Very Important Instructions for Customers

Please be aware that as our customer, it is your responsibility to protect and manage your data. Following the guidelines provided is crucial to maintaining your information’s confidentiality and security. Failure to comply may result in serious consequences for which you will be held responsible. Please take full responsibility for the outcome of your actions.

https://youtu.be/R8t3udkUI9c

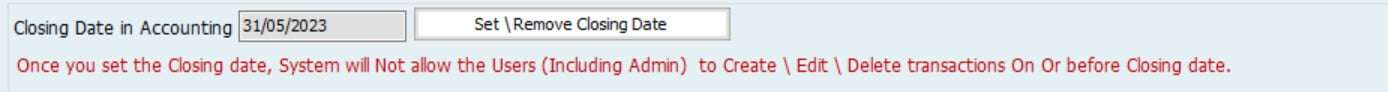

Set Closing Date

Failure to follow this step will lead to inconsistent reports. Allowing users to make changes anytime can result in reports that contradict previous ones. Follow this instruction to ensure accurate, reliable, and consistent results. And the customer will be fully responsible for the results.

Complete Missing Data

To ensure that you receive complete reports, please make sure to address the data deficiencies listed below. Otherwise, the responsibility for any incomplete results will fall entirely on you as the customer.

Backup Your Data

Not making additional data backups means not protecting it; you will lose many years of data. And the customer will be fully responsible for the results.

Click Here to read more, please

Keep Checking your reports

If the data is not continuously checked, this leads to delays in detecting user mistakes. And the customer will be fully responsible for the results.

Get the latest version

We appreciate your feedback on our Hinawi Software, which is vital to our commitment to excellence. We take your feedback seriously and address any issues you may have encountered while working to improve the program’s efficiency.

Please keep in touch with us to install the latest version as it will improve your current version. And the customer will be fully responsible for the results if they are not updated.

WhatsApp Group

To ensure safety and efficiency, the WhatsApp group supervisor is accountable for conducting regular reviews of all group members. It is their responsibility to confirm that every member is fulfilling their obligations and to remove any unauthorized or inactive members from the group.

QuickBooks License Policy

We want to inform our esteemed clients that QuickBooks’ new policy requires an annual subscription, and the option to purchase a one-time license is no longer available.

The company policy also mandates updating outdated versions, as they pose a significant risk to data security.

Every client must purchase the latest updates, and clients with obsolete versions will not receive support from the software owner.

Additionally, we would like to point out that we are unable to transfer data to a new server if the client has an outdated version of QuickBooks.

Annual Financial Closing

A Simple Process, Accurate Results, and Complete User Comfort

The annual financial closing is one of the most critical accounting procedures, and in many traditional accounting systems it is often a source of stress and complexity. In Hinawi ERP, the annual closing process is designed to be simple, direct, and free of complications, because the system is built on a key principle:

correct accounting work is done throughout the year, not at the last day of it.

First: The Core Concept of Annual Closing in Hinawi ERP

In Hinawi ERP, the user does not need to perform complex actions at the end of the financial year.

There are no manual closing entries, no stressful posting procedures, and no last-minute calculations.

The system automatically performs the following:

-

Carries forward all balance sheet account balances to the new financial year as they are.

-

Fully closes all profit and loss accounts.

-

Transfers the net result of the year (profit or loss) to Retained Earnings under Equity in the Balance Sheet.

In other words, when opening Profit and Loss reports in the new year:

-

No balances appear on revenue accounts.

-

No balances appear on cost or expense accounts.

-

The new year starts with zero balances in the income statement, while the balance sheet continues normally.

Second: How Profit and Loss Accounts Are Closed

All profit and loss items, including:

-

Revenues

-

Cost of Sales

-

Direct Expenses

-

General and Administrative Expenses

are automatically closed and their net result is transferred to Retained Earnings under Equity in the Balance Sheet.

From this retained earnings balance, the user can later:

-

Distribute profits to partners.

-

Transfer amounts to reserves.

-

Apply any other accounting treatment according to company policy.

These actions are performed through separate distribution entries in the new financial year, not as part of the closing process itself.

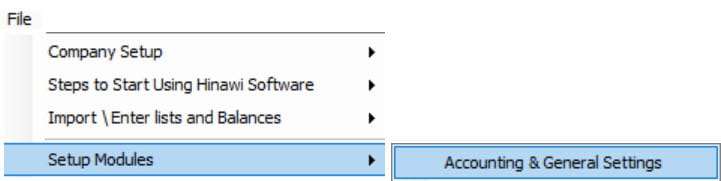

Third: Closing Date and Preventing Posting to Closed Years

One of the most important steps in Hinawi ERP is defining the Closing Date.

This date is used to prevent users from:

-

Posting new transactions.

-

Posting accounting entries.

-

Modifying data that affects a closed financial year.

This ensures:

-

Data integrity.

-

Protection against changes after closing.

-

Secure and reliable financial statements.

Fourth: Why No Year-End Closing Entries Are Required

In Hinawi ERP, accounting treatments are not postponed to year-end because:

-

Provisions are calculated monthly.

-

Prepaid expenses are allocated monthly.

-

Fixed asset depreciation is calculated monthly.

-

Deferred items and periodic adjustments are already processed during the year.

As a result, when year-end arrives:

-

There are no surprises.

-

No accumulated adjustments.

-

No stressful last-minute work.

Fifth: What the User Must Do Before Closing the Year

Although the closing process itself is simple, there are essential checks that must be completed to ensure data accuracy. These checks are a professional responsibility and cannot be ignored.

-

Verify Posting of All Transactions

The user must ensure that all transactions have been posted and have affected the general ledger.

If batch posting is used, the user must:

-

Review the batches.

-

Approve them.

-

Post them to accounting.

-

Verify Posting of All Provisions

The user must confirm that:

-

End-of-service provisions have been posted.

-

All other provisions have been posted.

This can be done easily with a single system action.

-

Review the Missing Data / Missing Procedures Report

This report is one of the most important pre-closing reports. It identifies:

-

Incomplete transactions.

-

Unapproved procedures.

-

Missing data that could impact financial results.

All issues in this report must be resolved, and no pending items should remain.

-

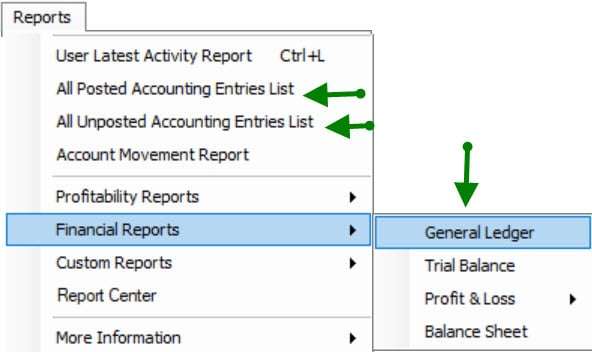

Review Key Financial Reports

Before closing, the following reports must be reviewed:

-

General Ledger

-

Profit and Loss Statement

-

Balance Sheet

Hinawi ERP provides a smart feature at the top of each report that highlights abnormal balances, such as:

-

Debit-nature accounts showing credit balances.

-

Credit-nature accounts showing debit balances.

This feature significantly helps in detecting errors quickly.

-

Match Analytical Reports with Account Balances

It is essential to ensure full reconciliation between:

-

Fixed Assets reports and their balances in the Trial Balance.

-

Inventory reports and stock account balances.

-

Deferred items, prepaid expenses, and depreciation reports with their respective ledger balances.

This reconciliation is a key auditing requirement, and Hinawi ERP greatly simplifies this process.

Sixth: Final Responsibility

Ultimately, the:

-

Finance Manager

-

or Chief Accountant

is the final person responsible for reviewing all these points, validating data accuracy, and approving the financial statements based on professional judgment.

Hinawi ERP provides the tools, alerts, reports, and automation—but the final professional responsibility remains with financial management.

Conclusion

Annual financial closing in Hinawi ERP is not a complicated procedure; it is the natural result of organized accounting work throughout the year.

The system operates continuously, closing is smooth, results are accurate, and auditing becomes easier—without stress or headaches.

User Access Setup and Audit Trail Reports

Only the Admin User can access (User Access Setup and Audit Trail Reports).

Admin User is the default User, which is built into the system. The Admin of the Company can use this User Credential to log in to the Hinawi Software Company File.

How to Set or Change the Admin Password of Hinawi Software?

To Make a New Password and Edit the Existing Password Admin,

Log in to Admin User in the Company File and Go to File Menu – Change Your Password

If you forget the Admin Password, Please request Hinawi Software Support by sending an official email; the Support team will access you & Clear the Admin Password from the Company File.

Please find the Contact details on the website.

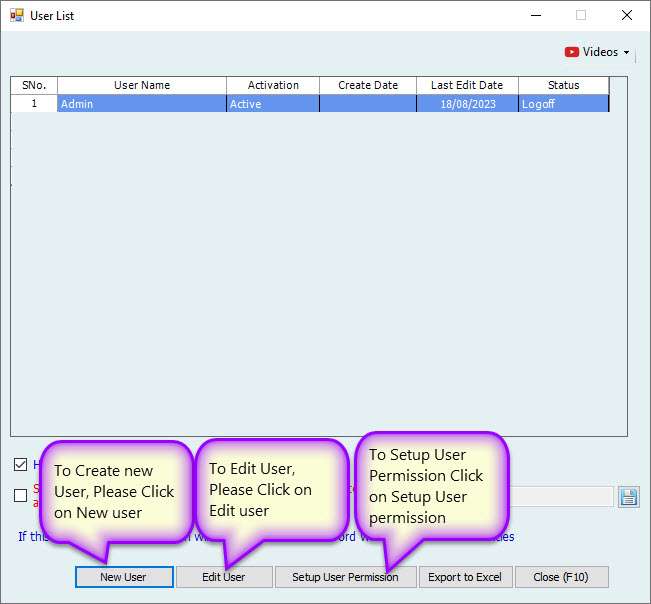

The Admin User can Create more users according to the number of user Licenses you have Purchased.

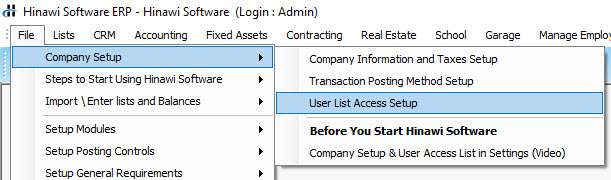

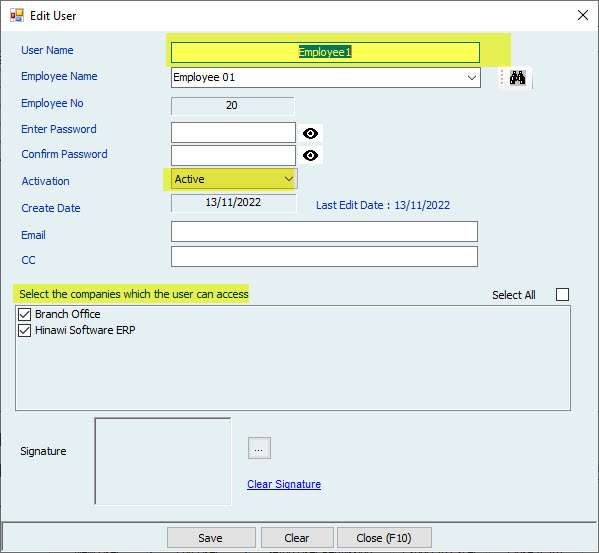

To Create or Edit users,

Log in As Admin User, then Go to File Menu – Company Setup – User Access Setup.

At the time of Creating Editing the User, Make sure to Select the Companies listed, and the activation must be Active.

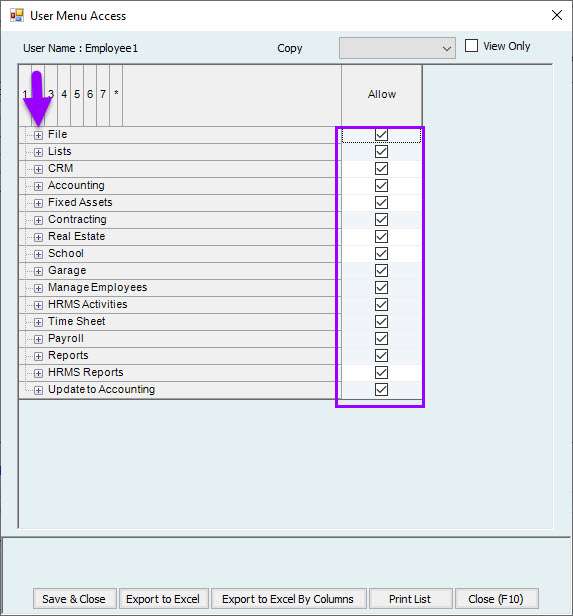

To Setup User Privileges on the Company File, Click on the Setup User Permission from the User List as shown before.

The entire form will be displayed in the User Menu Access List, To Allow or Not Allow, by Selecting or deselecting Allow Check Boxes.

If you tick the allow box, the User will have access to that form and vice versa.

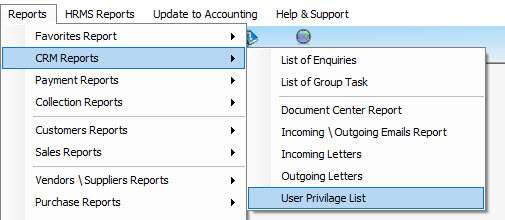

To get the report on user privileges, go to Report Menu – CRM Reports – User Privilege List.

In this report, You can filter the Users and see the Privileges assigned to the selected User. You can Export the List To Excel and Print it.

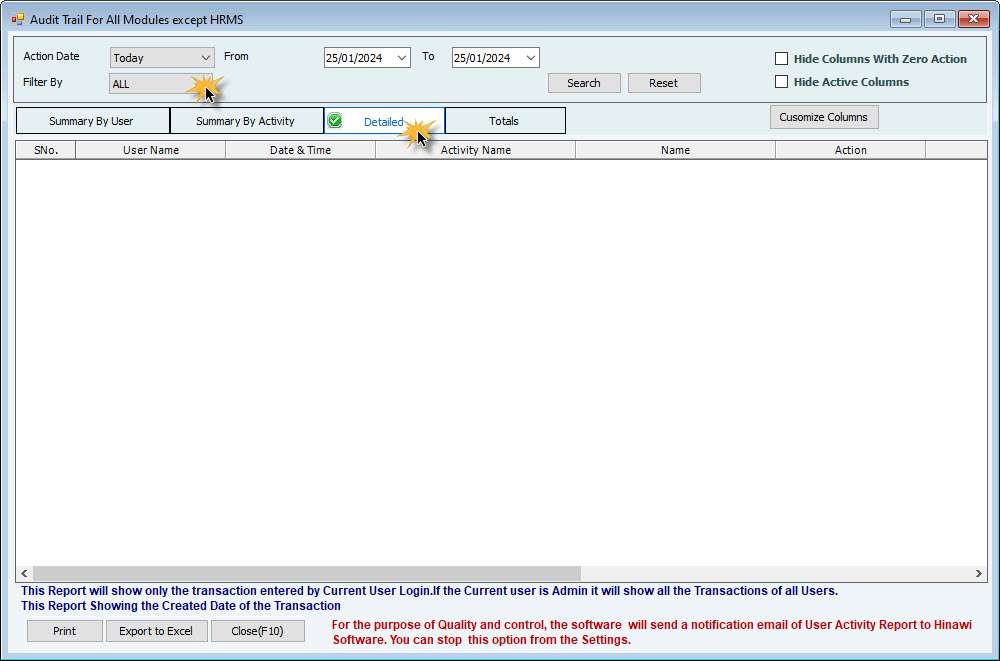

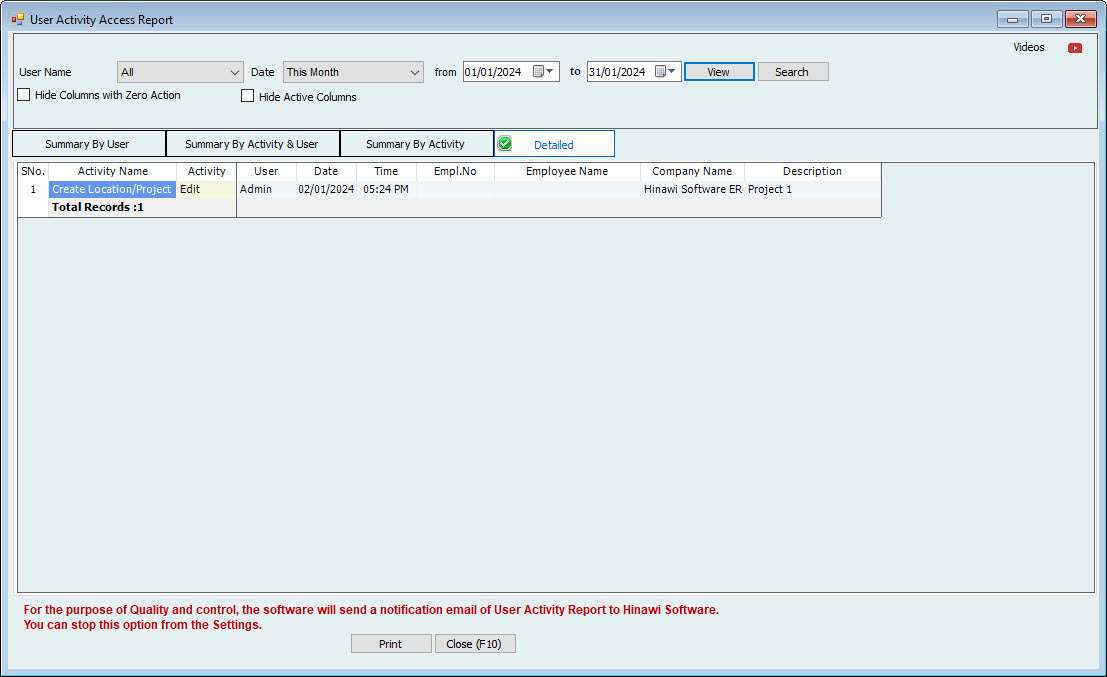

To See the Audit trail of the File by each User in Hinawi Software,

Go to File Menu – Audit trail of all modules Except HRMS and Audit Trail for HRMS Module (If HRMS registered)

In this report, the User can see the transactions created modified and deleted in Hinawi Software by User Name.

Multiple tabs to display the report.

Summary By User

Summary By Activity

Detailed