E-Invoicing Jordan – Overview

e-invoicing in Jordan is mandatory and regulated by the Income and Sales Tax Department.

The system is operated through the national platform JOFOTARA, which standardizes invoice issuance and reporting across the Kingdom.

Is E-Invoicing Mandatory in Jordan?

Yes. E-Invoicing in Jordan is mandatory and implemented in phases, as per directives issued by ISTD.

The obligation applies gradually to:

VAT-registered companies

Businesses issuing tax invoices

Commercial and service providers

Companies are subject to income and sales tax regulations

Each phase specifies a timeline and scope defined by ISTD.

Key Requirements of E-Invoicing Jordan

To comply with Jordanian e-invoicing regulations, an electronic invoice must include:

Unique invoice number and sequence

Invoice issue date and time

Seller name and tax number

Buyer details (where applicable)

Description of goods or services

Invoice value before tax

Sales tax amount

Total invoice amount

QR Code generated according to specifications

Electronic submission or readiness for submission to JOFOTARA

All invoices must be stored securely and made available for audit when required.

How Hinawi ERP Supports E-Invoicing in Jordan

Hinawi ERP provides a fully compliant, integrated e-Invoicing solution for Jordan, designed to meet ISTD and JOFOTARA requirements without requiring additional systems or manual work.

Key Capabilities

Electronic invoice generation compliant with Jordanian tax laws

Automatic calculation of sales tax

Built-in QR Code generation

Secure electronic archiving of invoices

Full integration with the Accounting Module

Readiness for integration with JOFOTARA

Accurate reporting aligned with tax audit requirements

Built-In Compliance, Not End-of-Year Adjustments

Unlike many systems that treat e-invoicing as an external or post-transaction process, Hinawi ERP handles compliance from the moment the transaction is recorded.

No manual adjustments at year-end

No duplicate data entry

No external invoicing tools

Accounting entries are generated automatically and accurately

This approach significantly reduces errors, workload, and audit risks.

E-Invoicing Jordan and Tax Audits

Using a compliant ERP system like Hinawi ERP helps businesses:

Maintain consistent data between invoices and accounting records

Simplify tax inspections and audits

Reduce penalties and compliance risks

Improve transparency and financial control

All invoice data remains traceable, structured, and aligned with Jordanian tax regulations.

Why Choose Hinawi ERP for E-Invoicing Jordan?

Designed for regional tax compliance

Proven ERP system with integrated accounting

Supports long-term regulatory changes

Eliminates dependency on third-party invoicing tools

Scalable for companies of all sizes

Hinawi ERP ensures that e-Invoicing Jordan compliance becomes a standard operational process rather than a regulatory burden.

Official e-invoicing requirements in Jordan are issued by the Income and Sales Tax Department (ISTD) https://istd.gov.jo

Hinawi ERP integrates e-invoicing Jordan directly with its Accounting Module to ensure accurate financial reporting https://hinawierp.com/accounting/

e-invoicing Jordan helps businesses maintain accurate financial records while meeting regulatory requirements set by the Income and Sales Tax Department. By using a compliant ERP system, companies can ensure consistency between issued invoices, tax reports, and accounting records, which significantly simplifies audits and reduces compliance risks. This structured approach supports long-term operational stability and financial transparency.

Hinawi ERP provides a structured and compliant approach to e-invoicing Jordan through full accounting integration.

JOFOTARA INTEGRATION WITH HINAWI SOFTWARE

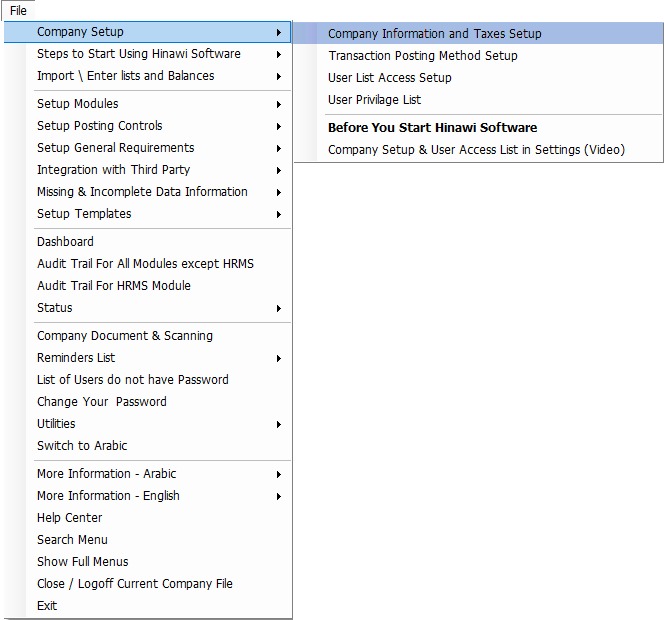

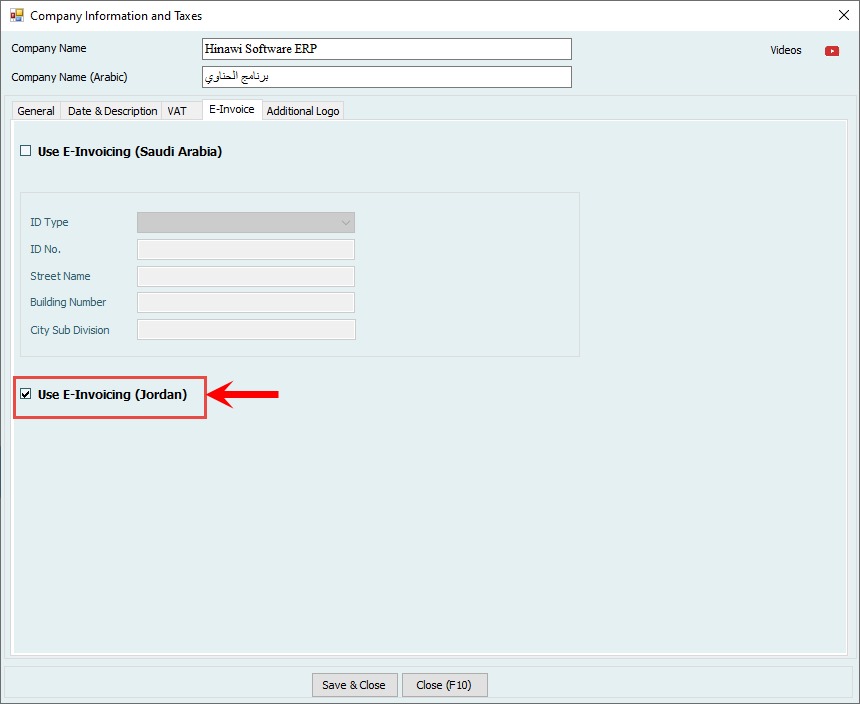

- Set Up for E-Invoice JORDAN (Should be Configured by Hinawi Software Team)

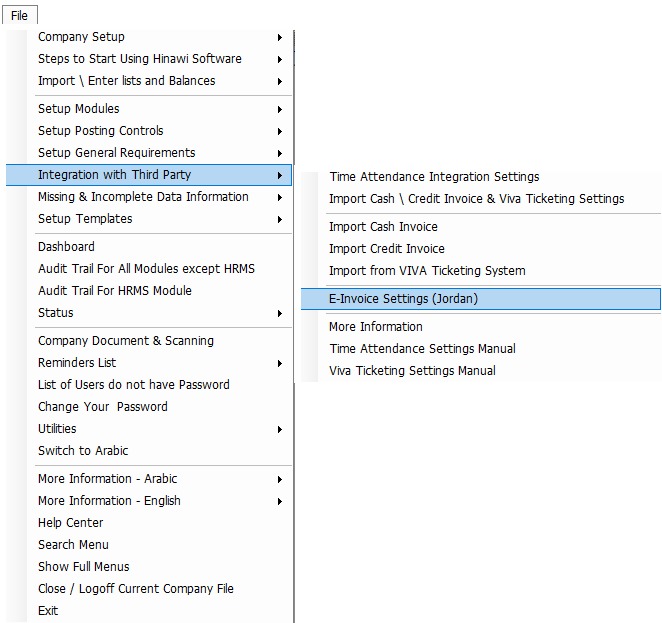

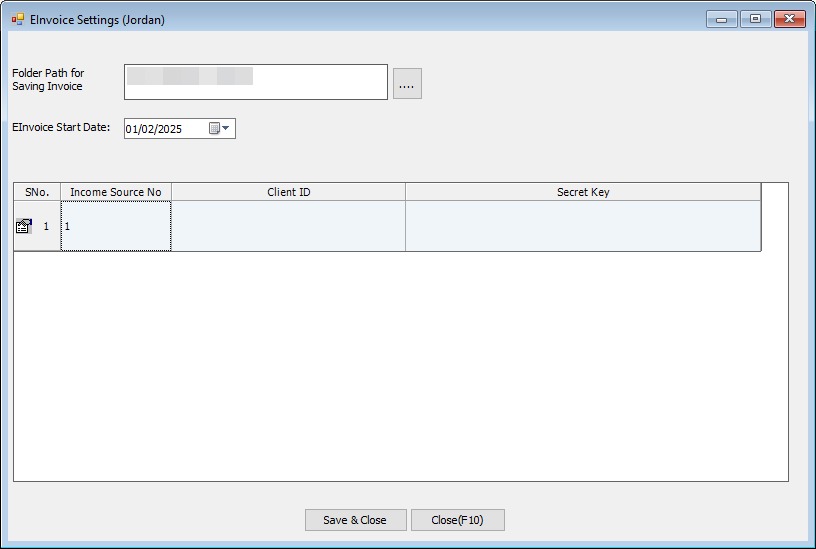

- E-Invoice Settings (Should be Configured by Hinawi Software Team)

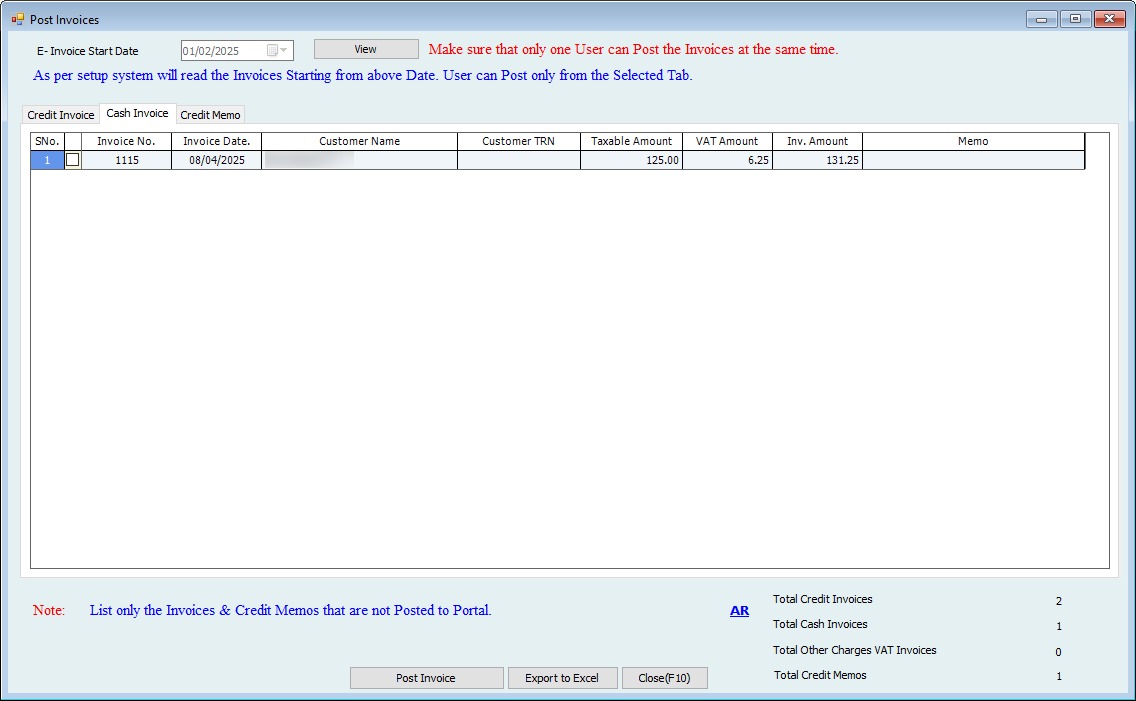

The system will read the Invoices, Sales Receipts, and Credit Memos from the E-Invoice Start Date.

Important:

Explorer Computer Sole Proprietorship L.L.C will do this setting.

Users must not modify their settings.

For any Changes needed, please contact the Hinawi Software Customer Support team.

- Reporting Invoices to JOFOTARA Portal (User Screen for Posting)

The system will display all Invoices, Sales Receipts & Credit Memos from the E-Invoice Start Date.

The user will tick the Invoices and click Post Invoices.

Important:

Only one user may post the Invoice at a time.