Posting Financial Outputs from HR to Accounting

Introduction:

The accounting system is an essential component of Hinawi Software, serving as the repository for all financial outputs from the program’s modules.

Posting to accounting is a single click, eliminating the need for manual entry, preparation, or Excel export, as the software automatically generates these entries.

The system includes the posting of vacation salaries, employee tickets, loan amounts, and end-of-service benefits to accounting. It also outlines provisions for vacation pay, travel expenses, and end-of-service benefits.

These operations improve the accuracy of financial records, ensure compliance with the company’s financial policies, save time, and enhance control.

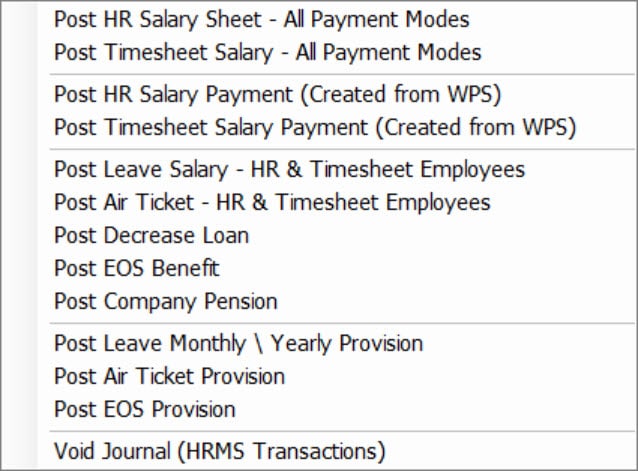

Screen Contents:

– Post HR Salary Sheet – All Payment Modes

– Post Timesheet Salary – All Payment Modes

– Post HR Salary Payment (Created from WPS)

– Post Timesheet Salary Payment (Created from WPS)

– Post Leave Salary – HR & Timesheet Employees

– Post Air Ticket – HR & Timesheet Employees

– Post Decrease Loan

– Post EOS Benefit

– Post Company Pension

– Post Leave Monthly/Yearly Provision

– Post Air Ticket Provision

– Post EOS Provision

– Void Journal (HRMS Transactions)

In general, the posting of procedures from the accounting system is of two types:

- Real-time posting: When a transaction is saved, it immediately affects the final financial reports.

- Batch Posting: The user must approve the outgoing procedures and then post, after which the impact is reflected in the financial reports.

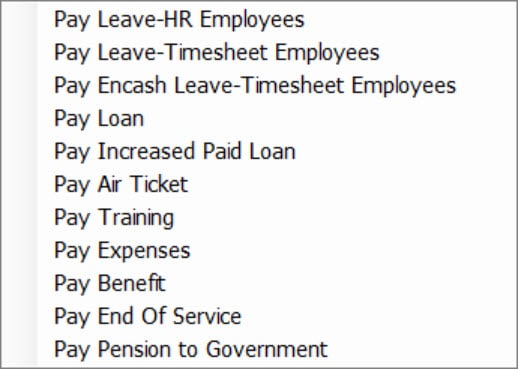

The Relationship Between HR and Payroll Procedures and Payments in the Accounting System

The attached screen illustrates the relationship between HR and Payroll procedures in the Hinawi Software and the accounting system. These procedures represent the method of making payments related to HR through the forms available in the accounting system.

Hinawi Software users should make payments using the procedures listed on the screen and should not go to the accounting menu to make direct payments. The advantage of using the payment screen provided is that it updates the procedure status to “Paid,” preventing duplicate payments.

If you go directly to the accounting menu and make the payment there, the procedure status will not change to “Paid,” which can lead to duplicate payments and loss of internal control. This is where the importance of this screen comes in.

These procedures include:

– Pay Leave – HR Employees

– Pay Leave – Timesheet Employees

– Pay Encash Leave – Timesheet Employees

– Pay Loan

– Pay Increased Paid Loan

– Pay Air Ticket

– Pay Training

– Pay Expenses

– Pay Benefit

– Pay End Of Service

– Pay Pension to the Government

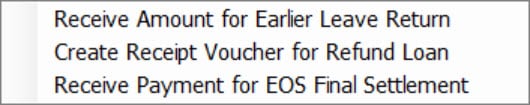

The Relationship Between the HR and Payroll Module and Receivables from Employees and Their Impact on Accounting

The attached screenshot illustrates the relationship between the HR and Payroll modules in Hinawi Software and the accounting module for employee receivables. This relationship includes the following procedures:

- Receive Amount for Earlier Leave Return

- Create a Receipt Voucher for the Refund Loan

- Receive Payment for EOS Final Settlement

These procedures outline how to handle employee receivables and record them in the accounting module to ensure the accuracy and integrity of financial transactions. This relationship facilitates the automatic recording of all employee-related receivables in the accounting module, ensuring that financial accounts are updated promptly and accurately.

When receivables are selected from this list, the procedure status is affected by their nature. However, if the accounting menu is used directly to create receipt vouchers, the procedure status in the HR module will not be updated correctly.

Discover the secrets of Hinawi Software and gain new skills through exciting YouTube videos! Learn how to improve your performance as a user of the software, master accounting and payroll management operations, and get ready for a promising future as a university student. Click here to find out more: [Videos Link]