Powerful Accounting Module in Hinawi ERP - Optimize Your Finances

Overview

Financial accounting includes integrated procedures such as payment cycle management, receivables cycle management, sales and purchase cycles, manufacturing processes, inventory and warehouse management, and other accounting functions.

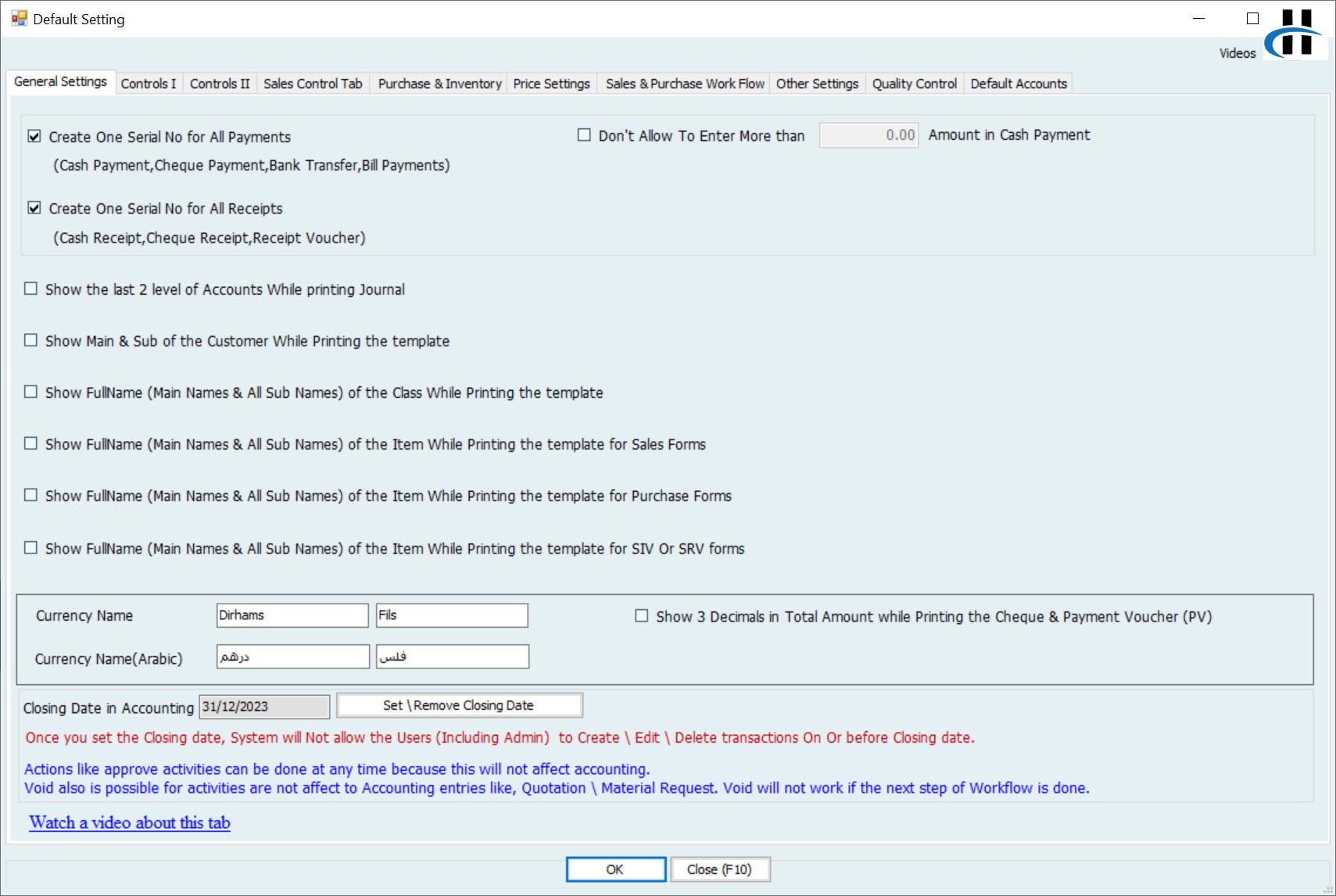

Additionally, the module provides two options for transaction posting: real-time posting or batch posting. Batch posting allows for flexibility, enabling approvals before transactions are finalized.

Hinawi ERP supports electronic invoicing, allowing invoices to be issued and tracked in compliance with government regulations.

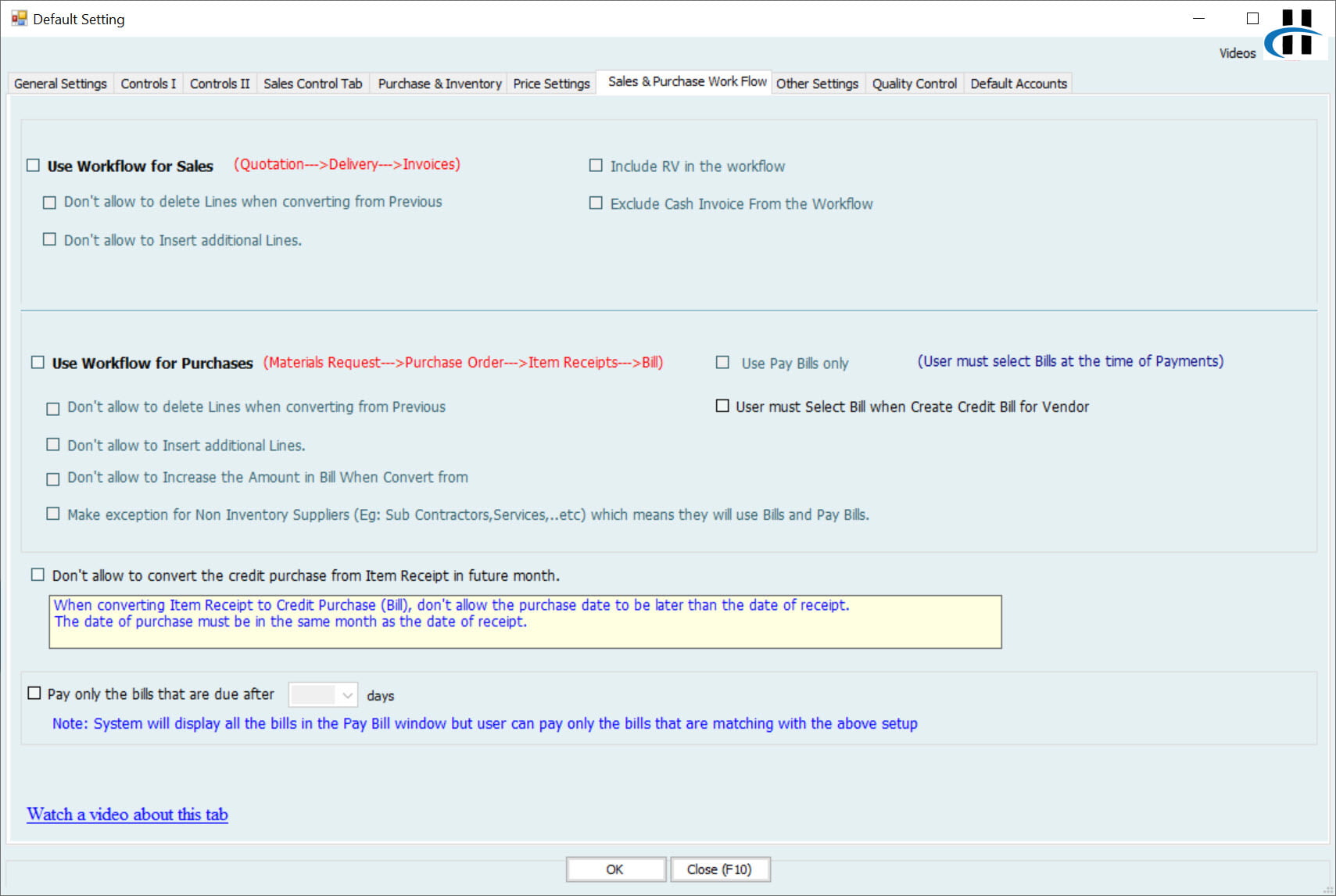

The module covers the entire sales and purchase process, from inquiries to delivery notes, eliminating the need for accountants to create orders manually. It also includes features for inventory and manufacturing management.

Designed to be customizable, the system supports sorting in Arabic and English, catering to businesses’ diverse needs.

A system demonstration can be arranged by contacting the mobile or WhatsApp number +971506228024

Sales Workflow Automation for Smarter Business

The sales workflow in Hinawi ERP’s accounting module empowers business owners to manage and track their sales processes with precision and flexibility. It offers real-time updates and complete control over every sales stage, from customer inquiry to final payment status.

It begins with creating a quotation or estimate that includes detailed product selection, item prices, and related costs. Users can easily edit, print, share, or delete these documents. Once finalized, authorized personnel can approve the document, triggering the next steps in your business’s daily operations. If revisions are required, approval can be canceled, allowing for real-time document updates and customer interaction.

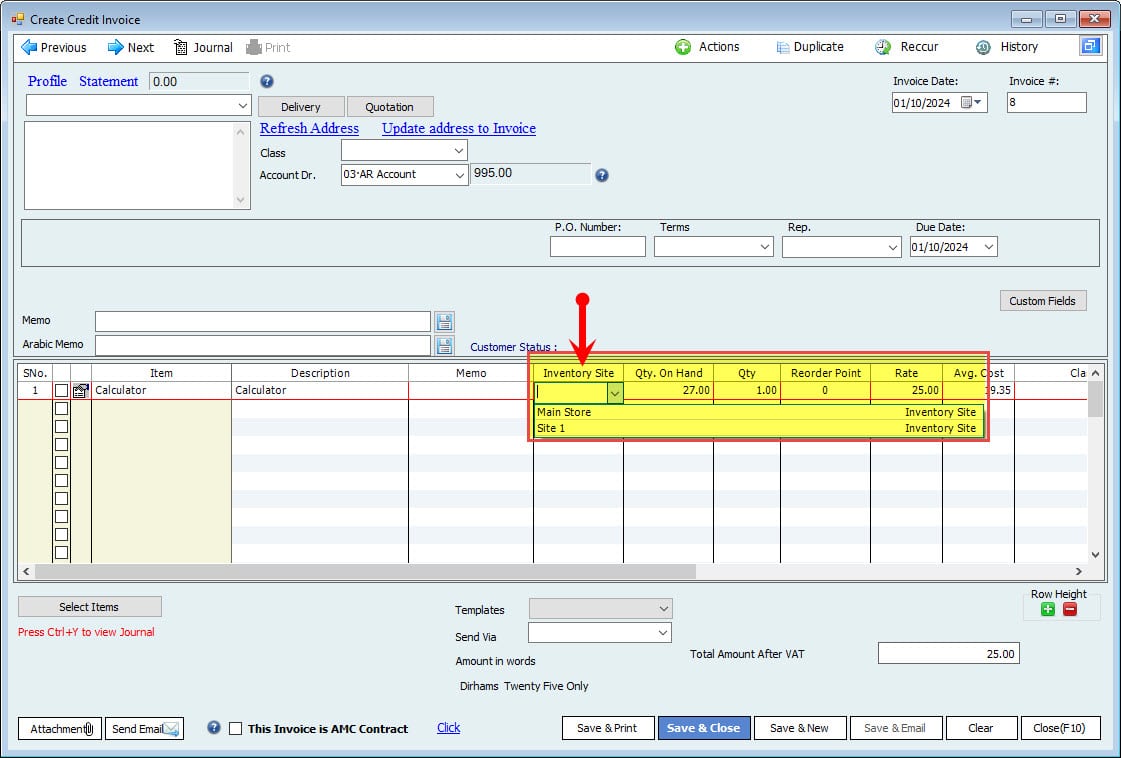

Approved quotes can generate delivery orders or invoices, and custom templates can be saved for future use—streamlining retail sales, reducing repetitive tasks, and ensuring consistency. The Order in Progress feature allows users to monitor ongoing business operations, track inventory sales, and manage stock levels efficiently. The Order Status History function enables tracking order changes to enhance customer experience and ensure service accuracy.

Hinawi ERP also supports Annual Maintenance Contracts (AMC), allowing businesses to move approved or completed contracts into a centralized AMC list. This simplifies tracking and managing ongoing agreements in one place.

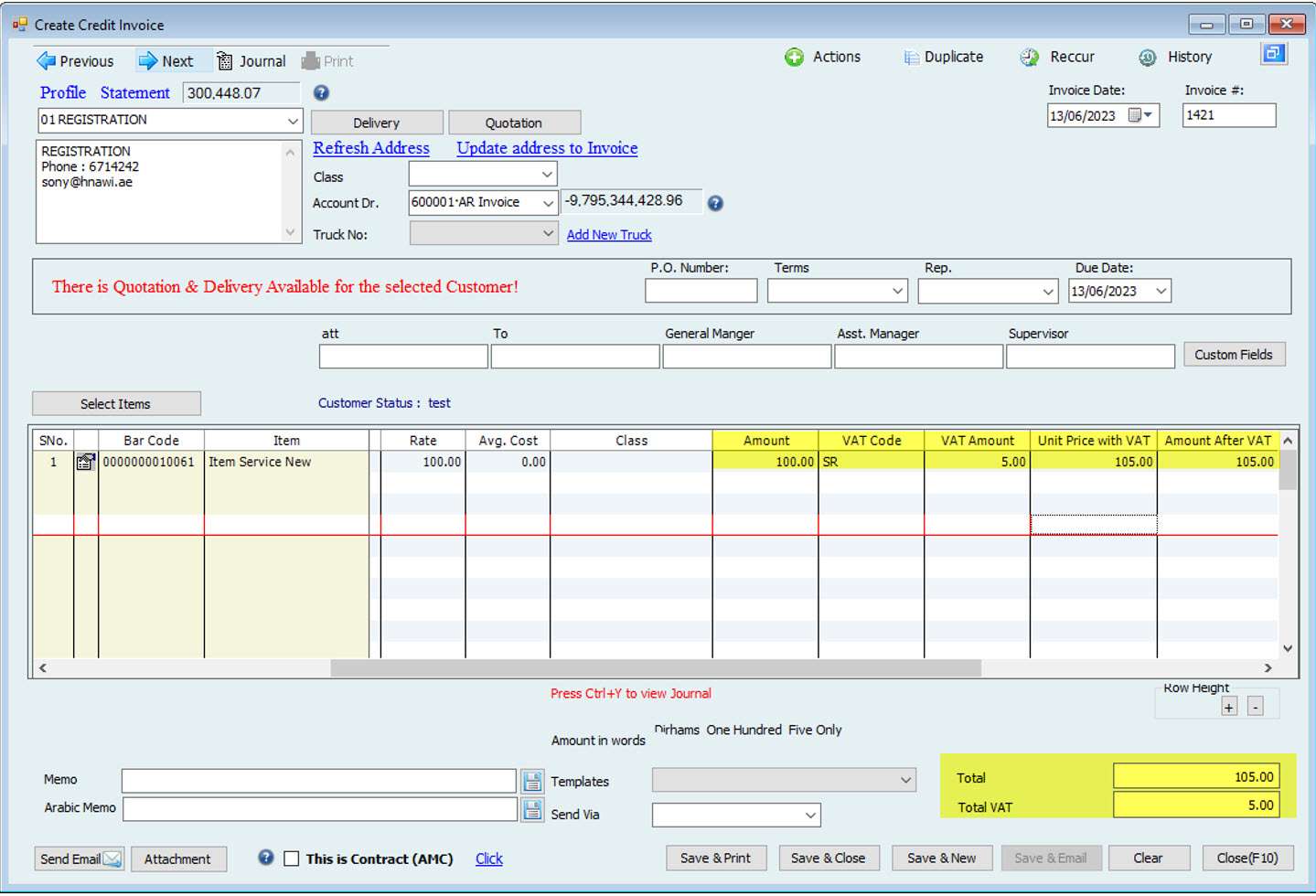

When managing deliveries and payment options, users can create, modify, print, or cancel payment documents and invoices—cash or credit. Credit invoices can be linked to payment vouchers (RV), journal vouchers (JV), or credit memos and even imported using the Import Credit Memo Invoice function, ensuring every transaction reflects accurately in the balance sheet.

Additionally, the system supports creating and managing credit memos, enabling users to handle returns or pricing adjustments efficiently.

For businesses focusing on performance-based pay, the built-in commission management feature lets users create, edit, approve, and pay commissions to employees or non-employees, helping to align your marketing and sales software efforts.

By integrating inventory data, sales, and payments, Hinawi ERP strengthens inventory controls, supports effective inventory management, and enhances customer satisfaction through real-time access and accurate updates. Whether managing inventories, checking stock in multiple stores, or evaluating days of outstanding sales, this workflow empowers businesses to make smarter decisions, optimize operations, and deliver exceptional service.

How Hinawi ERP Simplifies the Purchase Process

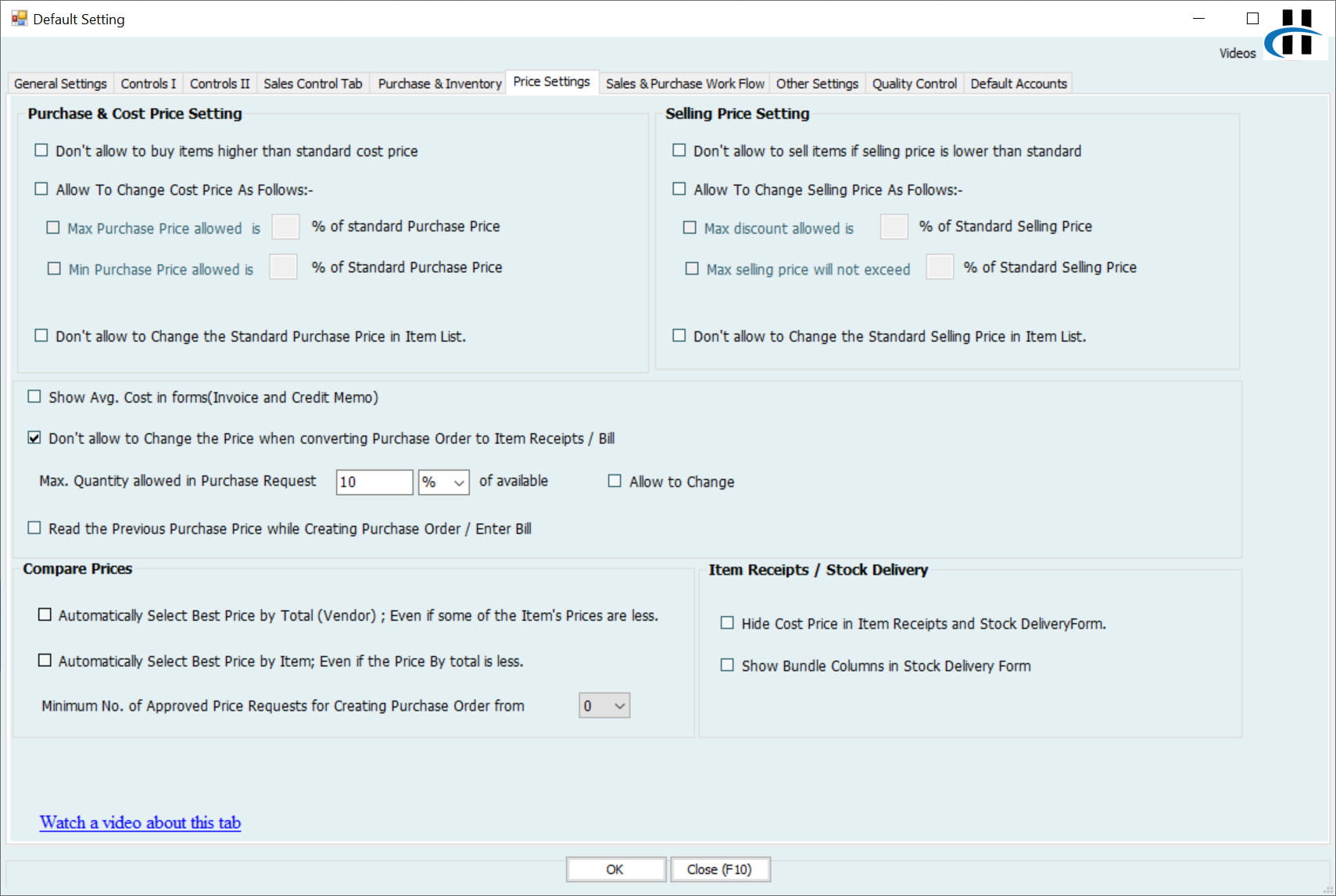

The purchasing workflow in Hinawi ERP’s accounting module is designed to streamline business processes and empower companies to make accurate, data-driven purchasing decisions regarding materials and services while maintaining real-time visibility over inventory levels, item prices, and vendor performance.

The process begins with creating a material or service request, clearly outlining the needed items or services for a specific project or transaction. Each request can be edited to ensure accuracy and must be approved by an authorized user before proceeding. If revisions or cancellation are required, the request is returned to the originator. Users can also print, share, or void requests when needed, keeping all inventory management processes aligned and documented.

To evaluate pricing, users can generate a vendor price request, which can be sent to one or more suppliers. This step facilitates easy comparison of item prices, helping the company select the best value. Vendors’ responses can be reviewed through a comparison sheet, and the most suitable price can be approved for the next stage. Approved price quotes can be printed or canceled as needed, with full tracking of all vendor contact information.

Once a vendor and price are selected, a purchase order (PO) is created to initiate the purchase order process. Users may modify the purchase order, and it requires final approval before execution. Upon fulfillment, the PO can be marked as closed, printed, or voided. Each purchase order creation directly affects the inventory items purchased, ensuring accurate stock levels and integration with the broader inventory management system.

As goods or services are delivered, users issue an item receipt to record and confirm receipt of materials. This receipt supports real-time inventory sync, automatically updating inventory quantities and preparing the company for financial posting. Each receipt can be modified, printed, shared, or voided as needed.

Following delivery, a vendor bill is generated, detailing the purchased inventory items or services and their costs. Bills are editable, printable, and can be voided if canceled. Users can also link the bill to a payment voucher (PV), journal voucher (JV), or a credit bill, supporting both cash and credit purchase options. Upon posting, the balance sheet is updated immediately to reflect the inventory costs of items purchased, ensuring accounting and real-time inventory reports remain consistent.

In addition, freight costs and any other related charges can be allocated directly to the cost of the items, giving a full and accurate valuation of the product inventory. This detail helps maintain tight control over inventory purchases, optimize stock levels across stores, and reduce overstocking or stockouts.

From purchase order management to receiving goods and making payments to vendors, Hinawi ERP offers a fully integrated solution that supports transparency, audit readiness, and efficient procurement operations—keeping your inventory, stock, and analytics accurate, up to date, and aligned with your strategic goals.

Understanding Payment Types: Cash, Cheque, and Bank Transfer

In today’s fast-paced financial landscape, efficient payment management is essential for businesses and individuals alike, with core methods such as cash payments, cheques, and bank transfers forming the backbone of daily financial transactions; systems like Hinawi ERP streamline these processes by enabling the issuance of customizable payment vouchers in multiple languages, managing post-dated and guarantee cheques, and automating the posting of payments—either instantly or upon approval—while offering detailed financial reports and easy document printing. The beneficiary could be a customer or vendor. Hinawi ERP offers solutions for smooth business operations, providing reliable proof of payment and addressing issues such as insufficient funds.

Cash payments remain one of the most straightforward and universally accepted methods of payment worldwide, especially for day-to-day transactions, as they involve the direct exchange of physical money or national currency within the Hinawi ERP system, these transactions are efficiently managed through a detailed cash voucher system that ensures accurate recording and enhances financial transparency for both businesses and customers; despite its traditional nature, cash usage faces limitations such as risks of theft, physical storage requirements, and impracticality of handling large sums due to setup limits, which is why many businesses are gradually shifting toward cashless payment solutions, yet cash continues to play a vital role as an essential payment method, and Hinawi ERP ensures that all cash transactions are recorded precisely to maintain clarity and control in every step of the process. The amounts of cash can be limited based on the setup.

Cheques have been a cornerstone of non-cash transactions, especially in scenarios requiring a paper trail or involving large amounts. This method involves writing a cheque from a bank account to pay a specified amount to a specified entity or person.

However, cheques are becoming less popular as they can be subject to insufficient funds and long clearing times and are increasingly considered outdated due to the rise of digital alternatives. Hinawi ERP manages these transactions by efficiently tracking the cheque clearing cycle and handling events such as cancellation or replacement if needed. Business owners or accountants can check the bank statement.

Bank transfers provide a seamless option for those who prefer electronic payments, facilitating money transfers across various countries with differing rates. Hinawi ERP integrates bank transfers with detailed vouchers to ensure every transaction is accurately recorded in the relevant bank accounts, no matter the business day. This practice enhances the reliability and accuracy of financial records, ensuring efficient bank transfers and the Transfer of money. Payees and payers should be aware of potential service charges and additional charges that may apply, especially when interacting with a beneficiary bank. Customer satisfaction is a priority, as seamless transactions can be managed through one’s bank branch or online transactions. Whether dealing with transaction fees for current accounts or navigating international transfers, Hinawi ERP aids in minimizing payment processing fees while ensuring the timely arrival of funds. In the digital age, bank transfers have emerged as the predominant payment method because they are efficient and secure. They allow direct electronically authorized payments between bank accounts. Transfers could be local or international by online payment through the service provider.

💼 Key Features of Payment Vouchers

Payment vouchers within the Hinawi ERP document financial transactions with precision. They include two main sections:

Credit Side: Found at the top, representing money leaving cash or bank accounts.

Debit Side: Located at the bottom, recording entries related to expenses, materials, or assets.

These vouchers can be customized for printing in Arabic or English, with numbering sequences adjusted to fit an organization’s specific needs.

🧾 Managing Post-Dated and Guarantee Cheques

Post-dated cheques require meticulous monitoring to maintain accurate financial management. Hinawi ERP’s reporting tools help organizations track these cheques effectively. Guarantee cheques are logged for record-keeping but do not affect financial accounts until their intended purpose is fulfilled, preserving clear financial records.

⚙️ Flexible Settings

Hinawi ERP allows users to tailor their payment handling practices by combining all vouchers into a single sequence or creating distinct sequences for each type. This flexibility enables organizations to customize processing methods to meet operational needs.

🔁 Posting Methods

Hinawi ERP offers two posting methods:

Automatic Posting: Immediately records transactions in accounts for swift processing.

Manual Posting: Approve and determine when transactions are recorded, offering enhanced control over financial operations.

📈 Final Note

Through these adaptable tools, Hinawi ERP supports organizations in managing financial systems effectively, improving efficiency and accountability for cash, cheque, and bank transfer.

Understanding Collection Types: Cash, Cheque, Bank Transfer, and Credit Card

The accounting system in the Hinawi ERP provides four types of receipts: cash, cheques, bank transfers, and credit cards.

Receipts are recorded through a receipt voucher form, with an immediate or deferred financial impact depending on the posting settings. The system also manages post-dated cheques, settlements, and guarantee cheques that do not have a direct financial effect.

It offers detailed reporting and flexible numbering and sequencing settings for efficient receipt management.

A single receipt can be issued for all four types of payments.

Cash payments remain one of the most straightforward and universally accepted methods of payment worldwide, especially for day-to-day transactions, as they involve the direct exchange of physical money or national currency within the Hinawi ERP system, these transactions are efficiently managed through a detailed cash voucher system that ensures accurate recording and enhances financial transparency for both businesses and customers; despite its traditional nature, cash usage faces limitations such as risks of theft, physical storage requirements, and impracticality of handling large sums due to setup limits, which is why many businesses are gradually shifting toward cashless payment solutions, yet cash continues to play a vital role as an essential payment method, and Hinawi ERP ensures that all cash transactions are recorded precisely to maintain clarity and control in every step of the process. The amounts of cash can be limited based on the setup.

The system processes cheques instantly, allowing users to specify whether the cheque is dated today or post-dated. Post-dated cheques are automatically recorded under “Cheques Under Collection”, with due dates and statuses tracked through dedicated reports like the “Post-Dated Cheques Report,” which shows whether the cheque has been cleared, returned, or replaced. This feature ensures no cheque is forgotten and simplifies bank reconciliation.

Once a bank transfer is confirmed, the receipt is recorded in the system and linked to the appropriate bank account. The transfer can also be associated with a specific invoice or customer account. Hinawi ERP supports managing multiple bank accounts, enabling smooth local and international transaction processing.

Hinawi ERP supports recording credit card receipts immediately. These payments can be routed to intermediary or temporary settlement accounts, facilitating later bank reconciliation.

📄 Receipt Voucher Form:

The receipt voucher in Hinawi ERP is flexible and customizable. It includes customer name, invoice number, payment method, amount, linked accounts, and any additional comments. If automatic posting is enabled, the accounting entry is posted immediately to the general ledger. Alternatively, in manual posting mode, the accountant must review and post the transaction manually. The voucher layout can be printed in both Arabic and English and customized to fit the company’s branding.

🧾 Post-Dated Cheques Handling:

When a post-dated cheque is received, it is recorded under “Cheques Under Collection” and remains there until its due date. Once cleared, it is automatically moved to the designated bank account. If the cheque is replaced or canceled, a financial adjustment is recorded in the system without impacting the accounts until final settlement is complete. Hinawi ERP also allows auto-alerts for cheques due within a selected period, ensuring proactive financial management.

🛡️ Guarantee Cheques:

Guarantee cheques are logged for record-keeping but do not affect financial records. These cheques are held as security and are returned to the customer once their purpose—such as completing a contract or project—is fulfilled. The system provides specific reports for tracking guarantee cheque statuses and expiry dates.

⚙️ Receipts Settings:

Hinawi ERP offers full flexibility in managing numbering and sequencing for all types of receipts. Businesses can apply a unified numbering system or assign separate sequences for each type (cash, cheque, bank transfer, credit card). User-level or department-level permissions can also be configured for input and approval processes, reinforcing internal control.

📊 Reports:

The system includes a comprehensive set of reports covering all types of receipts, with advanced filters for date, customer, payment method, bank account, or user. Notable reports include:

Post-Dated Cheques Report

Customer Receipt Summary

Daily Cash Receipts Report

Returned Cheques Report

Guarantee Cheques Report

All reports can be exported to Excel and are valuable for analyzing cash flow and supporting financial decision-making.

Manufacturing Process

The accounting module streamlines manufacturing by setting up default accounts and tracking materials, labor, and operational costs. Job orders are created to manage production, and materials are issued via Stock Issue Vouchers. The system ensures transparency and accuracy in tracking the entire production process.

Accounts Receivable

When a credit invoice is issued, its financial impact is automatically recorded as a debit to Accounts Receivable. Once the invoice is paid, the system automatically credits the same account; the accountant does not need to make manual entries.

Accounts Payable

Accounts Payable is credited when suppliers provide materials or goods, accurately reflecting the company’s liabilities in cost accounting or inventory. Once the bill is paid, the system automatically updates the account by crediting it, eliminating does not need for the accountant to enter transactions manually.

Posting and Reconcile Cheques Issued

The system manages issued cheques and post-dated cheques (PDCs). Features such as cheque reconciliation and correction of canceled cheques ensure accuracy. Integration with Journal Vouchers helps maintain reliable accounting records for post-dated transactions.

Posting and Reconciling Cheques Received

The system manages received cheques and post-dated cheques (CUCs). Features such as cheque reconciliation and correction of canceled cheques ensure accuracy. Integration with Journal Vouchers helps maintain reliable accounting records for post-dated transactions.

Defining and Tracking Warehouses

The system can create and manage an unlimited number of warehouses. Each warehouse is defined with specific information, such as name, location, and settings. Furthermore, each item can be assigned to a particular warehouse or multiple warehouses, allowing for tracking available quantities in each warehouse separately.

Journal Entries

Hinawi ERP provides tools for managing general journal vouchers, including creating, editing, and importing vouchers. Users can handle prepaid expenses and recurring transactions, while features like Reverse Advance Payment and Overhead Cost Allocation ensure accurate financial tracking and management.

Reports

Hinawi ERP’s accounting system offers a wide range of reports for accurate transaction tracking and insights into financial performance. Key reports include Payment and Receipts, Customer and Sales, Creditors and Purchases, and Inventory and Manufacturing Management. These tools help organizations assess their financial health and operational efficiency.

The system also provides Legal and Tax Reports for regulatory compliance and essential financial statements like balance sheets and profit and loss statements, which are vital for strategic decision-making. Companies can customize reports and use advanced search features for efficient data retrieval.

Additionally, Hinawi ERP allows data export to Excel for easier information manipulation and presentation, with reporting available in both Arabic and English to support multilingual environments.

Reminder Lists

The accounting module in Hinawi ERP includes reminders for crucial tasks such as cheque management, unpaid quotes and invoices, inventory levels, and commercial license expiration for customers and suppliers. These reminders can be sent to the company’s email to improve task management and ensure compliance.

Missing Data Information

Managing shortfalls in the financial accounting system in Hinawi ERP includes identifying accounts that require review to correct any discrepancies and tracking missing information related to debtors and creditors to ensure accuracy in account management.

It also involves identifying gaps or shortfalls in sales prices or costs to ensure compliance with accounting policies and monitoring shortfalls or errors in reconciling incoming and outgoing cheques to ensure the integrity of financial operations.

Request a Demo

The customer can view a demo of the software via Zoom or request to use the system. To schedule a software demo, the customer can complete the form using the following link. The customer Can Also visit our Office in Abu Dhabi, United Arab Emirates.

A system demonstration can be arranged by contacting the mobile or WhatsApp number +971506228024

Accounting Concepts

Accounting Period

An accounting period is a designated time frame during which a company records and reports its financial transactions.

This period can be set monthly, quarterly, or annually, depending on the company’s preferences. At the end of each period, financial statements are generated to evaluate key aspects like profit, cash flow, and overall financial position, ensuring organized and consistent financial management.

Cash Accounting Method

Cash accounting records financial transactions only when cash is received or paid. This method is simple and provides a clear view of cash flow, making it ideal for small businesses or those seeking straightforward cash management.

However, it doesn’t reflect outstanding receivables or payables, limiting visibility into a company’s overall financial obligations.

Accrual Accounting Method

Accrual accounting records revenues and expenses when they are incurred, regardless of when cash is exchanged. This method offers a more comprehensive view of a company’s financial health, helping to track liabilities, manage budgets, and forecast future cash flows. It best suits larger businesses with complex operations and long-term financial planning needs.

Frequently Asked Questions about the Accounting Module

Accounting can be challenging for some, especially when dealing with complexfinancial rules and regulations. However, with proper study, practice, and tools, it becomes manageable and rewarding.

An accountant manages financial records, prepares tax returns, audits, and ensures the accuracy of financial transactions. They also help businesses make informed financial decisions.

Accounting refers to the process of recording, summarizing, and analyzing financial transactions. It helps organizations track their financial health and comply with legal obligations

Accounting involves basic math like addition, subtraction, multiplication, and division. More advanced calculations may involve percentages and ratios, but the main focus is understanding financial principles and regulations.

The acounting module in Hinawi ERP is a comprehensive system designed to document and record all financial transactions, catering to businesses of all sizes and industries.

The module offers comprehensive integration, multi-language support, custom access permissions, high data security, and technical support to ensure efficient financial management.

It provides tools to manage payments, receipts, sales, purchases, manufacturing, and inventory, ensuring a smooth and efficient financial workflow.

Payments can be handled in various forms, such as cash, cheques, bank transfers, and issued guarantee cheques.

he system supports recording cash receipts, cheques, bank transfers, and credit card payments, providing flexibility in transaction management.

The sales cycle begins with customer inquiries, creating price quotes, managing contracts, issuing delivery notes, converting them into sales invoices, and handling credit memos for returned goods.

The system allows for commission management, including creating, editing, approving, and tracking commissions for sales representatives, ensuring smooth commission payouts.

The purchase cycle involves requesting materials, generating price quotes, issuing purchase orders, registering received items, and handling debit memos for returned goods.

Manufacturing is managed by creating work orders, tracking the production process, and registering finished products to ensure accurate cost tracking.

The accounting module tracks incoming and outgoing goods, organizes items in warehouses, and calculates the cost of goods using the average cost method.

The system provides reminders for cheques (issued, incoming, and deferred), unpaid price quotes, low inventory levels, delivery dates, and the expiration of commercial licenses.

The system offers full customization through general settings, mandatory requirements, and user access settings to ensure alignment with company-specific policies.

It integrates with modules like fixed assets, human resources, real estate management, school management, and car garage management, providing a comprehensive solution.

The module provides advanced data security to protect sensitive information, including automatic backups and custom access permissions.

Discover the secrets of Hinawi Software and gain new skills through exciting YouTube videos! Learn how to improve your performance as a user of the software, master accounting and payroll management operations, and get ready for a promising future as a university student. Click here to find out more: [Videos Link]