Simplify Your Asset Management with the Fixed Assets Module

Overview:

The Fixed Assets module in Hinawi ERP provides an integrated solution for fixed asset management, covering the entire asset lifecycle—from initial registration and tracking to depreciation and final disposal. Seamlessly integrated with key modules such as Accounting, Real Estate, School Management, and Garage, the system ensures consistent financial reporting and eliminates manual errors through automation.

This integration enables accurate asset tracking and clear visibility into the financial and operational status of tangible assets across departments. Developed in Abu Dhabi, UAE, the module helps businesses maintain compliance, manage depreciation schedules, and improve capital investment decisions.

Unlocking the Secrets of Fixed Assets

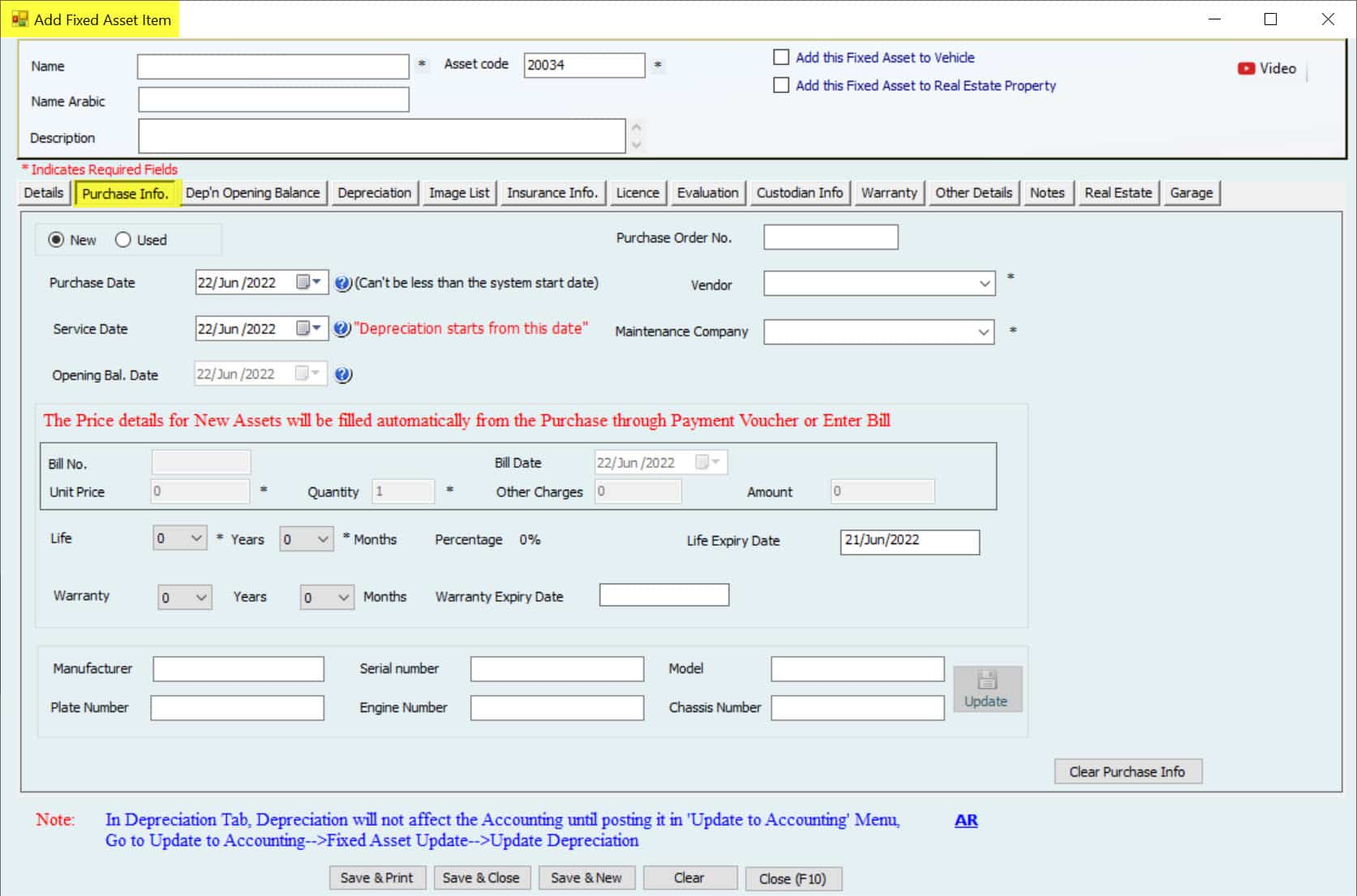

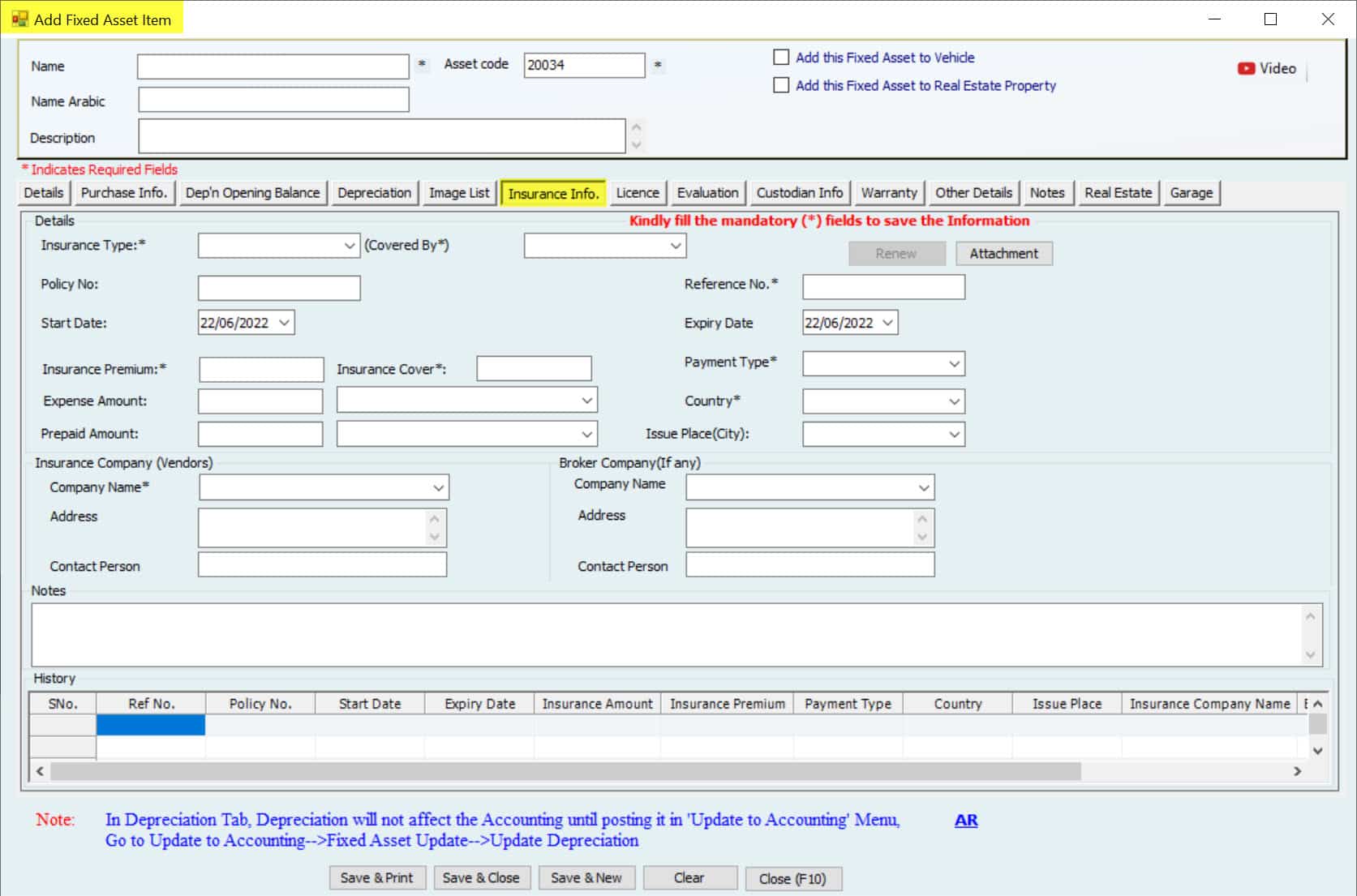

Users can register both new and existing assets in the system, including personal, depreciable, and real property items. Each asset entry requires essential details, including asset name, code, description, location, and department. The system also tracks asset classification, city, and the person responsible for each item, offering full visibility and control over fixed asset tracking.

Assets like land, real estate, equipment, vehicles, and computers can all be registered. Monthly depreciation is calculated automatically and reflected in the accounting module, covering original cost, accumulated depreciation, depreciation expense, and gain or loss from asset disposal.

The module includes useful features such as warranty tracking, maintenance schedules, asset images, and location data. Common asset types, such as office furniture and computers, are easily managed within the system. It also integrates with the HR and Payroll modules, allowing organizations to assign assets to employees and ensure proper asset returns upon termination or role changes.

This integration improves internal control, reduces manual workload, and enhances resource management. Users can generate detailed reports to track asset history and modifications, improving the accuracy of financial reporting.

It’s essential to distinguish fixed assets from current assets. While fixed assets are depreciated over time, this module also supports the tracking of amortization for intangible assets, ensuring complete financial visibility.

Depreciation

Hinawi ERP’s Fixed Assets module efficiently manages monthly straight-line depreciation for various tangible assets such as buildings, real estate, and equipment. The system automatically calculates depreciation every month and updates financial records accordingly. Depreciation stops once the asset is fully depreciated or disposed of, ensuring accurate financial tracking throughout the asset lifecycle and improving compliance with accounting standards.

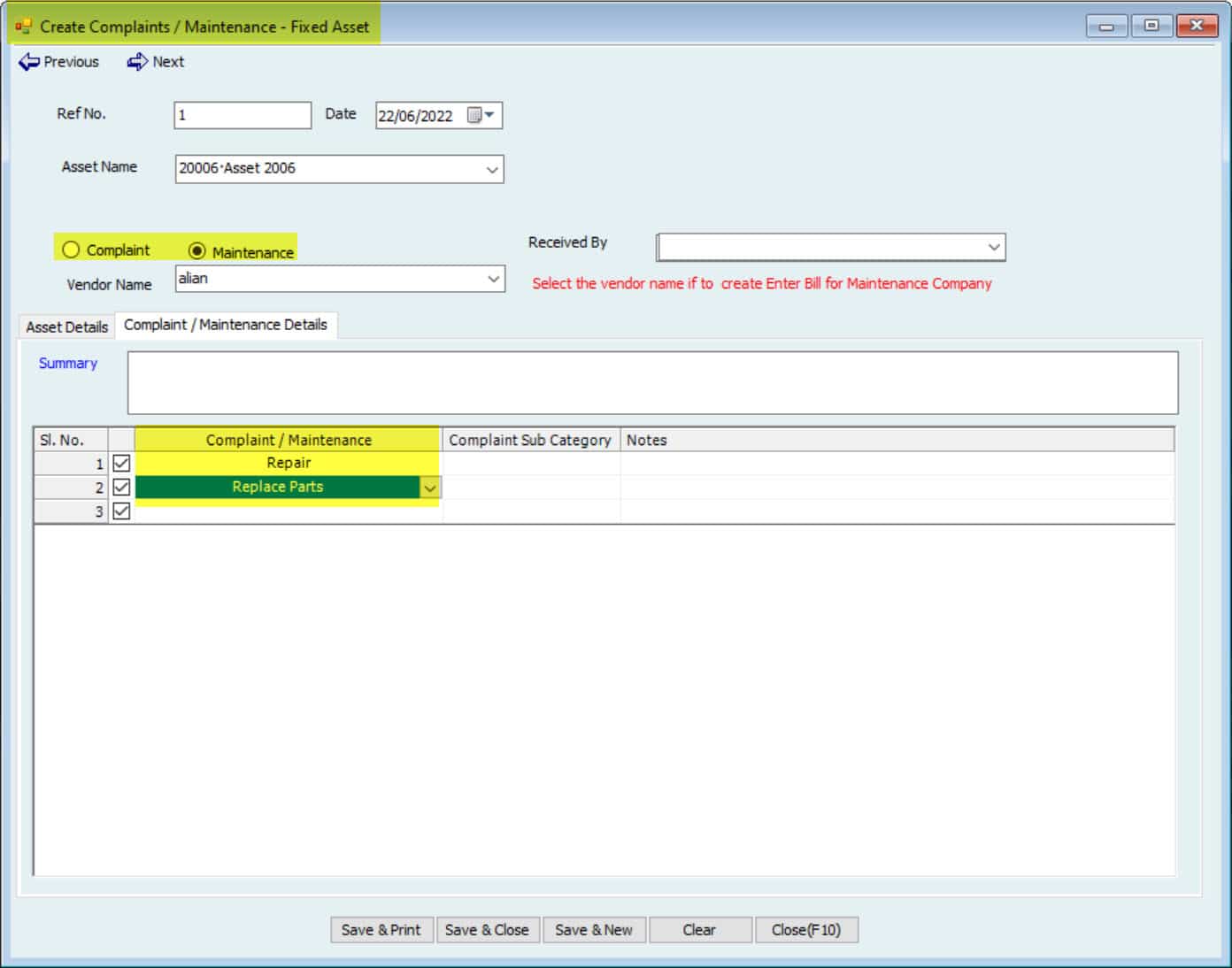

Maintenance

The maintenance feature in Hinawi ERP enables users to manage service requests and complaints, generate work orders, and issue invoices for completed tasks. This process improves resource utilization and helps businesses control maintenance expenses. The system integrates with the Accounting and HR modules to assign workers, accurately calculate maintenance costs, and manage related inventory. Job cards can be opened for condition-based maintenance, and work orders are tracked and closed to maintain financial accuracy and operational control.

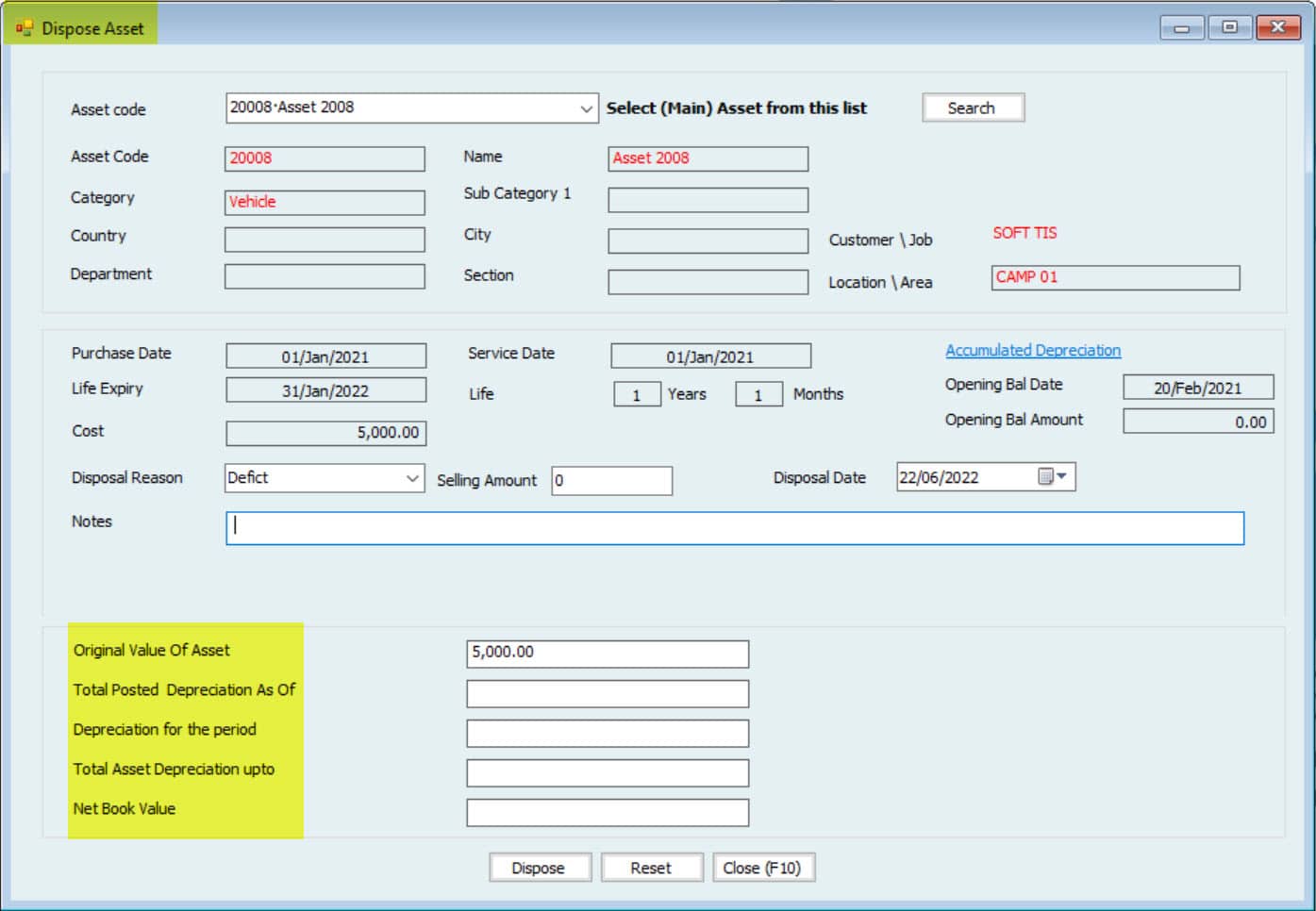

Disposal

The Disposal feature in Hinawi ERP allows for efficient handling of fixed asset retirement, whether through sale or full depreciation. The system meticulously calculates residual value, identifies profit or loss, and automatically updates financial records. Asset disposal can occur when an asset is no longer usable or is sold via the system’s intuitive interface. In both scenarios, depreciation is calculated through the disposal date, affecting the relevant profit and loss accounts. If a fixed asset is sold, revenue is recognized automatically, ensuring accurate, up-to-date financial statements without manual intervention. Keywords such as “asset management,” “financial reporting,” and “automated processes” highlight Hinawi ERP’s streamlined approach to managing the entire fixed-asset lifecycle.

Transfers Between Locations

When resources need to be relocated, the system tracks the transfer process between locations, departments, or projects with ease. The system automatically adjusts depreciation calculations based on the new location, ensuring that financial records remain accurate and all movements are fully documented.

One of the key features of the Fixed Assets module is the ability to seamlessly transfer resources between projects or departments.

Depreciation is calculated for the new project or department when a resource is transferred. Additionally, if the resource is used within the Contracting module of the Hinawi ERP system.

Depreciation is allocated to the project based on the resource’s usage duration, allowing businesses to determine the exact depreciation value for that specific project.

Integration with Other Modules

The Fixed Assets module in Hinawi ERP integrates seamlessly with other key modules, particularly Accounting, enabling automated financial updates to ensure accurate income statements and balance sheets. Each asset is linked to predefined accounts for original value, accumulated depreciation, depreciation expenses, and profit or loss on disposal. When an asset is sold, the system can generate an invoice and reflect the sale in the accounting records.

Monthly depreciation is calculated using the straight-line method, with the amounts recorded in both the balance sheet and the income statement. The module also integrates with the Garage Module for equipment and vehicle maintenance tracking, with HR and Payroll for asset assignment to employees, and with the Property Management Module for tracking leased or rented assets. This real-time integration enhances financial control and improves asset tracking across departments.

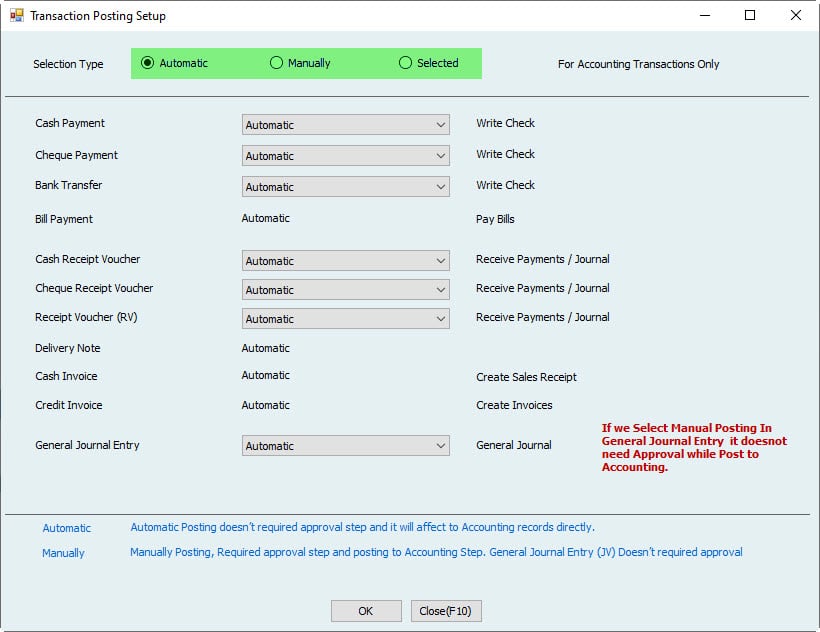

Settings

Hinawi ERP’s Fixed Assets module offers flexible configuration options that allow businesses to tailor the system to their specific operational and financial policies. Administrators can predefine resource classifications, account numbers, and depreciation methods to match internal workflows.

Users can set a custom activity start date for resource registration, apply monthly depreciation methods, and use custom fields to capture additional asset data. The system also supports linking profit and loss accounts for asset disposal and managing deferred invoice fields. These settings ensure that asset tracking and financial reporting align with company-specific policies and provide accurate data structure and control.

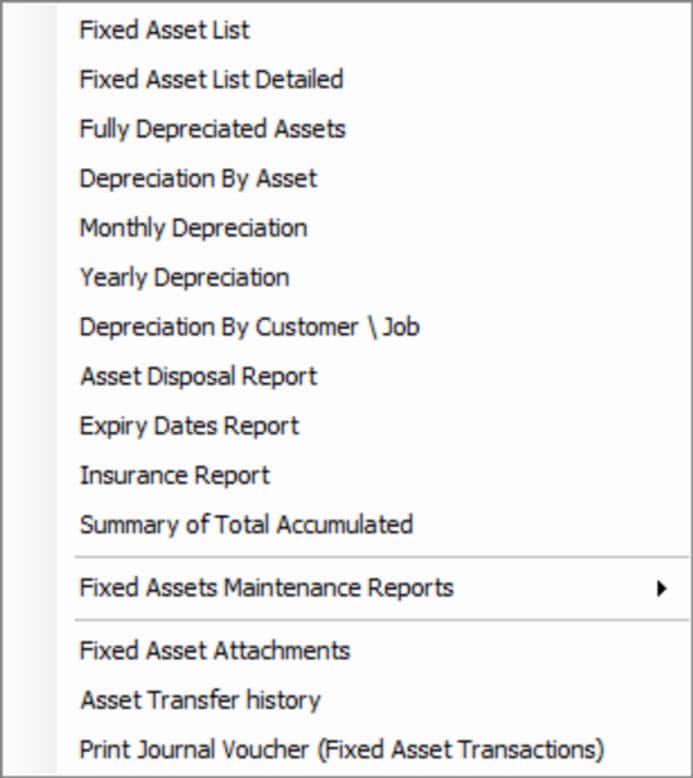

Reports of Fixed Assets

| Report Name | Description |

|---|---|

| Detailed Asset List | Displays a full list of registered assets, including relevant data such as classification and value. |

| Depreciation Report | Shows monthly and yearly depreciation for each asset, including rate and accumulated amount. |

| Expired Resources Report | List assets that have reached the end of their useful life or are fully depreciated. |

| Insurance Report | Provides details on insured assets along with associated insurance policy information. |

| Accumulated Depreciation Report | Tracks total depreciation amounts applied to each asset over time. |

| Maintenance Report | Displays maintenance activities performed on assets, including task history and related costs. |

| Attachment Report | Tracks documents or images attached to each asset for audit and verification purposes. |

| Transfer Movement Report | Logs movement of assets between departments, locations, or projects for traceability. |

| Accounting Entries Report | Shows detailed journal entries related to depreciation, asset disposal, and adjustments |

Standard Features of Hinawi ERP

| Feature | Description |

|---|---|

| User Interface and Usability | Hinawi ERP provides an intuitive, user-friendly interface for users of all skill levels. Customizable access permissions help improve security and streamline workflow across departments. |

| System Integration and Scalability | The system integrates seamlessly with Fixed Assets, HR, Real Estate, Garage, and School Management modules. It supports accurate tracking, reporting, and scalability for businesses of all sizes. |

| Installation and Configuration | Effective installation begins with evaluating existing systems. Users can tailor the software to their environment, ensure proper infrastructure, and conduct staff training for optimal performance. |

| Comprehensive Module Integration | All modules in Hinawi ERP are fully integrated within the same platform. A single interface gives access to all purchased modules. The Accounting module serves as the central hub for all financial transactions. |

| QuickBooks Accounting | Hinawi ERP was designed to complement QuickBooks and address functional gaps, particularly in the UAE and MENA region. It supports Arabic and English, includes advanced modules, and offers both batch and real-time posting—features not supported in QuickBooks. |

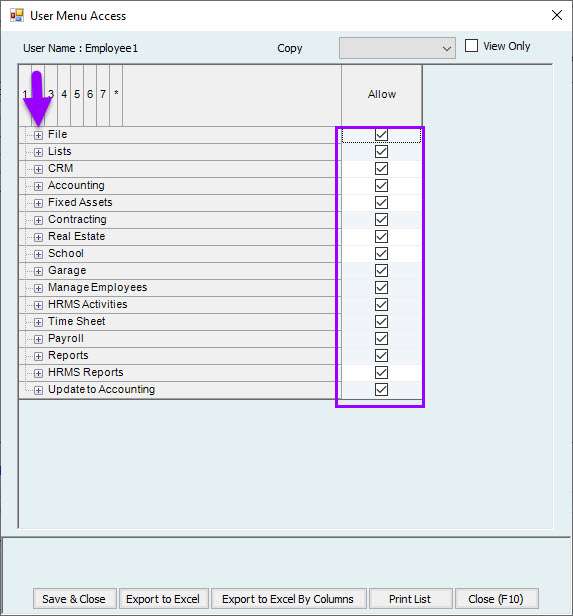

| Access Permissions | The system provides advanced access control, allowing administrators to assign specific permissions to each menu item. Permissions can be copied between users and set as “view only,” enhancing data security and operational control. |

| General Settings | Hinawi ERP offers extensive customization, including general system settings, user permissions, and legal configurations. It also supports template and field customization, advanced reports, and graphical analysis for businesses across the UAE and Arab countries. |

Frequency Ask Questions

The module helps track purchases, maintenance, depreciation, and disposal, improving efficiency, transparency, and financial control.

You can easily register items through the designated creation tab by entering details such as name, code, description, and classification.

The module offers reports, including resource lists, depreciation by item, monthly and annual summaries, and reports on disposed items.

The maintenance tab handles tasks such as creating and tracking work orders, managing complaints, and issuing related invoices.

Items can be transferred between locations, departments, or projects, with complete tracking and automatic depreciation recalculation based on the new location.

The module can record disposals, calculate the remaining value, and generate accounting entries for profit or loss, ensuring financial accuracy.

Depreciation is the process of allocating a resource’s cost over its useful life, gradually reducing its value due to wear and tear or obsolescence.

Straight-line depreciation is a method that allocates a resource’s cost evenly over its useful life, recording the same expense each year until full depreciation or salvage value is reached.

Accumulated depreciation is the total depreciation recorded over time, subtracted from the original cost of a resource in financial records.

It integrates seamlessly with accounting, garage, HR, payroll, and property management modules, ensuring smooth resource management across the system.

Module settings allow for customization of the system, including options for depreciation methods, custom fields, and profit/loss accounts for sales.

Salvage value is estimated based on the resource’s condition, expected useful life, and potential resale value.

Revaluations adjust a resource to reflect its current market value, recording the difference in a revaluation reserve and updating future depreciation accordingly.

The module enhances control by tracking operations, providing monitoring reports, and issuing alerts for data deficiencies or incomplete procedures.

When an item is sold or disposed of, the difference between its sale price and net book value is recorded as a gain or loss, and the item is removed from the records.

Fixed assets include long-term tangible items like buildings, machinery, vehicles, equipment, and furniture, which are used in business operations and have a useful life of more than one year.

A fixed asset is a tangible resource owned by a business, used in operations, and not expected to be sold quickly. It is depreciated over time as its value decreases due to use.

A fixed asset has a useful life over one year, is used in operations, is tangible, and is not for immediate sale. Its value depreciates over time.

Current assets are short-term, easily converted to cash, like inventory and receivables, while fixed assets are long-term and used in operations, depreciating over time.

Discover the secrets of Hinawi Software and gain new skills through exciting YouTube videos! Learn how to improve your performance as a user of the software, master accounting and payroll management operations, and get ready for a promising future as a university student. Click here to find out more: [Videos Link]