the leave calculations Help page

https://www.youtube.com/watch?v=VZQ6CG2UciA&list=PL3LzdsN_338ApoJnaVJxzGv03k0Z7McKy&index=2

Leave Activity in HRMS

Setup

Feature setup is essential for setting the company’s regulations, arrangements, and control policy.

Before recording any operations, the user must set up the company file.

If these settings are not made, the customer may find that the results do not comply with its policies and need to re-enter its operations.

Therefore, settings are vital when using the software. It’s very important to understand this. The setup unit is the most important step and must be done before using the software.

leave calculations

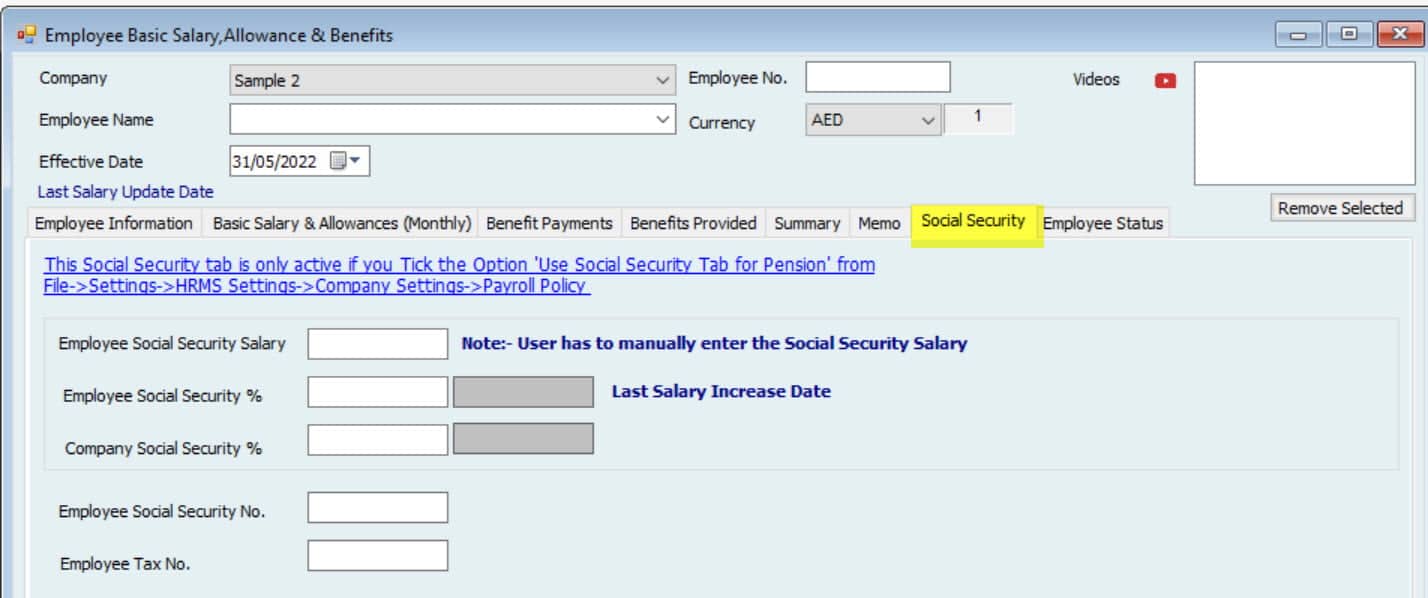

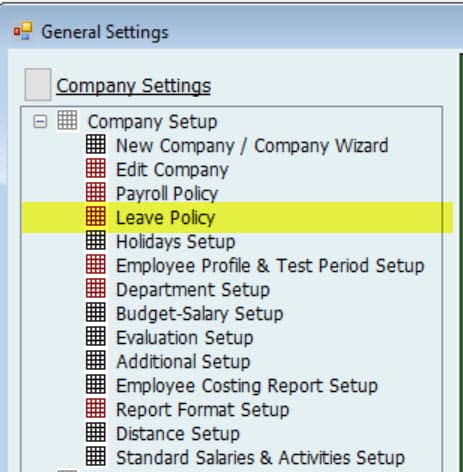

First Step Setup

Important to use leave Activity.

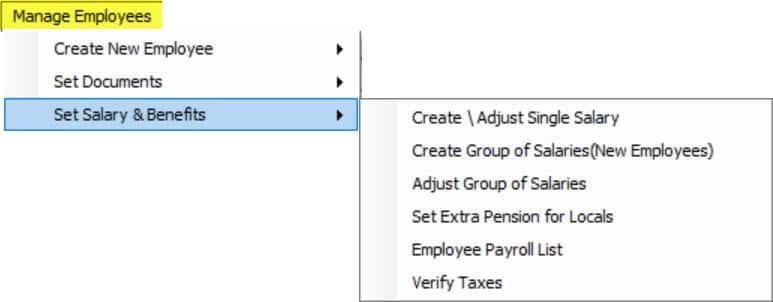

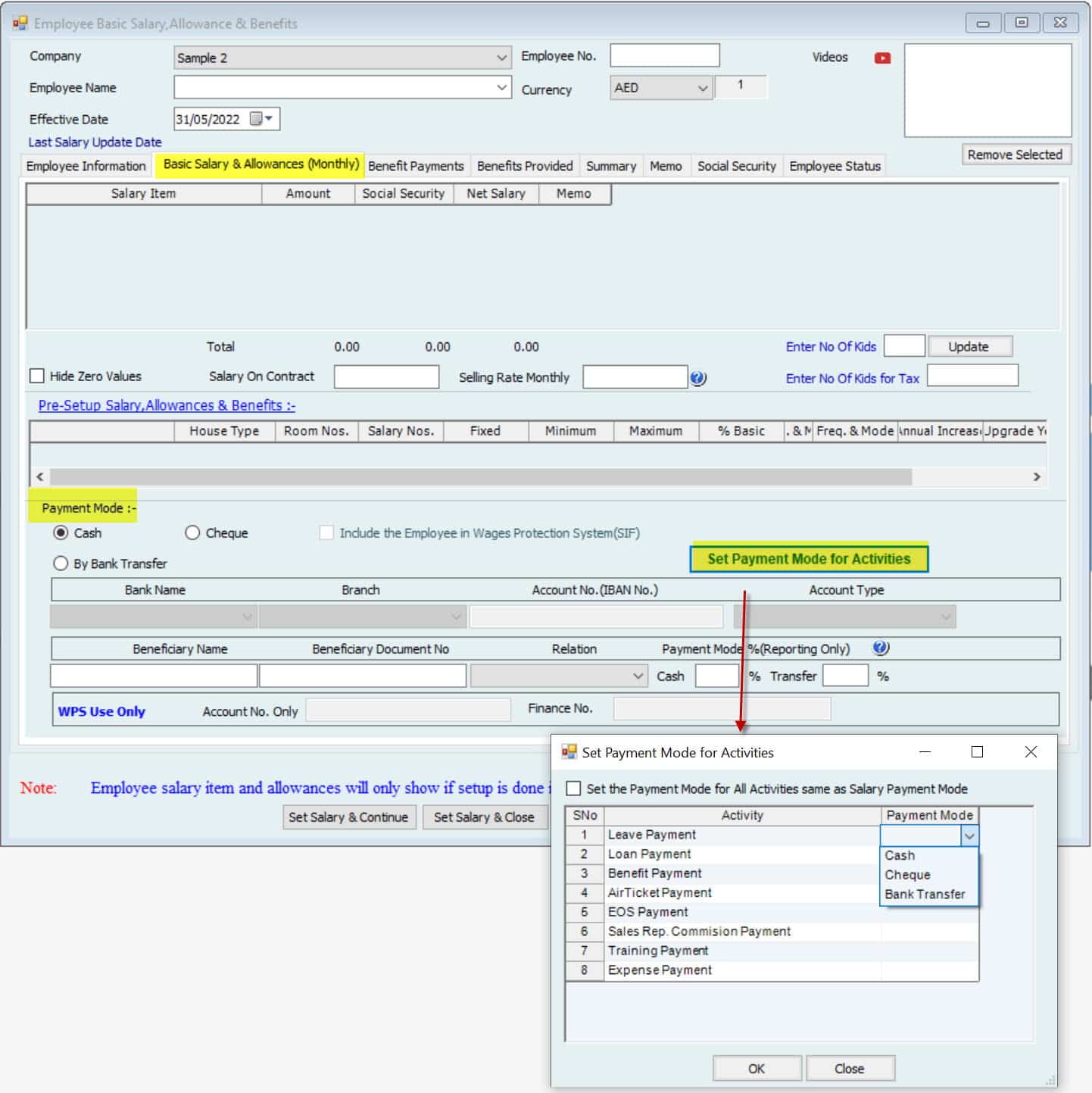

Set the Salary and Payment Mode

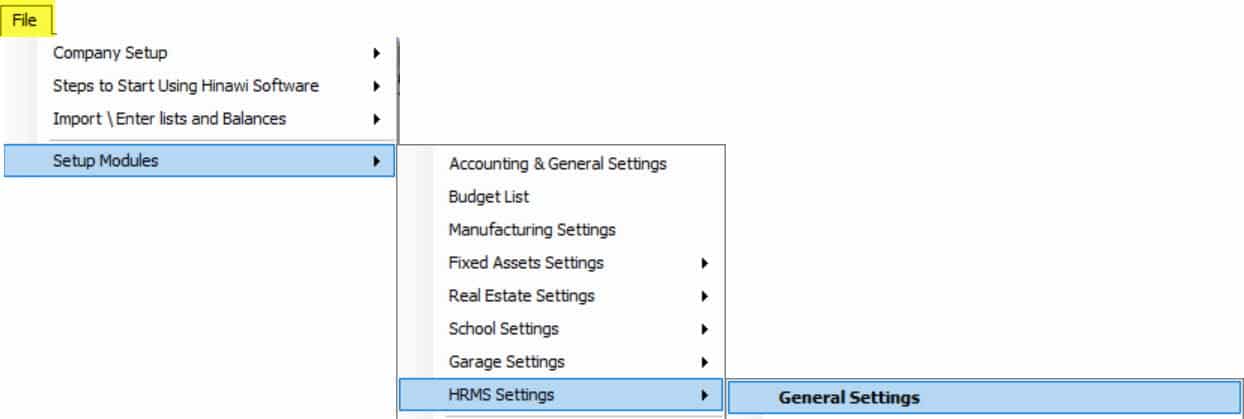

General Settings

Salary Calculation Policy |

||||

|

Employee Salary |

Fixed 30 Days |

Actual Month Days |

360 Days |

365 Days |

|

Employee Salary: |

Yes | Yes | X | X |

|

Absence Amount: |

Yes | Yes | X | X |

|

Absence Days: |

X | Yes | X | X |

|

Leave Amount: |

Yes | Yes | Yes | Yes |

|

Leave Days: |

Yes | Yes | X | X |

Important Notes about Leave and Abcense

Note:

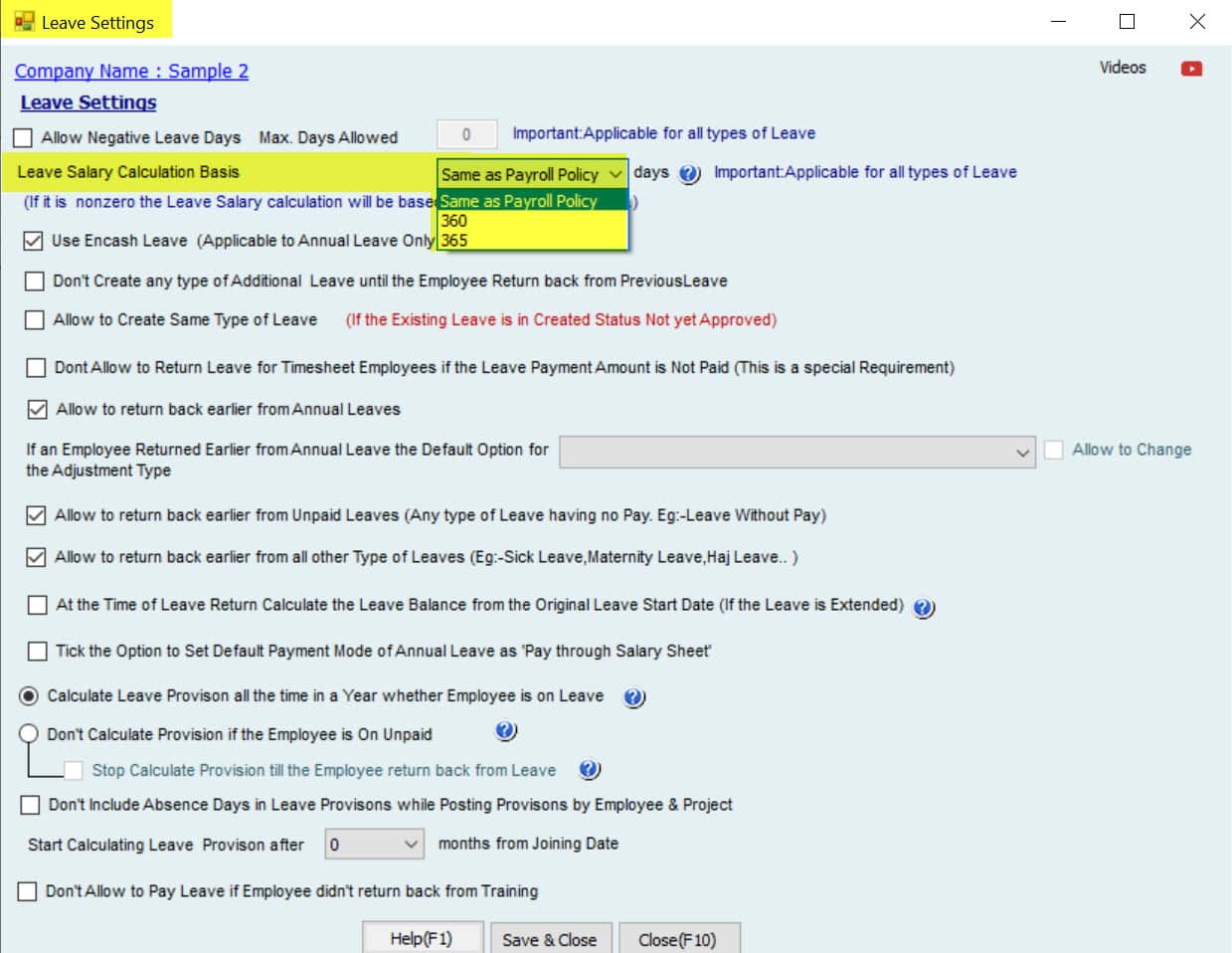

- Leave Salary Calculation Basis is enabled only If the Salary calculation is Actual Month Days. When the Salary calculation is Fixed for 30 Days, this option is disabled.

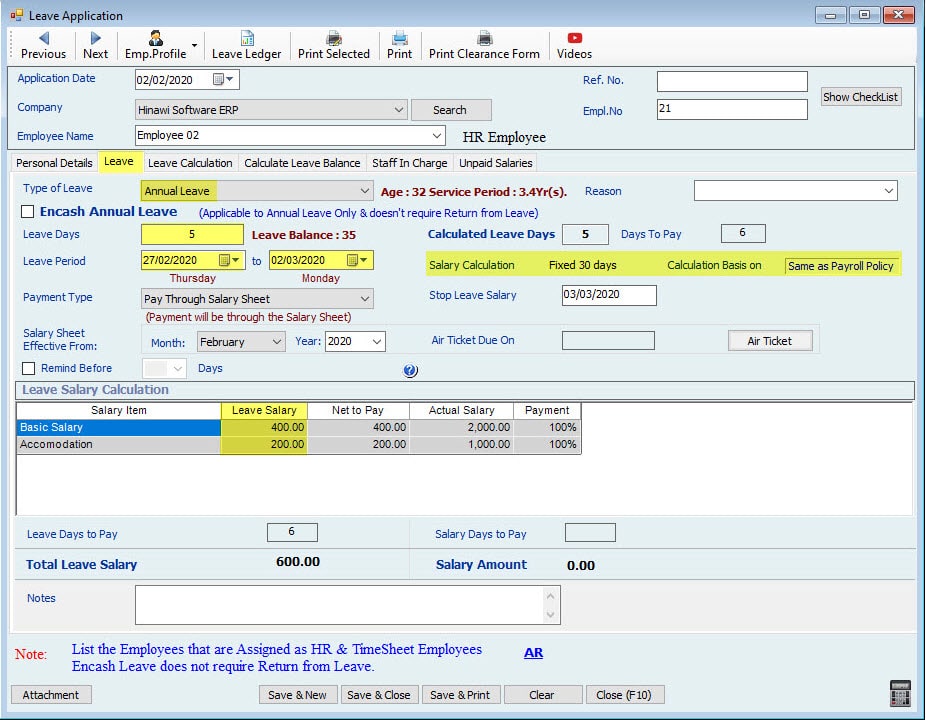

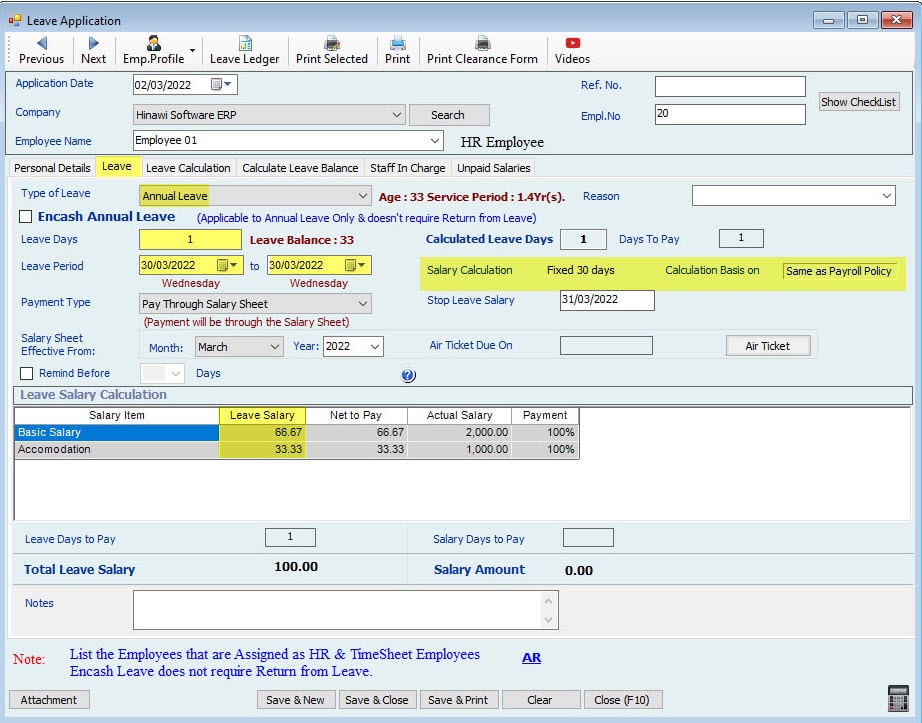

- If EOS is created for an Employee (resign or terminated), the remaining leave Salary and unpaid salaries will show in EOS for Calculate Actual Leave Days if Salary calculation is Fixed 30 Days:

e.g., If this option is checked, and an Employee takes a leave for 5 days on Feb 27, then the leave days will be 5 (27,28 & 1,2,3). If this option is not checked, the leave days calculated will be 7 (27, 28, 29, 30 & 1, 2, 3).

- The absence Salary will be deducted from the Effective Month given while reading an absence: E.g., an Employee absent from Jan 29 to Feb 2. Therefore, while creating the absence, if the effective Month is selected as Feb, the absence day Salary will be deducted from Feb Monthly Salary.

- Calculating Leave Days (for all types of leaves) is always based on the ACTUAL MONTH DAYS.

Special Cases When:

1. Setup is based on a fixed 30 days. If an Employee were absent on Jan 31, the leave would be deducted from Leave Days if the Setup is “Deduct from Leaves”. .” d absent day Salary will be deducted if the Setup is “Deduct from Salary.”

.” Setup is based on a fixed 30 days. If an Employee were absent on Feb 28, the absent Salary would be deducted from the effective Month if the Setup is “deduct from Salary.”

3. .” absence is created for an Employee, and the Setup type is deducted from:

Leaves → annual leaves will de leave days from the annual Leave Balance.

4. Setup is based on a fixed 30 days. If an Employee goes on leave on Jan 31, the leave will be deducted from Annual Leave Days. But it will not be paid for that 1 day since it is fixed for 30 days.

5. Setup is based on a fixed 30 days. If an Employee goes for leave on the 28th, leaves will be deducted from Annual Leave Days. Salary is calculated for 27 working days + 1 day to leave Salary. For the next 2 days (29 and 30), Salary must be manually added as a separate e in addition and deduction by the User. And next Month’s Salary (March) will be 30 Days and 2 days in the Addition column.

Important:

Changing between Basis of calculation:

When the User wants to change the Basis of calculation or anything else in SETUP, the activities like Leaves, absence, Salary sheet, and EOS must be approved before proceeding (if there will be no further changes on activities in the future).

Note:

- We advise the User to approve all the activities (If there is no change later) before changing the Setup.

- We also advise users to create Salary sheets before proceeding with Setup changes. Also, to start doing changes in Setup after approving the Salary sheet.

- Activities approved before changing the policy (Setup) will remain the same and will not change after filling a new policy. I.e., There will be no effect on the calculation if there are changes between the 2 methods when activities and salaries are approved.

- The new calculation will affect the new activities reading from new changes in Setup.

- If the User wants to affect the new changes in activities created already, recreate the activities after changing the Company policy.

Exceptional:

- Calculate the First Month’s Salary as Actual Days Worked:

If the Setup is fixed for 30 days and the Employee joining Date is not 30 days a month, calculate the working days based on the actual Month.

Note:

By default, this option will be checked. We strongly recommend keeping this checked. e.g., Employee joined on 27/01, so total working days will be: 5 days and will be calculated as 5/30 X Total Salary.

The Employee joined on 27/02, so the total working days will be: 2 days and will be calculated as 2/30 X Total Salary.

- Include Employees in the Salary sheet who joined on or before the Month. This allows the User to include an Employee who joined the Company before the given Date of the Month, and their Salary is generated in the Salary sheet.

e.g., If an Employee joins on the 20th of a month and we set the above to 22, he will be included in the Salary sheet for this Month.

- Show the Standard Salary Information in Salary Sheet Columns: If checked, the standard monthly Salary will only be seen on the Salary sheet.

- Allow to Edit Employee Salary Information even if the Salary sheet is approved: This option allows users to change the Employee Salary Information even if the Salary Sheet is approved. This option is added for employees whose salaries have increased after approving the Salary sheet. Therefore, the System allows these changes for history status purposes regarding Salary. This does not affect the Approved Salary Sheet. It will only affect the future Salary sheets.

Note:

Differences in the Salary for the previous period will be adjusted in the next Salary sheet.

The absence Salary will be deducted from the Effective Month while creating an absence. E.g., if an Employee was absent from Jan 29 to Feb 2, this means that while creating the absence, if the effective Month is selected as Feb, then the absence Salary will be deducted from Feb Monthly Salary.

Leave WorkFlow with Payments and Accounting Entries

|

|

Leave Work Flow and Accounting EntriesAnnual Leave Work Flow Summary |

||||

| A. Create Form | B. approvals | C. Post to Accounting | D. Payments | Memo | |

| Create Annual Leave | 1. Pay Through Salary Sheet |

Approve Leave is a must to continue. | The leave Amount will be posted to accounting, and the Salary Amount will be at the time of posting the Salary Sheet. | Pay By WPS or Cash or Cheque or Bank Transfer By Each Employee (There is an option to create one Cash or Cheque Amount for Multiple Employees. |

* Make ( Post Approved Leave to Accounting ) a must before making Payment. * Admin can set Predefine up to link the Salary Items, Allowances, or leave with Chart of Accounts. Then when the Payment is created, the Debit Side will display automatically from the previous step posting in column F. * Salary will stop until the Employee returns. |

| 2. Pay Through Payment Voucher |

Approve Leave is a must to continue. | The left Amount will be posted to accounting, and the Salary days Amount before the leave start Date. Posting will be through a Payment Voucher. | Pay By Cash Cheque or Bank Transfer Payment Voucher only. | ||

| 3. Update Ledger | Approve Leave is a must to continue. | Leave Days only will affect in Leave Ledger. No Posting amounts to accounting. The Salary Amount for the month will pay full. | There is no payment for Leave. The total amount of Salary will be paid on the Salary Sheet. | ||

| Ancash Annual Leave | 1. Pay Through Salary Sheet |

Approve Leave is a must to continue. | The leave Amount will be posted to accounting, and the Salary Amount will be at the time of posting the Salary Sheet. | Pay By WPS or Cash or Cheque or Bank Transfer By Each Employee (There is an option to create one Cash or Cheque Amount for Multiple Employees. |

* Post Approved Leave to Accounting is a must before making Payment. * Admin can set Predefine up to link the Salary Items, Allowances, or leave with Chart of Accounts. When the Payment is created, the Debit Side will display automatically from the previous step posting in column F. * Salary will NOT stop * No need to create Leave Return. |

| 2. Pay Through Payment Voucher |

The leave Amount will be posted to accounting, and the Salary days Amount before leaving the Start Date. | Pay By Cash or Cheque Bank Transfer Payment Voucher only. | |||

| A . Create Form | B & C: Accounting Entries on Approvals | Menu Location | D. Entries on Payment of Leave and Salary | Menu Location | |

| Create Annual Leave | A. If Payment by WPS: | ||||

| 1. When Pay Leave through Salary Sheet. |

Dr. Salaries and Allowances Cr. Accrued Salaries & Leave |

Go to: Update to Accounting Menu >>> HRMS Update >>> Post Salary Sheet. |

Dr. Accrued Salaries & Leave (Automatically Selected) Amount 5.000 (For 50 Days) Cr. Bank Amount 5.000 Note: (No Partial or Split Payment of Salary or Leave Amount.) |

Go to: Update to Accounting Menu >>> HRMS Update >>> Post Payment | |

| Posting to Accounting by JV | Posting is posted to Accounting by JV Because Payment of Salary is by WPS, not Payment Voucher. | ||||

|

Posting the Salary and Leave can be in different options:- * By Total Monthly Summary |

Posting the Payment can be in different options:- * By Total Salary Amount that saw in |

Total Salary Amount that is seen in WPS by Each Employee. | |||

| B. If Payment by Payment Voucher. Payment of Salary & Leave Can be paid by: Cash, Cheque, or Bank Transfer | Go to Payroll & Taxes Menu >>>> Payment of Salary Sheet >>>> Pay Non-WPS Employees. | ||||

|

Dr. Accrued Salaries & Leave (Automatically Selected) Amount 5.000 Cr. Cash / Bank Amount 5.000 (No Partial or Split Payment of Salary or Leave Amount.) Posting to Accounting by Payment Voucher. |

|||||

| 2. When Pay Leave through a Payment Voucher | Post Approved Leave | Payment is by Payment Voucher only (Cash, Cheque, or Bank Transfer)—no Payment by WPS. | |||

|

Dr. Salaries and Allowances Amount 2.000 (For 20 Days) Dr. Leave Salary Amount 3.000 (For 30 Days) Cr. Accrued Salaries & Leave Amount 5.000 (For 50 Days) |

Go to Update to Accounting Menu >>> HRMS Update >>> Post Leave Amount (only) |

Dr. Accrued Salaries & Leave (Automatically Selected) Amount 5.000 Cr. Cash / Bank Amount 5.000 (No Partial or Split Payment of Salary or Leave Amount). |

Go To: HRMS Activities >>>> Payment of Activities >>>> Pay Leave Salary. | ||

| * Posting to Accounting by JV. * The 20 working days will be calculated with the leave Amount. * No Salary Sheet will be created for the current month. |

* Posting to Accounting by Payment Voucher. * Options to post the Salary Payment will be By Each Employee only. |

||||

| 3. When using Update Ledger | No Accounting Entries. The Salary Sheet will be created as usual, and Leave days will be adjusted from the total leave balance. See Leave ledger Report. |

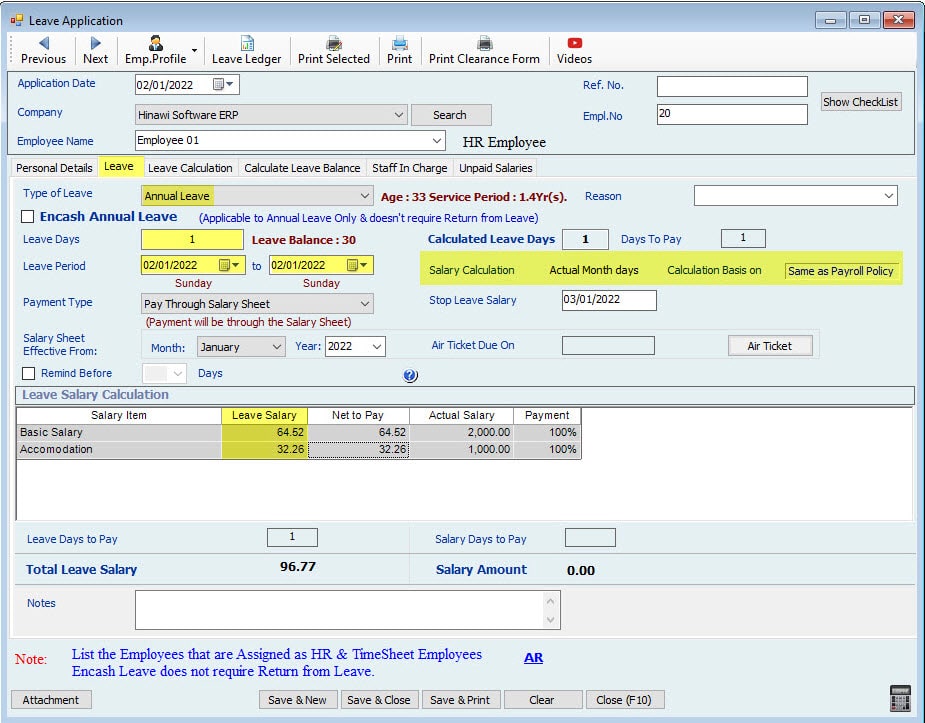

Leave Calculation Setup is: (Month is Actual Month Days)

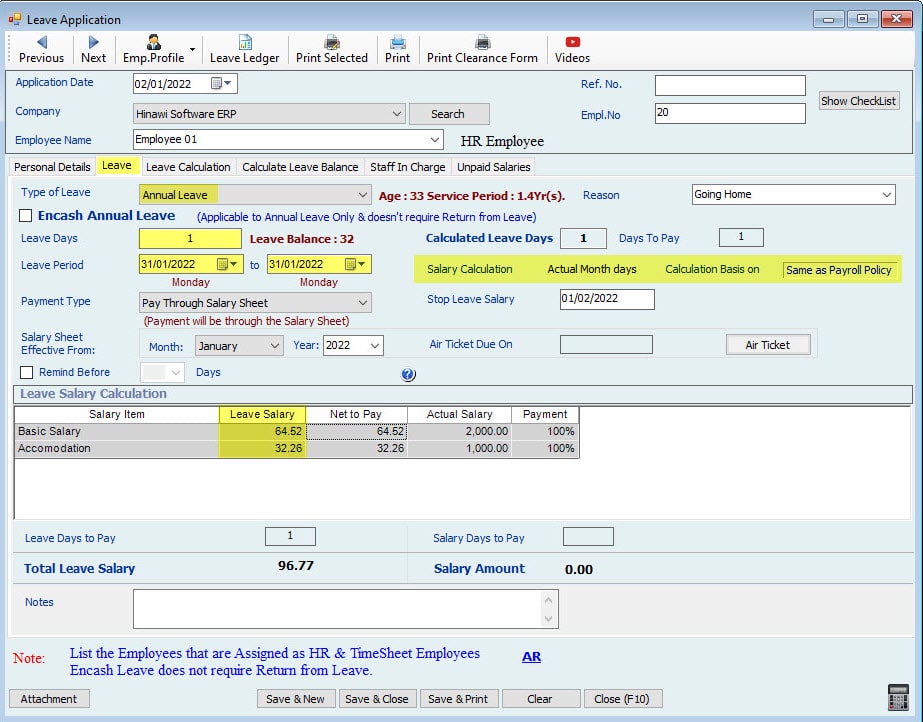

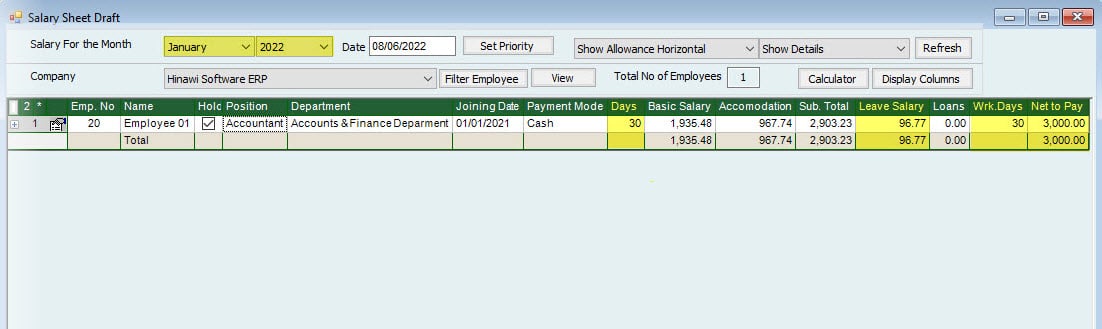

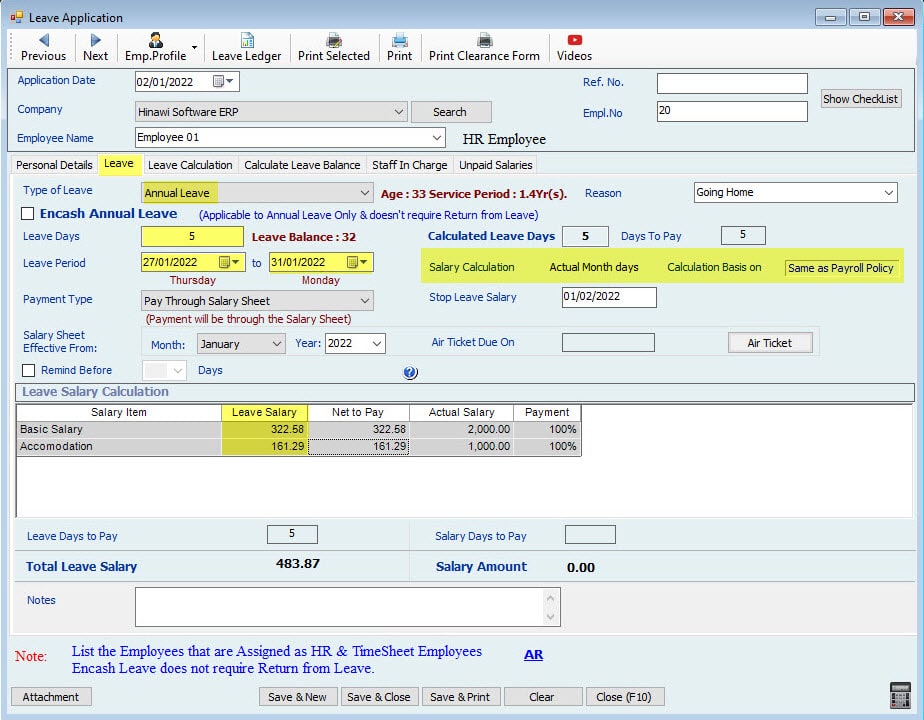

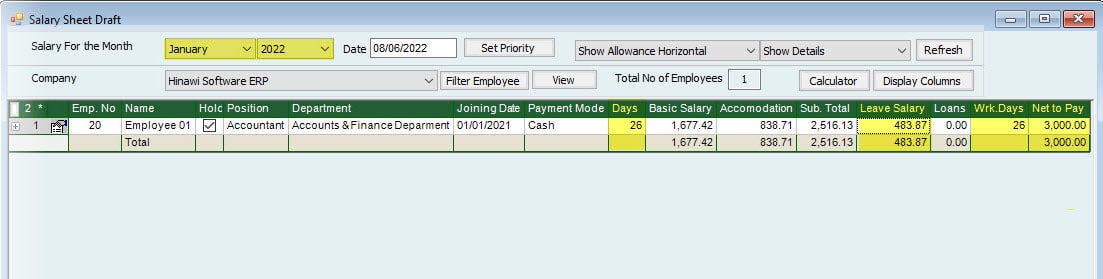

Leave Calculation Setup is: (Month is Actual Month Days) For January 31 Days.

Leave Calculation Setup is: (Month is Actual Month Days) for January 31.

| January | ||||||

| Salary | 3000 | 1 Day’s Leave During the month | 1 Day Leave on 30th of the month | 1 Day’s Leave at the end of the month (On 31) | 5 Days’ Leave from the 27th of the month | Note |

| Actual Month Days | 31 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | Days are: January 27+28+29+30+31 | |||||

| Calculate Leave days | 1 | 1 | 1 | 5 | ||

| Calculate Working Days | 30 | 30 | 30 | 26 | ||

| Description | One Day Leave only one | One Day Leave only one | One Day Leave only days | Days are: January 27+28+29+30+31 | ||

| Leave Amount | Total Salary / 31 X Leave days | 96.77 | 96.77 | 96.77 | 483.87 | |

| Working Days Salary | Total Salary / 31 X Working days | 2903.23 | 2903.23 | 2903.23 | 2516.13 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3000.00 | |

Note:

If the Leave is 10 days, the System will calculate the 5 Days in January as (3000 / 31 * 5) and 5 days in February as (3000 / (28 or 29) * 5)

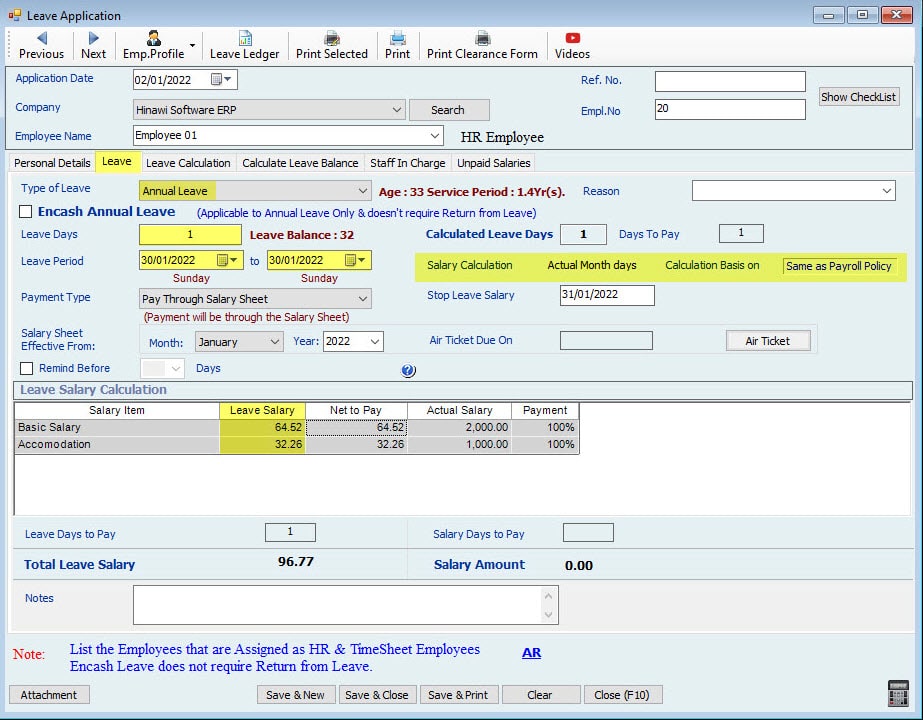

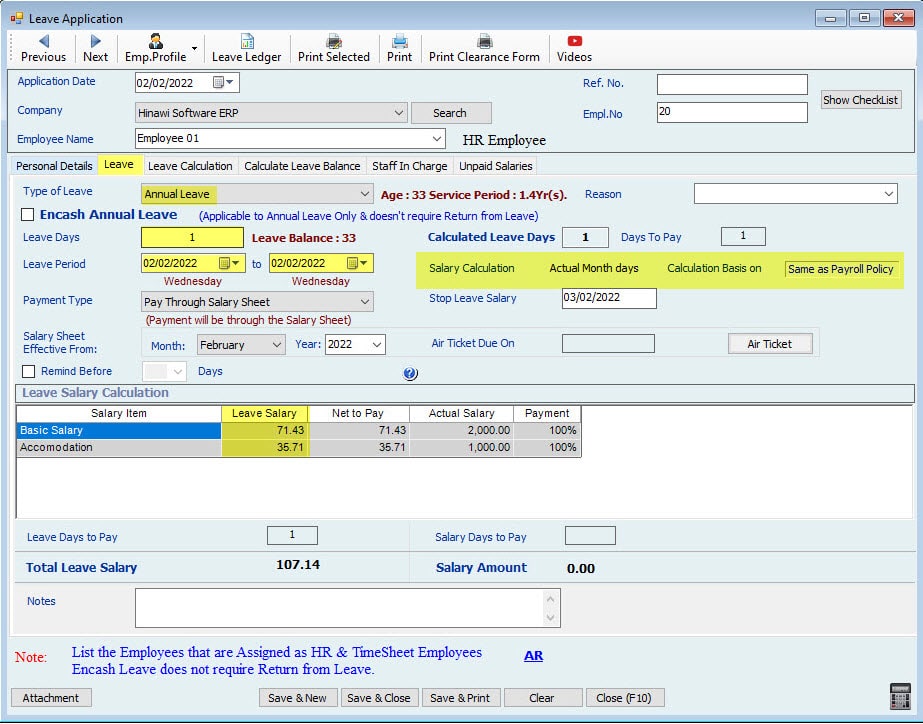

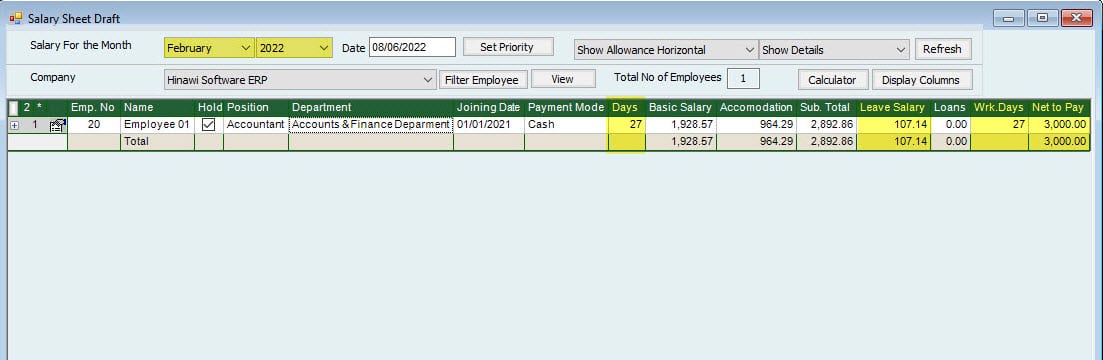

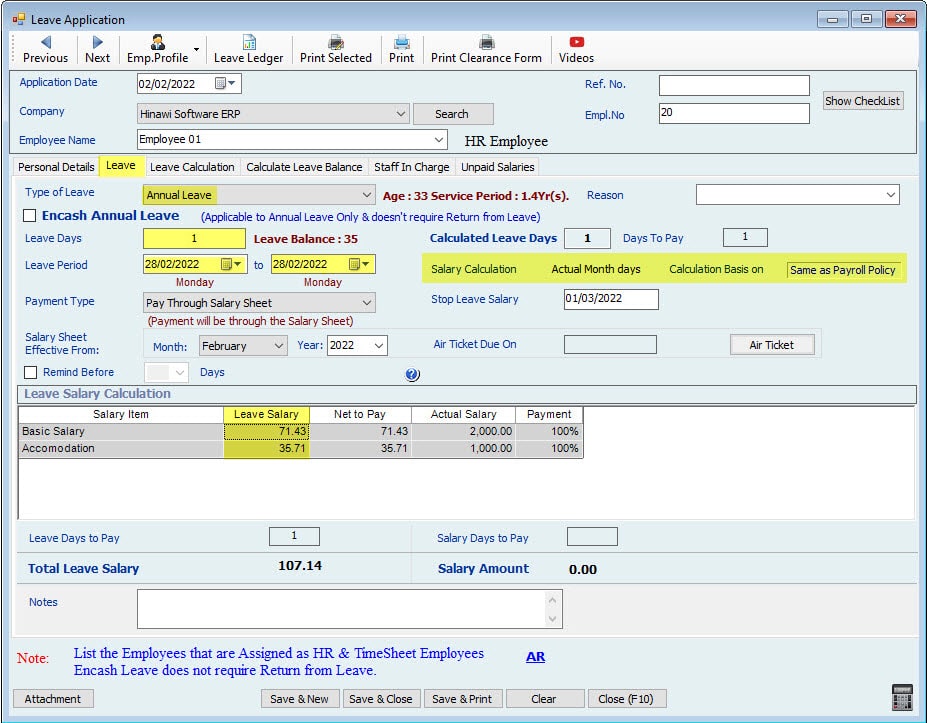

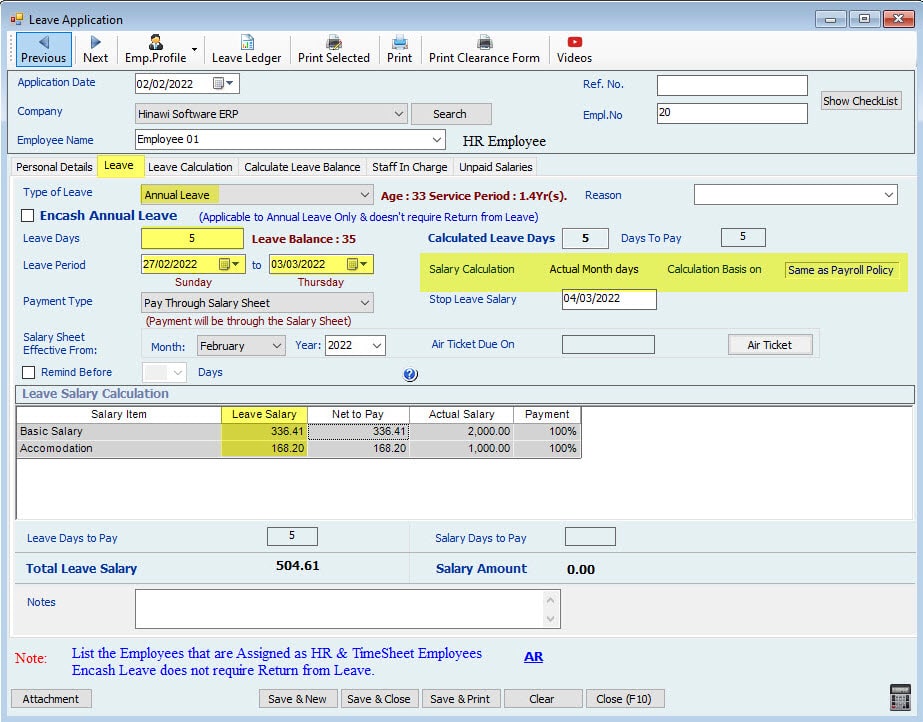

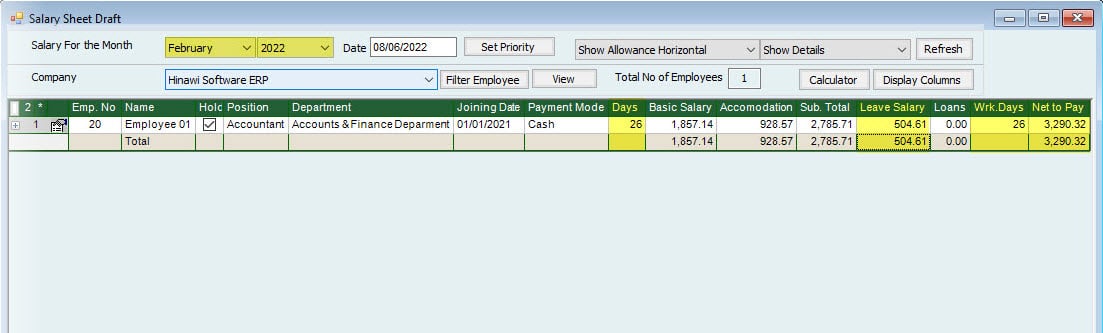

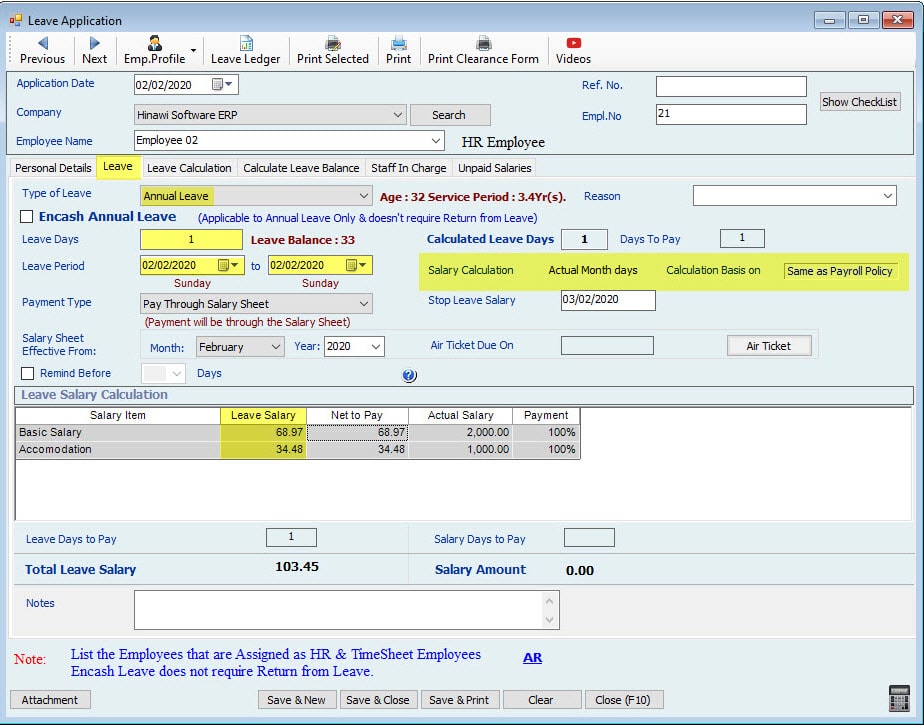

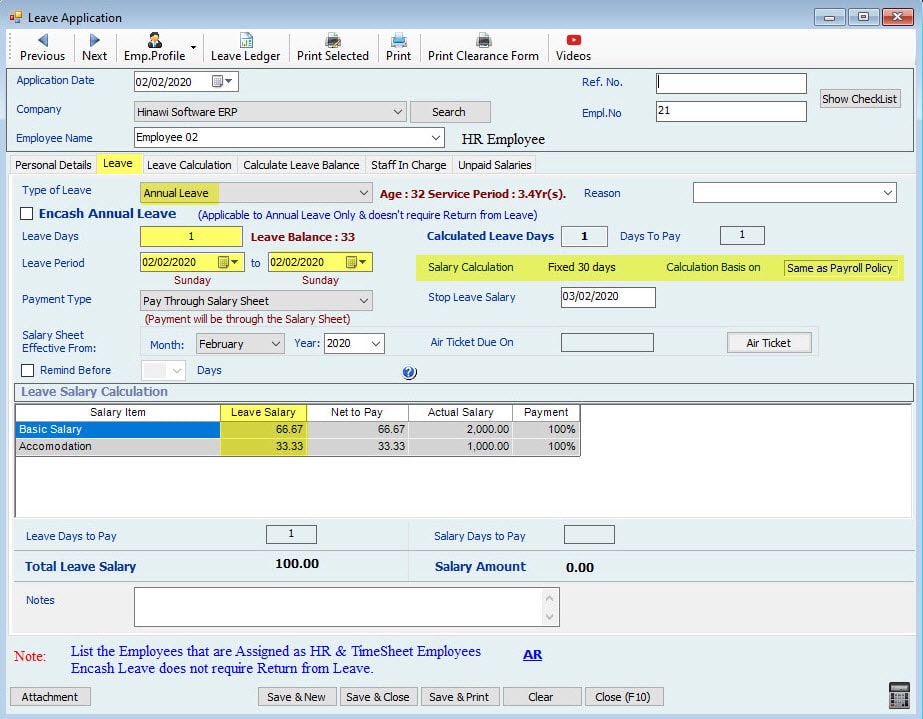

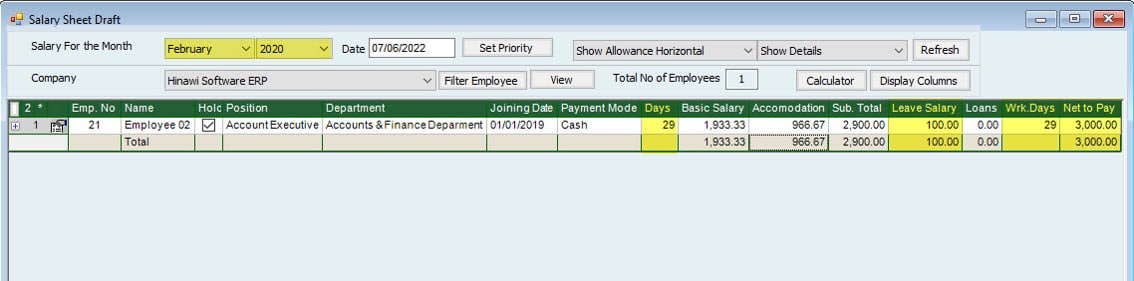

Leave Calculation Setup is: (Month is Actual Month Days) For February 28 Days.

Leave Calculation Setup is: (Month is Actual Month Days) for February 28.

| February – The Month is 28 Days (None Leap Year) | ||||||

| Salary | 3000 | 1 Day’s Leave During the Month | 1 Day Leave 30 of the Month | 1 Day’s Leave at the end of the Month (On the 28) | 5 Days Leave from 27 of the Month. | |

| Actual Month Days | 28 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | The days are: February: 27+28 March: 1+2+3 |

|||||

| Calculated Leave days | 1 | 0 | 1 | 5 | Days will be Split into 2 Months | |

| 2 | 2 Days in February | |||||

| 3 | 3 Days in March | |||||

| Working Days | 27 | 28 | 27 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only days. | The days are: February 27+28 March: 1+2+3 |

||

| 214.29 | Calculation of Leave Amount for February. | |||||

| 290.32 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 28 X Leave days | 107.14 | 0 | 107.14 | 504.61 | |

| Working Days Salary | Total Salary / 28 X Working days | 2892.86 | 3000.00 | 2892.86 | 2785.71 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3290.32 | The Leave Salary for 3 days of March will also be included with this Month. In March Employee will get 28 Days’ Salary. |

Note:

If the Leave is ten days, the System will calculate the 2 Days in February as (3000 / 28 * 2) and 8 days in March as (3000 / 31 * 8)

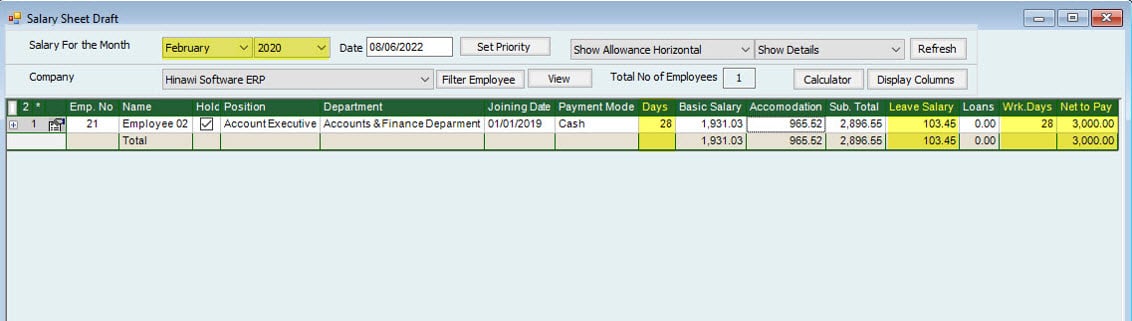

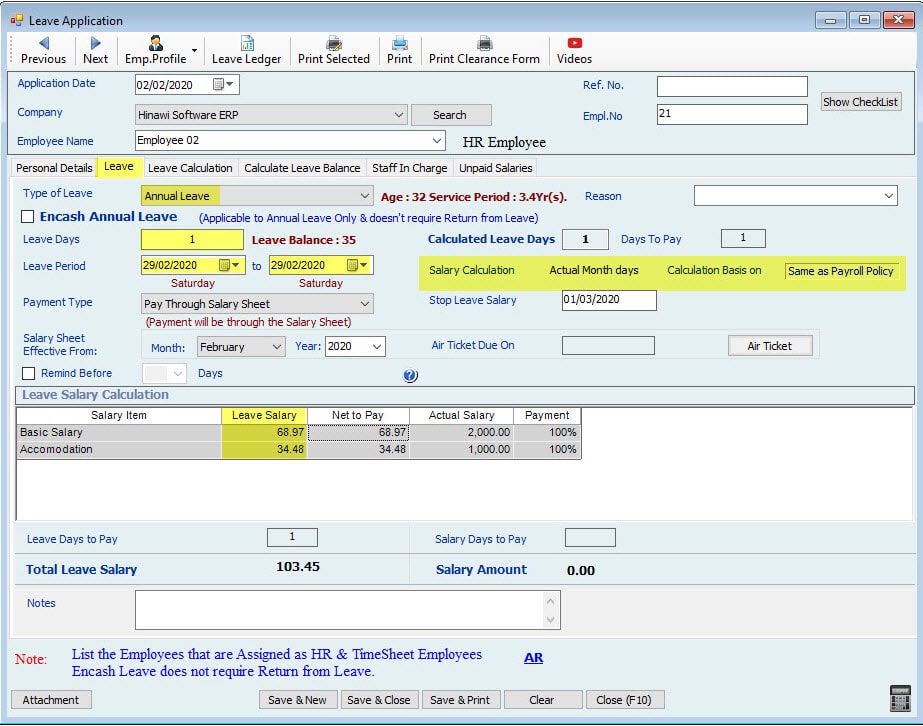

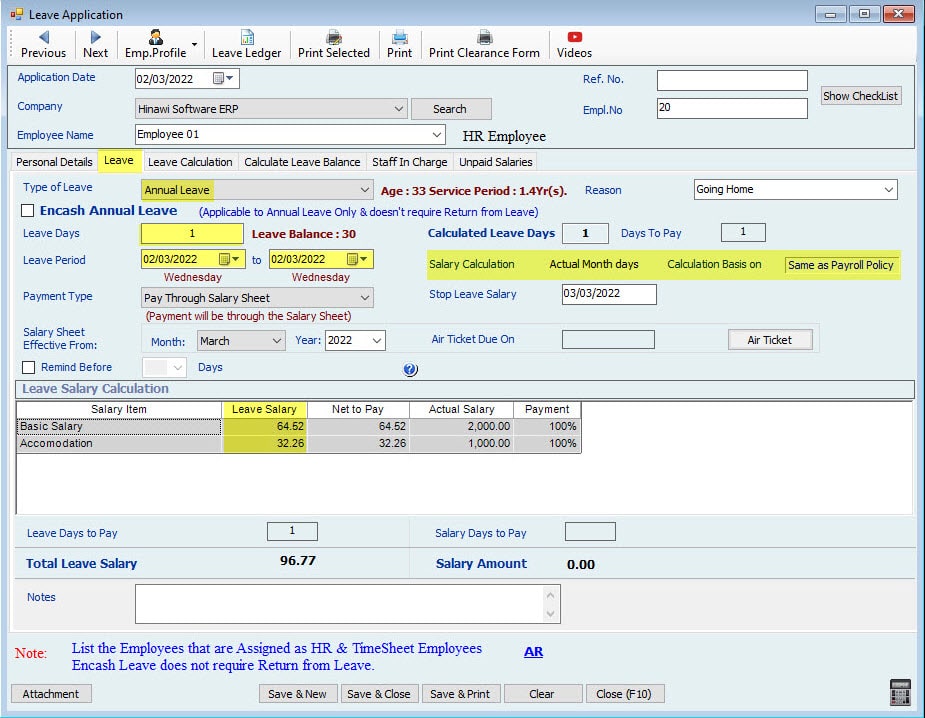

Leave Calculation Setup is: (Month is Actual Month Days) For February 29 Days.

Leave Calculation Setup is: (Month is Actual Month Days) for February 29.

| February – The Month is 29 Days (Leap Year) | ||||||

| Salary | 3000 | 1 Day’s Leave During the Month | 1 Day Leave 30 of the Month | 1 Day’s Leave at the end of the Month (On 29) | 5 Days Leave from 27 of the Month. | |

| Actual Month Days | 29 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | The days are: February 27+28+29 March: 1+2 |

|||||

| Calculated Leave days | 1 | 0 | 1 | 5 | Days will be Split into 2 Months | |

| 3 | 3 Days in February | |||||

| 2 | 2 Days in March | |||||

| Calculate Working Days | 28 | 29 | 28 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only days | The days are: February 27+28+29 March: 1+2 |

||

| 310.34 | Calculation of Leave Amount for February. | |||||

| 193.55 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 29 X Leave days | 103.45 | 0.00 | 103.45 | 503.89 | |

| Working Days Salary Amount | Total Salary / 29 X Working days | 2896.55 | 3000.00 | 2896.55 | 2689.66 | |

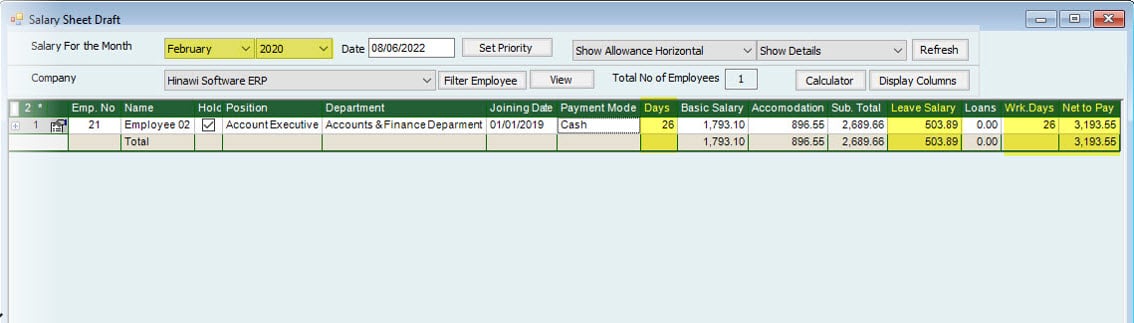

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3193.55 | The Leave Salary for 2 days of March will also be included with this Month. In March Employee will get 29 Days’ Salary. |

Note:

If the Leave is 10 days, the System will calculate the 3 Days in February as (3000 / 29 * 3) and 7 days in March as (3000 / 31 * 7)

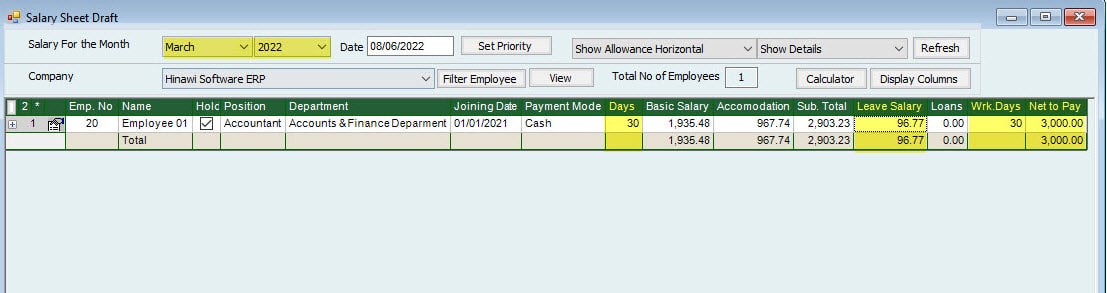

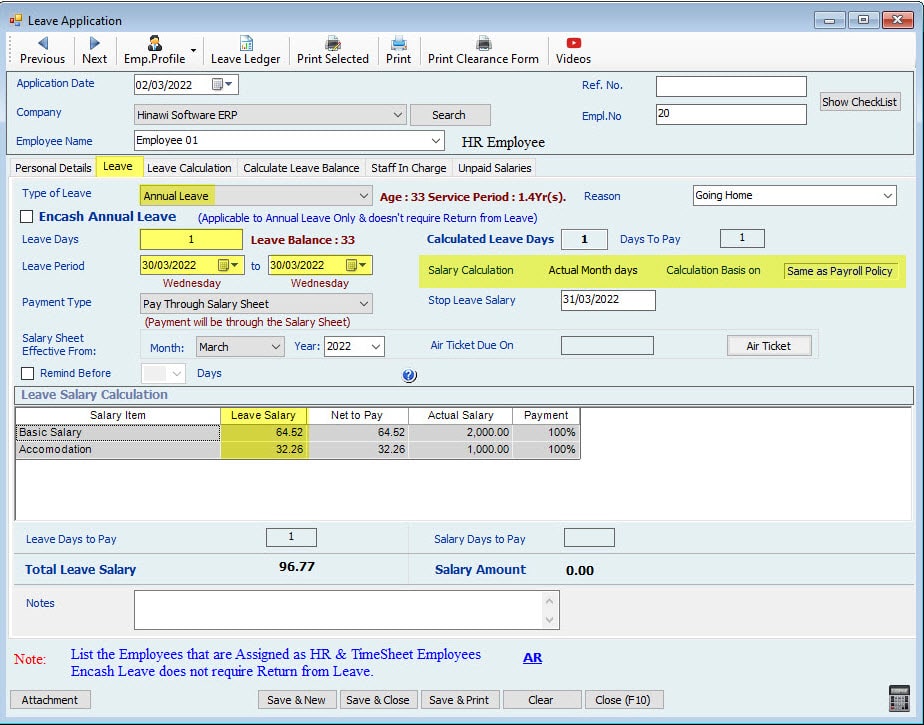

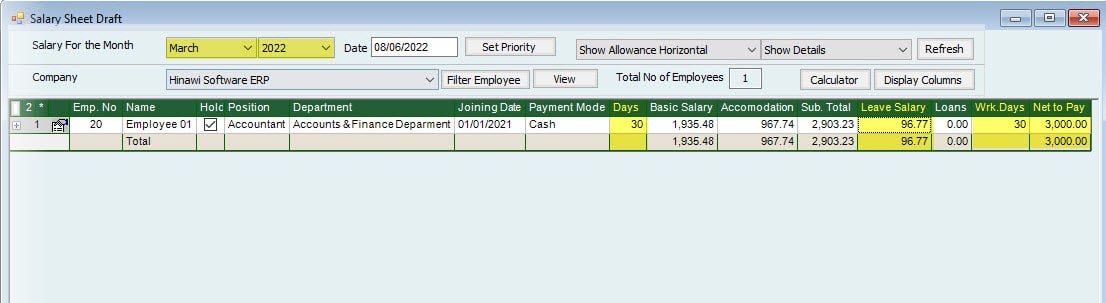

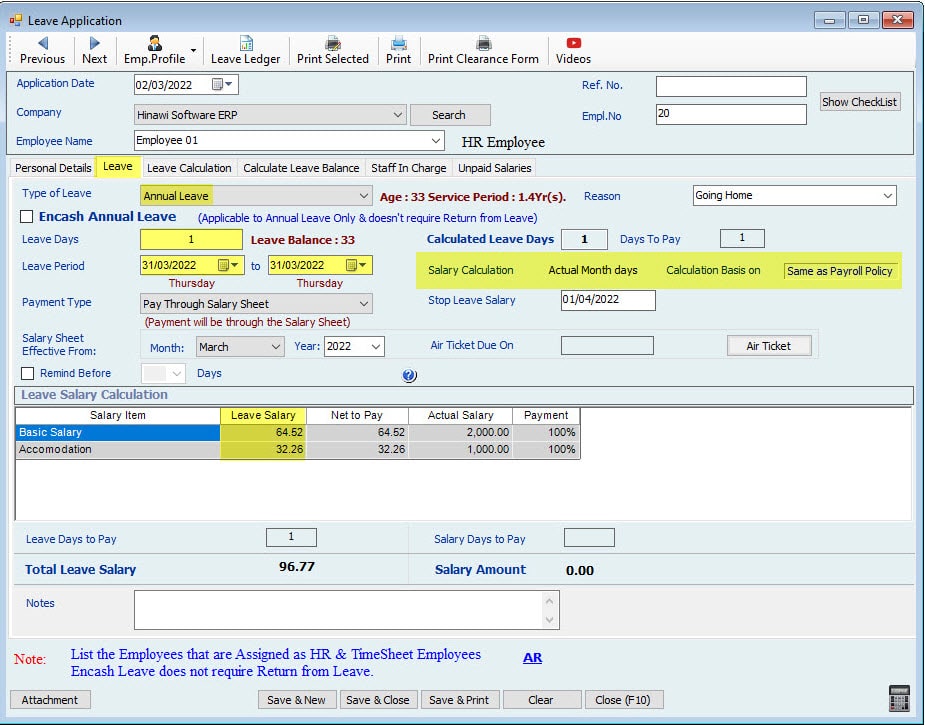

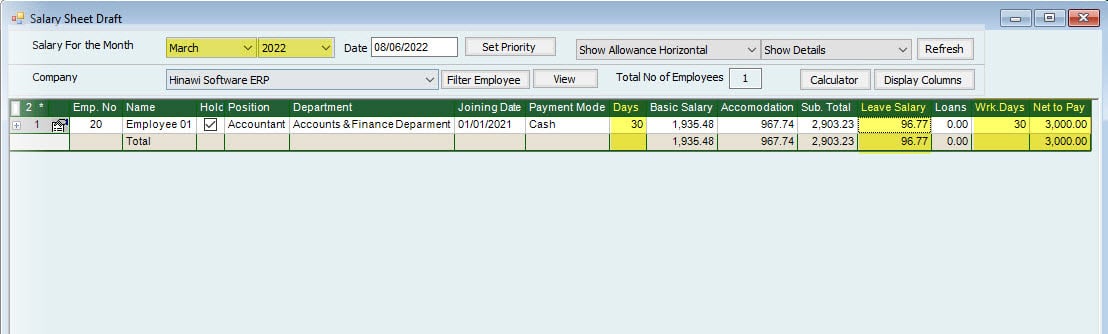

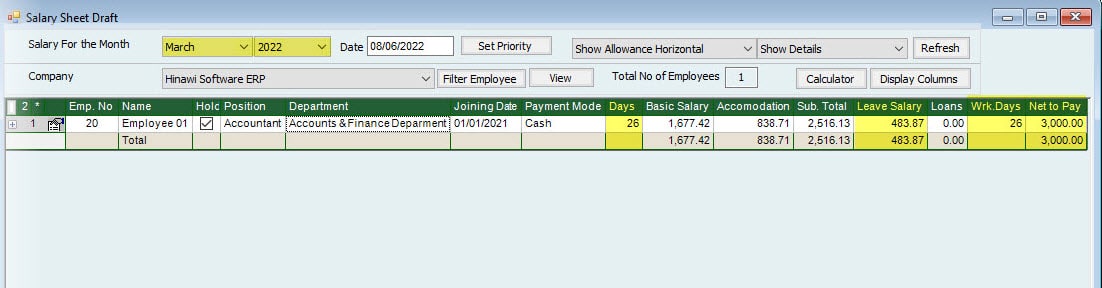

Leave Calculation Setup is: (Month is Actual Month Days) For March 31 Days.

Leave Calculation Setup is: (Month is Actual Month Days) For March 31.

| March | ||||||

| Salary | 3000 | 1 Day’s Leave During the month | 1 Day Leave 30 of the month | 1 Day’s Leave at the end of the month (On 31) | 5 Days Leave from 27 of the month. | |

| Actual Month Days | 31 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Leave days | 1 | 1 | 1 | 5 | ||

| Calculate Working Days | 30 | 30 | 30 | 26 | ||

| Description | One Day Leave only one | One Day Leave only one | One Day Leave only days | Days are: March 27+28+29+30+31 | ||

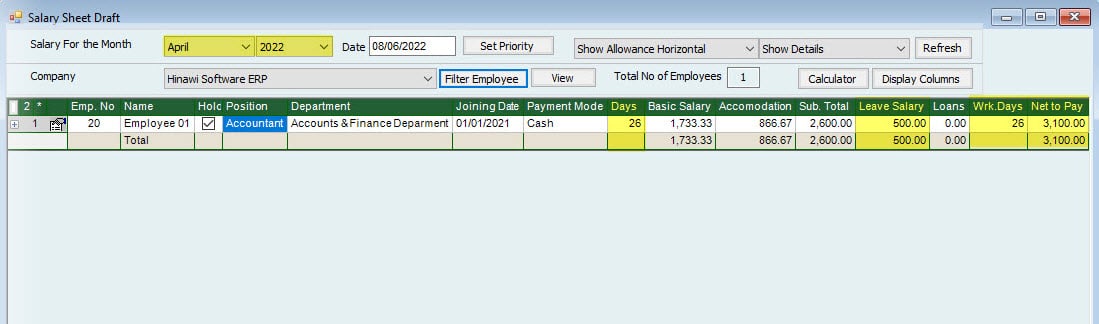

| Leave Amount | Total Salary / 31 X Leave days | 96.77 | 96.77 | 96.77 | 483.87 | |

| Working Days Salary | Total Salary / 31 X Working days | 2903.23 | 2903.23 | 2903.23 | 2516.13 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3000.00 | |

Note:

If the Leave is 10 days, the System will calculate the 5 Days in March as (3000 / 31 * 5) and 5 days in April as (3000 / 30 * 5)

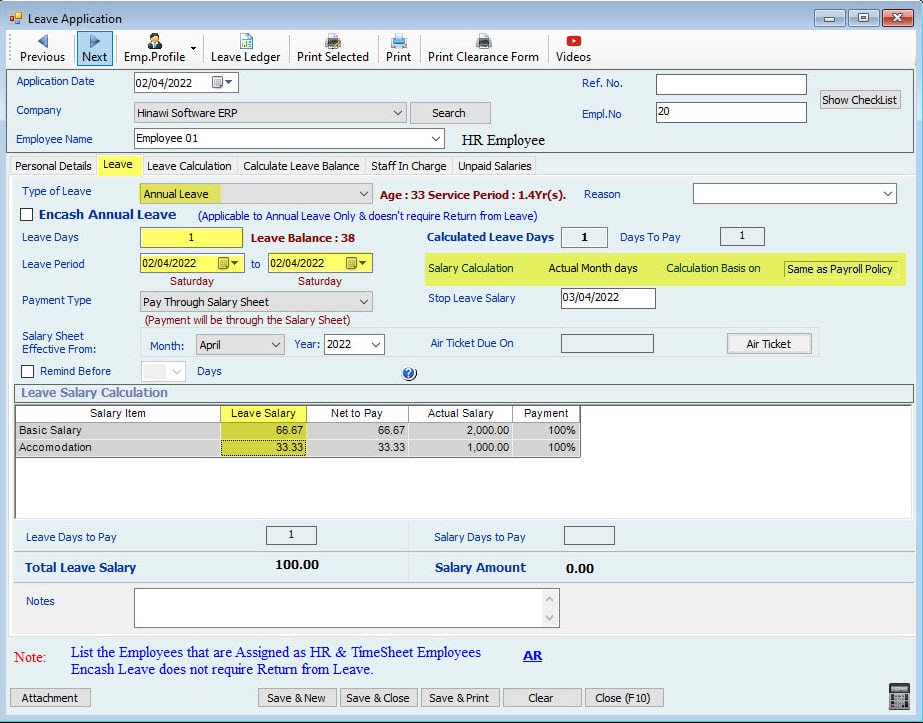

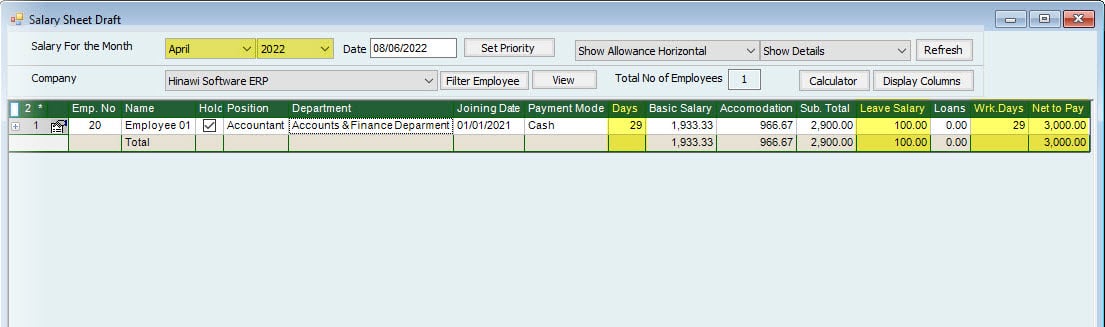

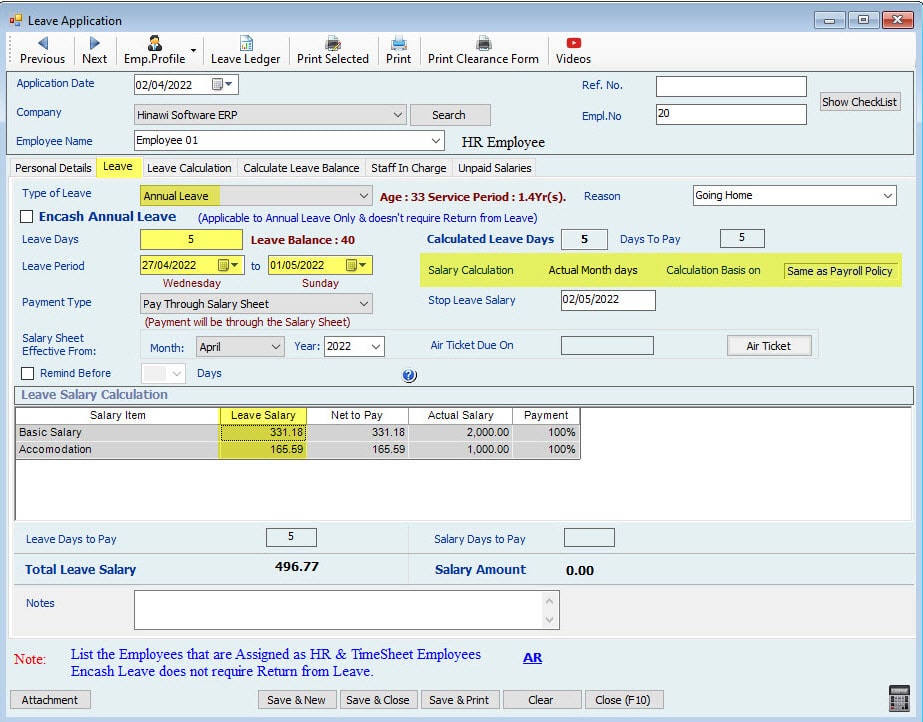

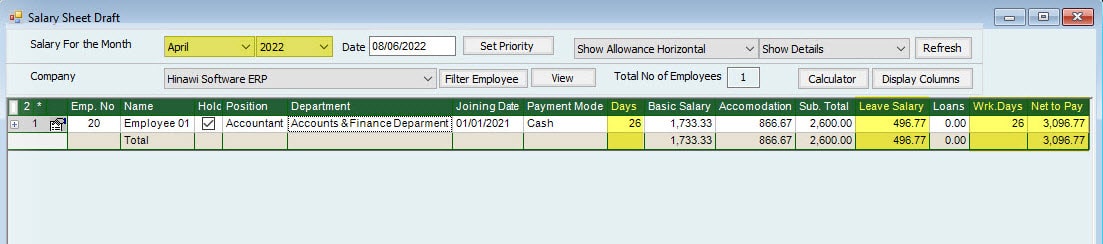

Leave Calculation Setup is: (Month is Actual Month Days) For April 30 Days.

Leave Calculation Setup is: (Month is Actual Month Days) For April 30.

| April | ||||||

| Salary | 3000 | 1 Day’s Leave During the Month | 1 Day Leave 30 of the Month | 1 Day’s Leave at the end of the Month (On 31) | 5 Days Leave from 27 of the Month. | |

| Actual Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | N/A | 5 | This will show in Leave Ledger Report. | |

| Description | The days are April 27+28+29+30 and May 1 Day. | |||||

| Calculated Leave days | 1 | 1 | 0 | 5 | Days will be Split into 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Day in May | |||||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave only one | One Day Leave only | Only April is 30 Days only days | Days in April are 27+28+29+30, and 1 Day in May. | ||

| 400.00 | Calculation of Leave Amount for April. | |||||

| 96.77 | Calculation of Leave Amount for May. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 496.77 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3096.77 | The Leave Salary for 1 day of May will also be included in this Month. In May Employee will get 30 Days’ Salary. |

Note:

If the Leave is 10 days, the System will calculate the 4 Days in April as (3000 / 30 * 4) and 6 days in May as (3000 / 31 * 5)

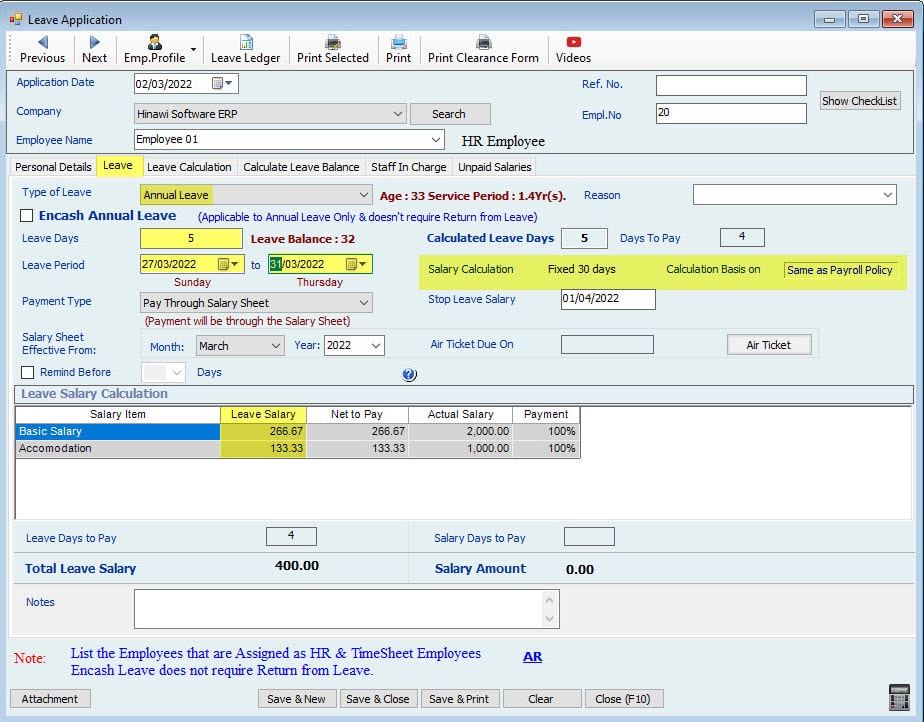

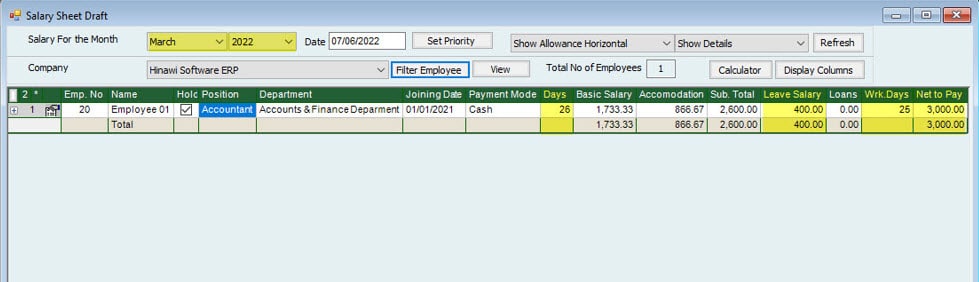

Leave Calculation Setup is: (Month is Fixed 30 Days)

Leave Calculation Setup is: (Month is Fixed 30 Days) For January 31 Days.

Leave Calculation Setup is: (Month is Fixed 30 Days) For January 31 Days.

| January | ||||||

| Salary | 3000 | 1 Day’s Leave During the month | 1 Day Leave 30 of the month | 1 Day’s Leave at the end of the month (On 31) | 5 Days Leave from the 27 of the month | Note |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | Days are: January 27+28+29+30+31 | |||||

| Calculated Leave days | 1 | 1 | 0 | 4 | ||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave only one | One Day Leave only days | Days after 30 will not be considered days | Days are: 27+28+29+30 31 will not be calculated |

||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3000.00 | |

Note:

If the Leave is 10 days, the System will calculate the 4 Days in January as (3000 / 30 * 4) and 5 days in February as (3000 / 30 * 5) [31 will not be calculated]

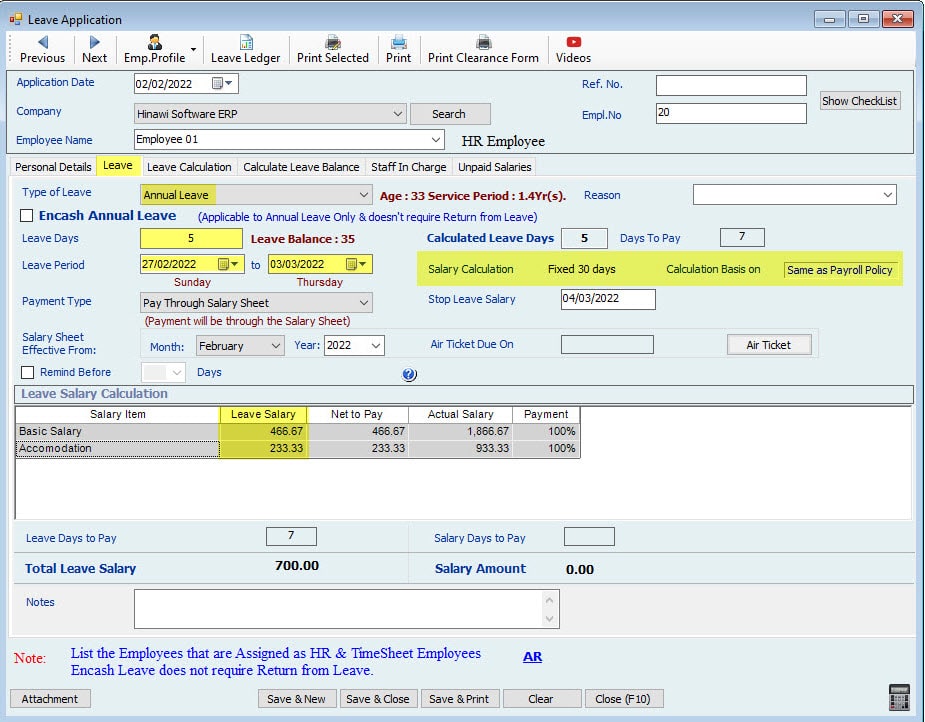

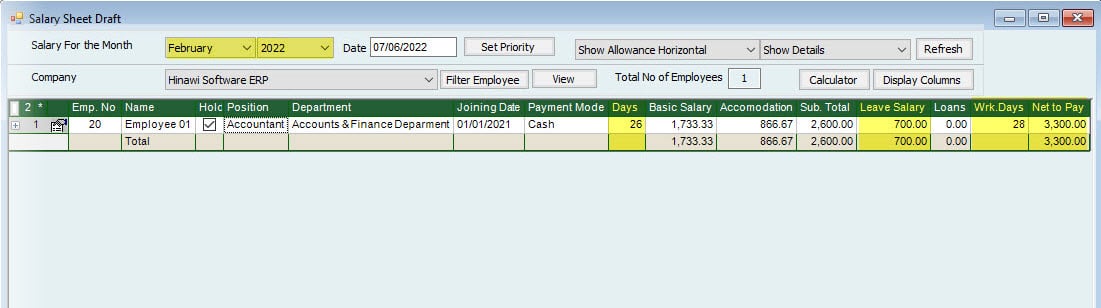

Leave Calculation Setup is: (Month is Fixed 30 Days) For February 28 Days.

Leave Calculation Setup is: (Month is Fixed 30 Days) For February 28 Days.

| February – The Month is 28 Days (Non-Leap Year) | ||||||

| Salary | 3000 | 1 Day’s Leave During the Month | 1 Day Leave 30 of the Month | 1 Day’s Leave at the end of the Month (On the 28) | 5 Days Leave from 27 of the Month. | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | Days’ | The days are: February: 27+28 March: 1+2+3 |

||||

| Calculated Leave days | 1 | 0 | 1 | 7 | Days will be Split into 2 Months | |

| 4 | 4 Days in February | |||||

| 3 | 3 Days in March | |||||

| Working Days | 29 | 30 | 29 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only days | Days are: February 27+28+29+30 March: 1+2+3 |

Payroll Settings can calculate Actual Leave Days if Payroll Policy is Fixed by 30 days. If the User Tick this option System will Calculate only 27+28+1+2+3 ( 5 Days).In this case, Leave Amount will be 500 | |

| 400 | Calculation of Leave Amount for February. | |||||

| 300 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 0.00 | 100.00 | 700.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 3000.00 | 2900.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3300.00 | The Leave Salary for 3 days of March will also be included with this Month. In March Employee will get 27 Days’ Salary. |

Note:

If the Leave is 10 days, the System will calculate the 4 Days in February as (3000 / 30 * 4) and 8 days in March as (3000 / 30 * 8)

Leave Calculation Setup is: (Month is Fixed 30 Days) For February 29 Days.

Leave Calculation Setup is: (Month is Fixed 30 Days) For February 29 Days.

| February – The Month is 29 Days (Leap Year) | ||||||

| Salary | 3000 | 1 Day’s Leave During the Month | 1 Day Leave 30 of the Month | 1 Day’s Leave at the end of the Month (On 29) | 5 Days Leave from 27 of the Month. | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | N/A | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | The days are: February: 27+28+29 March: 1+2 |

|||||

| Calculated Leave days | 1 | 0 | 1 | 6 | Days will be Split into 2 Months | |

| 4 | 4 Days in February | |||||

| 2 | 2 Days in March | |||||

| Calculate Working Days | 29 | 30 | 29 | 26 | ||

| Description | One Day Leave only | _ | One Day Leave only days | Days are: February 27+28+29+30 March: 1+2 |

Payroll Settings can calculate Actual Leave Days if Payroll Policy is Fixed by 30 days. If the User Tick this option System will Calculate only 27+28+1+2+3 ( 5 Days). In this case, Leave Amount will be 500 | |

| 400 | Calculation of Leave Amount for February. | |||||

| 200 | Calculation of Leave Amount for March. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 0.00 | 100.00 | 600.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 3000.00 | 2900.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3200.00 | The Leave Salary for 2 days of March will also be included with this Month. In March Employee will get 28 Days’ Salary. |

Note:

If the Leave is 10 days, the System will calculate the 4 Days in February as (3000 / 30 * 4) and 7 days in March as (3000 / 30 * 7)

Leave Calculation Setup is: (Month is Fixed 30 Days) For March 31 Days.

Leave Calculation Setup is: (Month is Fixed 30 Days) For March 31 Days.

| March | ||||||

| Salary | 3000 | 1 Day’s Leave During the month | 1 Day Leave 30 of the month | 1 Day’s Leave at the end of the month (On 31) | 5 Days Leave from 27 of the month. | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | 1 | 5 | This will show in Leave Ledger Report. | |

| Description | Days are: March 27+28+29+30+31 | |||||

| Calculated Leave days | 1 | 1 | 0 | 4 | ||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave only one | One Day Leave only days | Days after 30 will not be considered days | Days are: 27+28+29+30 31 will not be calculated |

||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 400.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3000.00 | |

Note:

If the Leave is 10 days, the System will calculate the 4 Days in March as (3000 / 30 * 4) and 5 days in April as (3000 / 30 * 5) [31 will not be calculated]

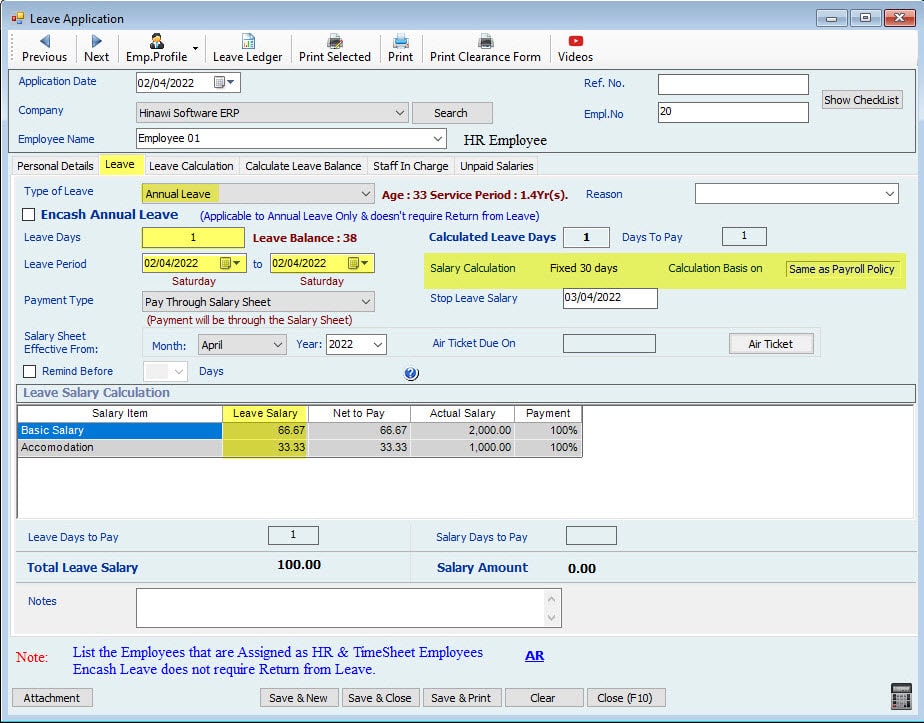

Leave Calculation Setup is: (Month is Fixed 30 Days) For April 30 Days.

Leave Calculation Setup is: (Month is Fixed 30 Days) For April 30 Days.

| April | ||||||

| Salary | 3000 | 1 Day’s Leave During the Month | 1 Day Leave 30 of the Month | 1 Day’s Leave at the end of the Month (On 31) | 5 Days Leave from 27 of the Month. | |

| Fixed Month Days | 30 | |||||

| Actual Leave Days. | 1 | 1 | N/A | 5 | This will show in Leave Ledger Report. | |

| Description | The days are April 27+28+29+30 and May 1 Day. | |||||

| Calculated Leave days | 1 | 1 | 0 | 5 | Days will be Split into 2 Months | |

| 4 | 4 Days in April | |||||

| 1 | 1 Day in May | |||||

| Calculate Working Days | 29 | 29 | 30 | 26 | ||

| Description | One Day Leave only one | One Day Leave only April | April is 30 Days only days | Days in April are: 27+28+29+30, and 1 Day in May for | ||

| 400 | Calculation of Leave Amount for April. | |||||

| 100 | Calculation of Leave Amount for May. | |||||

| Leave Amount | Total Salary / 30 X Leave days | 100.00 | 100.00 | 0.00 | 500.00 | |

| Working Days Salary | Total Salary / 30 X Working days | 2900.00 | 2900.00 | 3000.00 | 2600.00 | |

| Net Salary Amount | Total Working Days Salary + Leave Amount | 3000.00 | 3000.00 | 3000.00 | 3100.00 | The Leave Salary for 1 day of May will also be included in this Month. In May Employee will get 29 Days’ Salary. |

Note:

If the Leave is 10 days, the System will calculate the 4 Days in April as (3000 / 30 * 4) and 6 days in May as (3000 / 30 * 6)

Note:

The monthly Salary calculation will be: Leave Amount waddled to Working days Salary.

Leave Return Workflow and Accounting Entries

| Leave Return Summary Workflow | |||||

| A. Create Form | B. Approvals | C. Post to accounting the on | D. Collection | Memo | |

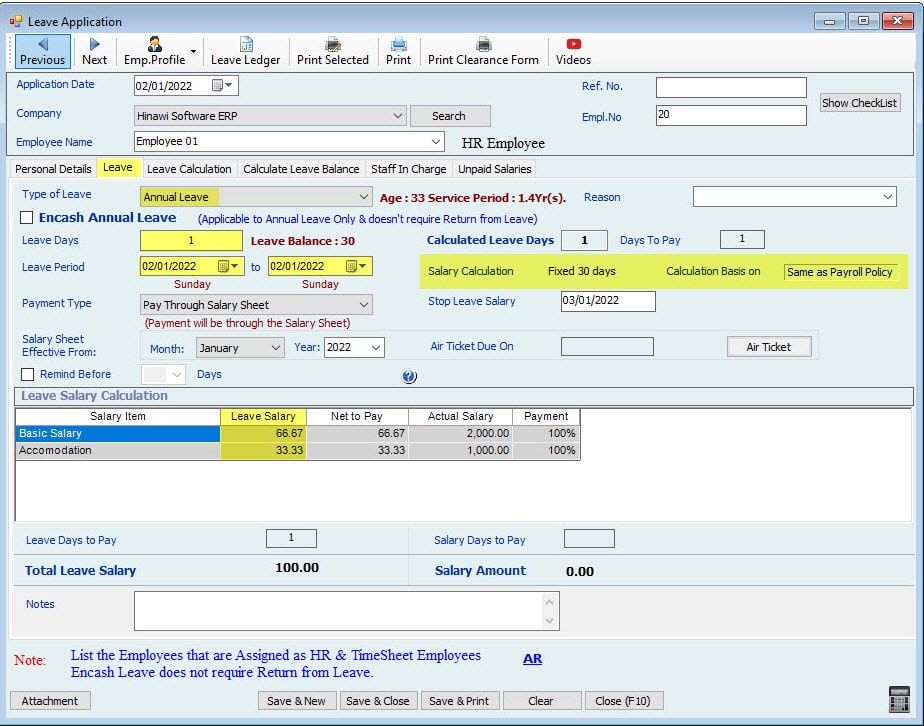

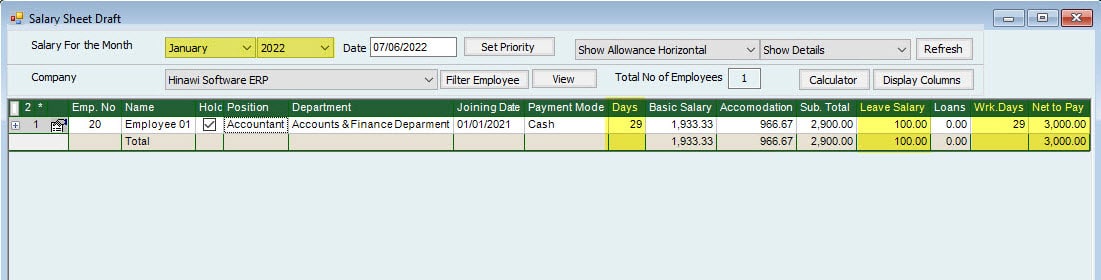

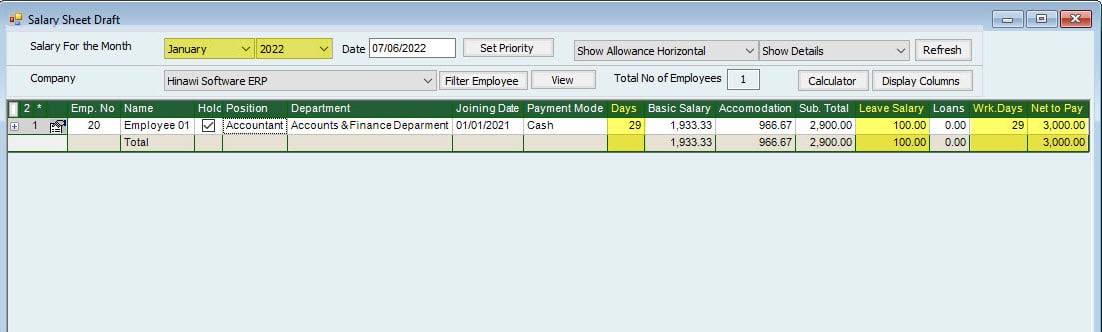

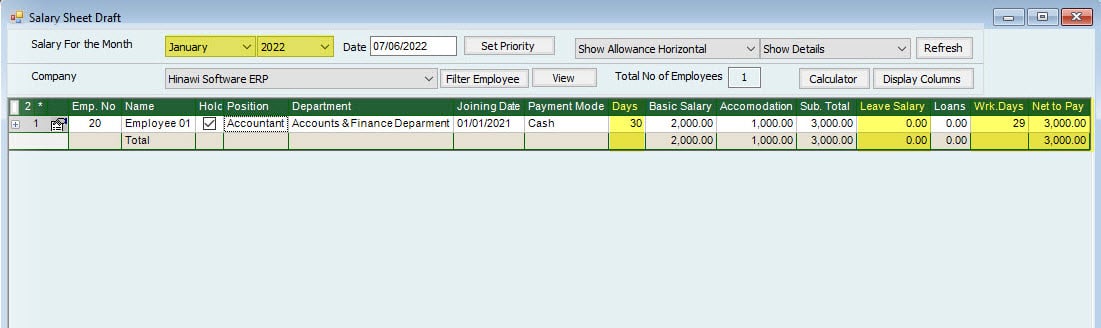

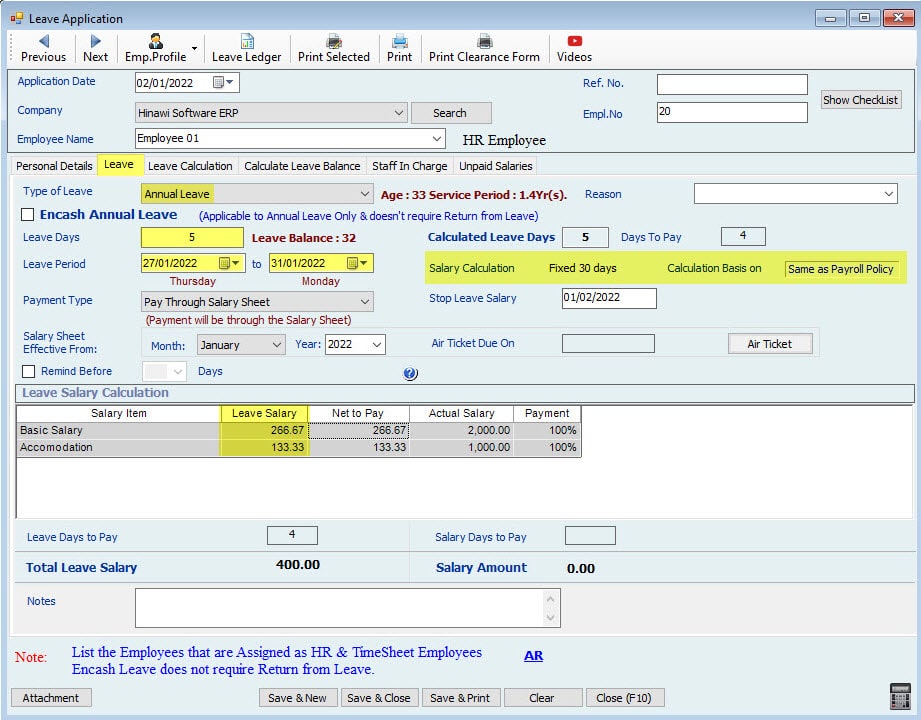

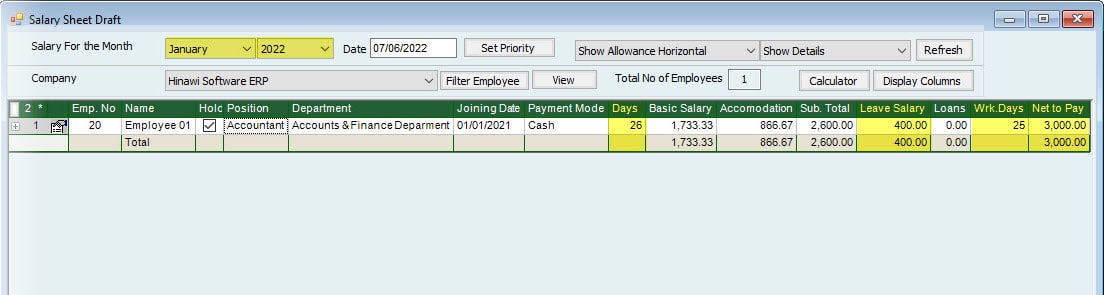

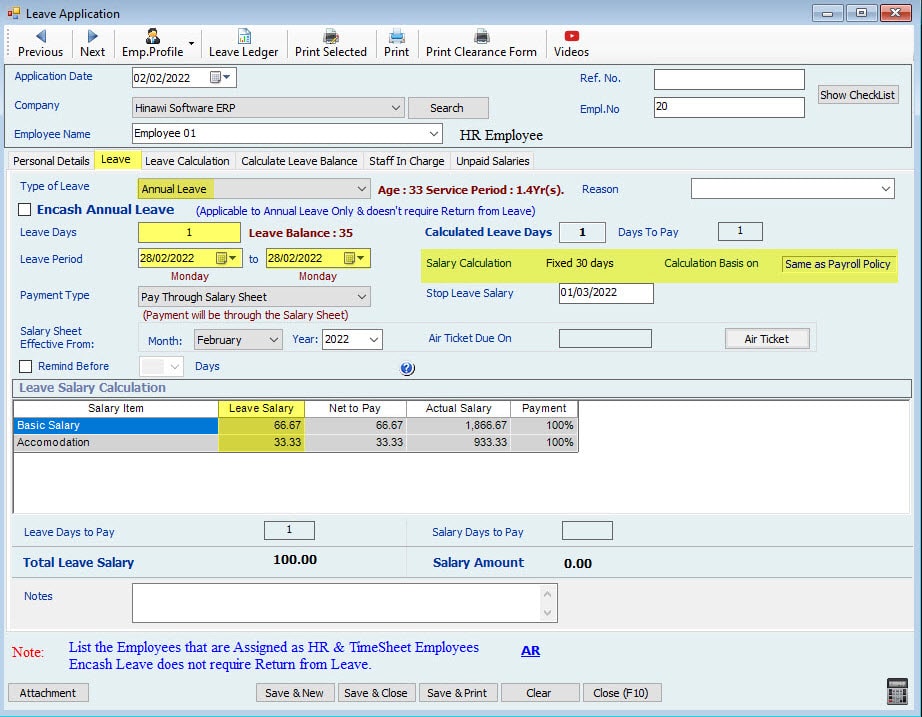

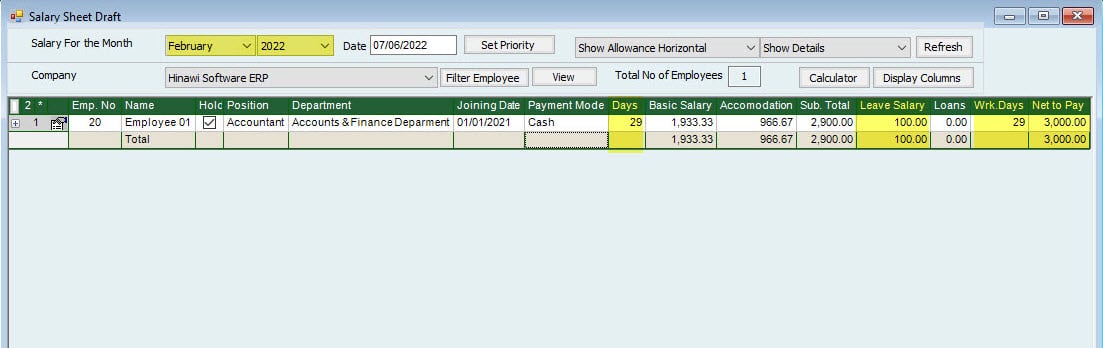

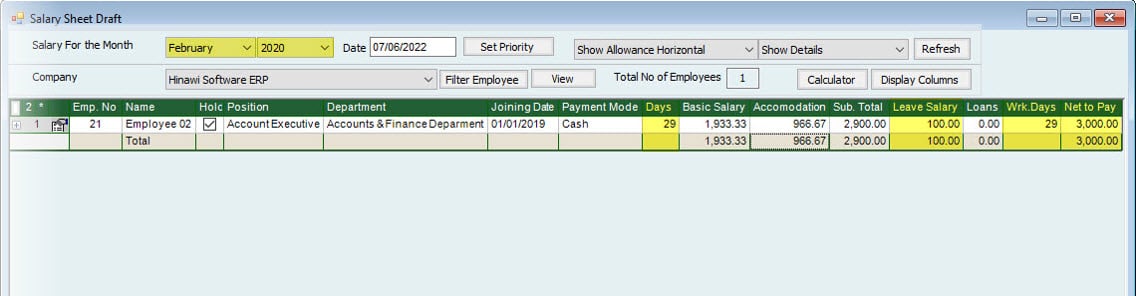

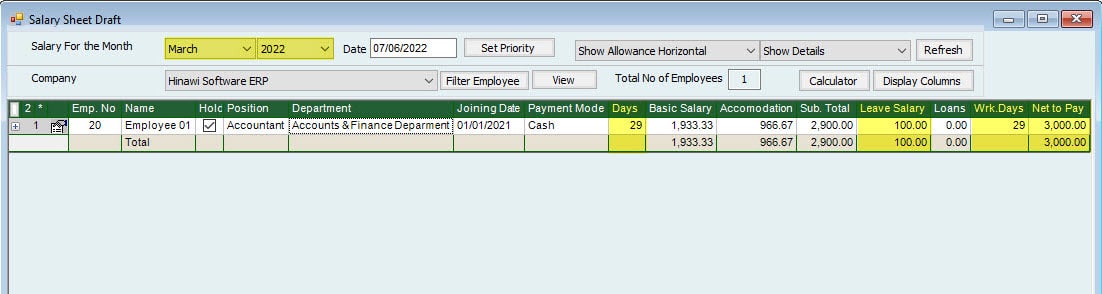

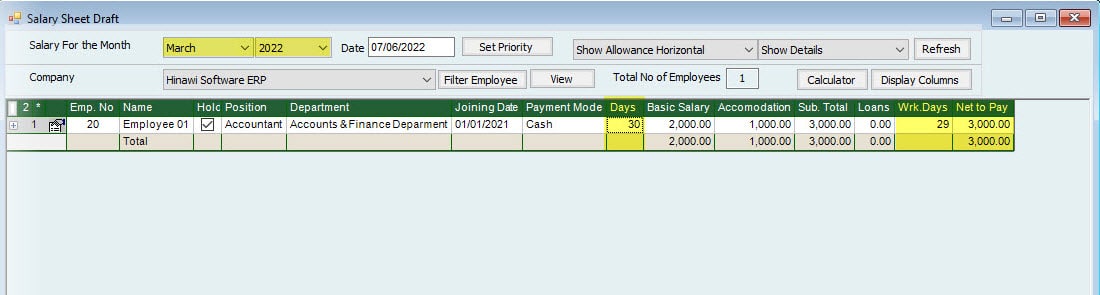

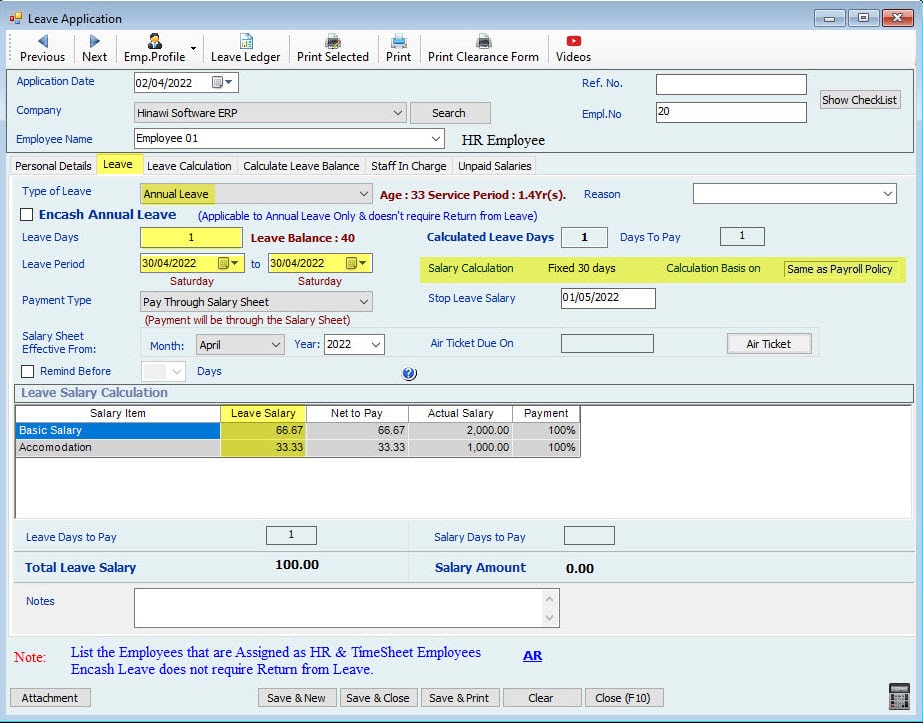

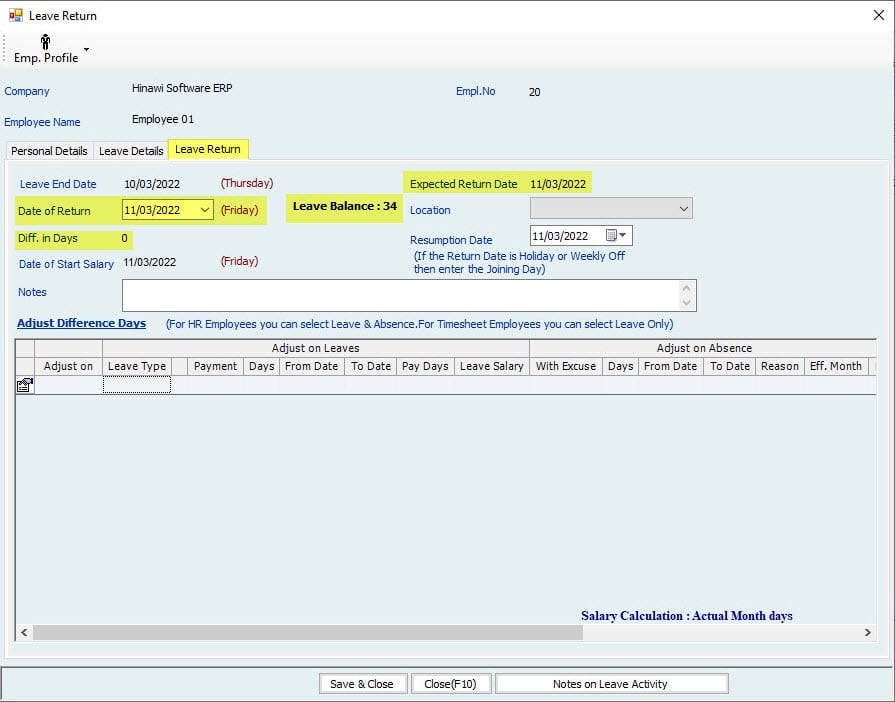

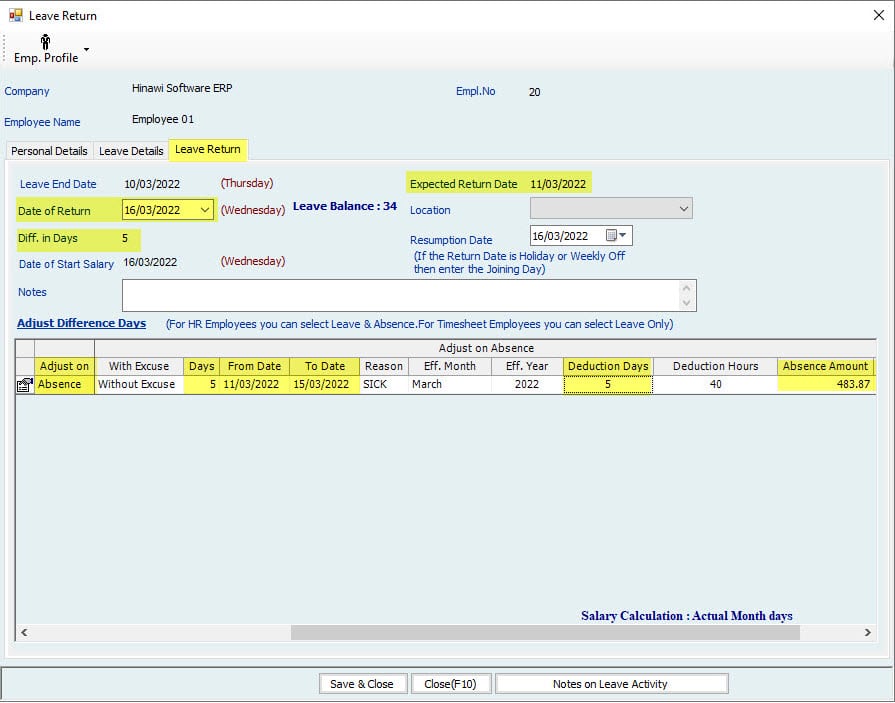

| 1. When Retuned on time. Image 1 | No Actions | Approval is not required | No Accounting effect | No Collection required | The Salary will resume from the return Date. |

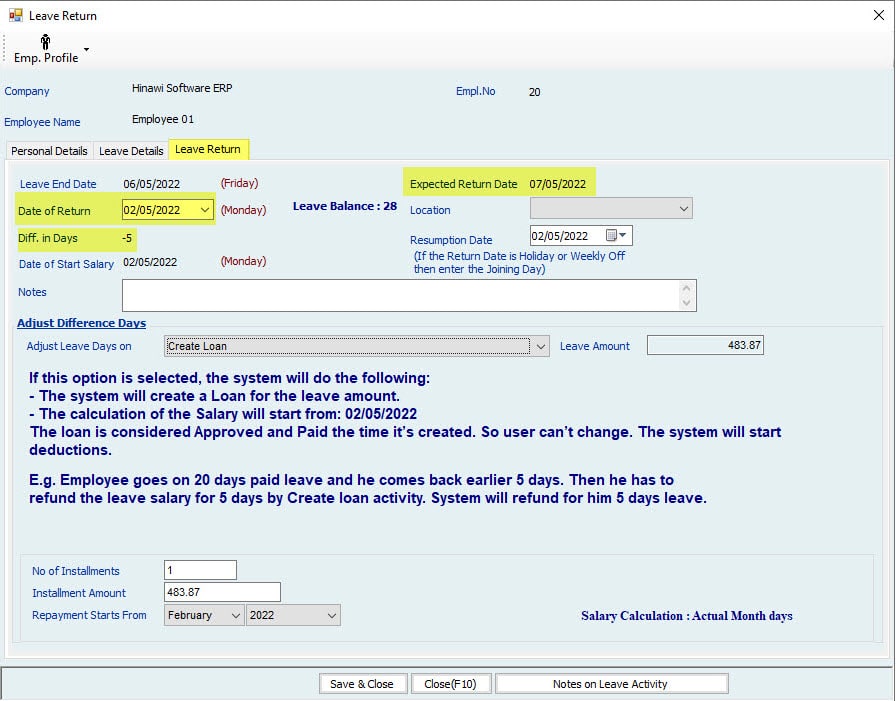

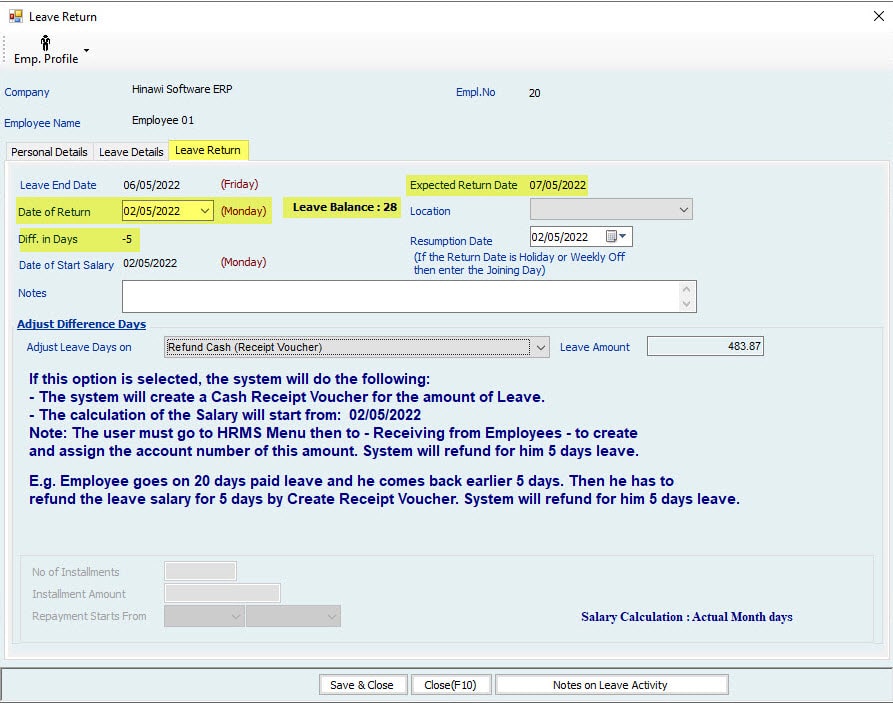

| 2. When Returned Earlier | 1. Refund Leave Amount option. | Approval is not required—YES Refund | YES | Refund By Cash or Cheque through Receipt Voucher located in HRMS Menu. | I am posting to Accounting through Receipt Voucher. |

| 2. Create a Loan option. | It will be considered automatically as created, Approved, and Paid Loan. So deduction from Salary will start automatically. | The automatically created Loan will not affect the accounting. | affect | The effect on accounting will be while posting of Salary Sheet. | |

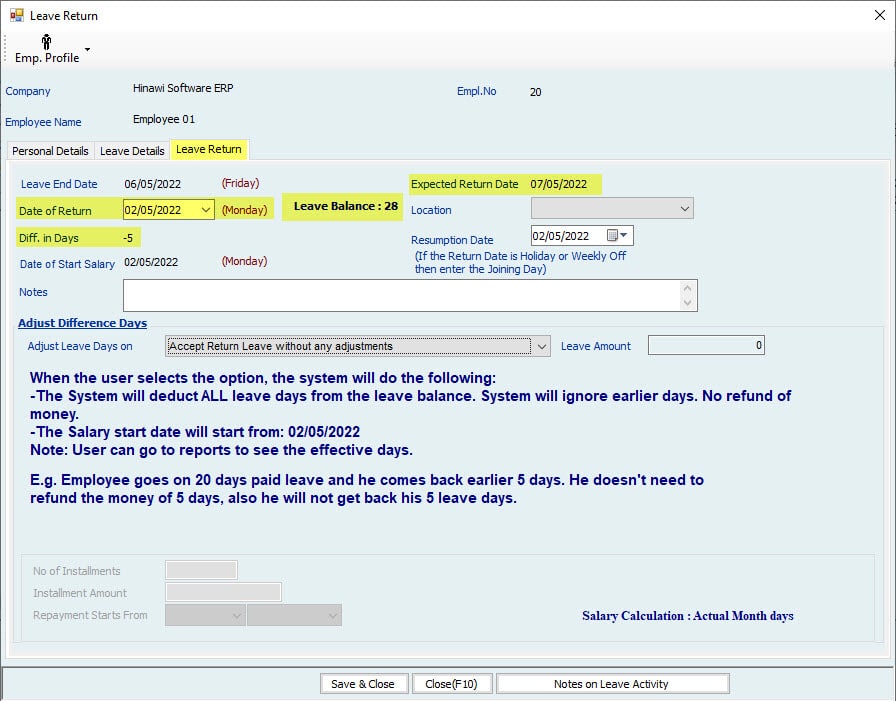

| 3. Return the earliest days to the Employee balance option. | Approval is not required on | NO | NO | The leave days will affect the Employee Leave Ledger. | |

| 4. No Adjustments option approval | Approval is not required | NO | NO | No accounting effects. | |

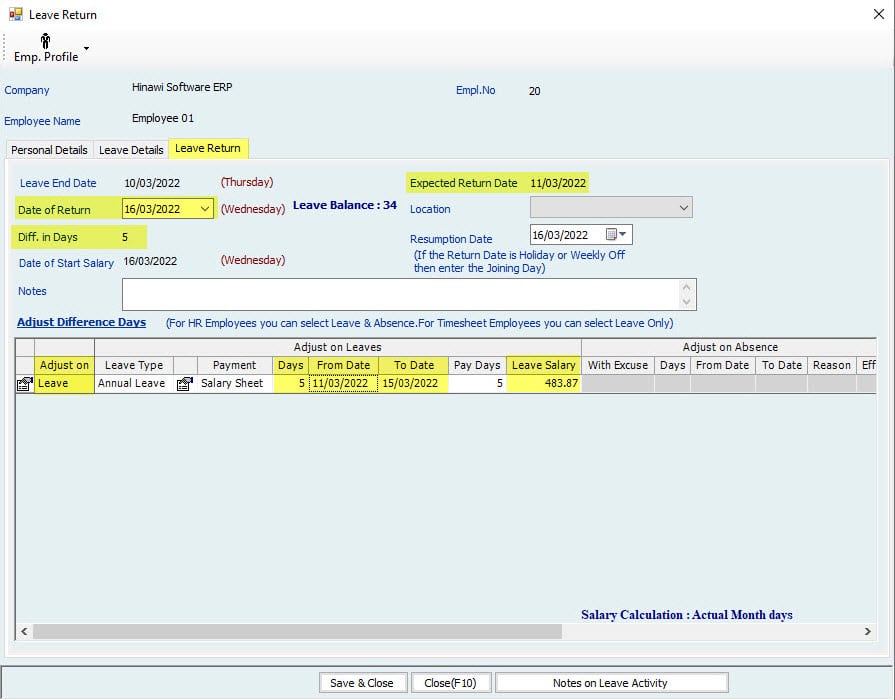

| 3. When Return Late | 1. Deduct from Leave. The System will show all types of leave to select. |

Approval is not required because it will be approved automatically. | YES Accounting and Payment affect the same as creating a new Leave Process. |

insurer | The usurer will select the type of leave to adjust the late days. After saving, the System wgenerateeate the exit Automatically while filling in the Return Leave —accounting thing and Payment effect; Same as Leave Process. |

| 2. Create an Absence | Approval is not required because it will be approved automatically. | YES When posting the Salary sheet. |

NO | Abs license is available for HR employees on Theon. The System stem will automatically create ate absence form with approved status. These days of absence will deduct the total service period based on the selected Setup. | |

| Leave Return Accounting Entries | |||||

| A. Create Form | B & C: Accounting Entries on Approvals | Menu Location | D. Entries on Payment of Leave and Salary | Menu Location | Memo |

| 1. Refund Leave Am option approval approval | Approval is not required |

Dr. Cash / Bank Cr. Leave. |

HRMS Activities >>>> Receive From Employees >>>> Receive Amount for Earlier leave return. | ||

| 2. Create Options | It will be considered automatically as Approved, and Pathed will affect | An insult to accounting will be while posting of Salary Sheet. | – |

1. When Retuned on time. Image 1 No Actions

https://www.youtube.com/watch?v=_wW3yNg3mlM&list=PL3LzdsN_338DV29J5Uxhdwt48-U6Y9x8l&index=10

Road Map for Leaves and Absence Activities

https://www.youtube.com/watch?v=zY8bV0JKVnQ&list=PL3LzdsN_338ApoJnaVJxzGv03k0Z7McKy&index=5

Leave Questions in HRMS

https://www.youtube.com/watch?v=Pa0K7zdf05Q&list=PL3LzdsN_338DV29J5Uxhdwt48-U6Y9x8l&index=54

Leave Setup in HRMS

https://www.youtube.com/watch?v=J83sSEiRpNQ&list=PL3LzdsN_338ApoJnaVJxzGv03k0Z7McKy&index=3