Use VAT In Hinawi with QuickBooks users.

In Hinawi, we have the option to utilize VAT, while QuickBooks lacks this feature.

After Registering the VAT in Hinawi System, you will not read the Unpaid Bills and Unpaid Invoices from QuickBooks.

All the Transactions must be entered through Hinawi System.

Also if we use the Link Bills with PV, JV, Credit Bill will not affect QuickBooks.

Users have to use Set Credit Option in QuickBooks.

If the User makes Set Credit In QuickBooks, it will not affect Hinawi. The user has to do Link Bills with PV, JV, and Credit Bill.

The system will create new Accounts for the VAT in Hinawi and QuickBooks. The system will Post the VAT Transactions to these Accounts Only

| A\C 33 VAT·VAT Liability | Other Current Liability |

| 3301 SR·Standard Rated VAT 5% | Other Current Liability |

| 33011·SR – Collected Tax | Other Current Liability |

| 33012·SR – Paid Tax | Other Current Liability |

| 3302 EX·VAT Excempt | Other Current Liability |

| 3303 ZR·VAT Zero | Other Current Liability |

| 33031·ZR – Collected Tax | Other Current Liability |

| 33032·ZR – Paid Tax | Other Current Liability |

| 3304 RC·Reverse Charged | Other Current Liability |

| 33041·RC – Collected Tax | Other Current Liability |

| 33042·RC – Paid Tax | Other Current Liability |

| 3305 IG·Intra GCC | Other Current Liability |

| 3306 OA·Amendments to Output Tax | Other Current Liability |

VAT CODE LIST

VAT ITEM LIST

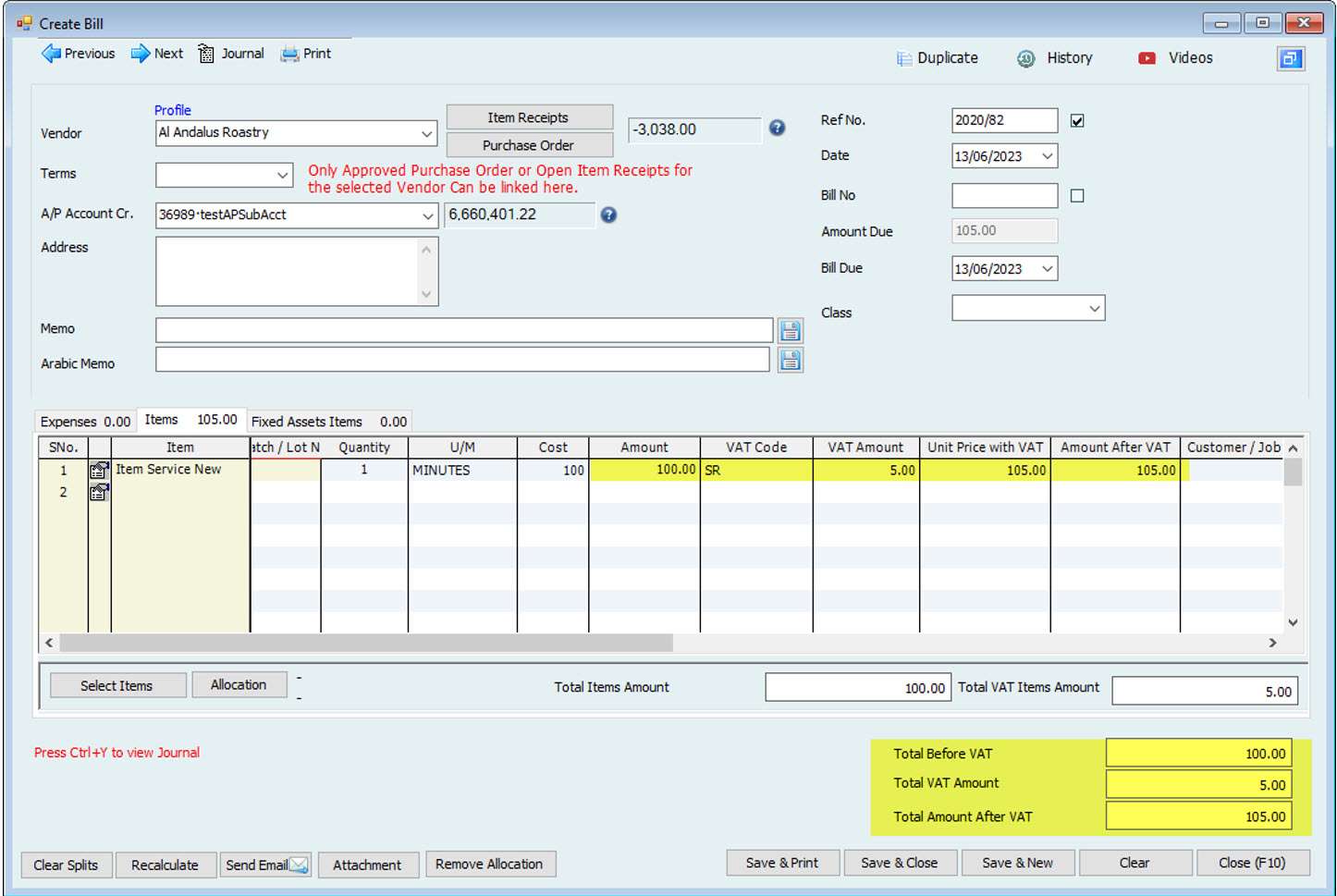

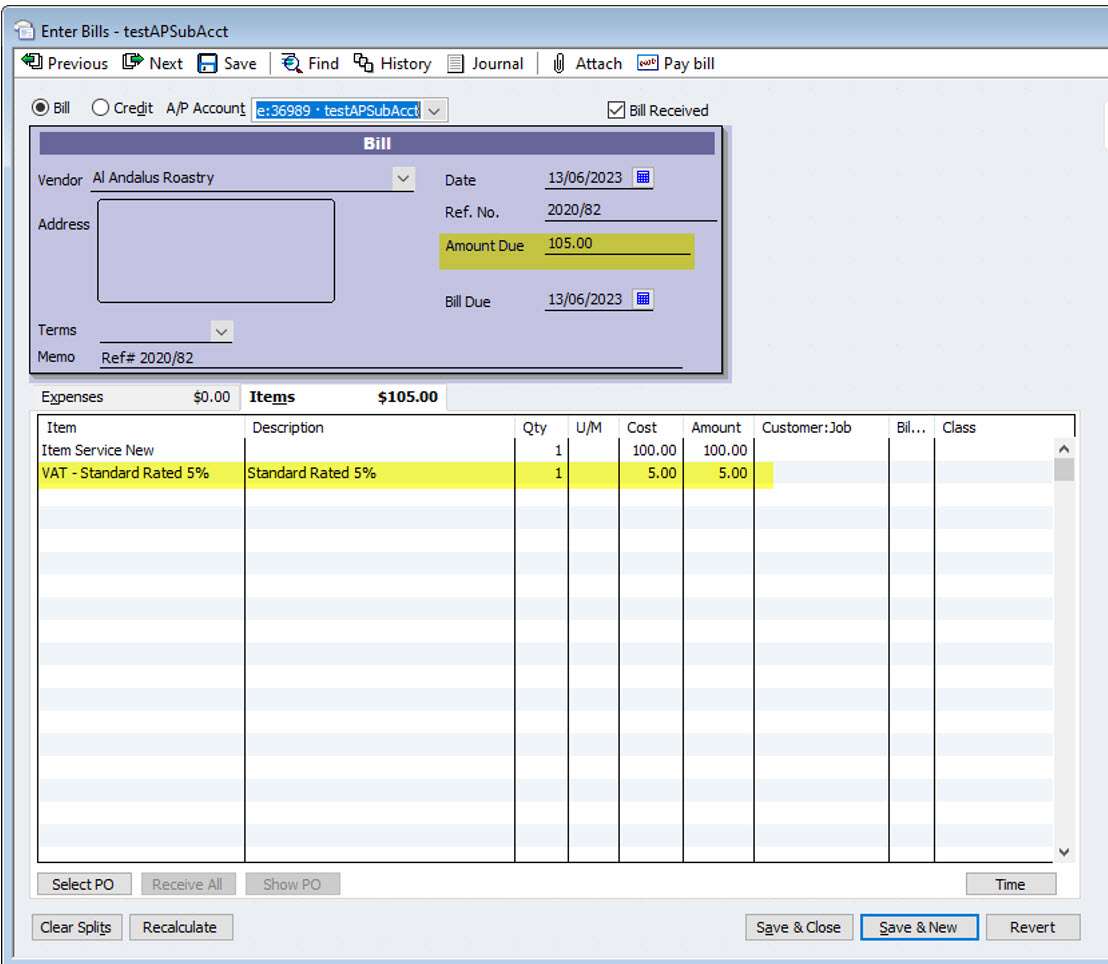

Create a Bill with VAT in Hinawi and the effect in QuickBooks

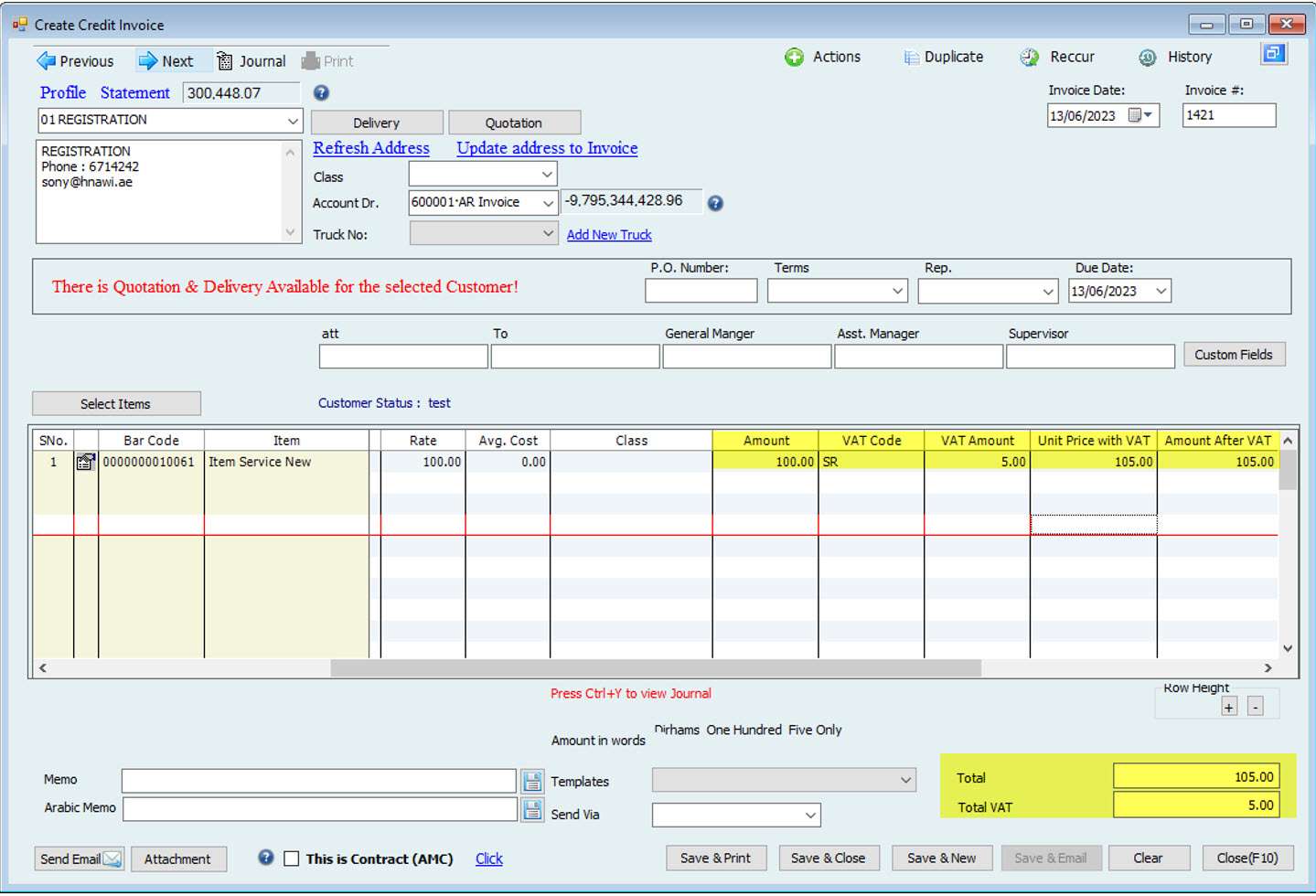

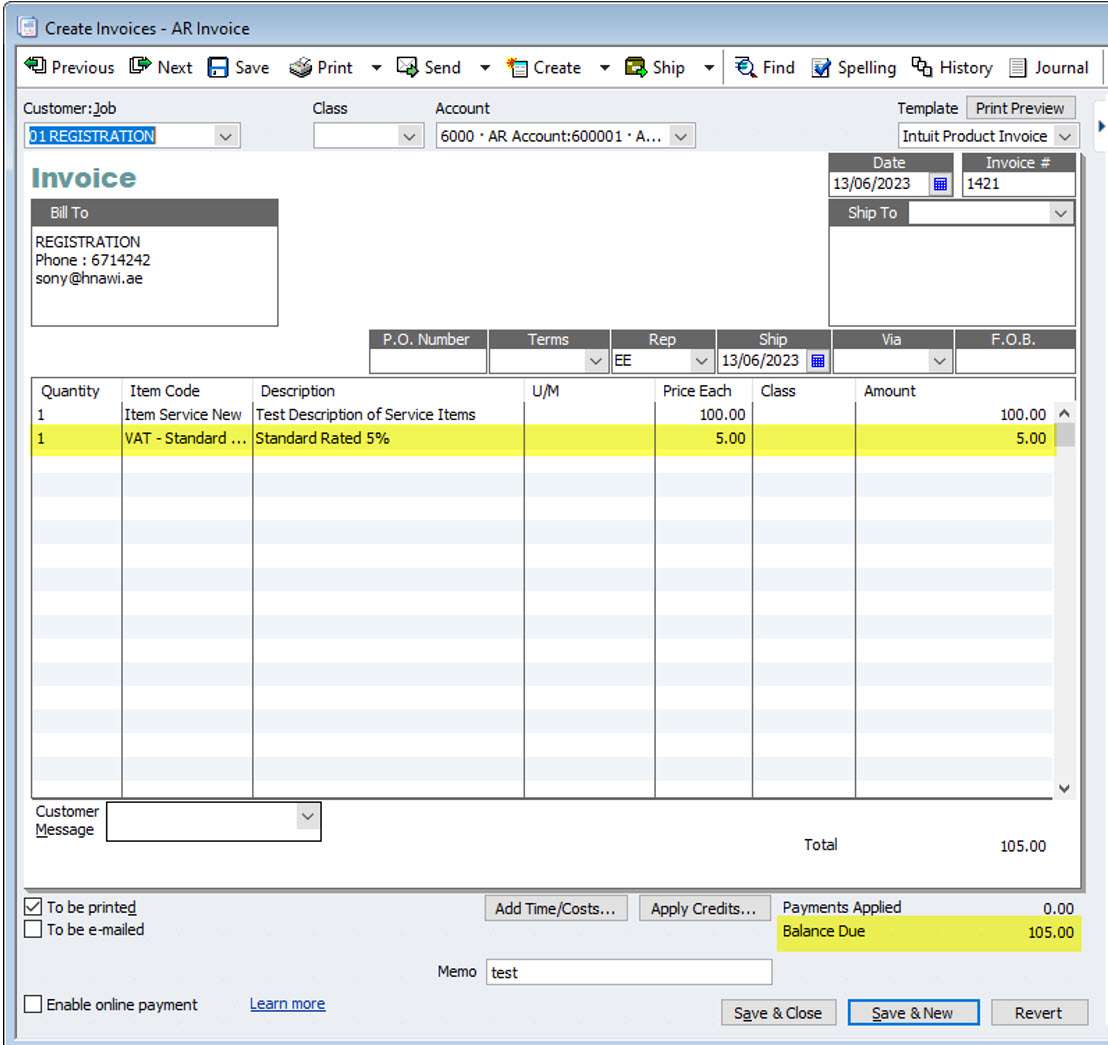

Create an Invoice with VAT in Hinawi and the effect in QuickBooks