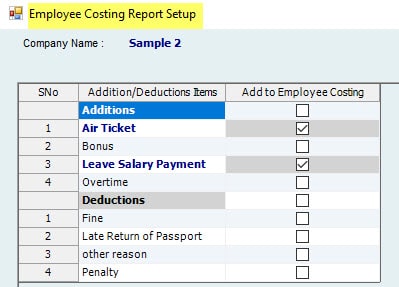

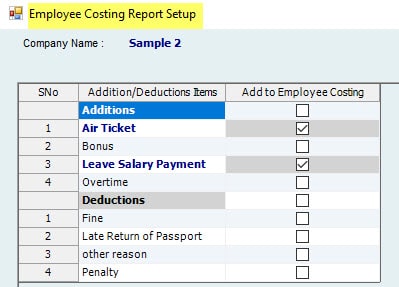

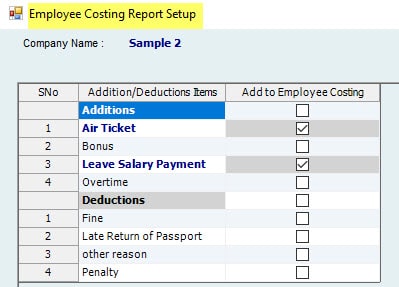

Employee Costing Setup:

Company Settings → Company Setup → Employee Costing Report Setup

You can add any of the “Addition / Deduction” activities to the “Employee costing report”, so that it will calculate the addition or deduction added as employee “Cost”.

Report Format Setup:

Company Settings→ Company set up→Report Format Setup different forms.

Select Format Tab:

Here, the user can set available formats to Add prefix text to the employee’s number, and the text will be added before the Employee Number. For e.g.: If the prefix set is ‘A’ and the Employee numbers are 01,02, the Employee numbers are A01, A02

Report Margin tab:

The user can provide the margin details for reports.

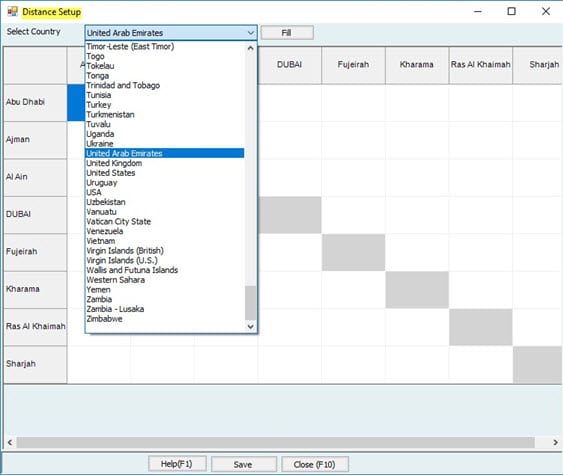

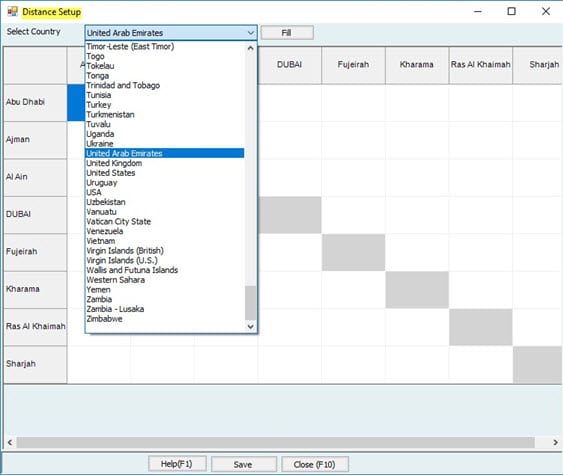

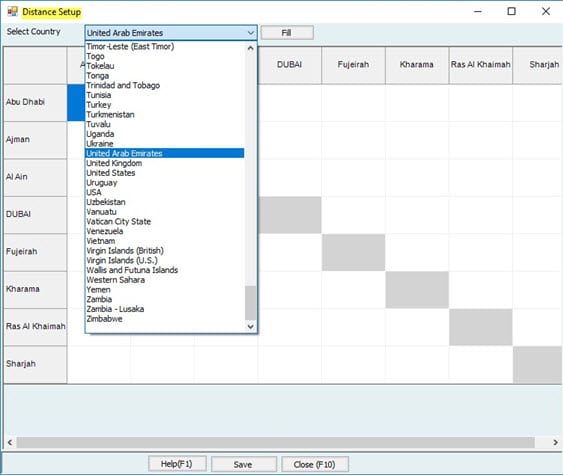

Distance Setup:

Company Settings→ Company set up→Distance Setup

Country:

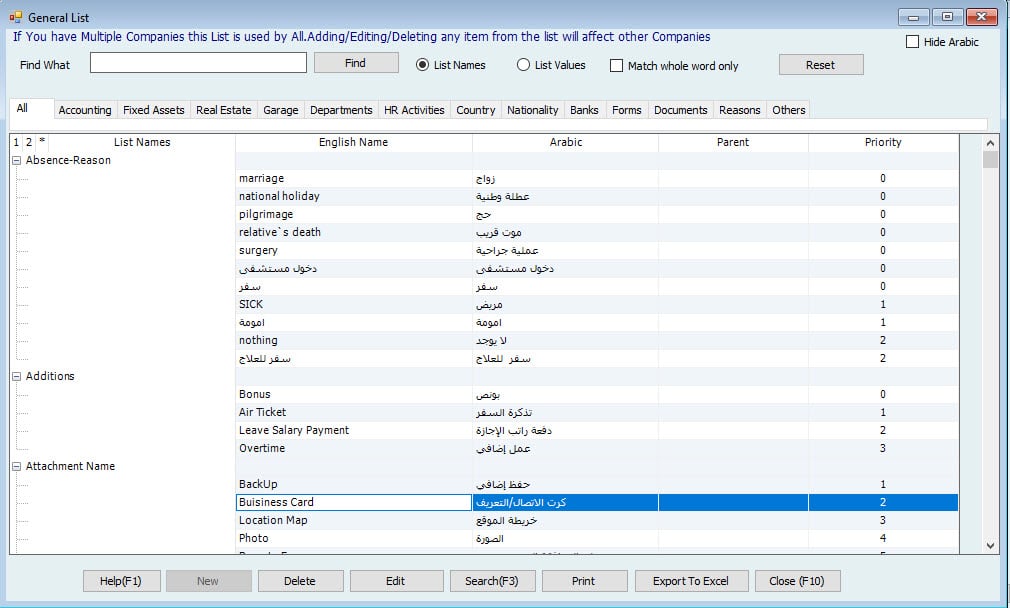

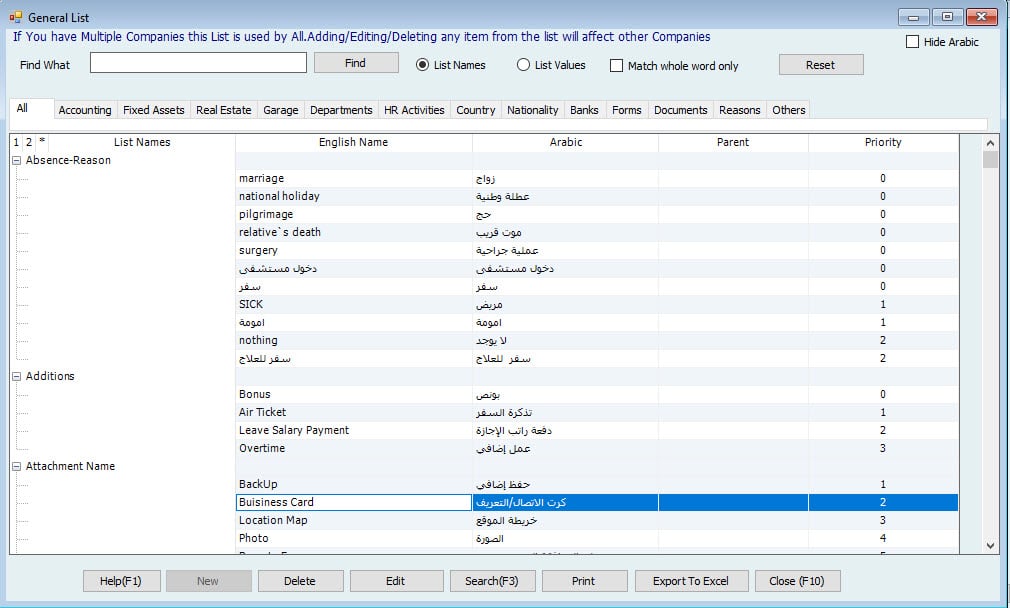

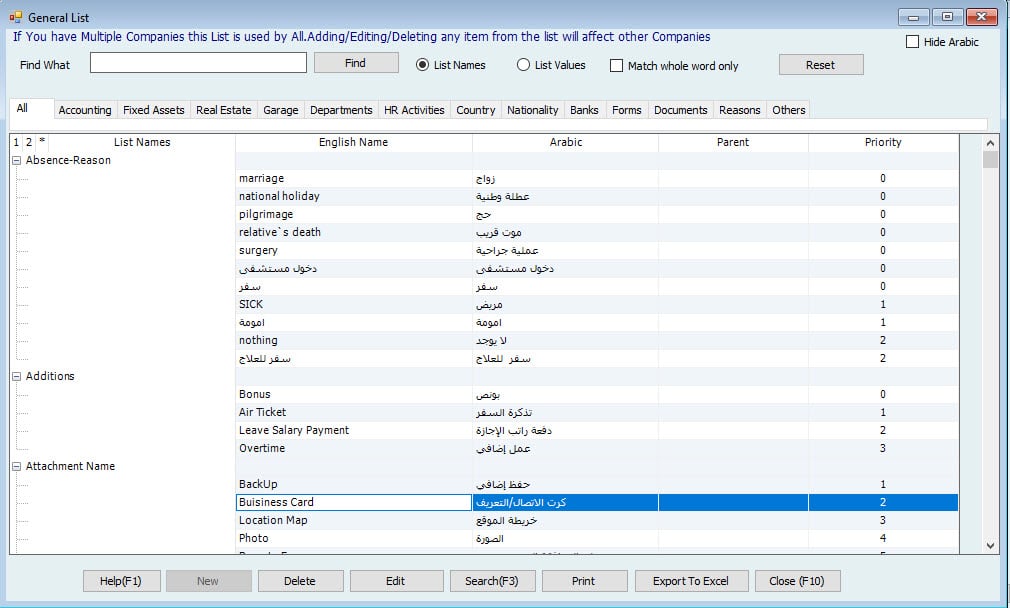

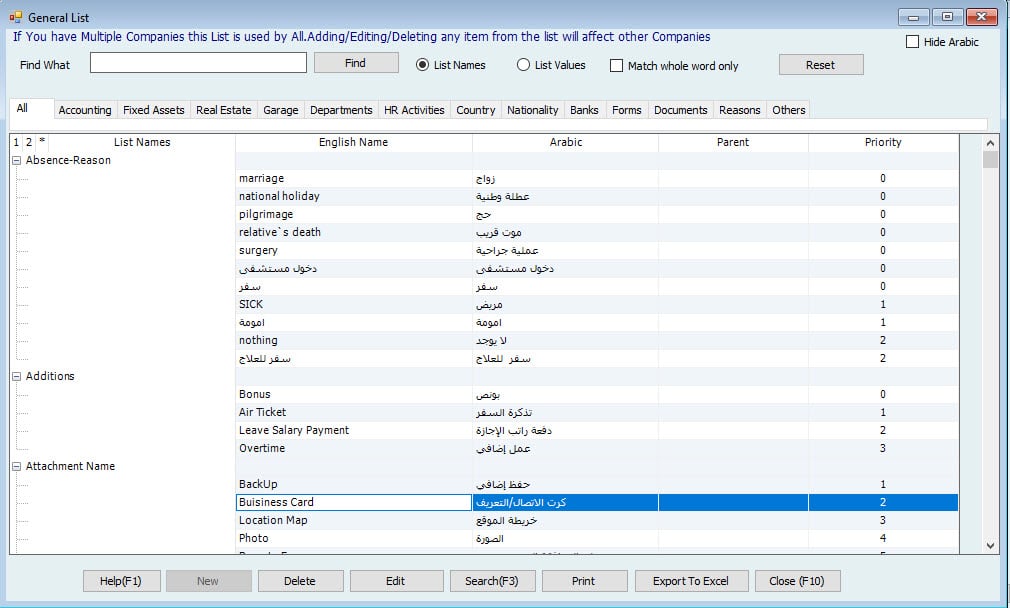

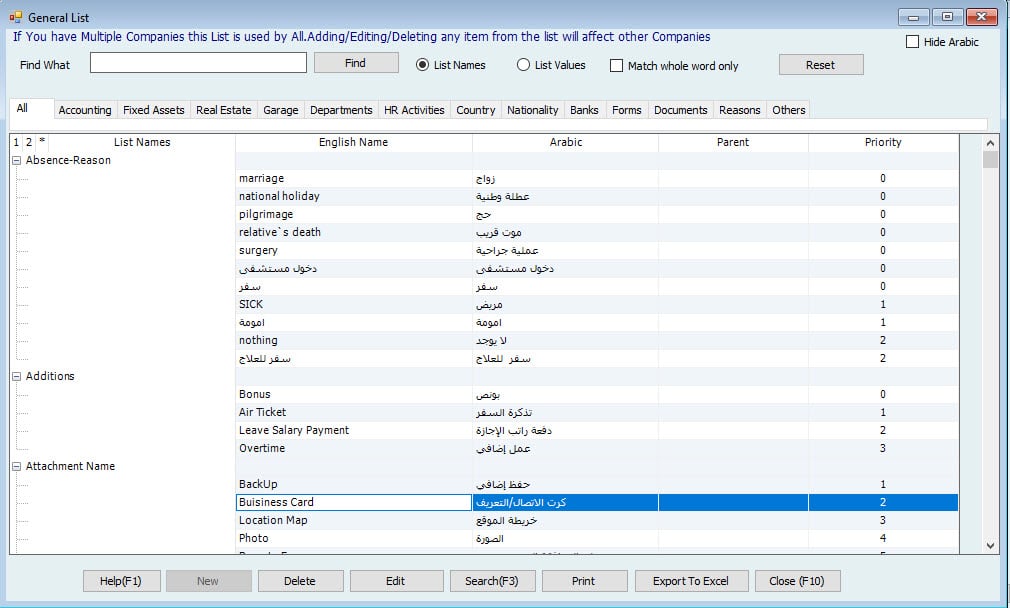

The user can select a country which will list the cities in that country and the distance between 2 cities. Countries or cities can be added from “General List” under settings. The values in this screen are just information and will not affect any calculations in the system.

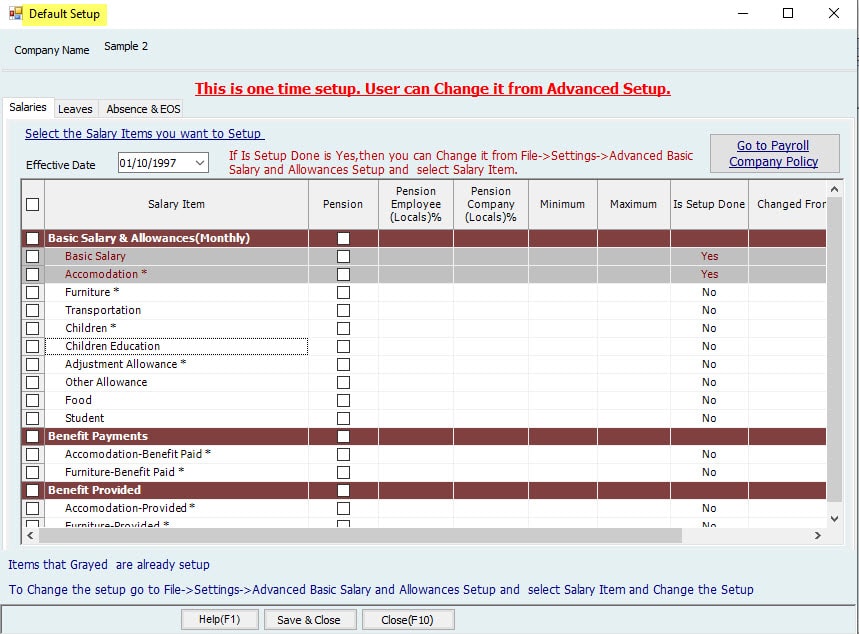

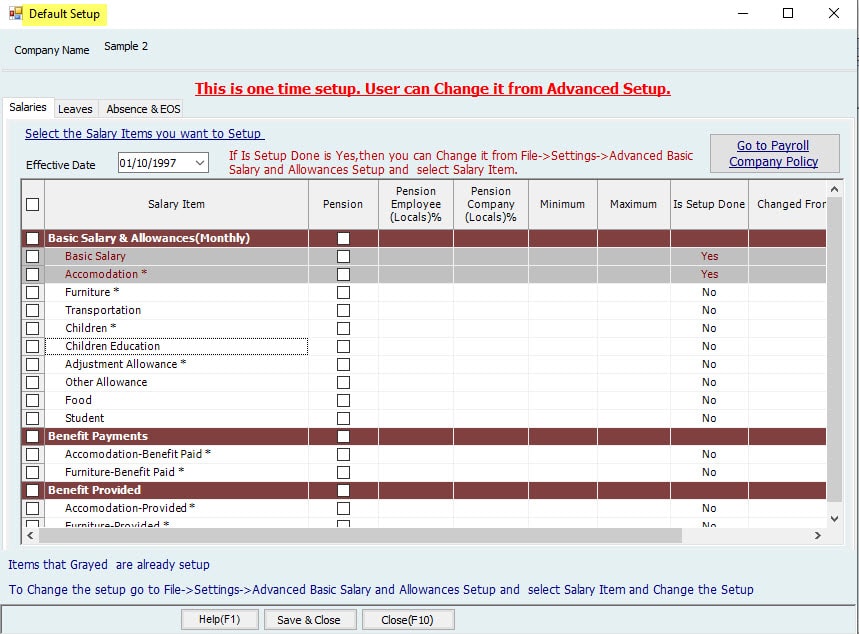

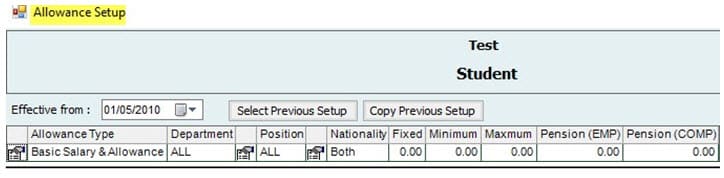

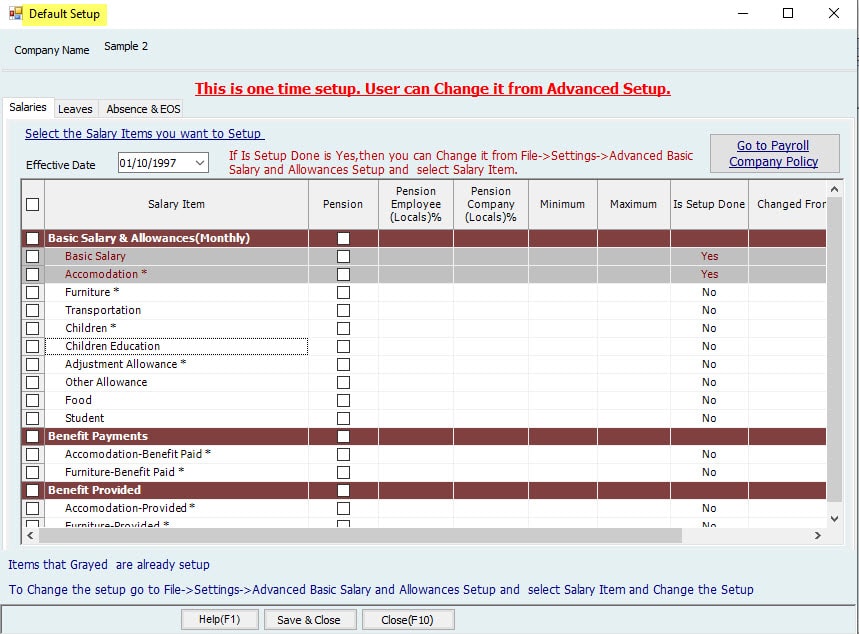

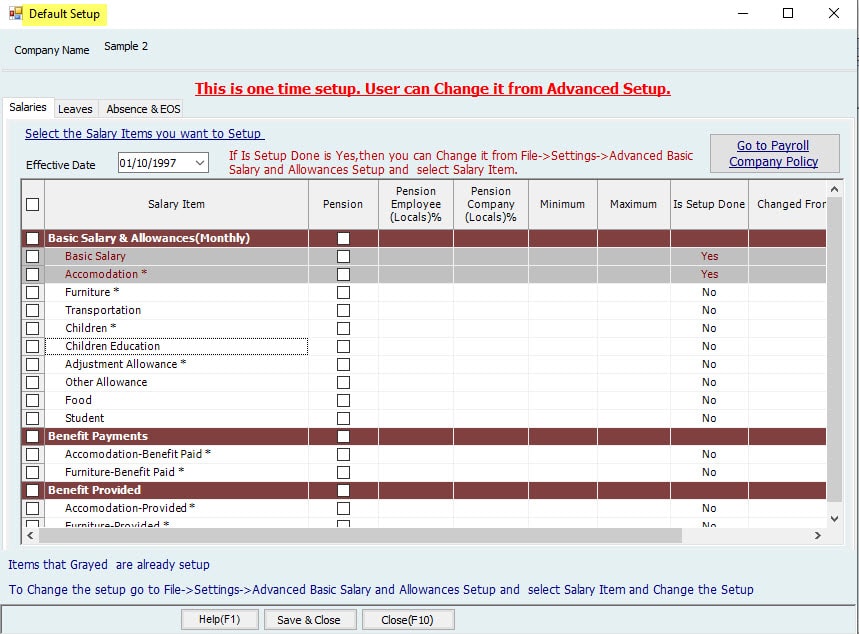

05 Salaries & Other Activities Setup:

Standard Salary Setup

Basic Salary Setup

Accommodation Setup

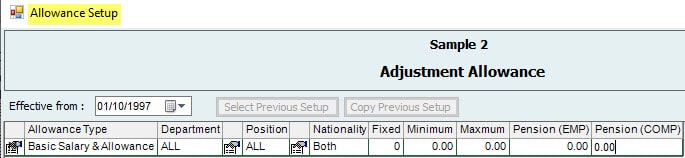

Adjustment Allowance

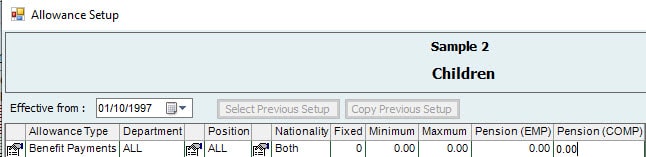

Children Setup

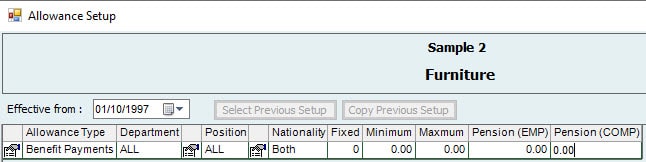

Furniture Setup

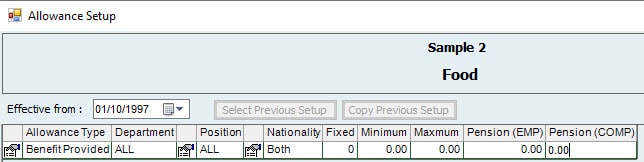

Food Setup

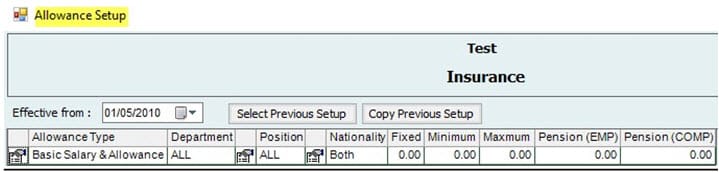

Insurance Setup

Loan Deduction

Maintenance Allowance

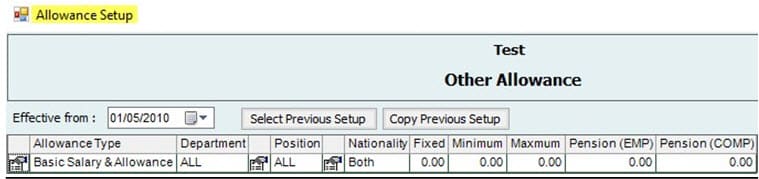

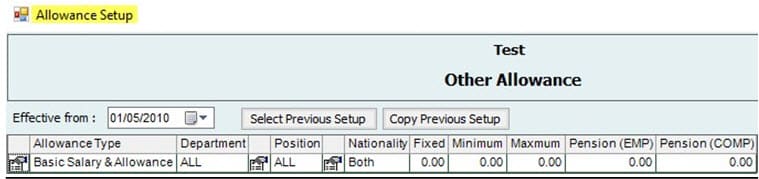

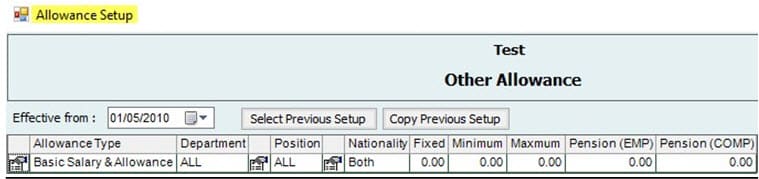

Other Allowance

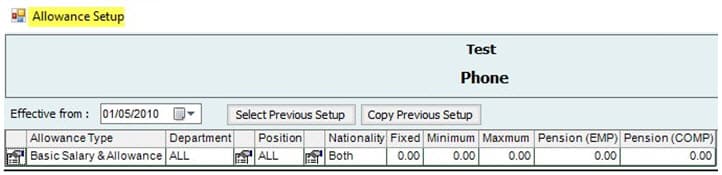

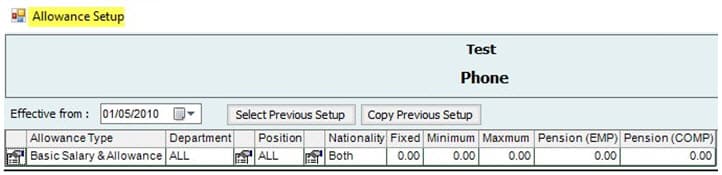

Transportation

Please see the below explanations:

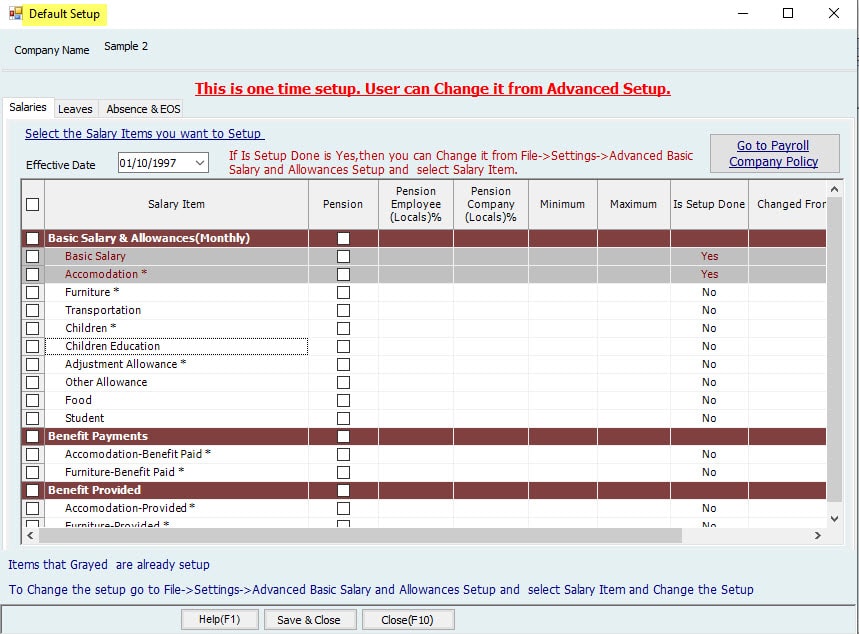

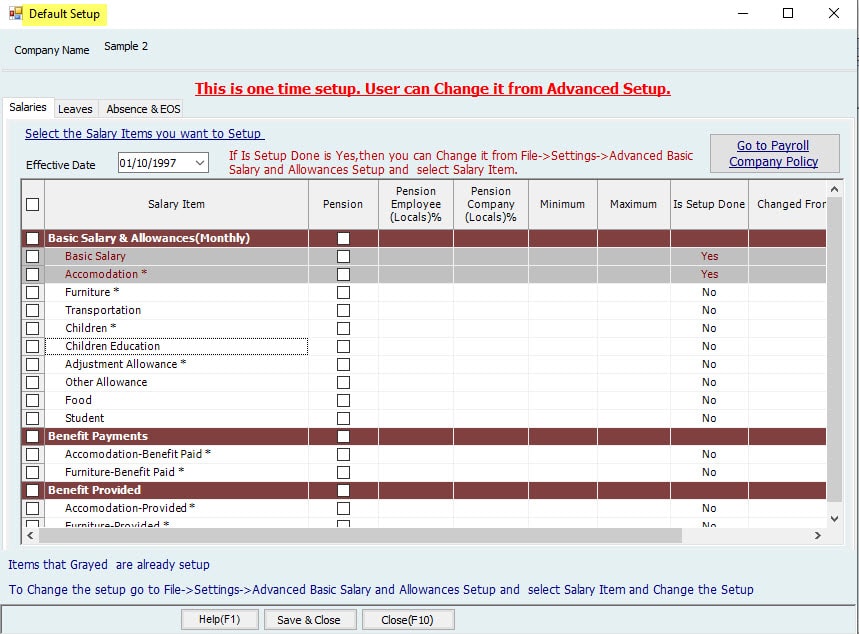

Standard Salary Setup:

Salaries tab:

The user can select the salary items to be included for the standard setup. This is the minimum / standard setup needed to be done to run the system.

The user can set the minimum and maximum salaries to be given for Employees. Also, setting up the Pension to be deducted from both the company and the employee in each salary item can be done as well.

If the user selects the salary item from here, it will be set for the company. Once set, the user cannot change the settings from here and items will be grayed out.

For more settings, the user can go to “Advanced Settings” for each item. If the user doesn’t want to setup from here, he/she can go to Advanced Settings.

The user can set “Pension” for Locals to be deducted from Employee and Company. After completing the setup, it will be updated in the advanced setup. Moreover, the user can change this through advanced setup.

The user can set the minimum and maximum allowed salary for each salary item. After that, it will be updated in the advanced setup.

“Changed from Advanced Setup”: If the user makes changes from advanced setup, this column will display ‘Yes’.

Leaves tab:

Users can select the type of leave wanted for setup, E.g.: Annual leave, Hajj leave. If the items are selected, it will be set for the system. Users can go to Advanced Settings to make changes anytime. However, once set from here, the items will be grayed out and cannot be changed from here anymore.

If the user doesn’t want to setup the system from here, he/she can go to “Advanced Settings”.

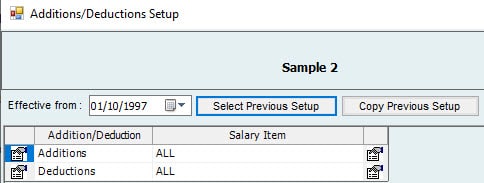

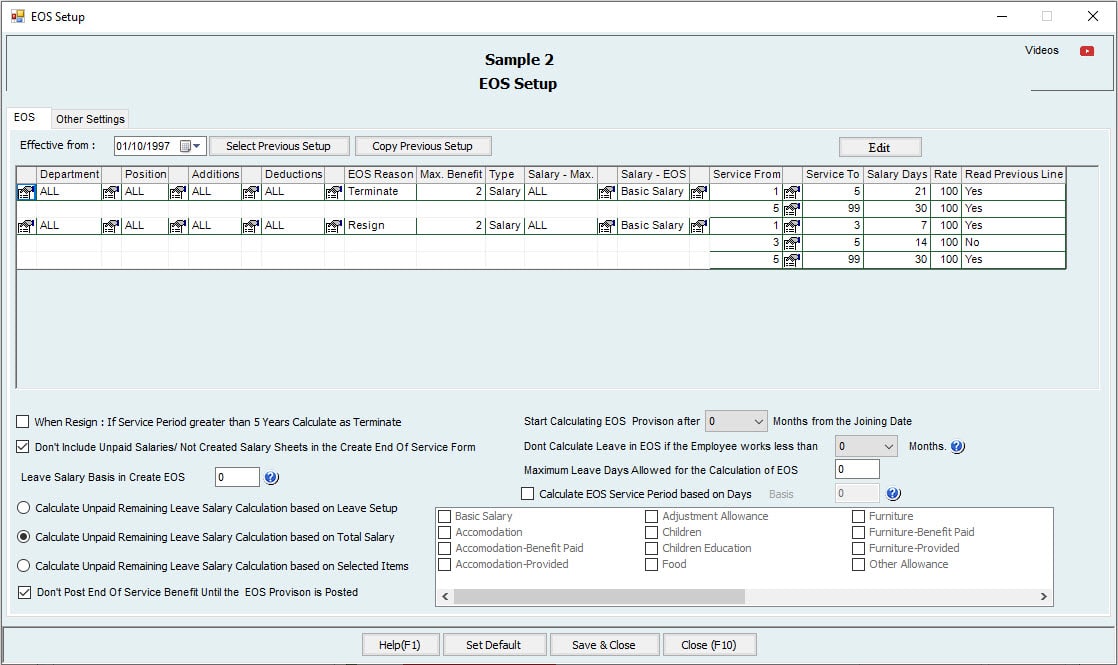

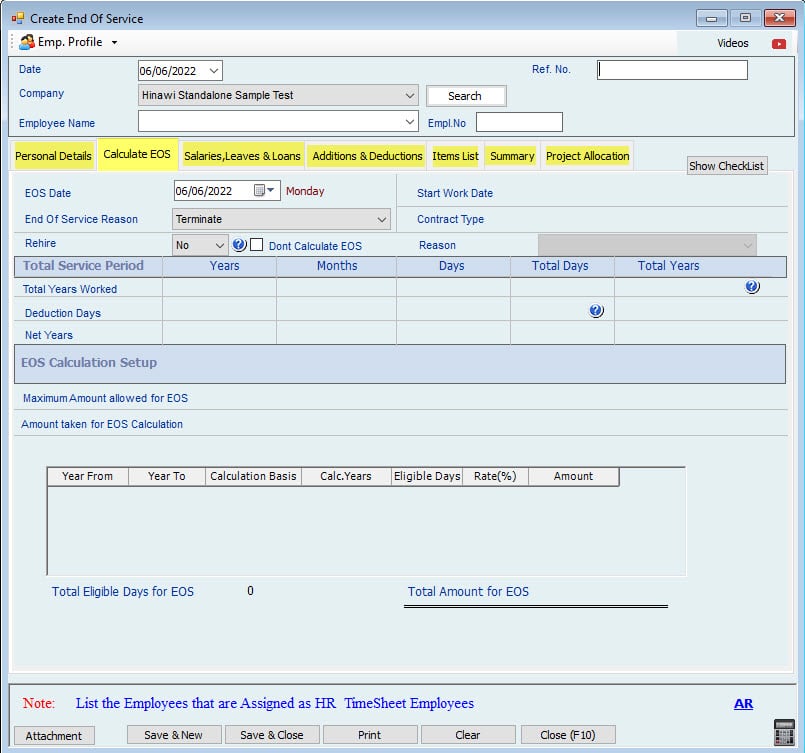

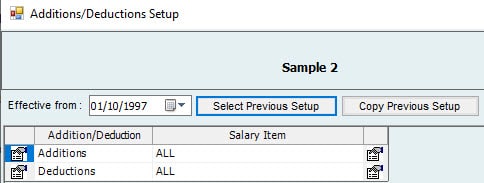

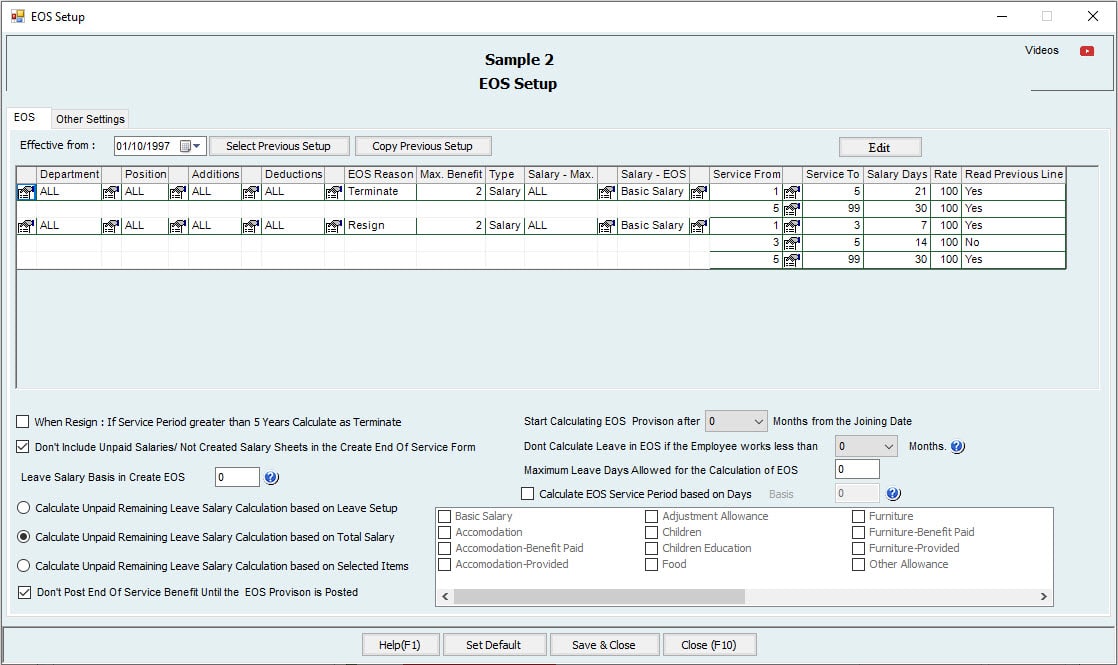

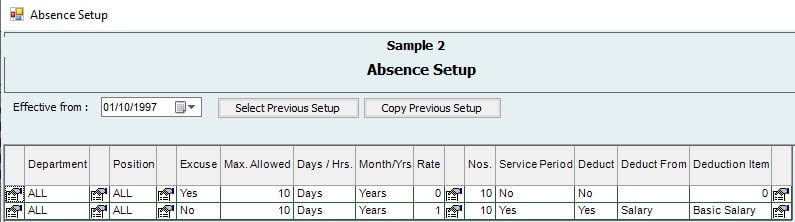

Absence & EOS tab:

Users can select the activities required for setup, E.g.: Absence, EOS (Labor law), and Additions & Deductions.

If the activity items are selected, it will be set in the system. Users can go to Advanced Settings to make further changes anytime. Once set from here, the items will be grayed out and cannot be changed from here.

If the user doesn’t want to setup the system from here, he/she can go to “Advanced Settings”.

Note:

- Once setup is complete, the user cannot change the settings from here. After the initial setup is complete, it will be grayed out.

- Users can go to Advanced Settings for more options.

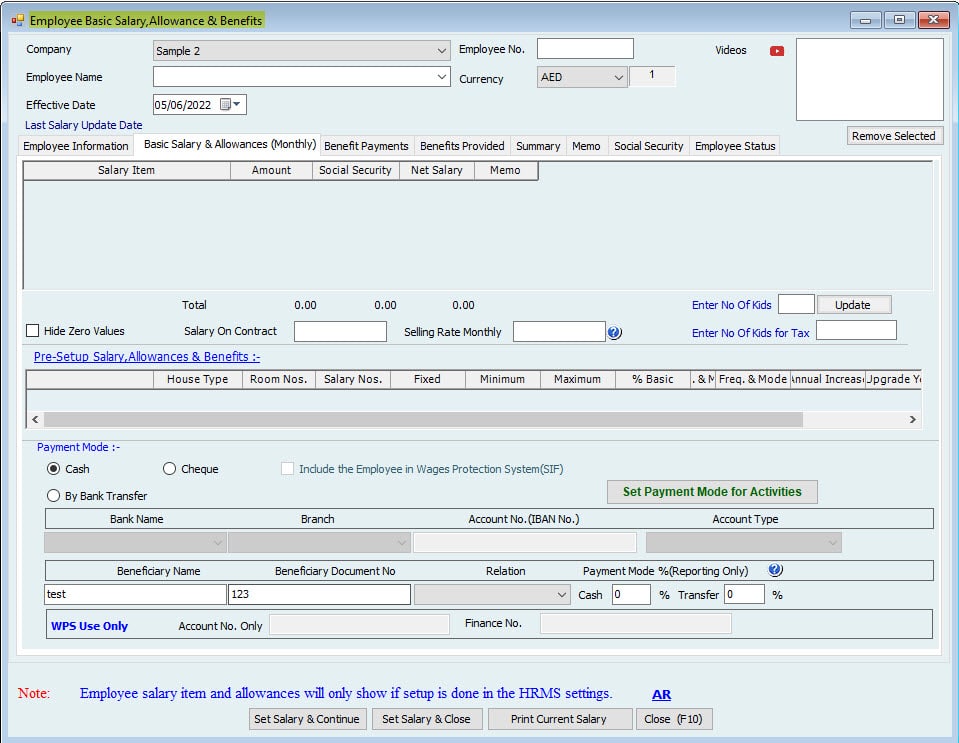

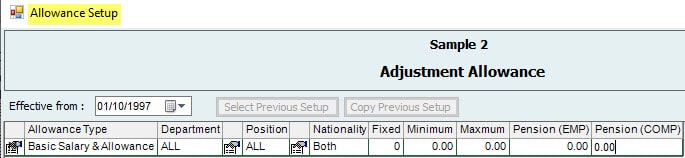

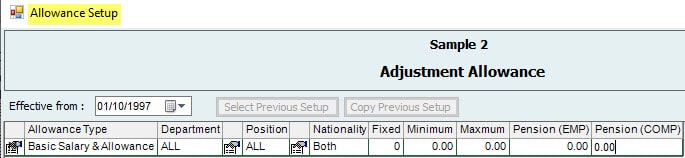

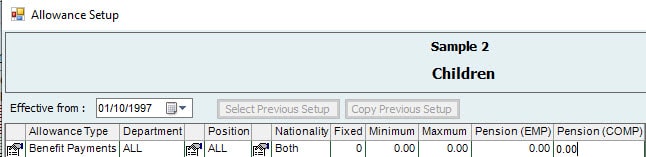

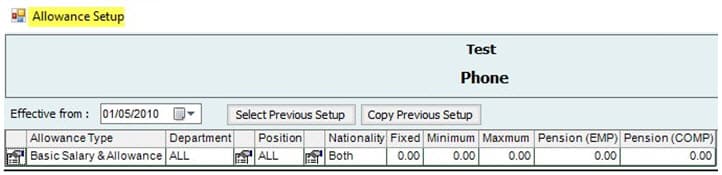

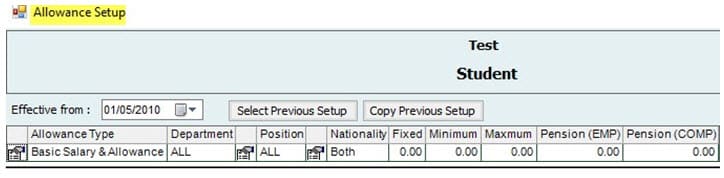

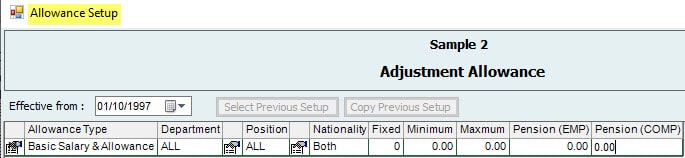

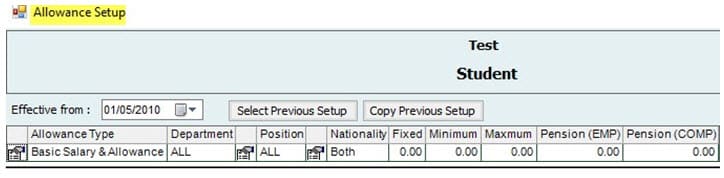

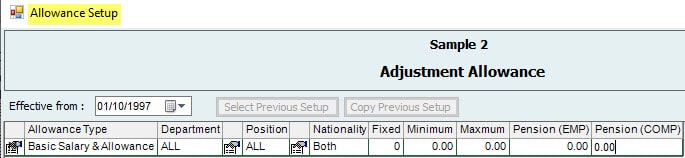

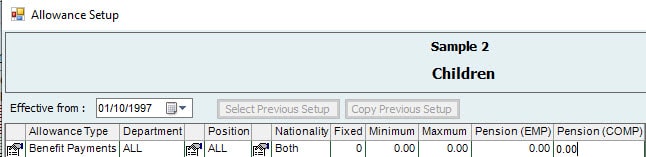

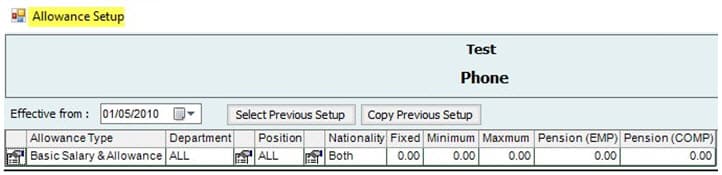

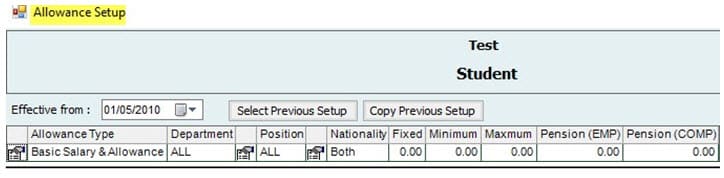

- Basic Salary & Allowance (Monthly) Setup.

In this part, users can setup Basic Salary and Allowances for their company sorted by levels (Department, Position or Grade…etc.). This depends on the items selected in department setup.

Users can select the Basic Salary & Allowances in company settings→ Basic Salary & Allowances.

Basic Salary Setup:

Note:

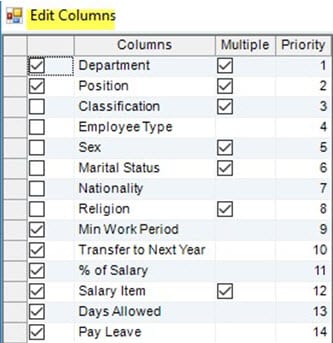

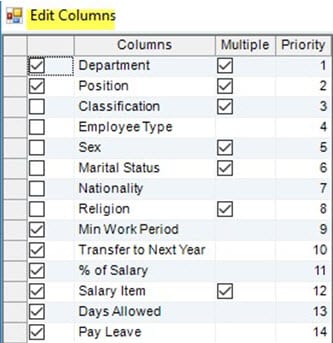

– Users can define which columns needed to be displayed for the Basic Salary setup using ‘Edit Columns’.

– The settings read from the standard setup. Minimum, Maximum and Pension will be reading from the Default setup. Users can change the settings from here.

Department and Position:

– Here, the user can define Basic Salary to be set for the levels: Department and Position.

– The user can select the option ‘All’ if he/she wants to have the same Basic Salary set up for all.

Nationality:

– The user can select which nationality applies to this basic salary settings.

– If Local is selected, the Basic salary will be applied to Locals.

– The user can set different Basic Salary setup for Locals and Non-Locals.

Fixed:

– Users can define a fixed amount to be given as basic salary for the specified employee.

– If the user set a fixed amount, then he/she cannot enter the columns Minimum and Maximum.

Minimum:

– Users can define the minimum basic salary to be given for the specified employee.

Maximum:

– Users can define the maximum basic salary to be given for the specified employee.

Pension (EMP):

– Users can define the percentage of salary to be deducted from the monthly salary as Pension from the employee.

Pension (COMP):

– Users can define the percentage of salary of the Employee to be deducted from the Company as Pension.

Note:

Users cannot define Pension (EMP) and Pension (COMP) for Non-Locals unless the ‘Include Pension for Non-Locals’ is checked from the Leave & Pension Settings. Allowance Type is fixed for Basic salary setup. It is always “paid” as monthly salary.

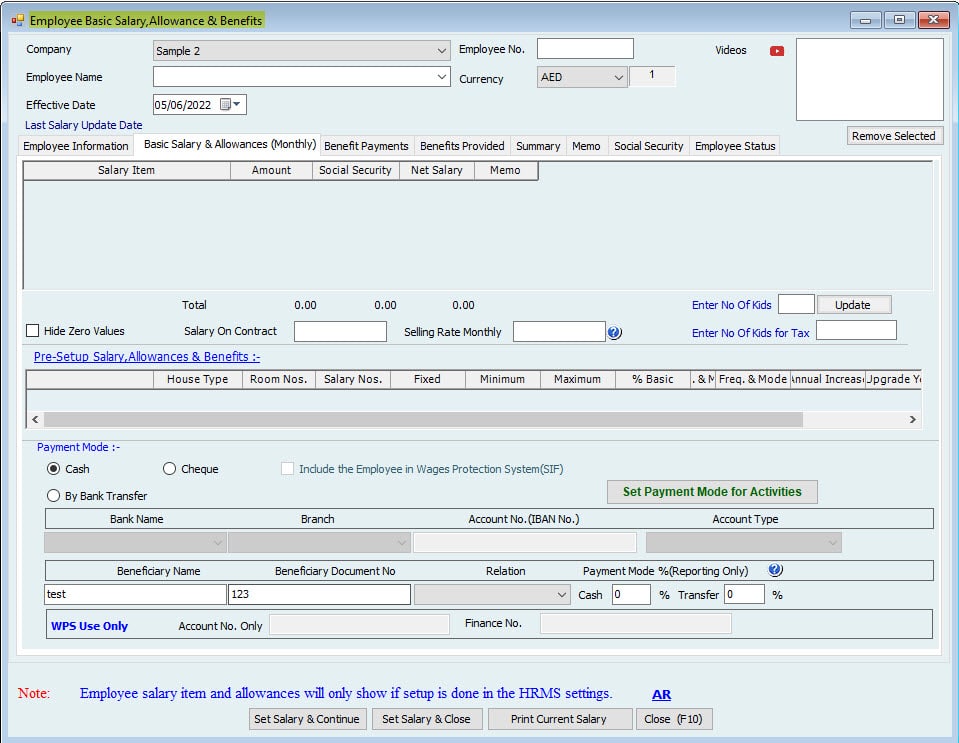

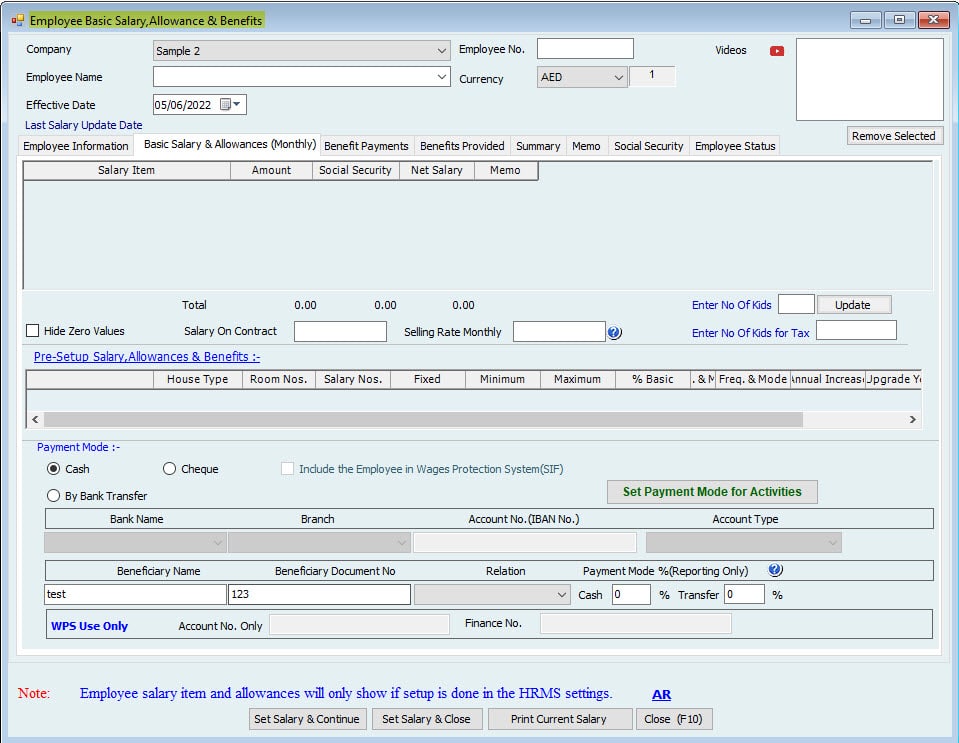

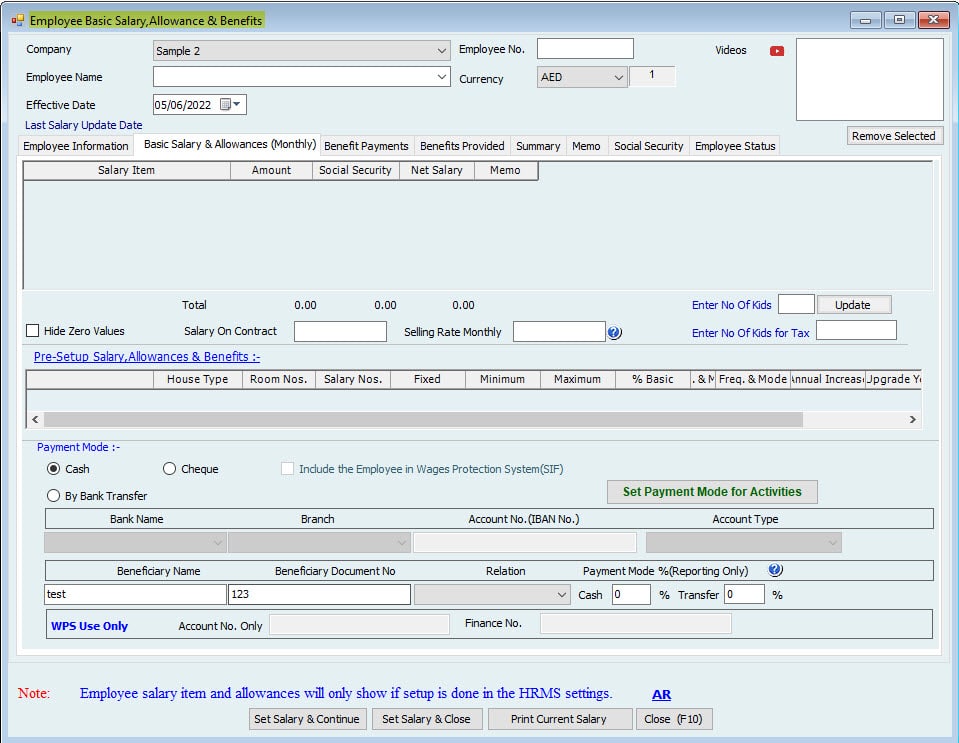

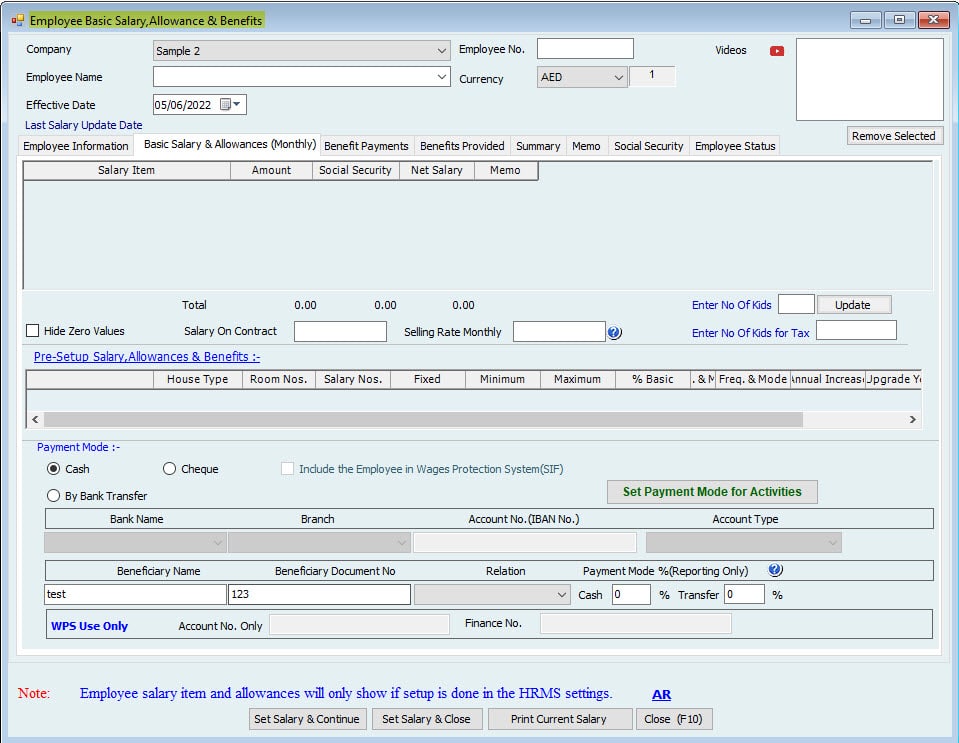

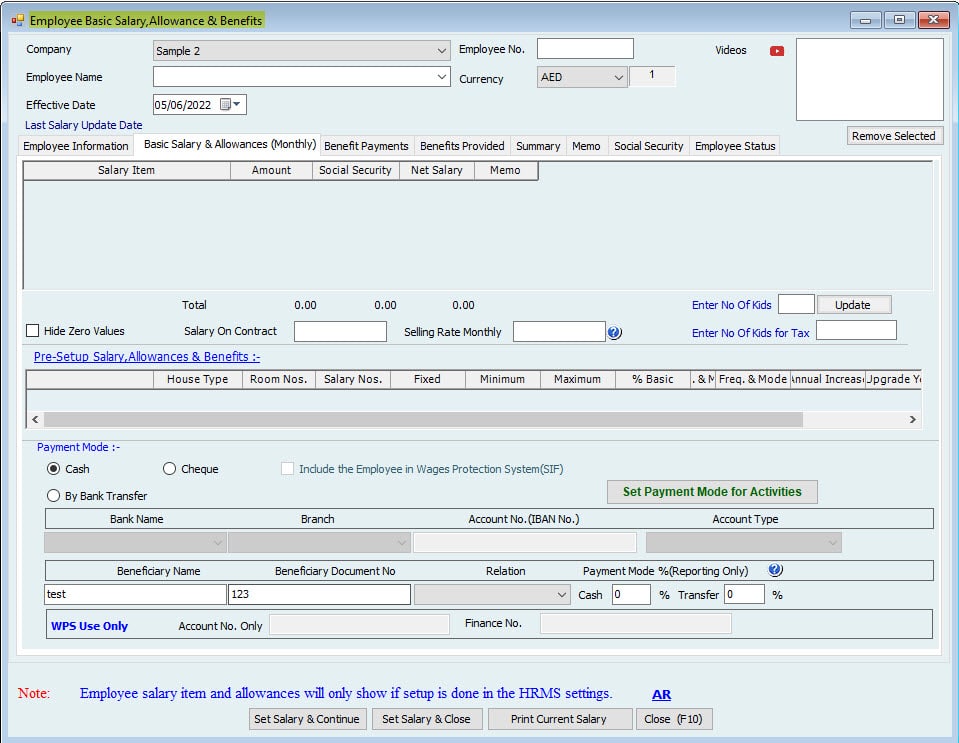

Users can set the Basic Salary for Employees from Manage Employees–>Set Salary & Benefits → Create / Adjust Single Salary.

The user can set the amount to be paid as “Basic Salary and Allowances” here. The Salary item displayed here are depending on the setup done in the Default Setup / Advanced Setup.

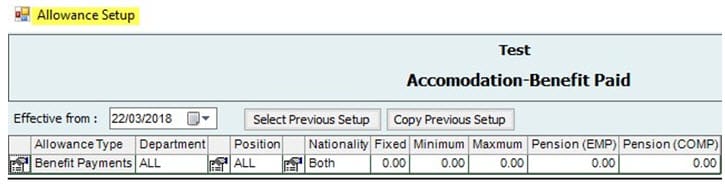

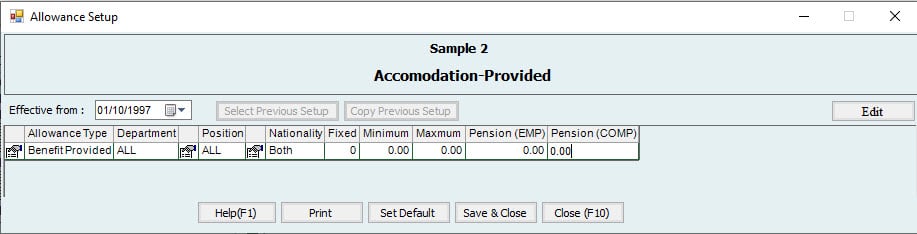

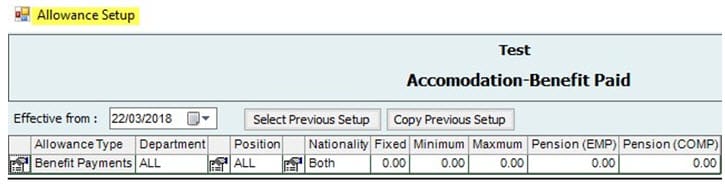

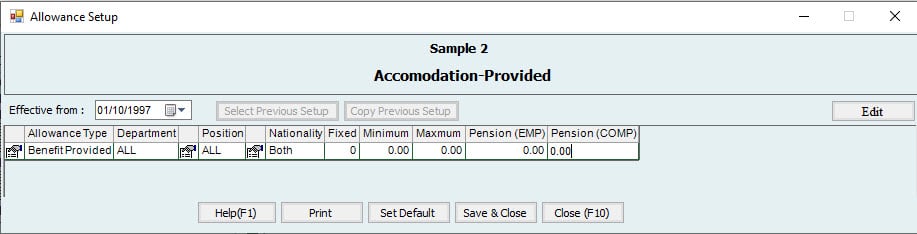

Accommodation Setup:

Note:

– The user can define which columns needed to be displayed for the Accommodation setup using ‘Edit Columns’.

– The settings read from the standard setup. Minimum, Maximum and Pension will be reading from the Default setup if any is set. The user can change settings from here.

Allowance Type:

– The user can select the allowance type to show how the accommodation needs to be paid.

– E.g. If “Benefit Payments” is selected as Allowance type then accommodation is paid as Benefit Payments and Accommodation will be moved under Benefit Payments.

Department and Position:

– Here, the user can define Accommodation allowance to be set for the levels: Department and Position.

– The user can select ‘All’ if he/she wants to have the same set up for all.

Nationality:

Users can select which nationality applies to this basic salary settings.

– If Local is selected, the Accommodation allowance will be applied to Locals.

Fixed:

– Users can define a fixed amount to be given as Accommodation for the specified employee.

Minimum:

– Users can define the minimum Accommodation to be given for the specified employee.

Maximum:

– Users can define the maximum Accommodation to be given for the specified employee.

Pension (EMP):

Users can define the percentage of salary to be deducted from monthly salary as Pension from the employee.

Pension (COMP):

– Users can define the percentage of salary from Employees to be deducted from the Company as Pension.

Note:

Users cannot define Pension (EMP) and Pension (COMP) for Non-Locals unless the ‘Include Pension for Non-Locals’ is checked from the Leave & Pension Settings.

Notes:

- Users can change the Allowance type of all items except Basic Salary. Users can decide how he/she wants to pay the allowance to the employee: as basic salary and allowances Or Benefits. Once the value is set from Manage Employees–>Set Salary & Benefits, users cannot change the Allowance type.

- Users can create new items from General List–>Activities–>Basic Salary, Allowances & benefits.

- New created items will be coming under Advanced Basic Salary & Allowances.

I.e., whenever a new item is created, allowance type will be Basic Salary & Allowances.

- Users can change the Allowance type from Advanced Basic Salary & Allowances for the item added.

- If the user changes the Allowance type to Benefit Payment, the item will be listed under “Benefit Payment” after refreshing it.

- E.g.: If a user creates a new item, ‘Wife Ticket’ under General List→Activities→Basic Salary, Allowances & benefits, then this item will come under “Advanced Basic Salary & Allowances”. Users can open the setup for ‘Wife Ticket’ and change the allowance type to ‘Benefit Payment’ if he/she wants ‘Wife Ticket’ to be paid as Benefit Payment. After refreshing, ‘Wife Ticket’ will be listed under “Advanced Benefit Payments”.

- For any item under “Basic Salary & Allowances”, if the user set Allowance Type as “Basic Salary & Allowance” and after that he/she sets a salary for that item, the user will not be allowed to change the allowance type. Allowance type will be fixed.

- E.g.: If the user sets Furniture as Basic Salary & Allowances and if he/she also sets an amount for Furniture from Manage Employees–>Set Salary& Benefits, then the allowance type for Furniture can’t be changed. It will be fixed as Basic Salary & Allowances.

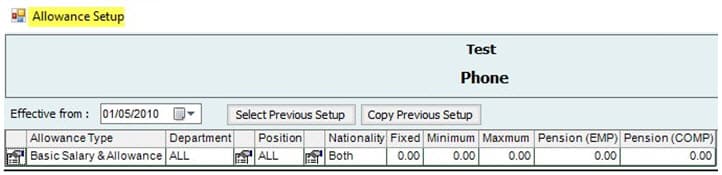

All the other allowances (Furniture, Transportation etc.) setup is the same as the above Accommodation setup.

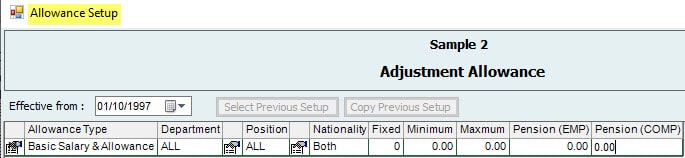

Adjustment Allowance:

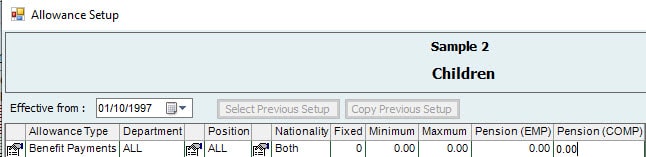

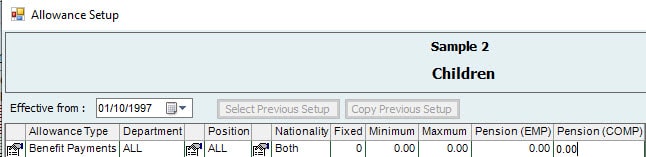

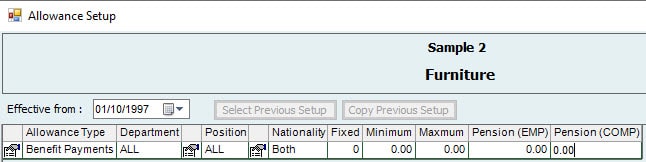

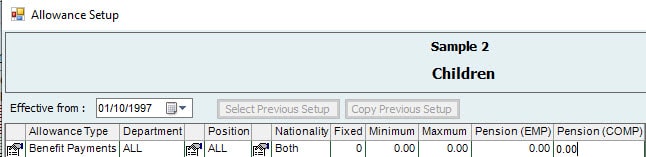

Children Setup:

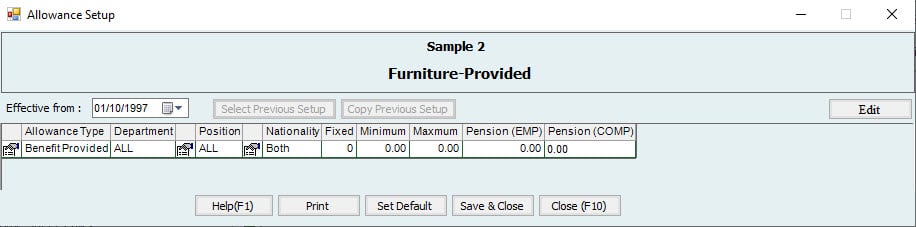

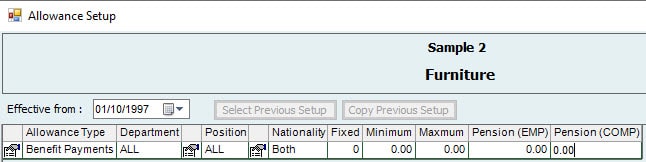

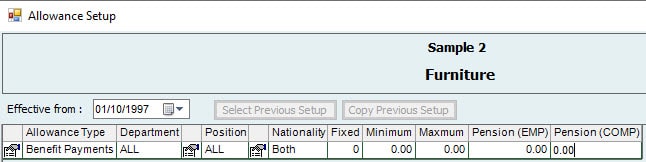

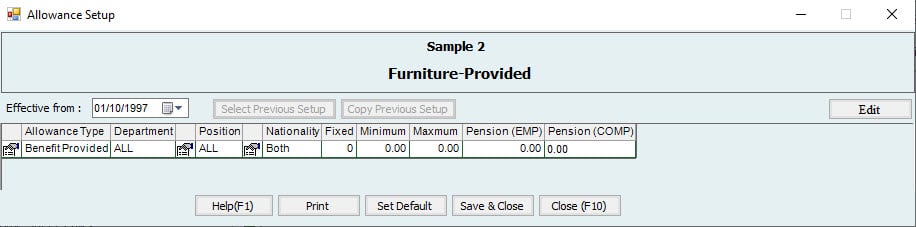

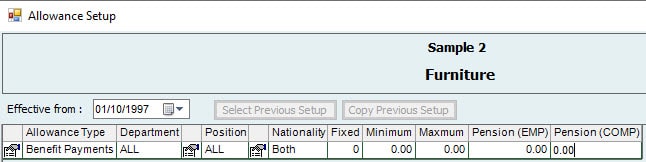

Furniture Setup:

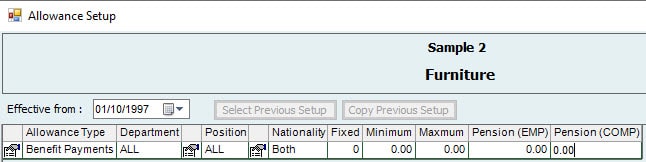

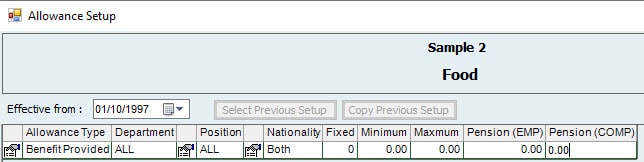

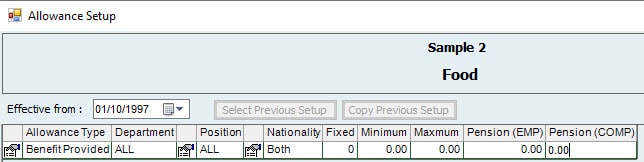

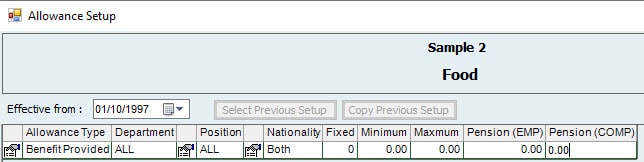

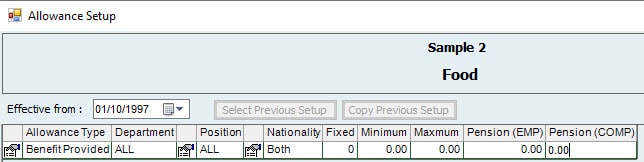

Food Setup:

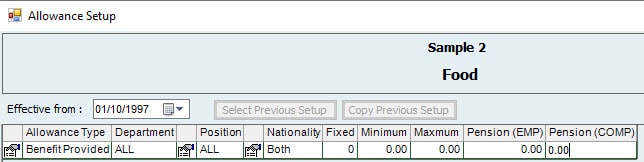

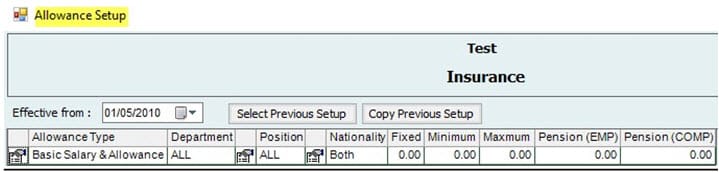

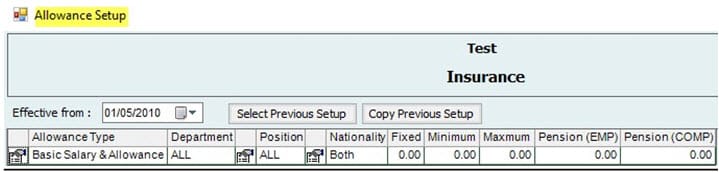

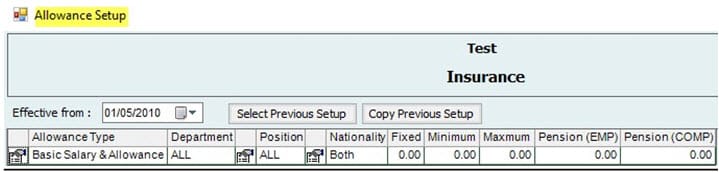

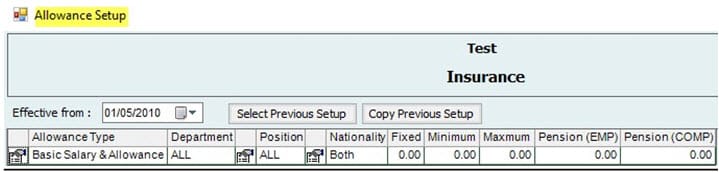

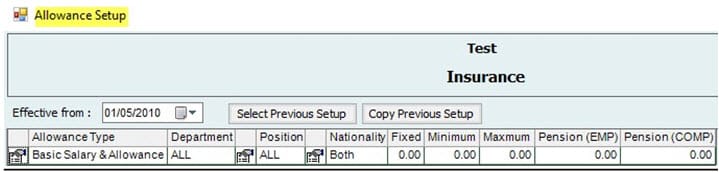

Insurance Setup:

Loan Deduction:

Maintenance Allowance:

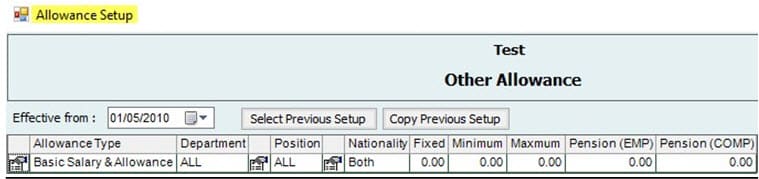

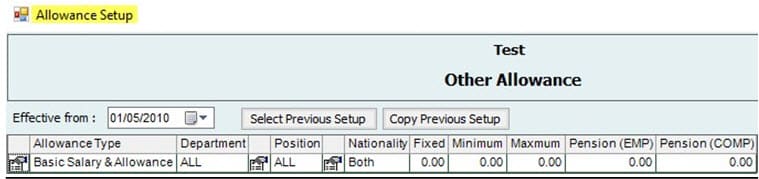

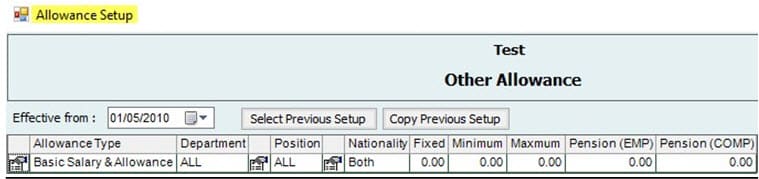

Other Allowance:

Transportation:

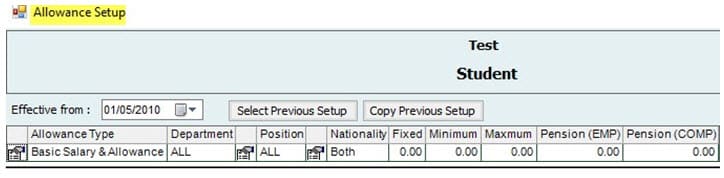

More Items can be added under Basic Salary & Allowances as well.

Benefit Payment Setup

User can set Advanced Benefit Payment settings from here.

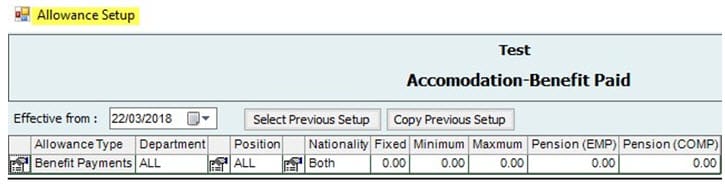

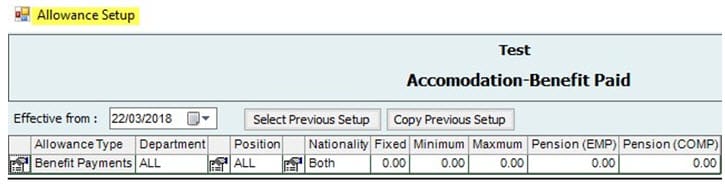

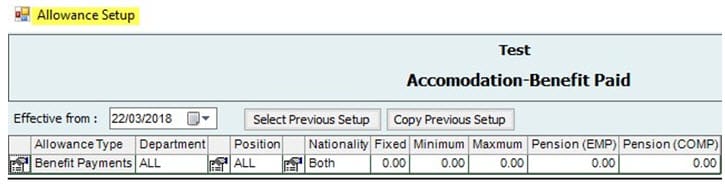

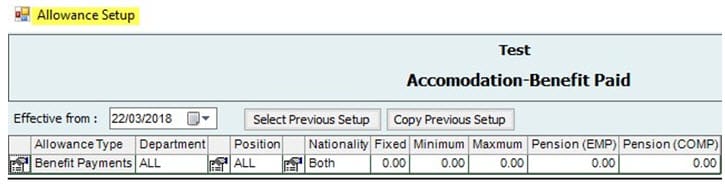

06 Benefits Paid & Provided

Accommodation –Benefit Paid:

Note:

-Users can define which columns required to be displayed for the Benefit Payments setup using ‘Edit Columns’.

-The settings read from the standard setup. Minimum, Maximum and Pension will be reading from Default setup. Users can change the settings from here.

Allowance Type:

-It will list the types of allowance: Benefit Payment.

Department and Position:

-Here, the user can define two levels: Department and Position. Setup needs to be done on the settings.

-Users can select ‘All’ if they want to have the same setup to apply for all.

Nationality:

-Users can select what nationalities apply to this benefit payment settings.

Fixed Amount:

-Users can define a fixed amount to be given as benefit payment for the specified employees.

Minimum Amount:

-Users can define the minimum amount to be given as benefit payment for the specified employee.

Maximum Amount:

-Users can define the maximum amount to be given as benefit payment for the specified employee.

Pension (EMP):

Employee.

Pension (COMP):

-Users can define the amount to be deducted as pension from the

-Users can define the amount to be deducted as pension from the Company.

Note:

Users cannot define Pension (EMP) and Pension (COMP) for Non-Locals unless the ‘Include Pension for Non-Locals’ is checked from the Leave & Pension Settings.

Users can set the Benefit Payments for Employees from Manage Employees→Set Salary & Benefits→Create/Adjust Single Salary→Benefit Payments Tab.

Note:

Benefit Payment is not paid through salary sheet. Users need to create benefit from HR Activities where they can pay to the Employee by cheque or cash. This will not affect the salary sheet.

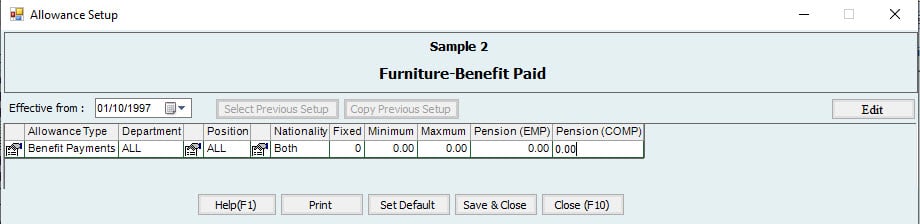

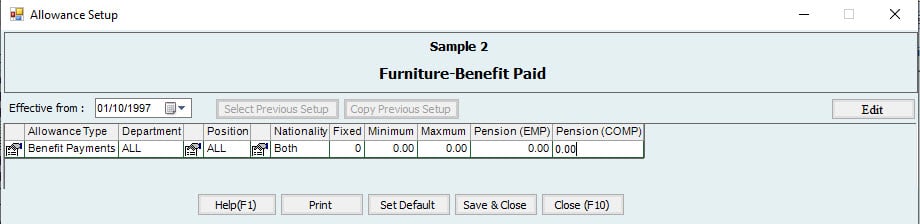

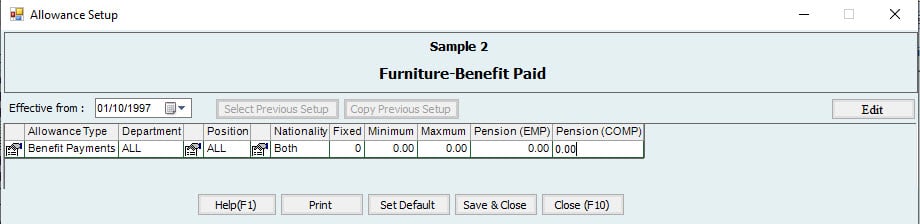

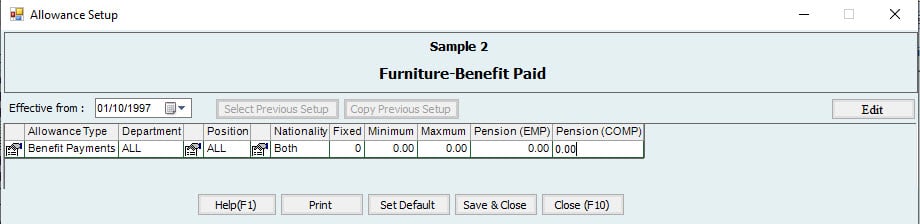

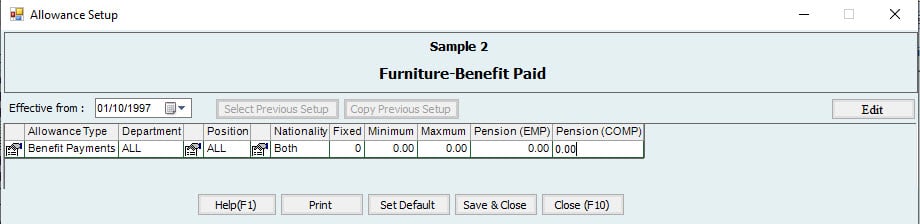

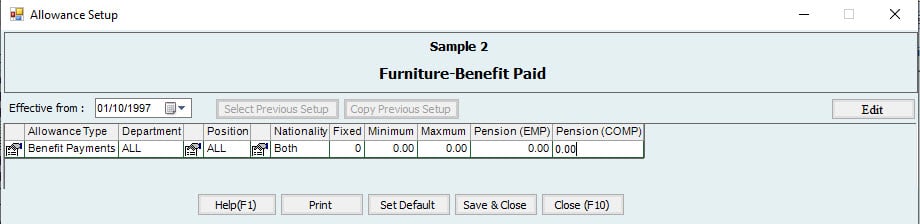

Furniture-Benefit Paid:

-Users can define which columns must be displayed for the Benefit Payments setup using ‘Edit Columns’.

-The settings read from the standard setup. Minimum, Maximum, and Pension will be reading from the Default setup. Users can change the settings from here.

Allowance Type:

-It will list the type of allowance: Benefit Payment.

Department and Position:

-Here, the user can define two levels: Department and Position. The setting needs to be setup.

-Users can select the option ‘All’ if they want the same set up for all.

Nationality:

-Users can select what nationalities apply to this benefit payment settings.

Fixed Amount:

-Users can define a fixed amount as benefit payment for the specified employees.

Minimum Amount:

-Users can define the minimum amount for benefit payment for the specified employees.

Maximum Amount:

-Users can define the maximum amount to be given as benefit payment for the specified employees.

Pension (EMP):

Users can define the amount to be deducted as pension from the Employee.

Pension (COMP):

-Users can define the amount to be deducted as pension from the Company.

Note:

Users cannot define Pension (EMP) and Pension (COMP) for Non-Locals unless the ‘Include Pension for Non-Locals’ is checked from the Leave & Pension Settings.

Users can set the Benefit Payments for Employees from Manage Employees→Set Salary & Benefits→Create/Adjust Single Salary→Benefit Payments Tab.

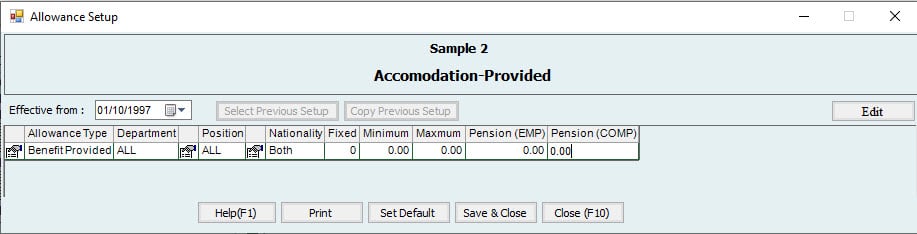

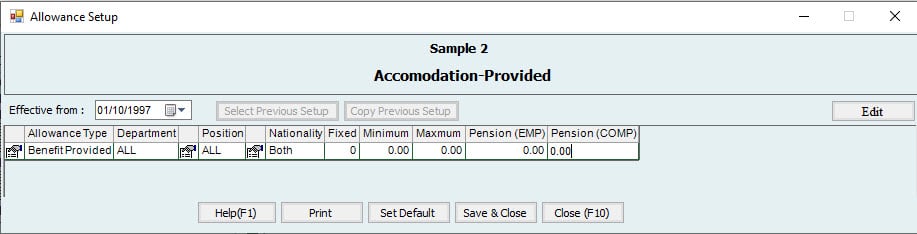

Benefit Provided Setup

User can set Advanced Benefit Provided settings from here.

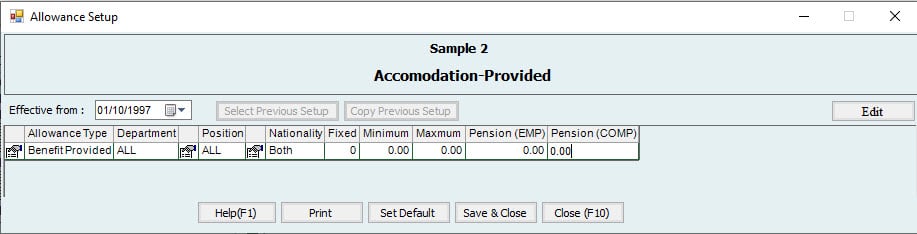

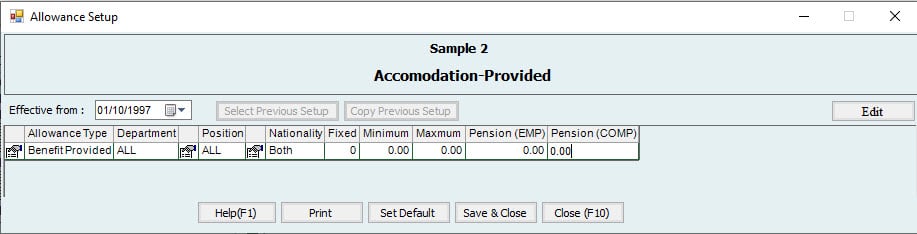

Accommodation- Provided:

Note:

-Users can define which columns need to be displayed for the Benefit provided setup using ‘Edit Columns’.

-The settings read from the standard setup. Minimum, Maximum and Pension will be reading from Default setup if set any. Users can change the settings from here.

Allowance Type:

It will list the type of allowance: Benefit Provided.

Department and Position:

-Here, the user can define two levels: Department and Position. Setting needs to be setup.

-The user can select ‘All’ if he/she wants to have the same set up for all.

Nationality:

-Users can select to which nationality to apply this benefit provided settings.

Fixed Amount:

-Users can define a fixed amount as a benefit provided for the specified employees.

Minimum Amount:

-Users can define the minimum amount to be given as a benefit provided for the specified employees.

Maximum Amount:

-Users can define the maximum amount to be given as a benefit provided for the specified employees.

Pension (EMP):

-Users can define the amount to be deducted as pension from the Employees.

Pension (COMP):

-Users can define the amount to be deducted as a pension from the Company.

Note:

Users cannot define Pension (EMP) and Pension (COMP) for Non-Local sunless the ‘Include Pension for Non-Locals’ is checked from the Leave & Pension Settings.

Users can set the Benefit Provided for Employees from Manage Employees→Set Salary & Benefit→ Create / Adjust Single Salary → Benefit Provided Tab.

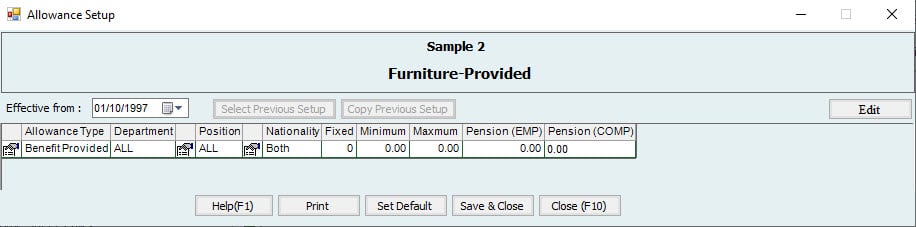

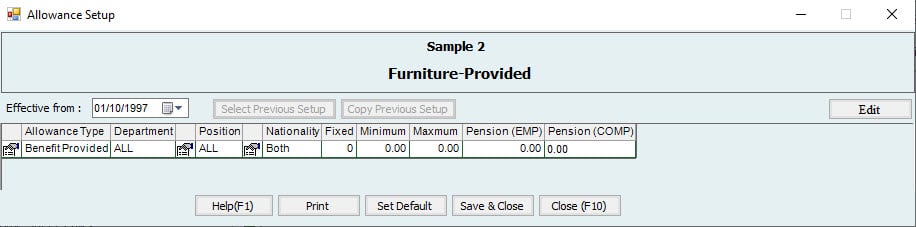

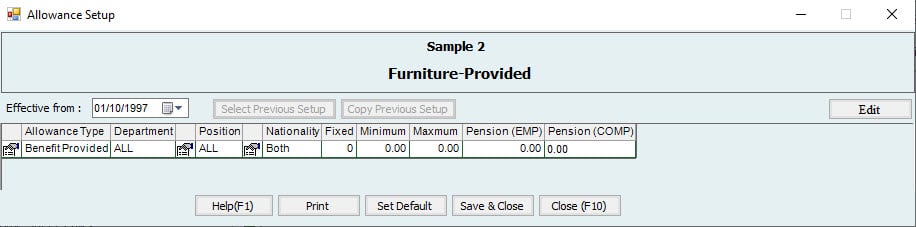

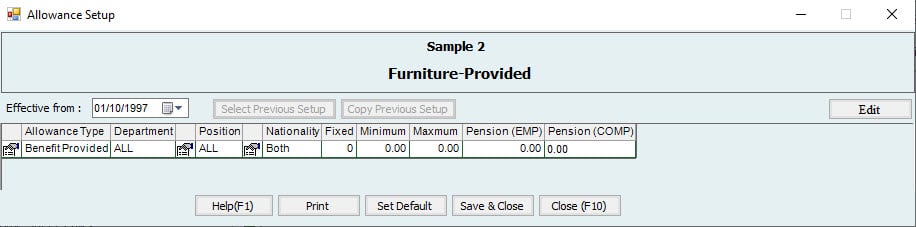

Furniture –Benefit Provided:

Note:

-Users can define which columns need to be displayed for the Benefit provided setup using ‘Edit Columns’.

-The settings read from the standard setup. Minimum, Maximum and Pension will be reading from Default setup if set any. Users can change settings from here.

Allowance Type:

-It will list the type of allowance: Benefit Provided.

Department and Position:

-Here, the user can define two levels: Department and Position. The settings need to be setup.

-User can select ‘All’ if he/she wants to have the same setup for all.

Nationality:

-Users can select to what nationalities apply to this benefit provided settings.

Fixed Amount:

-Users can define a fixed amount to be given as benefit provided for the specified employees.

Minimum Amount:

-Users can define the minimum amount to be given as benefit provided for the specified employees.

Maximum Amount:

-Users can define the maximum amount to be given as benefit provided for the specified employees.

Pension (EMP):

Users can define the amount to be deducted as pension from Employees.

Pension (COMP):

-Users can define the amount to be deducted as pension from the Company.

Note:

Users cannot define Pension (EMP) and Pension (COMP) for Non-Locals unless the ‘Include Pension for Non-Locals’ is checked from the Leave & Pension Settings.

Users can set the Benefit Provided for Employees from Manage Employees→Set Salary & Benefits→Create/Adjust Single Salary→Benefit Provided Tab.

07. HRMS Activities Setup:

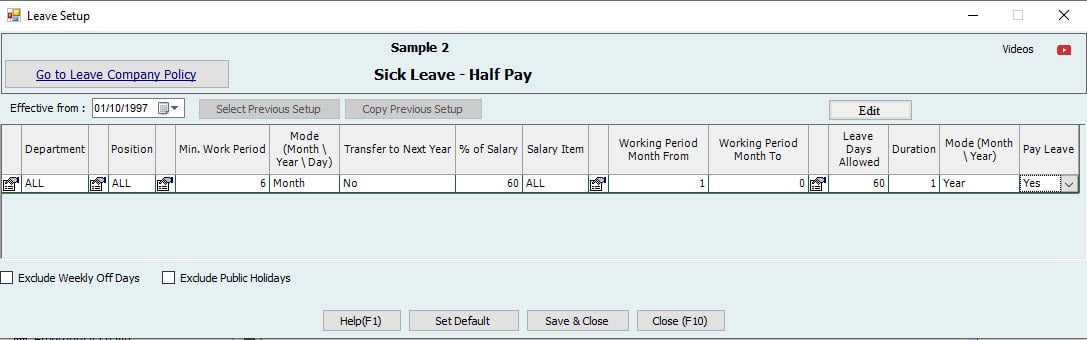

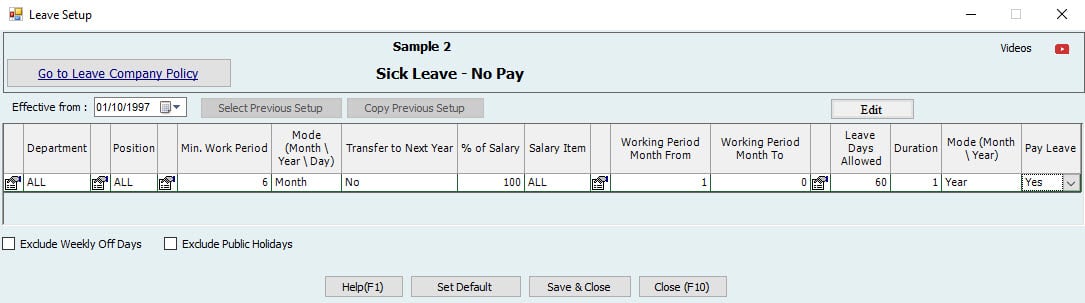

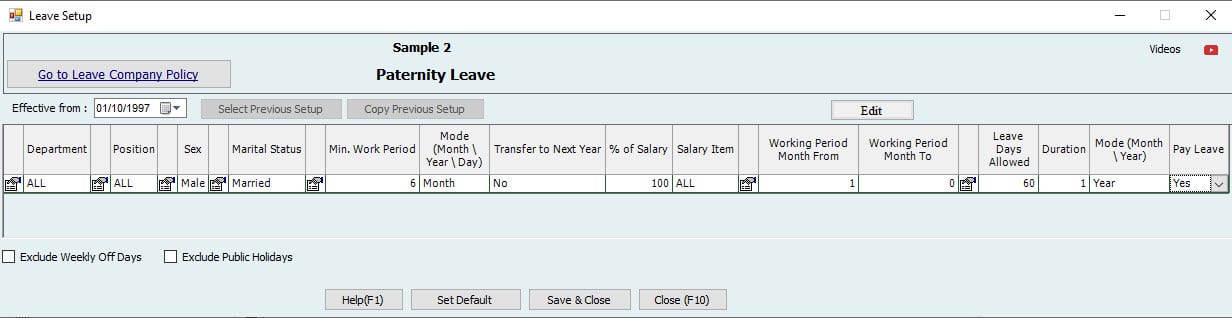

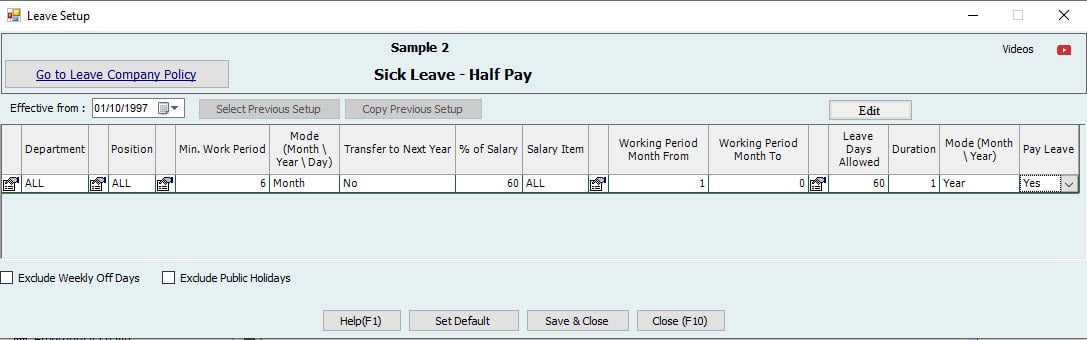

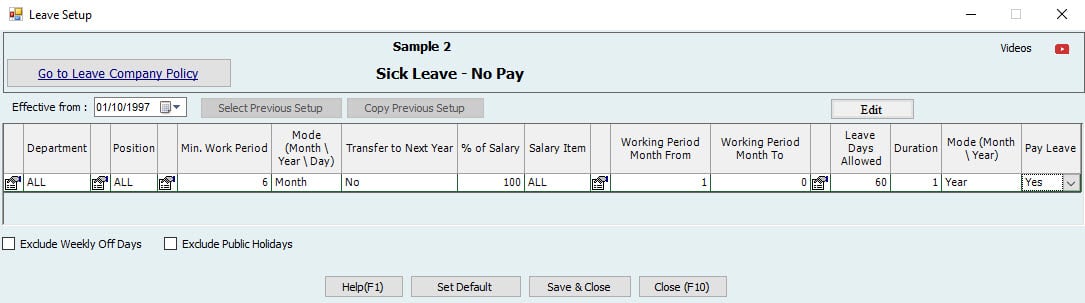

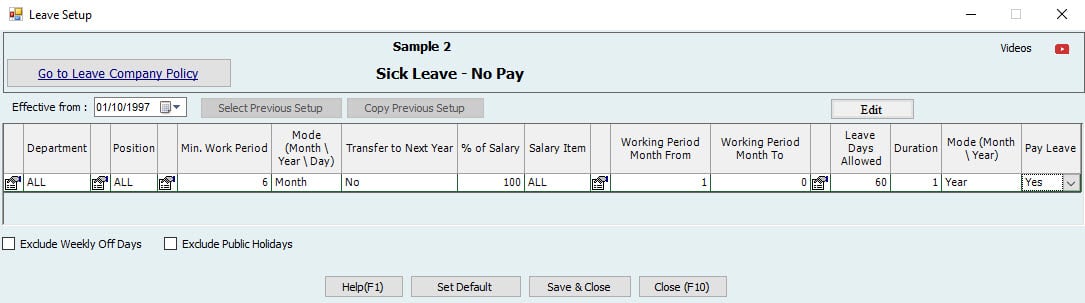

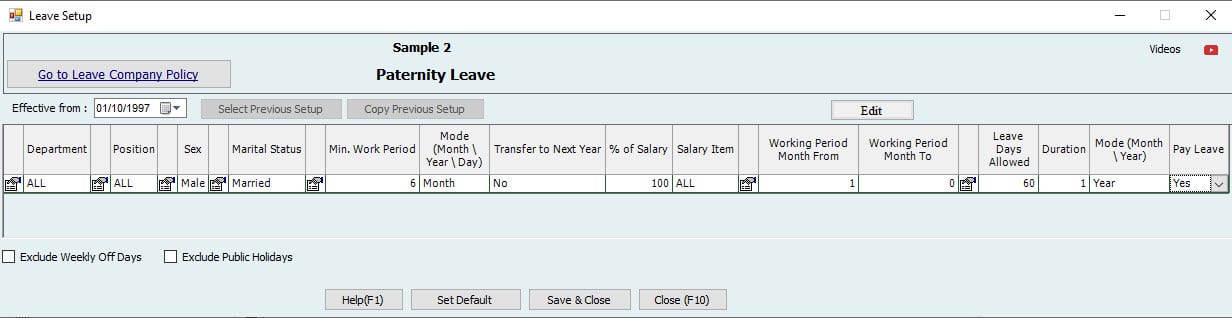

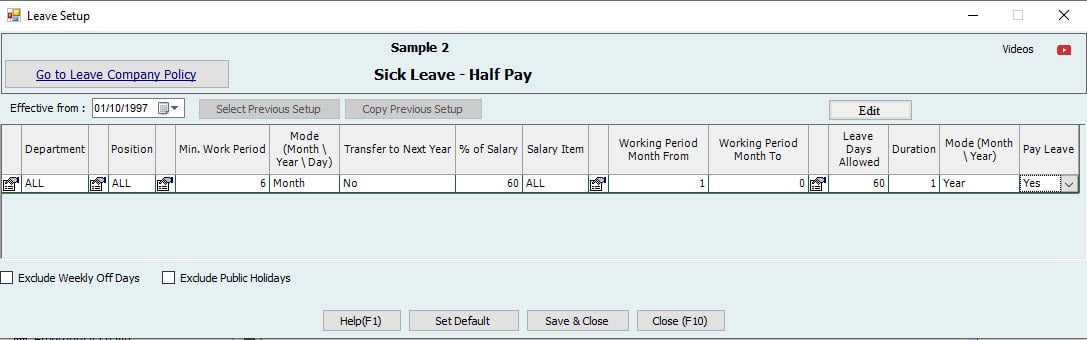

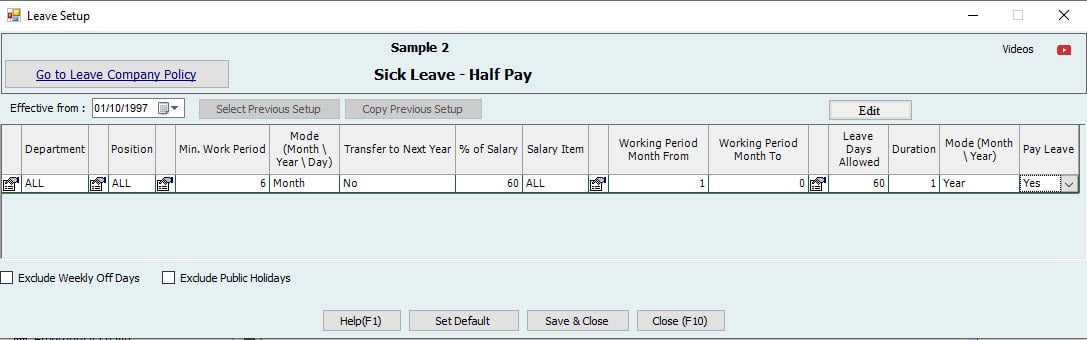

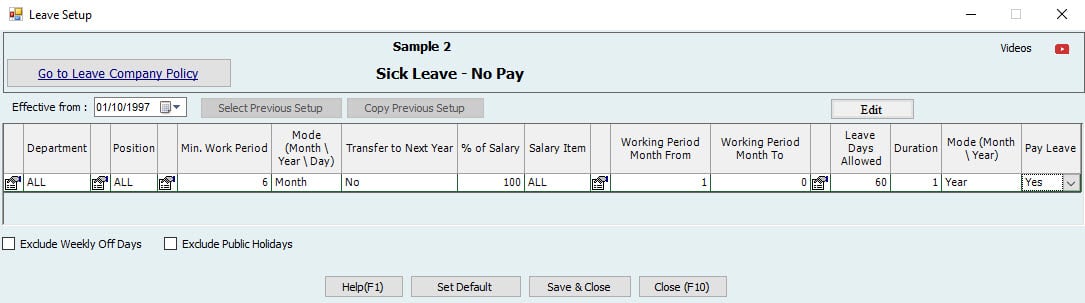

5-1. Leave Setup:

5-1-1. Annual Leave

Users can select the Activities setup in company settings→ HRMS Activities setup→ leave Setup → Annual Leave setup.

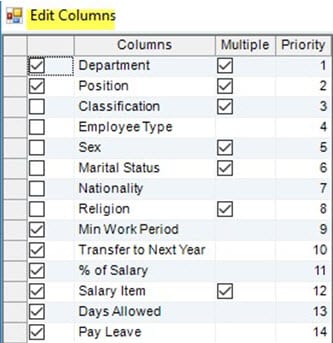

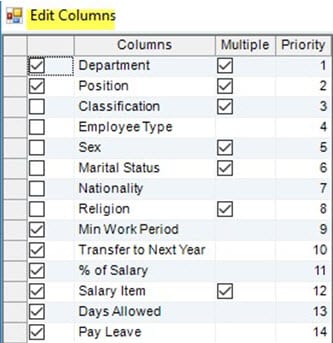

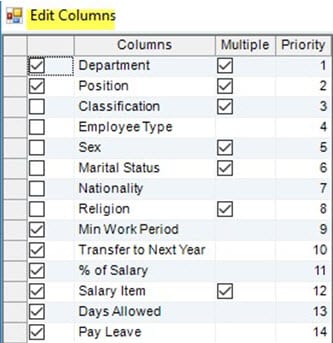

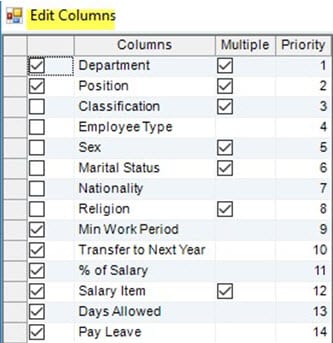

When users open the setup for the first time, it will open the below window to select the columns to be displayed for the setup:

By default, the ticked columns are selected, users must “Save Settings & Close” to continue. In case multiple were checked, there will be multiple lines for the column type. I.e., users can have different setup for different lines.

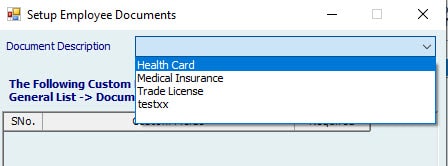

Users can add more Leave types depending on the Company policy from General List. I.e., Lists→General list→Leave Type.

Note:

User can define which columns need to be displayed for the Annual Leave setup using ‘Edit Columns’.

Department and Position:

-Here the user can define Annual Leave to be set for the levels: Department and Position.

-User can select ‘All’ if he/she wants to have the same setup for all.

Minimum work Period:

-This is the Minimum work period the employee needs to finish in the company before creating the leave.

-For example, if the user (Admin) puts 6 months, the system will not allow to create Leave before 6 months.

Mode:

-Users can define the mode as Month/Year/Days.

Transfer to Next year:

- Transfer to next year means the Leave Balance will be carried forward to next year and so on.

- If Transfer to Next Year is Yes (Monthly), then if an Employee has Leave Balance of 50 Days, it will be transferred to next year and his/her balance will be 50 at the beginning of the year. Also, this will be included in EOS Leave calculation.

- E.g.: When the setup is monthly, all the remaining Leaves from joining date of the Employee will be carried forward to next year at the beginning of the month. The end of each month 2.5 days (as per setup) leaves will be added to the leave balance. If the Employee changes the setup to Annual, then the Leaves from previous years will be lost and the Leave balance will be 30 days. If the user wants to keep the previous leave balances, he/she can add the remaining leaves in Activities→Leaves→Days Adjustments.

- If “Transfer to Next Year” is No (Annual), then if an Employee has Leave Balance of 50 Days, it will not be transferred to next year and this will not be included in EOS calculation as well. The leave balance of the Employee will only be from the current year. At the beginning of the year, his/her balance will be 30 days. If the Employee takes a leave for 15 days, his/her leave balance will be 15 Days. However, if the user changes the setup to “Monthly”, then the leaves from previous years (balance from joining date) will be added to the Leave balance, the taken 15 days will be deducted from the leave balance.

% of Salary:

-What percentage of Defined Salary does the user want to pay in Leave salary?

-If the percentage is 100 and the salary is 1000, then the employee will get 1000 as Leave salary. If the percentage is 50 and the salary is 1000, then the employee will get 500 as the Leave salary.

Salary Item:

-Define the Salary Components to be included in the Leave Salary. For example, Basic Salary + Accommodation + Other Allowances or All Allowances as per company policy.

Encash Leave:

-Users can define the salary component to be given for the leave encashment if the employee is not taking the leave.

Month From / Month To:

-Define period of Leave Calculation Days for Employees.

For example, from 0 to 6 means first 6 months of service period, 7 to 12 means after 6 months and 12 to 0 means after a year. “0” here means infinite.

Days Allowed:

-Users can define Maximum days allowed for calculation of Leave in a specified Service period (Specify the period by using Month From / Month To).

-User can set 7-12-month duration, Days allowed as 24; then the maximum allowed leaves between 7-12 months will be 24 Days.

Duration:

-How many times does the user want to give these Allowed Days? Once a year or Monthly.

Mode:

-Users can define whether the allowed days is Monthly/Yearly.

Pay Leave:

-Users can select whether he/she wants to pay the leave or not for the employees.

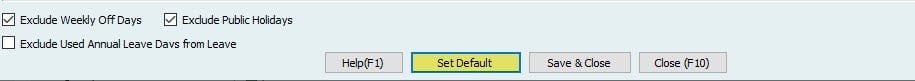

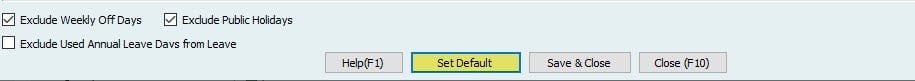

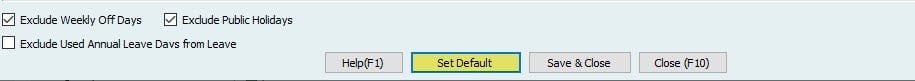

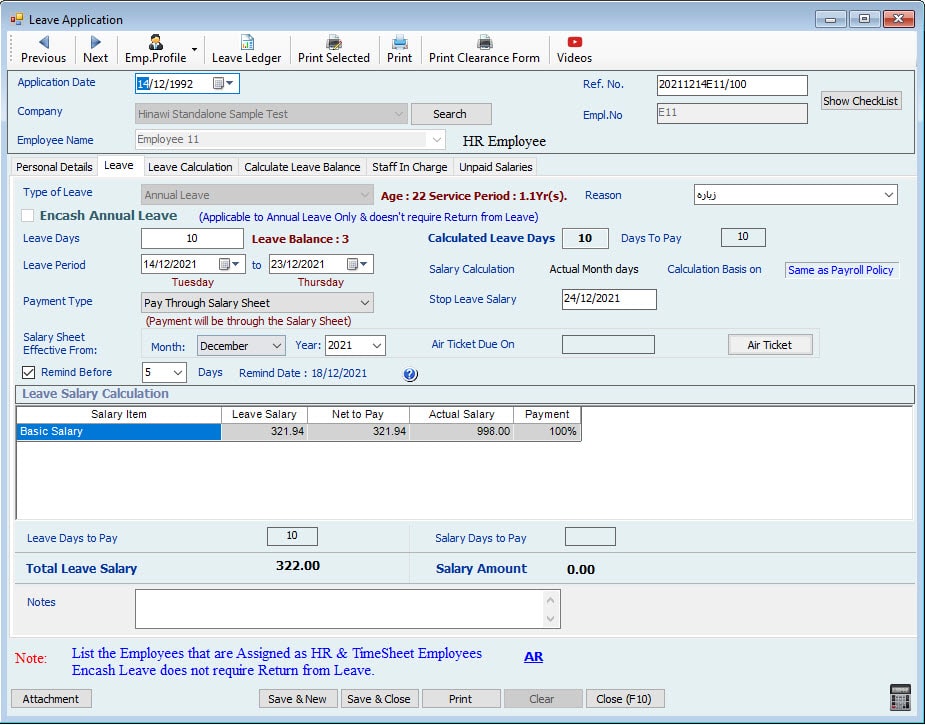

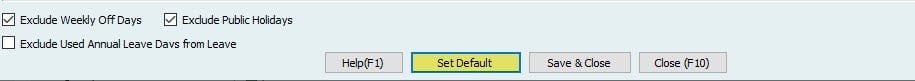

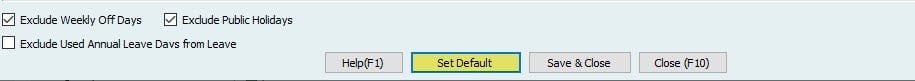

Exclude Weekly off Days:

-Weekly off days (e.g. Friday) will be excluded from Leave Days. Weekly off Days can be defined from:

File→ Settings→ Company Setup→ Holidays Setup

For example, yearly allowed leaves are 30. If this option is checked, weekly off days are excluded from annual Leave calculation, and the system will not include Fridays in the Leave Period. It means that if an employee is going for a 30 days leave, the leave calculation will be 26 assuming 4 Fridays during its Leave.

Exclude Public Holidays:

-Public Holidays will be excluded from Leave Days. Public Holidays can be defined from:

File→ Settings→ Company Setup→ Holidays Setup

For example, if any Public Holiday comes during the Leave Period, and if this option is checked, it will not be considered in the leave calculation.

Exclude Used Annual Leave Days from Leave Calculation:

– The Leave period will be excluded from Leave Calculation.

For example, if the user selects this option, the system will not calculate (Accrued) Leaves for created Leave period. This means that after one month leave, the employee will have to work for 12 months to get 30 days.

Note:

Set Default button should change the setup to the default settings for annual leaves setup, as below.

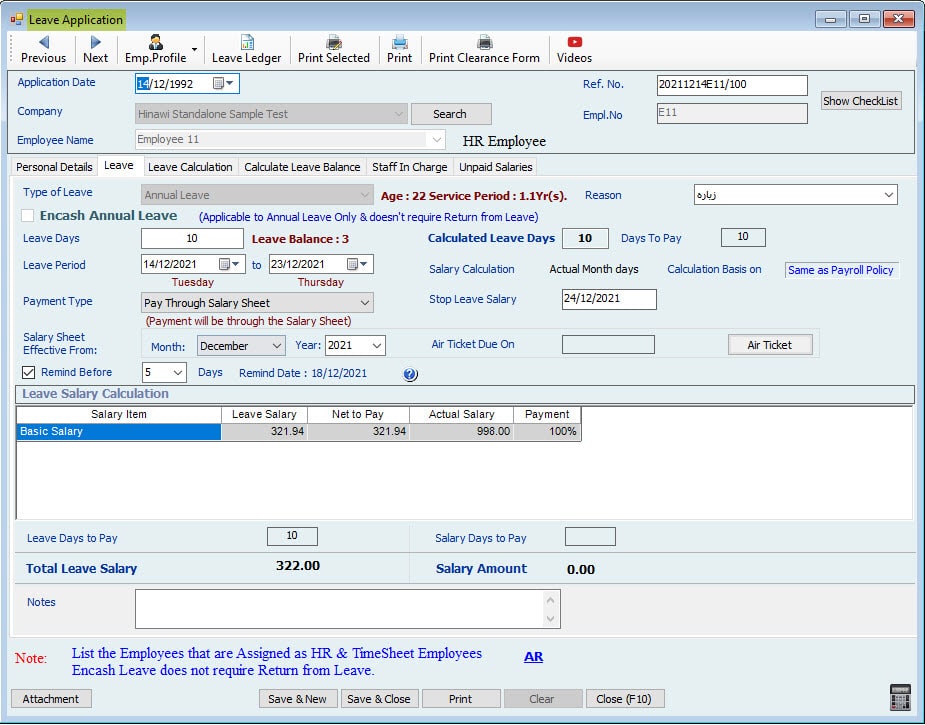

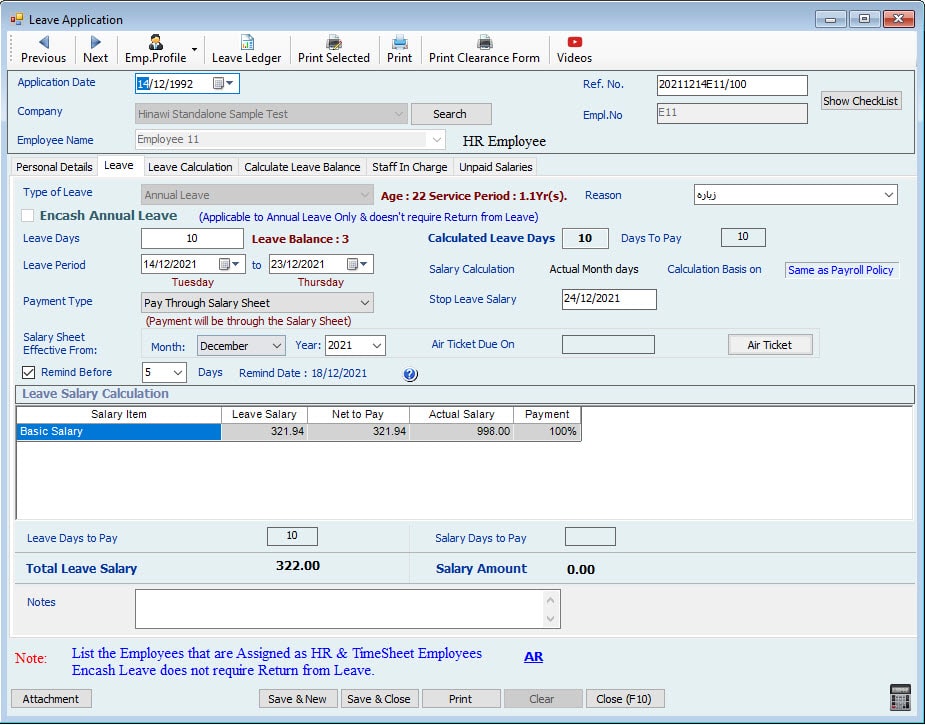

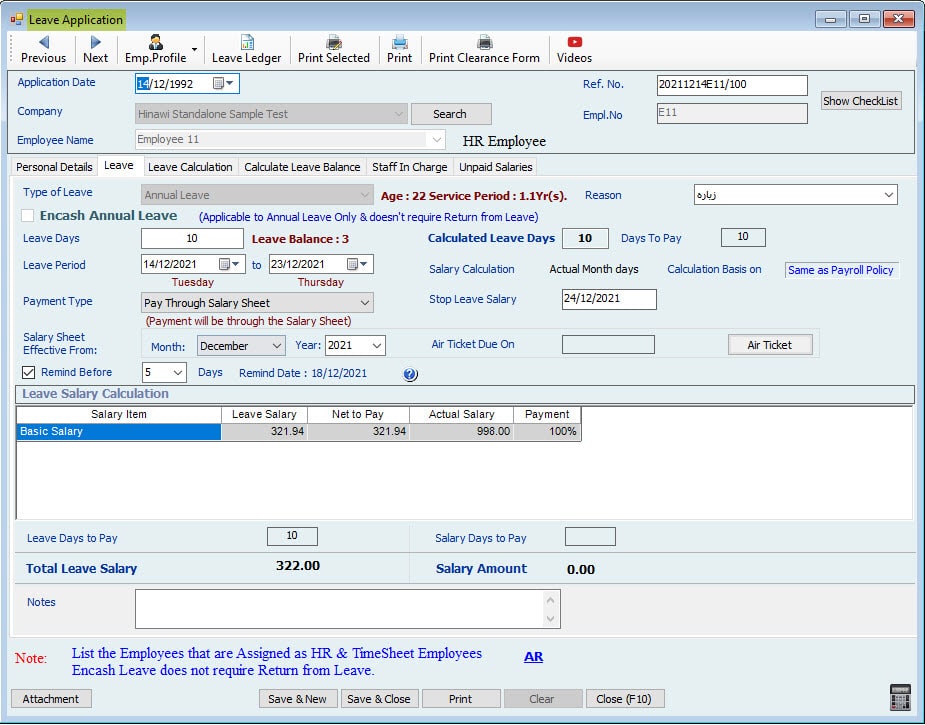

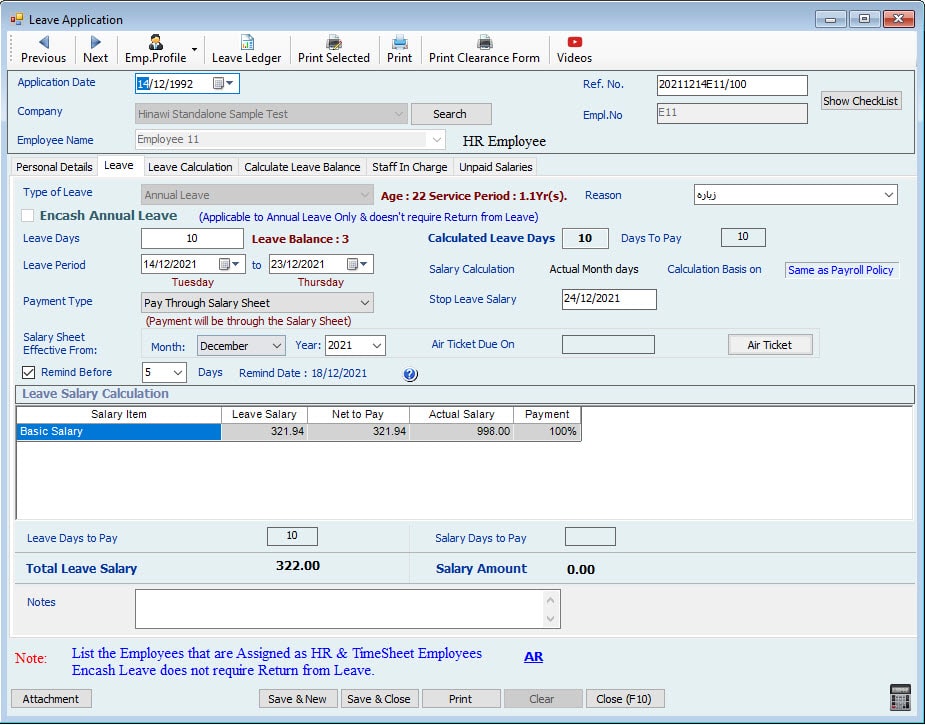

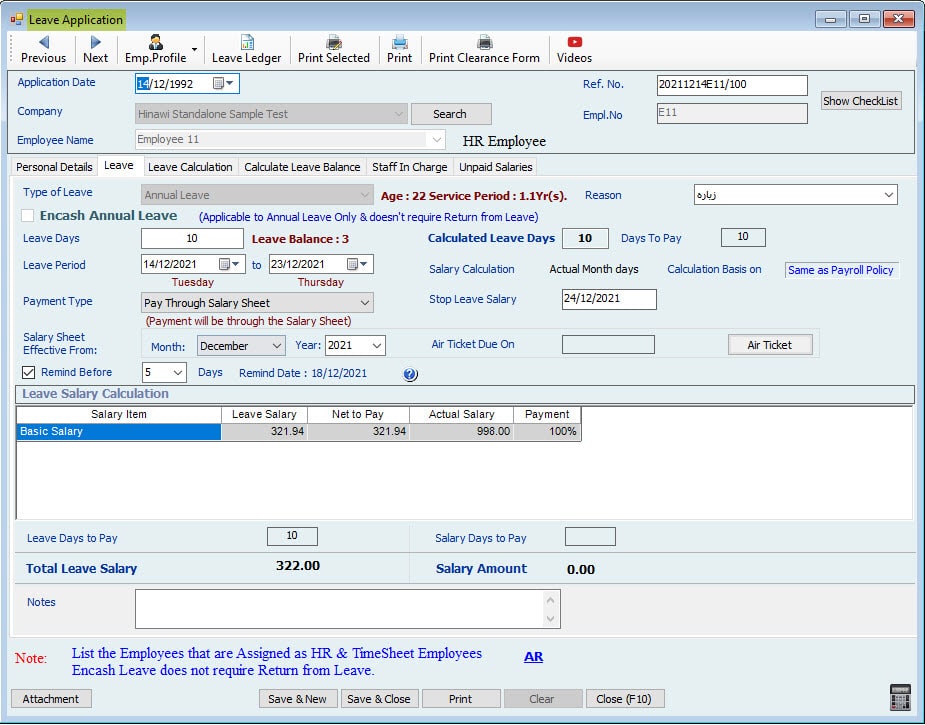

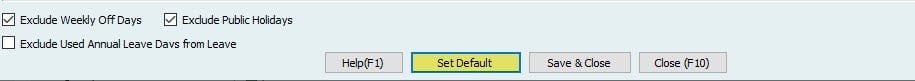

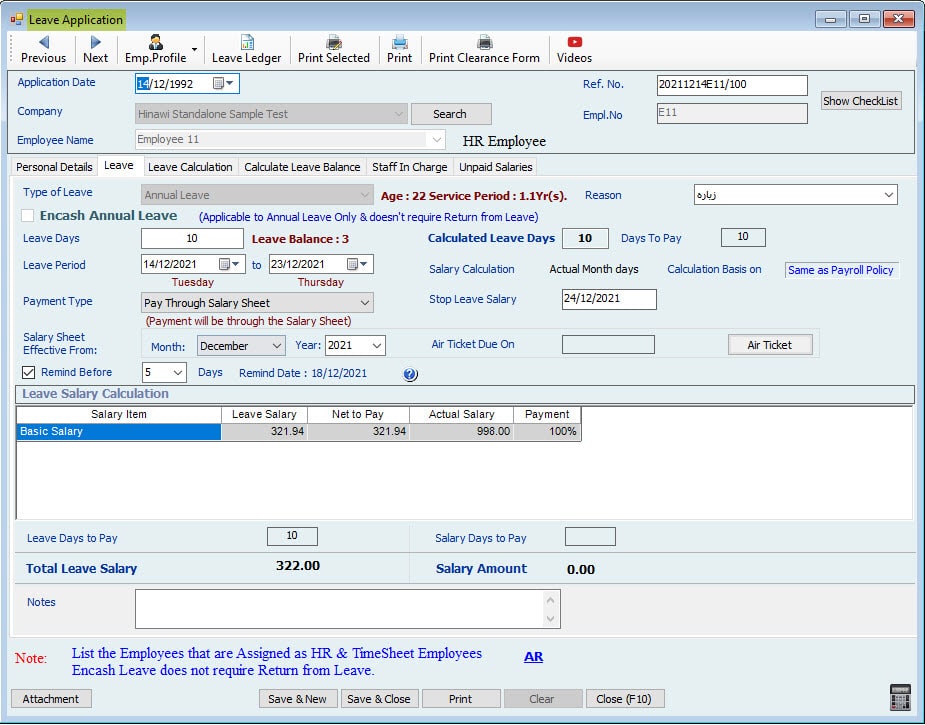

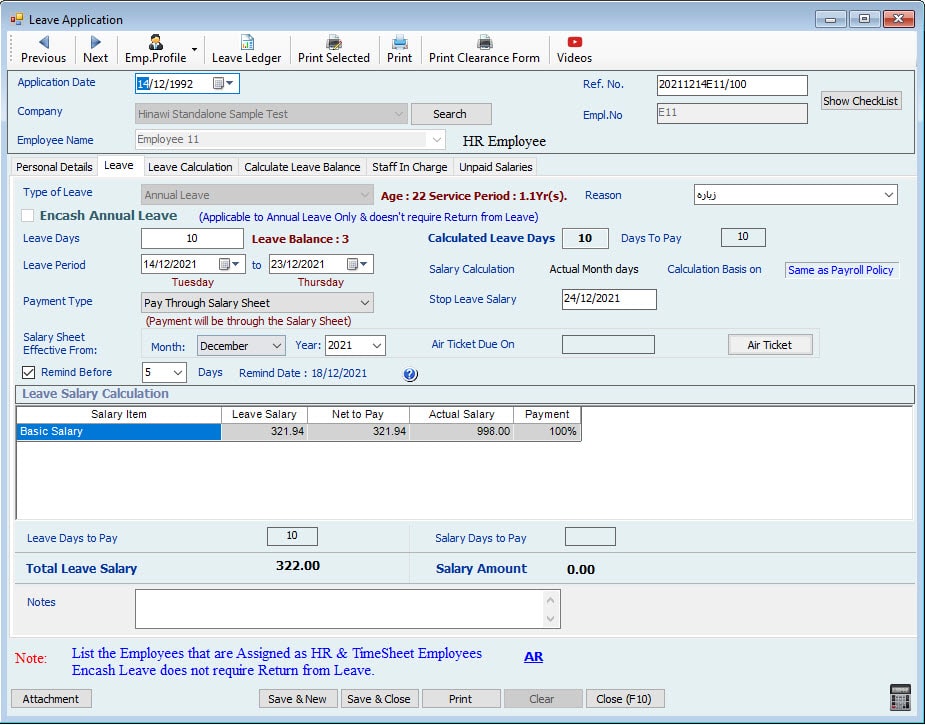

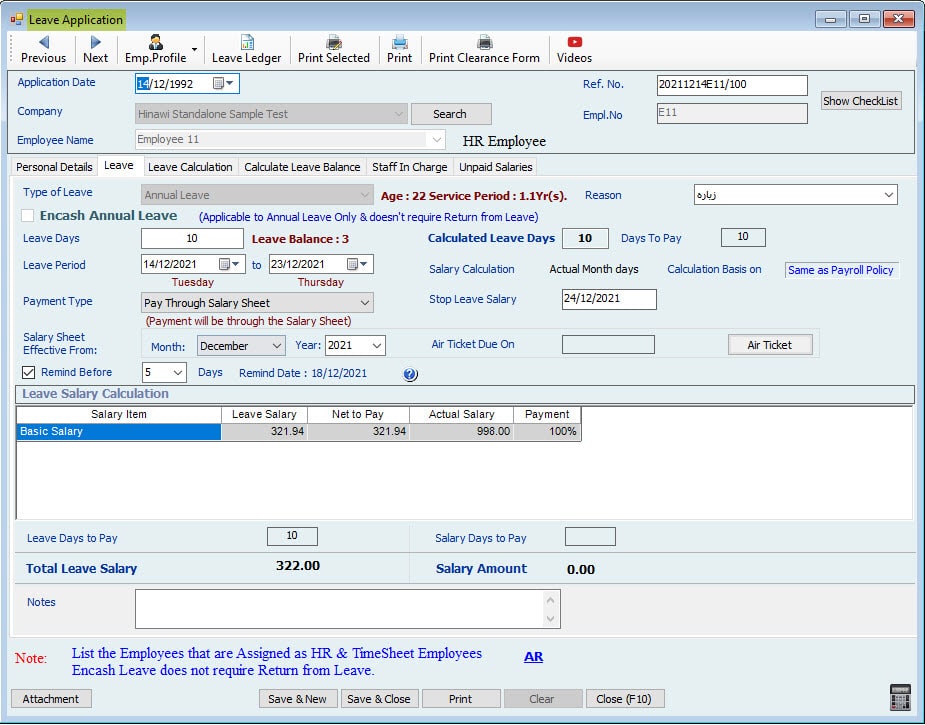

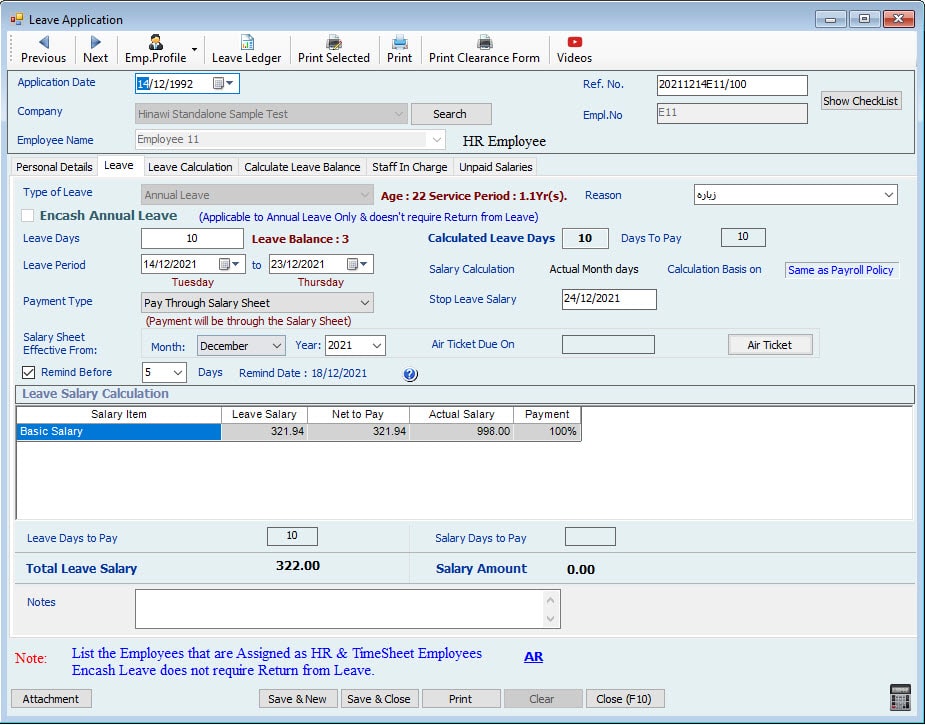

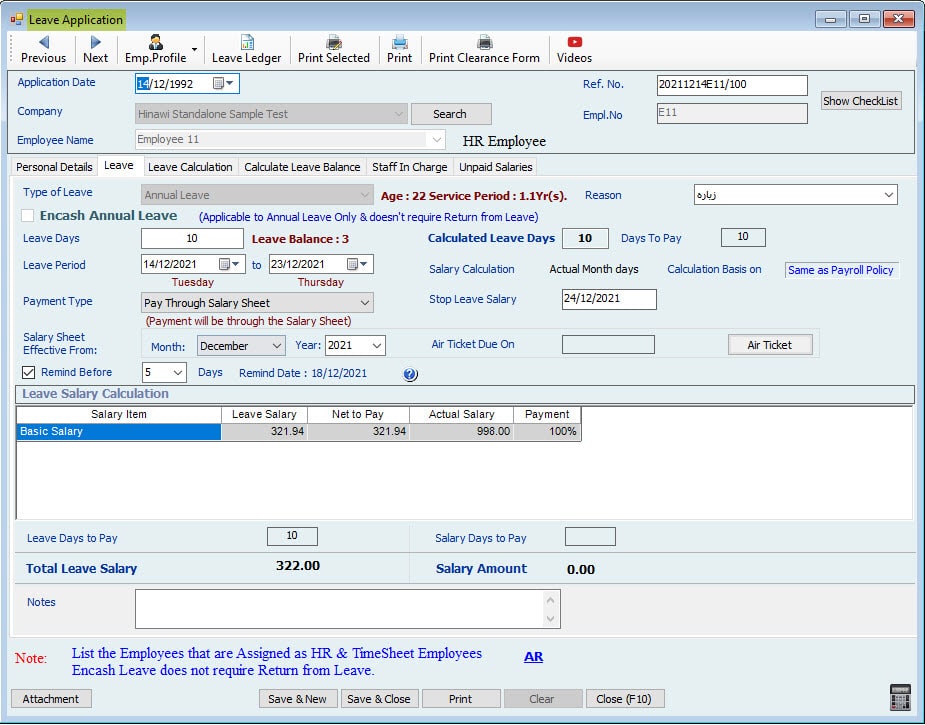

Users can create Annual Leave from: Activities Menu→ Leaves→ Create Leave and select Type of Leave as Annual Leave. Users can select the payment type to be Pay through salary sheet if he/she wants the leave salary to be paid as part of the salary sheet. Users can also select Pay Now if he/she wants to pay the leave salary separately. Leave amount is based on the setup in the Annual Leave Setup.

Users cannot create any other leave unless the created leave is processed. I.e., Accept Leave, Leave return.

Note:

- Encash Leave option will be enabled only if the user selects Annual leave.

- Users cannot have the Payment Type to be ‘Pay Now’ for Timesheet Employees.

- When the user creates a leave for Timesheet Employee and select the ‘Payment Type’ to “Update Ledger”, the leaves will not be shown while creating Timesheet.

- I.e., if the user creates sick leave from 02/03/2014 to 06/03/2014 for a timesheet employee and payment time is ‘Update Ledger’, then while creating timesheet for March, days ‘from 02/03/2014 to 06/03/2014’ will be shown as any other normal day.

- Leave Salary is paid in Leave column of the salary sheet for HR Employees.

- Leave Salary is paid in “Addition” column of the salary sheet for Timesheet

Employees.

- Whenever annual Leave is created, it will be deducted from Annual Leave Balance.

- Transfer to Next Year ‘Yes’ means All the leaves from joining date to leave start date will be calculated. It is a monthly calculation, and for each month there will be 2.5 Days added as per setup.

- Transfer to Next Year ‘No’ means that the system will calculate 30 Days starting from every year. The system will ignore all the leaves till end of the last physical year.

- If the user wants to change from Yes to No, and user needs to have the previous leave balance back, this can be done through Leaves Days Adjustment.

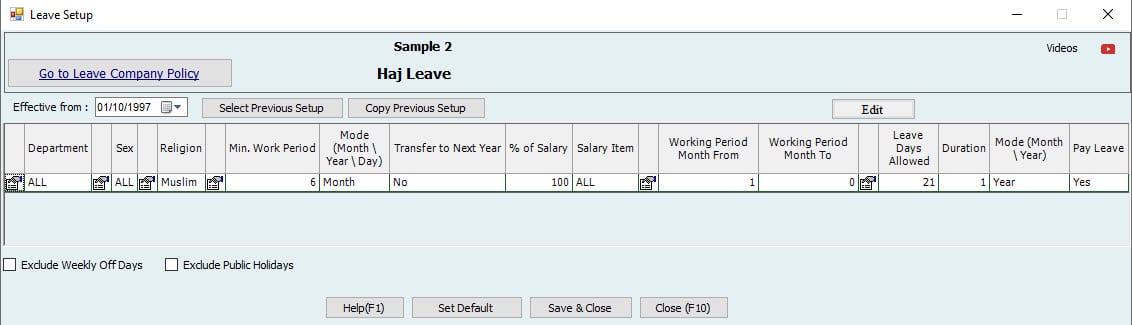

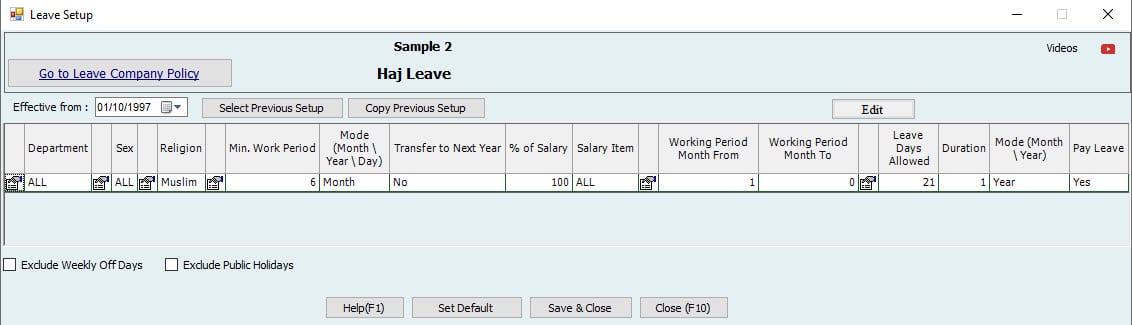

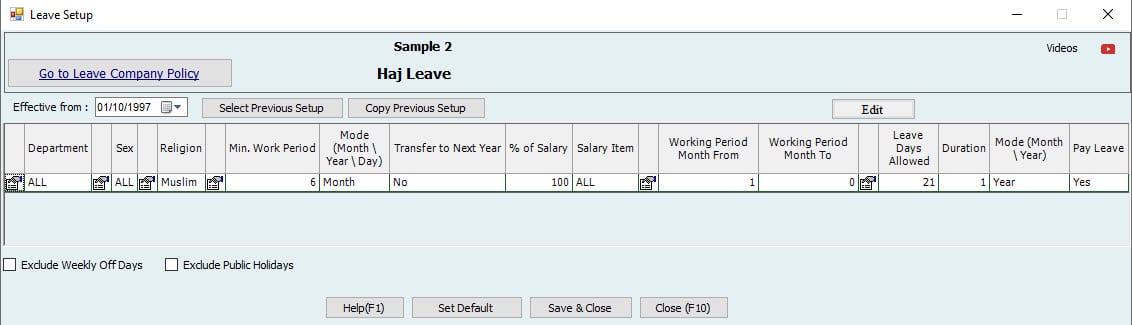

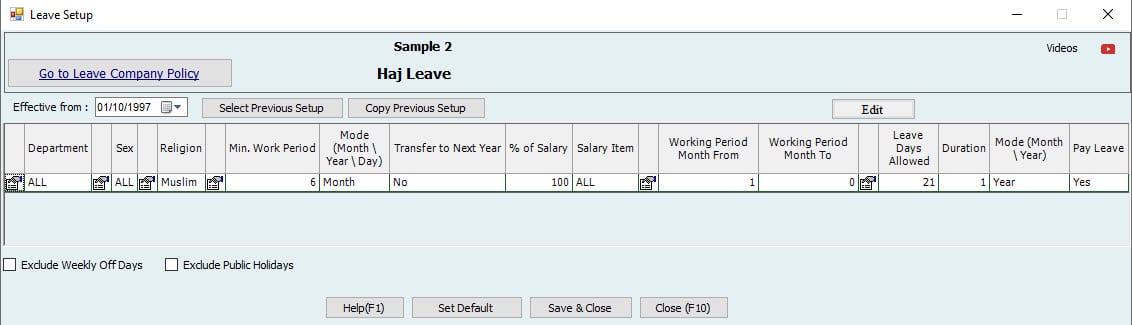

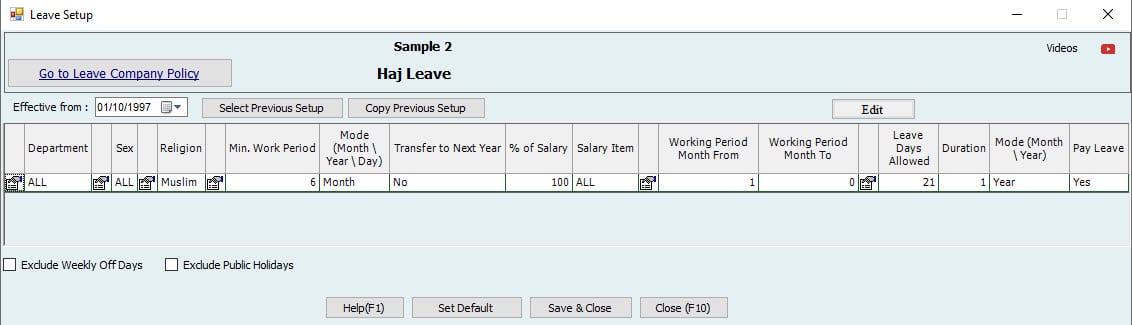

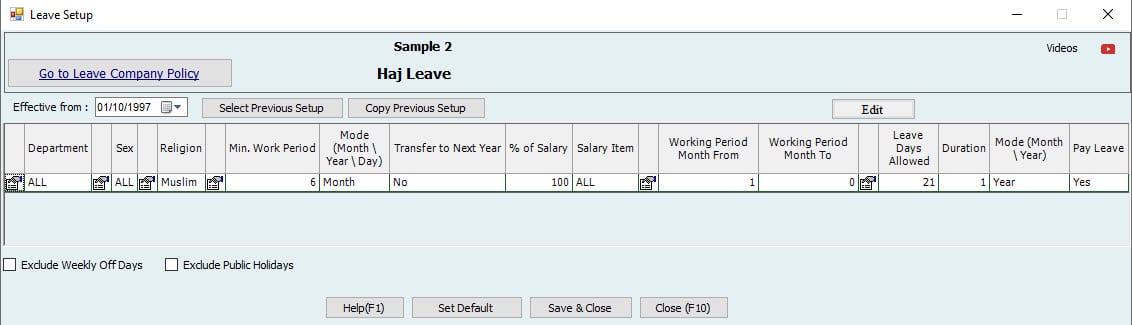

5-1-2. Haj Leave:

Note:

Users can define which columns need to be displayed for the Haj Leave setup using ‘Edit Columns’.

Department and Position:

-Here, the user can define Emergency Leave to be set for the levels: Department and Position.

-Users can select ‘All’ if he/she wants to have the same setup for all.

Religion:

-Religion should be Muslim to display Haj Leave in leave requests.

Minimum work Period:

– This is the Minimum working period required in the company before creating the leave.

– For example, if the user (Admin) puts 6 months, the system will not allow creating a Leave before 6 months.

Mode:

-Users can define the mode as Month/Year/Days.

Transfer to Next year:

-Transfer to next year means that the Leave Balance will be carried forward to next year and so on.

% of Salary:

– By Default, Transfer to Next Year is No for Haj Leave.

-What percentage of Defined Salary does the user want to pay in Leave Salary

-If percentage is 100 and the salary is 1000, then employee will get 1000 as Leave salary. If percentage is 50 and the salary is 1000, then the employee will get 500 as Leave salary.

Salary Item:

-Define the Salary Components to be included in the Leave Salary. For example, Basic Salary + Accommodation + Other Allowances or All Allowances as per company policy.

Month From / Month To:

-Define period for Leave Calculation Days of Employees.

For example, from 1 to 0 means throughout the service period.

Days Allowed:

-Users can define Maximum days allowed for calculation of Leave in a specified Service period (Specify the period by using Month From / Month To)

-Users can set Days allowed as 21; then, the maximum allowed Emergency leaves will be 21 Days.

Duration:

-How many times does the user want to give these Allowed Days? Once a year or monthly.

Mode:

-Users can define whether the allowed days are in Month/Year.

Pay Leave:

-Users can select whether he/she wants to pay the leave or not for the employees.

Exclude Weekly off Days:

– Weekly off days (e.g. Friday) will be excluded from Leave Days. Weekly off Days can be defined from:

File→ Settings→ Company Setup→ Holiday Setup

For example, yearly allowed leaves are 10. If this option is checked weekly, off days are excluded from Haj Leave calculation, and the system will not include Fridays in the Leave Period. This means that if an employee is going for 10 leave days, and there are 2 weekly off days, the leave calculation will be 8.

Exclude Public Holidays:

-Public Holidays will be excluded from Leave Days. Public Holidays can be defined from:

File→ Settings→ Company Setup→ Set Holidays

For example, if any Public Holiday comes during the Leave Period, and if this option is checked, it will not be considered in the leave calculation.

Deduct Leave Days from Service Period:

-If this option is checked, the Leave period will be deducted from the calculation of Service Period. Users can specify whether it is applicable for Locals or Non-locals.

-The Leave period will be deducted from Service Period which means that this Period will not be used for Accruing Annual Leave and deducted from End of Service

-For example, if this option is checked and an employee has been working for 5 years in the company, and during this period, he took 10 days (which is deducted from service period), his total service Period is as follows:

– (5 x 365) – 10 = 1815 Days.

Note:

Haj Leave is applicable only for Muslims. Users cannot Encash Haj Leave.

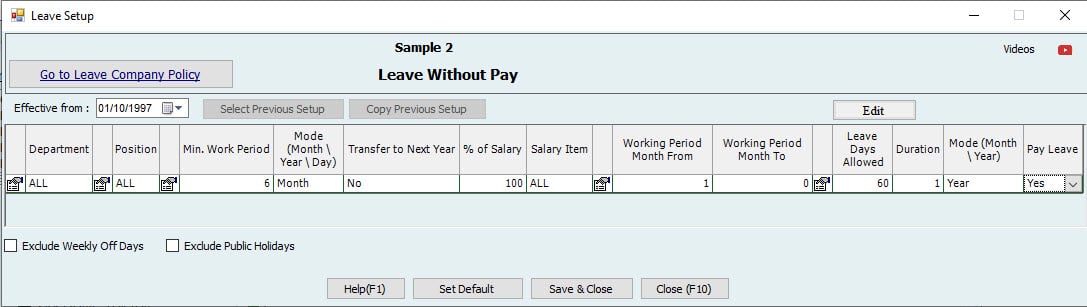

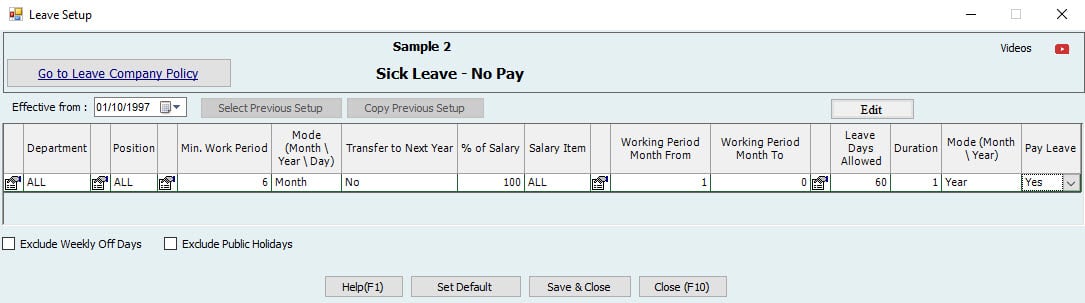

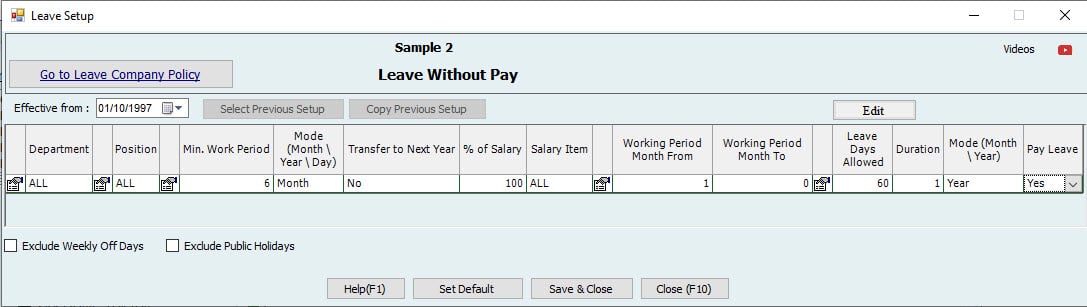

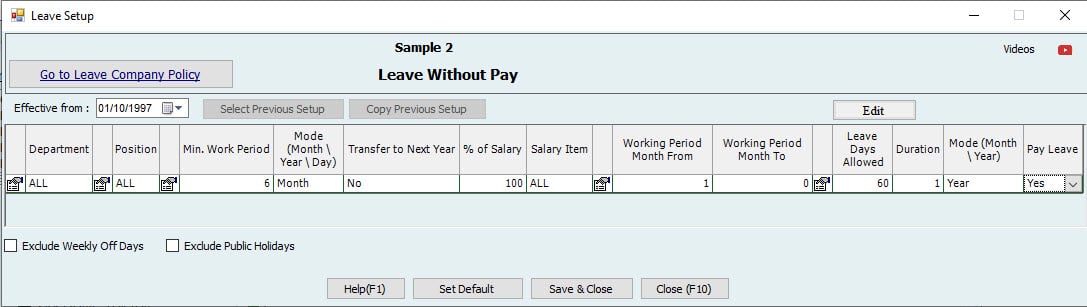

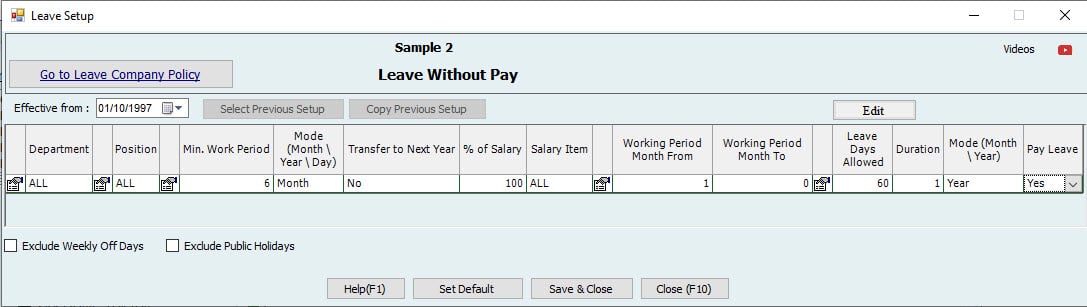

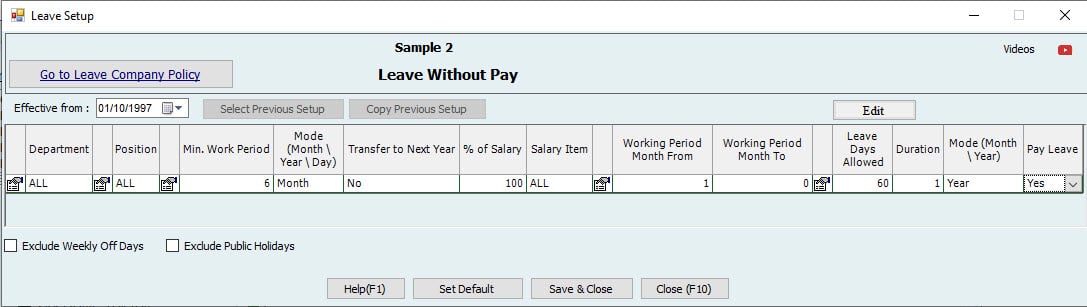

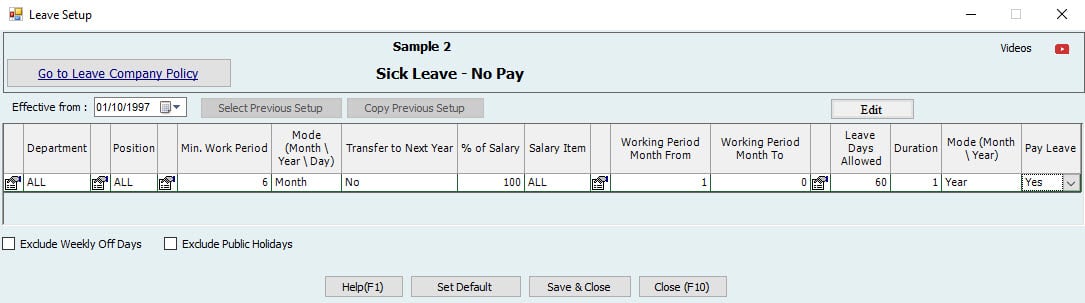

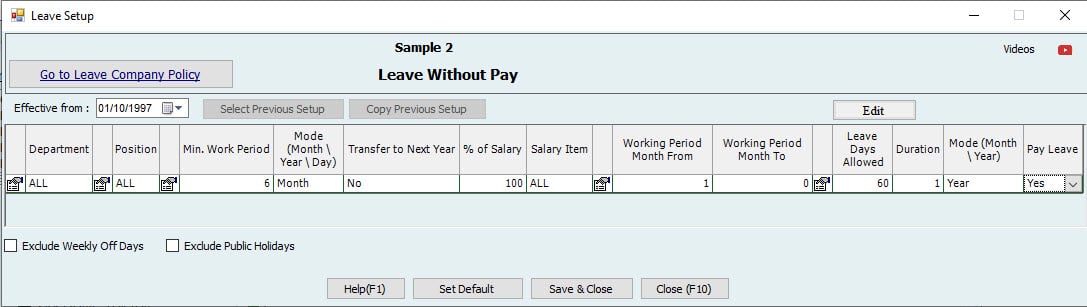

5-1-3. Leave without Pay Setup:

Note:

Users can define which columns required to be displayed for the Leave without Pay setup using ‘Edit Columns’.

Department and Position:

-Here, the user can define Leave without Pay to be set for the levels: Department and

Position.

-The user can select option ‘All’ if he/she wants to have the same setup for all.

Minimum work Period:

-This is Minimum working period employees need finish in the company before creating the leave.

-For example, if the user (Admin) puts 6 months, the system will not allow creating Leave before 6 months.

Mode:

-Users can define the mode as Month/Year/Days.

Transfer to Next year:

-Transfer to next year means that the Leave Balance will be carried forward to next year and so on.

– By Default, “Transfer to Next Year” is No for Leave without Pay.

% of Salary:

-What percentage of Defined Salary does the user want to pay in Leave? Percentage of salary will not make any difference for the setup since there is No payment for the leave.

Salary Item:

-Define the Salary Components to be included in the Leave Salary. This will not make any difference here since No payment is required for this leave.

Month From / Month To:

-Define period for Leave Calculation Days for Employees.

For example, from 1 to 0 means throughout the service period.

Days Allowed:

-Users can define Maximum days allowed for calculation of Leave in a specified Service period (Specify the period by using Month From / Month To)

-Users can set “Days allowed” as 60; which therefore means that the maximum allowed “Leave without pay” will be 60 days per year.

Duration:

-How many times the user wants to give these Allowed Days? Once a year or month.

Mode:

-Users can define whether the allowed days is Monthly/Yearly.

Pay Leave:

-The user can select whether he/she wants to pay the leave or not for the employees.

-Pay Leave is “NO” for this setup.

Exclude Weekly off Days:

– Weekly off days (e.g. Friday) will be excluded from Leave Days. Weekly off Days can be defined from:

File→ Settings→ Company Setup→ Set Holidays

For example, yearly allowed leaves are 60. If this option is checked, weekly off days are excluded from “Leave without Pay” calculation, and the system will not include Fridaysin the Leave Period. This means that if an employee is going for 10 days leave, and thereare 2 weekly off days, the leave calculation will be 8.

Exclude Public Holidays:

Public Holidays will be excluded from Leave Days. Public Holidays can be defined from

File→ Settings→ Company Setup→ Set Holidays

For example, if any Public Holiday comes during the Leave Period, and if this option is checked, it will not be considered in leave calculation.

Deduct Leave Days from Service Period:

-If this option is checked, the Leave period will be deducted from the calculation of Service Period. Users can specify whether it is applicable for Locals or Non-locals.

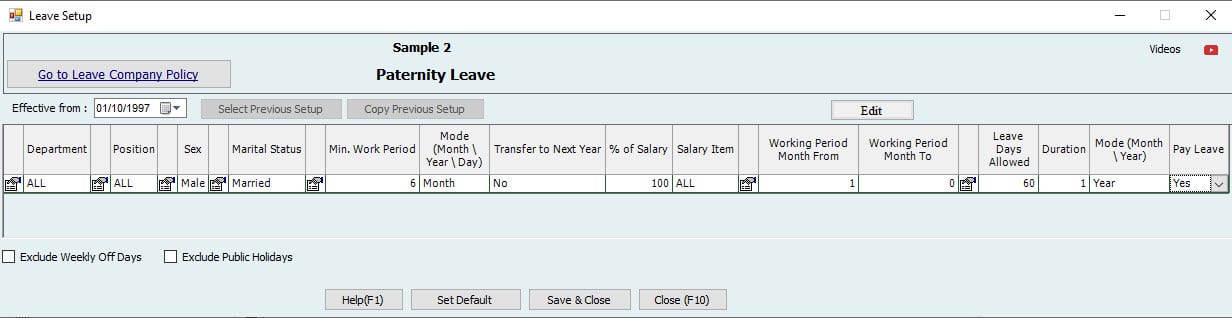

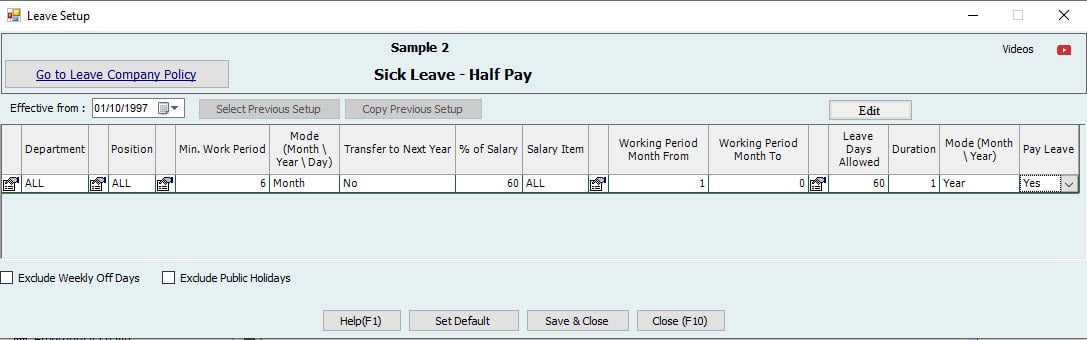

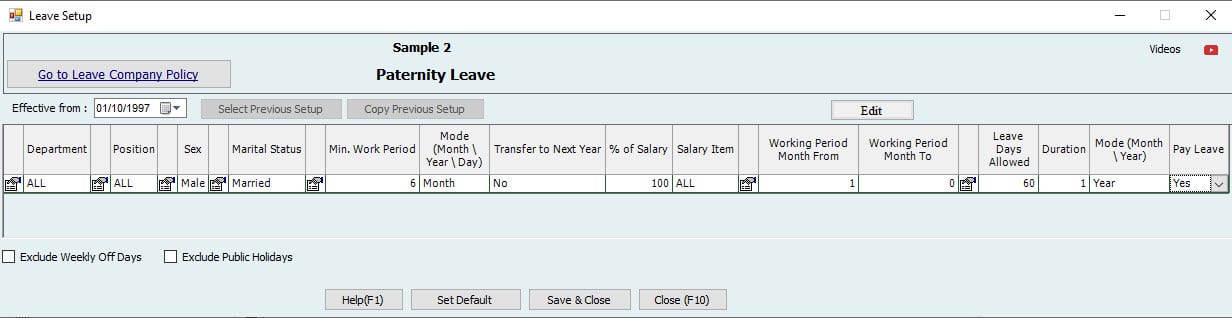

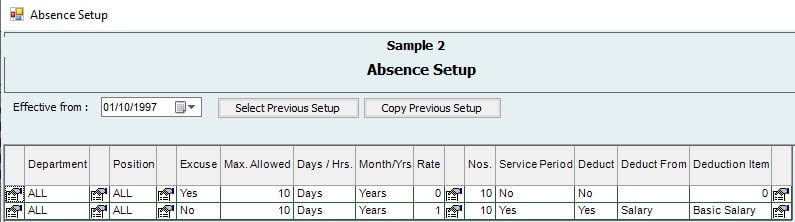

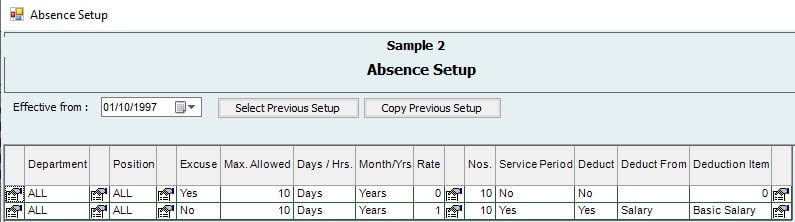

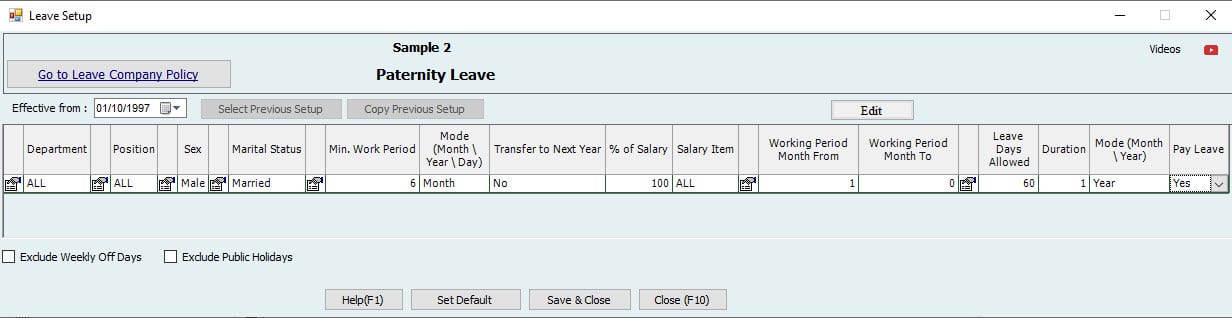

-The Leave period will be deducted from Service Period which means that this Period will not be used for Accruing Annual Leave and deducted from End of Service