End of Service (EOS) Process in Hinawi ERP

Introduction

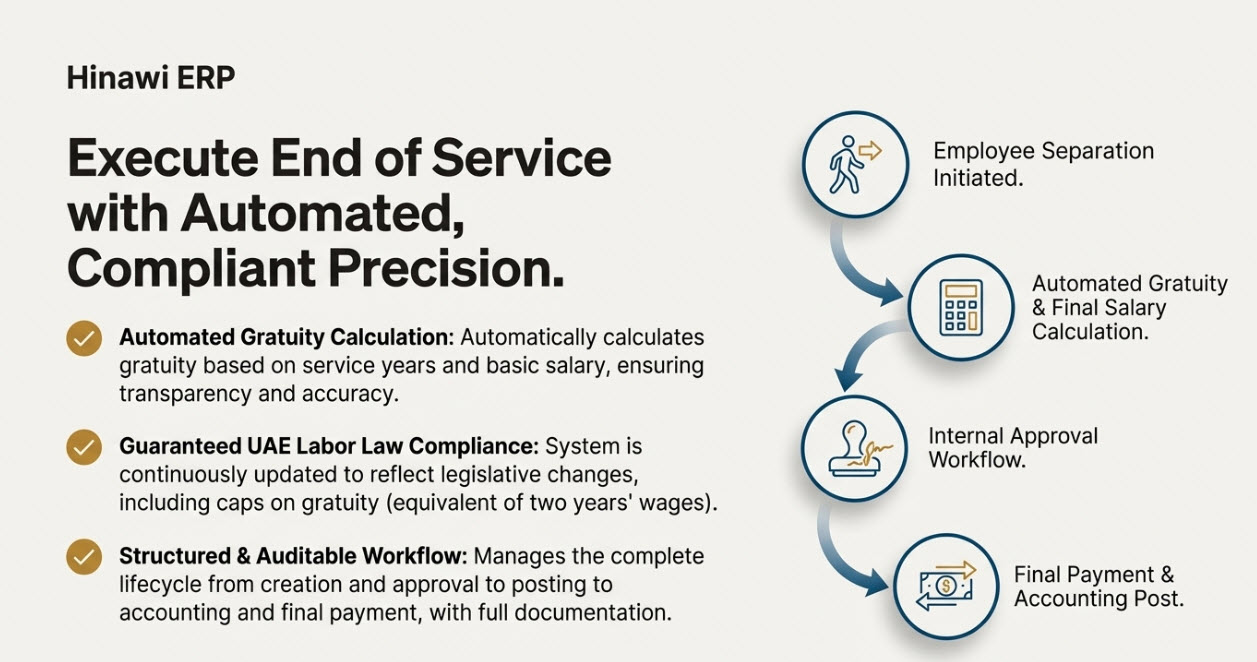

End of Service (EOS) is the formal process of concluding an employee’s service with a company, whether due to resignation, retirement, termination, or contract expiration. In Hinawi ERP, the EOS process is automated, structured, and aligned with UAE labor laws and internal HR policies. It ensures that every step—from verification and approval to payment—is accurate, efficient, and fully documented.

What is Employee End of Service in HRMS?

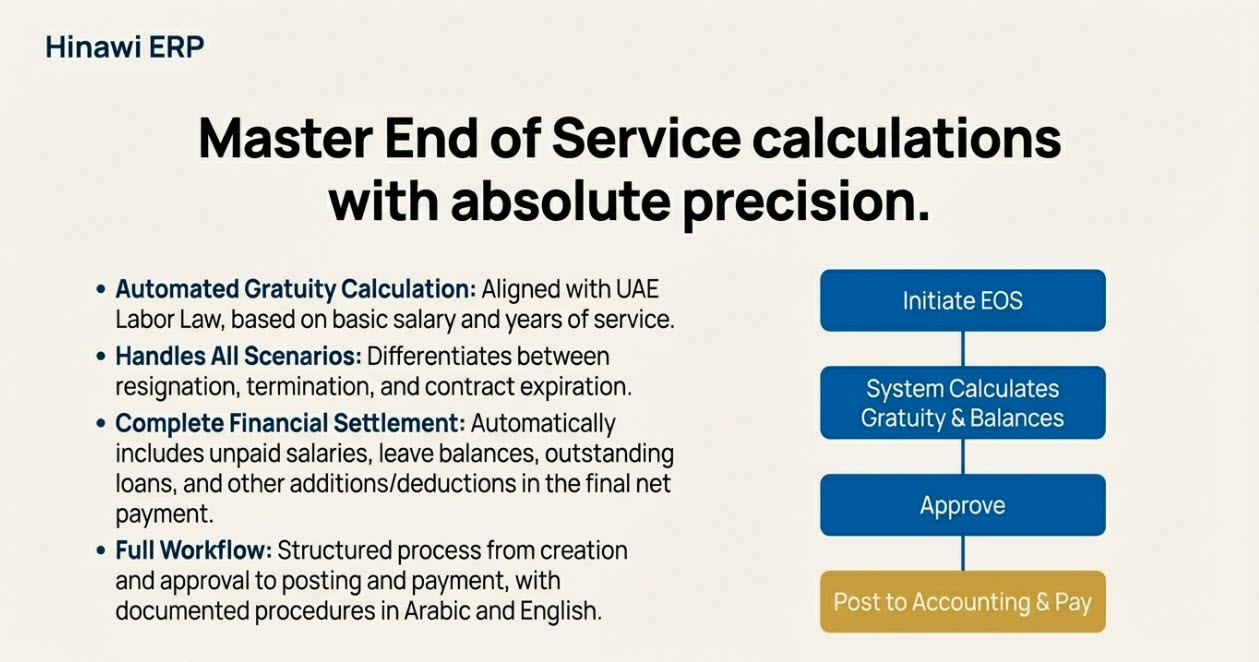

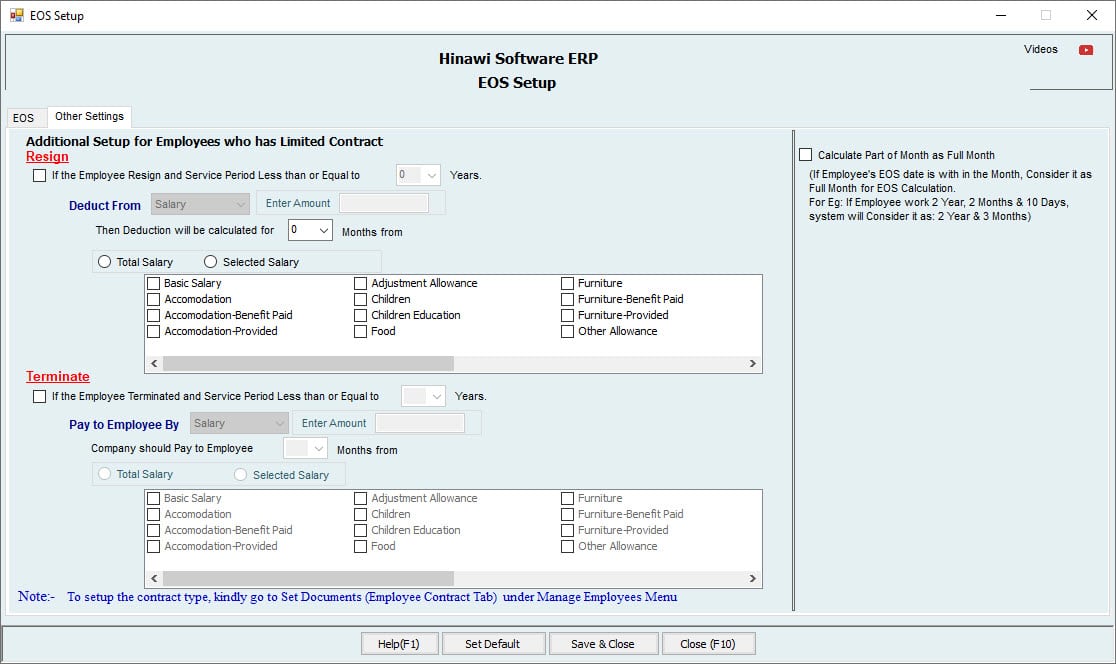

In HRMS, the End of Service workflow registers an employee’s final departure and processes their final entitlements. The process includes salary settlements, gratuity calculations, outstanding balances, and system updates to reflect the employee’s termination status. In Hinawi ERP, the EOS function includes complete lifecycle tracking—creation, approval, editing, deletion (if unapproved), posting to accounting, and payment.

The system allows HR users to define the termination reason, select a payment method (cash, cheque, or bank transfer), and generate a printed form for internal handovers and clearance. EOS activities are fully integrated into the HRMS Activities menu and include manuals and workflow documentation in both English and Arabic.

EOS Workflow for HR and Timesheet Employees

For HR Employees

The EOS process typically begins mid-month (e.g., the 15th). Before starting, HR must ensure that all HRMS activities and salary sheets from previous months are approved and paid. Create the EOS using the system-generated form, which includes the remaining salary (e.g., 1st to 14th). Edit or delete the EOS record if needed (before approval). Approve and post the EOS to the accounting system using QuickBooks integration. Pay EOS and Salary in a single payment voucher through “Payment of Activities.” If applicable, use the “Receive Payment for EOS Final Settlement” screen to recover unpaid employee amounts (e.g., loans). This step is only available if the final EOS amount is negative. Note: HR users cannot pay the 14-day salary separately. It must be processed within the EOS window.

For Timesheet Employees

If an employee resigns on the 15th, the HR team should complete the first 14 days in the Timesheet. Mark the remaining days as Absence and set “Calculate” to NO. Generate and approve the 14-day salary sheet, then process payment. Create EOS on the resignation date. Approve, post, and pay EOS just like the HR process. Recover unpaid dues from employees (such as loans) through the Final Settlement screen when needed.

Gratuity, Payroll, and UAE Labor Law Compliance

What is Full Gratuity Pay and How Is It Calculated?

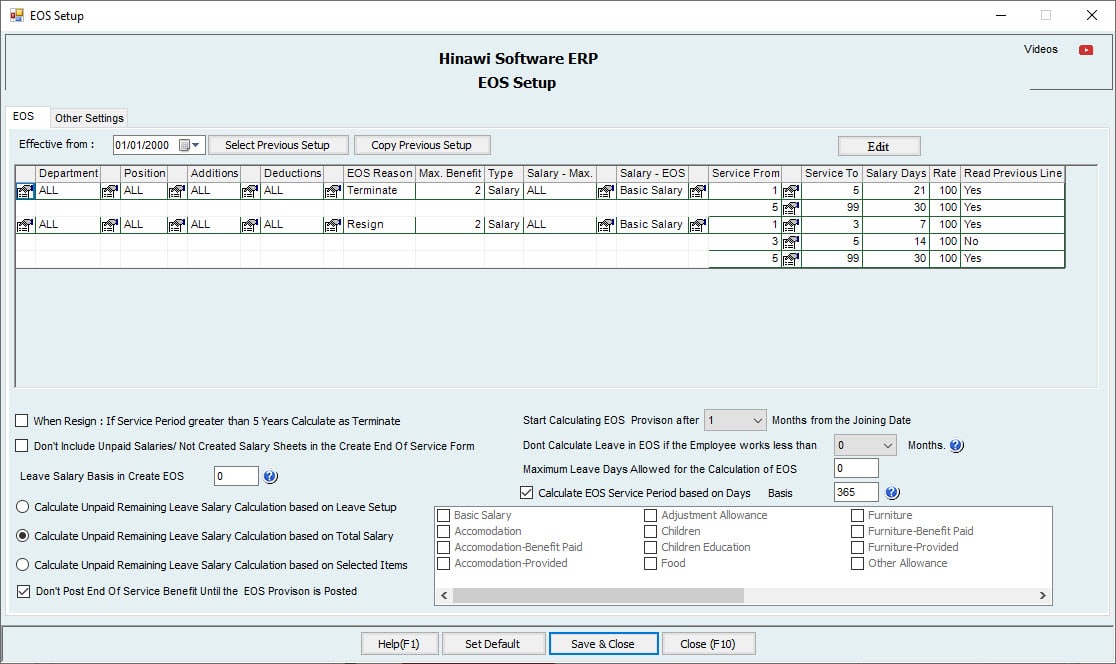

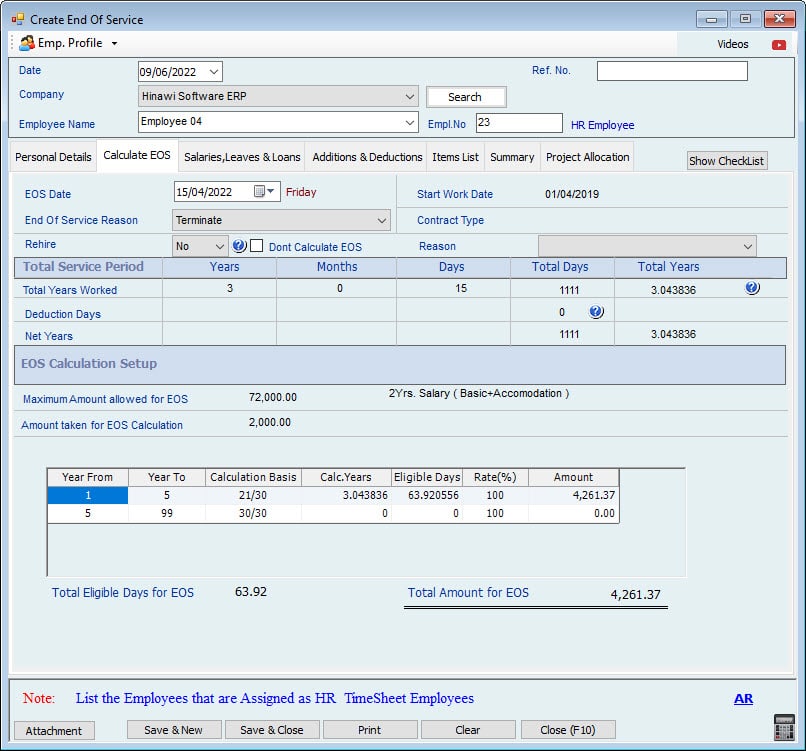

Gratuity pay is a lump-sum end-of-service benefit paid to eligible employees based on their basic salary and years of service. Hinawi ERP automates this calculation using straight-line formulas compliant with the UAE Labor Law, ensuring transparency and accuracy.

How Do UAE Labor Law Changes Affect EOS Calculations?

Recent labor law reforms in the UAE emphasize fairness and accuracy in EOS entitlements, especially regarding the base salary component. Employers must calculate gratuity based solely on the basic salary, excluding allowances. Hinawi ERP is regularly updated to reflect these legislative changes, helping companies stay compliant.

Are There Payroll Tools That Help With EOS Calculations?

Yes. Hinawi ERP includes built-in payroll features that automatically calculate gratuity, unpaid leave, benefits, and final payouts, ensuring accuracy, audit readiness, and compliance with UAE labor laws.

Is There a Cap on Gratuity in the UAE?

Under UAE labor law, gratuity is typically capped at two years’ wages. Hinawi ERP’s calculation engine incorporates such caps and conditions where required, ensuring proper application in EOS processing.

Additional EOS Features in Hinawi ERP

Unpaid Additions and Uncollected Payments

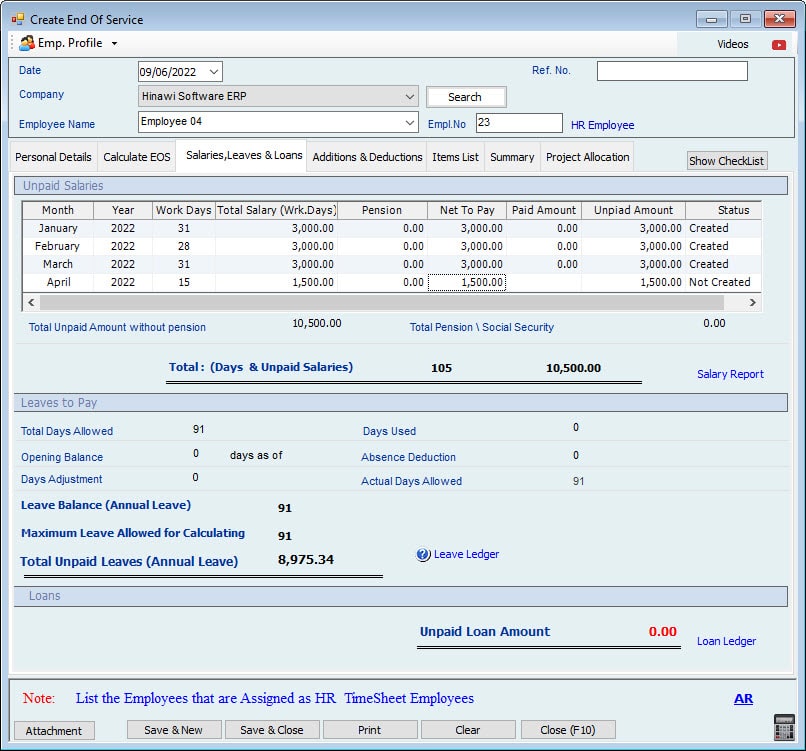

If recurring additions or deductions are scheduled beyond the EOS date, the system automatically calculates outstanding balances. These are displayed in the EOS summary tab and adjusted in the Net to Pay amount.

Documented Workflow and Manuals

Hinawi ERP provides EOS manuals in Arabic and English, with detailed instructions and visual workflows, ensuring HR teams follow a consistent, legally compliant process.

Gratuity and Payroll Integration

EOS benefits are directly posted to accounting, updated in payroll, and included in employee records for audit and reporting purposes.

Final Note

To ensure accurate, compliant results, users must understand their company’s HR policies and UAE labor laws before processing EOS in the HRMS module. Hinawi ERP ensures that all absence tracking, salary processing, gratuity pay, and final settlements are handled professionally—with full visibility, automation, and documentation.

End of Service (EOS) Work Process

End of Service (EOS) Work Process

HR and Time Sheet Employees

Kindly go to HRMS Activities (Menu), then select End of Service

End of Service Process for the HR Employees:

If an Employee is on the 15th of the month, the process will be

Verify the Status of Previous HRMS Activities:

Verify the status of the previous month’s HRMS Activities and Salary sheets.

Approval of all HRMS Activities of previous months:

All HRM Activities of Previous months should be Complete, Approved, and paid from the System.

Approval of Salary sheet of previous months:

All Salary Sheets for Previous months should be Complete, Approved, and paid from the System.

End of Service with Salary Sheet

Create EOS with Salary sheet.

Create the End of Service:

Create the End of Service on the 15th and the Salary of Salary4 working days (1st to 14th) System will automatically create the End of Service Form.

Edit/ Delete End of Service:

Users can also edit or delete the End of Service after creating.

Approve End of Service:

After creating the End of Service, the User will approve the End of Service.

Post of End of Service:

When the End of Service is approved, the User must Post the End of Service in QuickBooks the Accounting effect. For the posting, kindly go to (Update to QuickBooks—–HRMS Update———-Post EOS Benefit)

Pay End of Service:

Pay the EOS and 14 working days’ Salary from this Pay End of Service window in one Payment Voucher (PV) under HRMS Activities (Payment of Activities—–Pay End of Service). The mode of payment for the End of Service is reading from the pre-defined Setup in the set Setup Setup & benefits window.

Receive Payment for EOS Final Settlement:

After creating the End of service, if Company still has to receive some Amount from the Employee side, the Employee lipoid Loan, in this carmaker User can make the final settlement from the (Receive Payment for EOS Final Settlement) window. For this, Kindly go to them;

(HRM Activities ———Receiving from Employees——– Receive Payment for EOS Final Settlement)

The Company can create Receiving Voucher (RV) and receive the final settlement payment from the Employee side. But this option will only apply if the End of Service Final Settlement Amount is less than Zero.

Note:

The HR Employees User cannot pay the Salary separately from the sheet. Use Salary only pays the Salary of the Salary ways within the End of the Service window.

End of Service Process for the Timesheet Employees:

If an Employee resigns on Employees of the month, the process will be as follows;

Verify the Status of Previous HRMS Activities:

Verify the status of the previous month’s HRMS Activities and Salary sheets.

Approval of all HRMS Activities of previous months:

All HRM Activities of Previous months should be Complete, Approved, and paid from the System.

Approval of Salary sheet of previous months:

All Salary Sheets from Previous months should be completed, Approved, and paid from the System.

Salary Sheet:

Complete the process of the Salary Sheet as usual.

Create the Timesheet and Save:

Create the Timesheet for 14 days. And the rest of the Days from the 15th to the 31st, create the absence in the Timesheet for these days and select the Calculate column “NO.”

Create Salary Sheet & Approved:

Then create the Salary sheet for the 14 days the Employee works and approve the Salary.

Pay the Salary from the Salary Sheet:

Then Pay the 14 days of Salary from the Salary Sheet; Salary User has the option to pay this 14th Days Salary with the EOS Payment Salary

End of Service with Salary Sheet

Create EOS with Salary sheet.

Create the End of Service:

Create the EOS on the resignation Date of the 15th of the month.

Edit/ Delete End of Service:

Users can also edit or delete the End of Service after creating.

Approve End of Service:

After creating the End of Service, the User will approve the End of Service.

Post of End of Service:

When the End of Service is approved, the User must Post the End of Service in QuickBooks for the Accounting offer the posting. Kindly go to (Update to QuickBooks—–HRMS Update———-Post EOS Benefit)

Pay End of Service:

Pay the EOS from the Payment of Activities window. The Payment Mode for the EOS is reading from the pre-defined Setup of the Mode of Payment (Cash, Cheque, bank transfer) which User has selected in the set Salary & benefits window.

Receive Payment for EOS Final Settlement:

After creating the End of Service, if Company still has to receive some Amount from the Employee side, like an unpaid Loan, in Employee, the User can make the final settlement from the (Receive Payment for EOS Final Settlement) window. For this, Kindly go to them;

(HRM Activities ———Receiving from Employees——– Receive Payment for EOS Final Settlement)

The Company can create a Receipt Voucher (RV Company the final settlement payment from the Employee side. But this option will only apply if the End of Service Final Settlement Amount is less than Zero.

Note:

For the Time Sheet Employees, users can pay the Salary separately from the Salary sheet or the Salary with the Salary.

Important Note for Salary & Timesheet Employees:

Templates are created through Addition & Deduction Activities, and if the option selected is Every Month automatically, and the Template Stop Date is greater than the End of Service Date, the System will automatically calculate the outstanding unpaid Amount by Employee or by Company, and this Amount will be shown in the create End of Service window in the Summary Tab by the below-mentioned Names;

Unpaid Additions

Uncollected payment.

After the adjustment of Unpaid Addition to Employee or Uncollected payments from the Employee, in the End, the final Amount will be shown in (Net to pay).

And when the User Pay EOS from the Payment of Activities (Menu), the Actual Amount will show after adjusting the Unpaid Additions to Employee and Uncollected Payments from the Employee.

| A. Create Form | B. approvals | C. Post to Accounting | D. Payments / Collection | Memo |

| Create EOS. Payment of EOS will be Through Payment Voucher only. |

Approve EOS is the required System. | The System will calculate all amounts due to Employee, including Unpaid salaries, EOS, Leave, Additions, Deductions, Items not returned, Loans, and the penalty on the Company if terminated Employee before the limited Contract end. And penalty on the Employee if Resign before limited Contract end. |

By Cash or Cheque or Bank Transfer only. The payment mode is based on the Setup. The Employee must refund the Company if the total calculation of EOS dues is more minor than penalties. Or less than Items not refunded. Refund will be by Receipt Voucher. |

Admin can make a Predefined Setup to link the EOS with Char the t of Accounts. When the payment is created, the Debit Side will display automatically from the previous step posting. |

https://youtu.be/pL-Tj6Mqn3shttps://www.youtube.com/watch?v=Us3H2-d5mhI&list=PL3LzdsN_338BMA58hk588ReODoVANiy3y&index=4

EOS Setup in HRMS

https://www.youtube.com/watch?v=dbuILY7VPeE&list=PL3LzdsN_338DMNuu4v26sDhGOr5GcJ8yB

إجراءات نهاية الخدمة في نظام شؤون الموظفين

Youtube

Facebook

Instagram

X-twitter

Discover the secrets of Hinawi Software and gain new skills through exciting YouTube videos! Learn how to improve your performance as a user of the software, master accounting and payroll management operations, and get ready for a promising future as a university student. Click here to find out more: [Videos Link]