E-Invoicing Saudi Arabia | How Hinawi ERP Ensures Full ZATCA Compliance

E-Invoicing Saudi Arabia is a key regulatory requirement for businesses operating under ZATCA regulations.

This article explains how E-Invoicing Saudi Arabia is implemented and managed using Hinawi ERP.

E-Invoicing Saudi Arabia is a mandatory regulatory requirement for companies operating in the Kingdom.

Under Saudi e-invoicing rules, businesses are required to issue electronic invoices in a structured format, apply accurate tax calculations, and maintain secure invoice records. Hinawi ERP enables organizations to meet these requirements by integrating electronic invoicing directly with the accounting system.

Hinawi ERP simplifies compliance with E-Invoicing Saudi Arabia through built-in automation and accounting integration.

The system fully supports both Phase 1 and Phase 2 requirements, including invoice generation, reporting, secure storage, and regulated data transmission, ensuring full compliance with Saudi e-invoicing standards.

Businesses seeking long-term compliance with E-Invoicing Saudi Arabia can rely on Hinawi ERP as a secure ERP solution.

Hinawi ERP helps companies achieve full compliance with E-Invoicing Saudi Arabia through automation and system integration.

Benefits of Using Hinawi ERP for E-Invoicing in Saudi Arabia

Full compliance with ZATCA regulations

Automated e-invoice generation and reporting

Seamless integration with accounting and ERP modules

Secure data handling and audit-ready records

Arabic and English language support

Learn more about ZATCA requirements from the official authority:

https://zatca.gov.sa

It’s integrated with the Accounting Module in Hinawi ERP

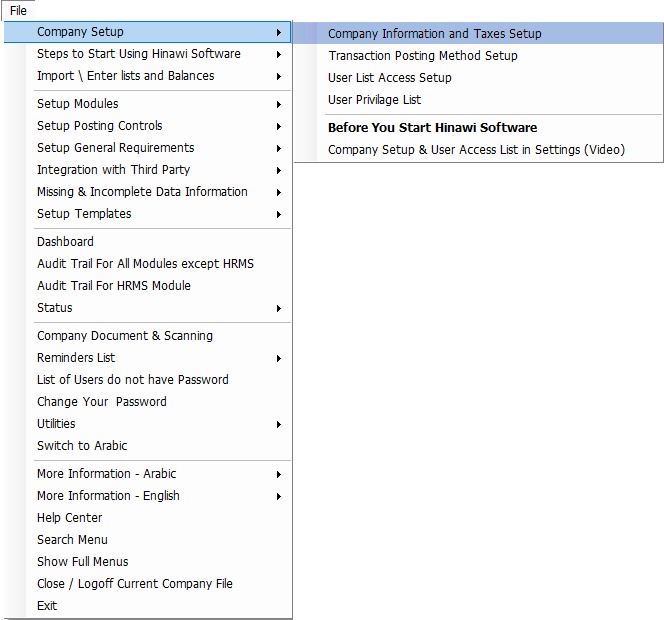

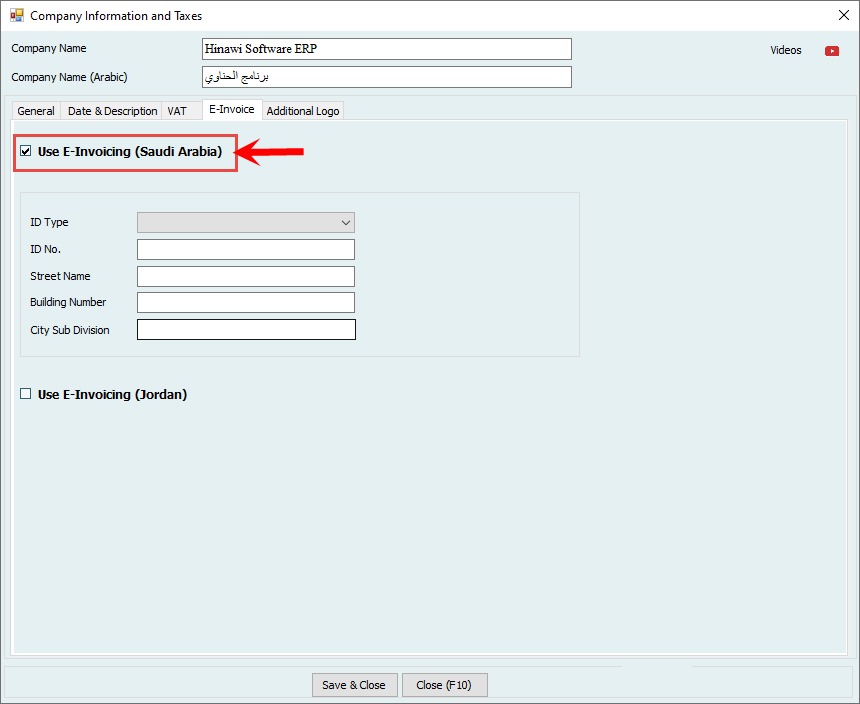

- Set Up for ZATA E-Invoice (Should be Configured by the Hinawi Software Team)

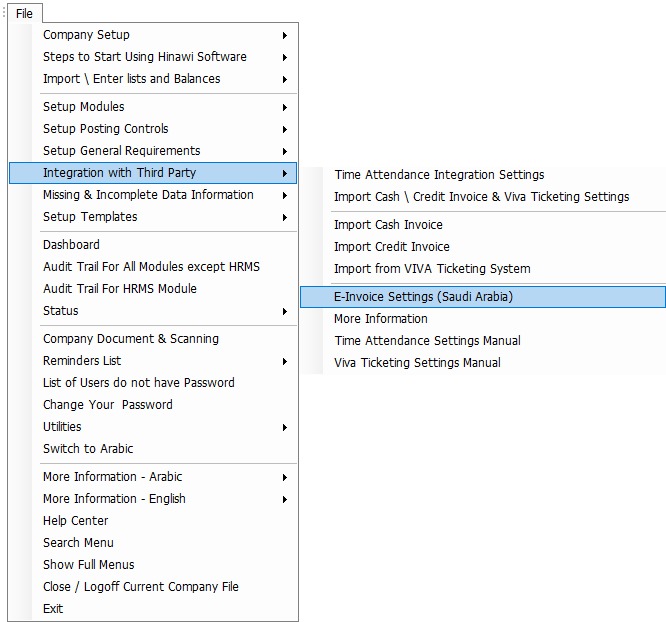

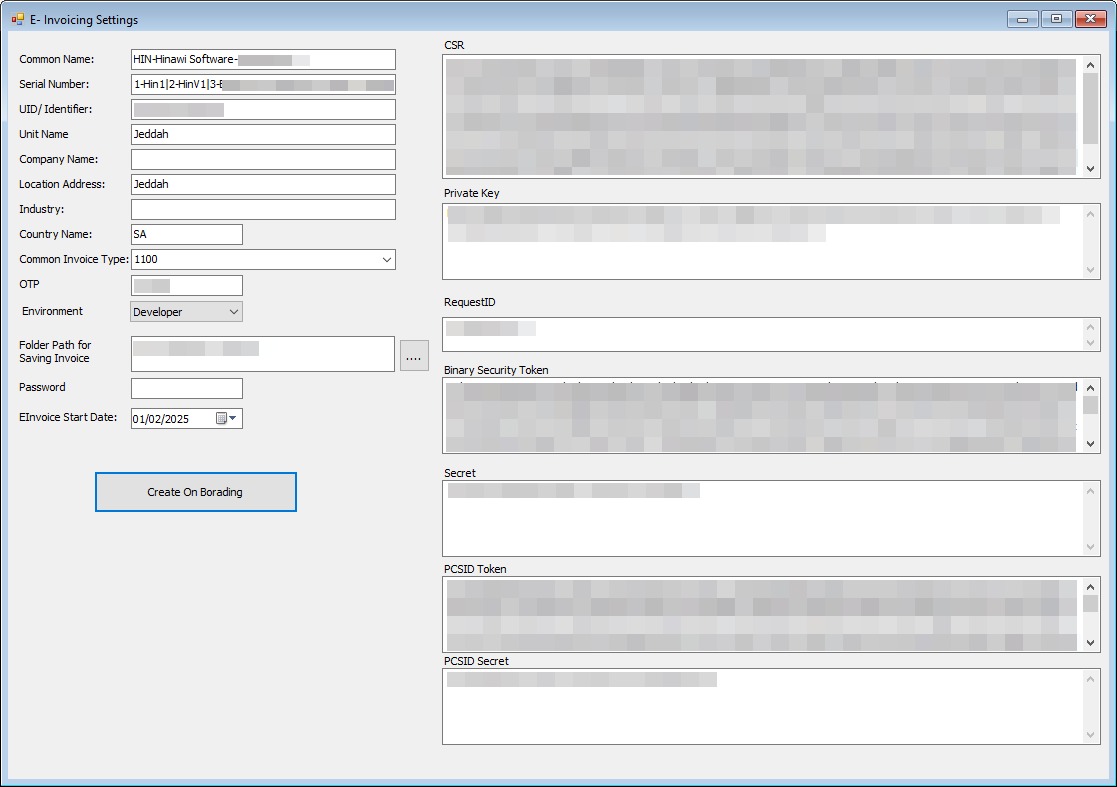

- E-Invoice Settings. This Should be Configured by the Hinawi Software Team. E-Invoicing Saudi Arabia and ZATCA Compliance

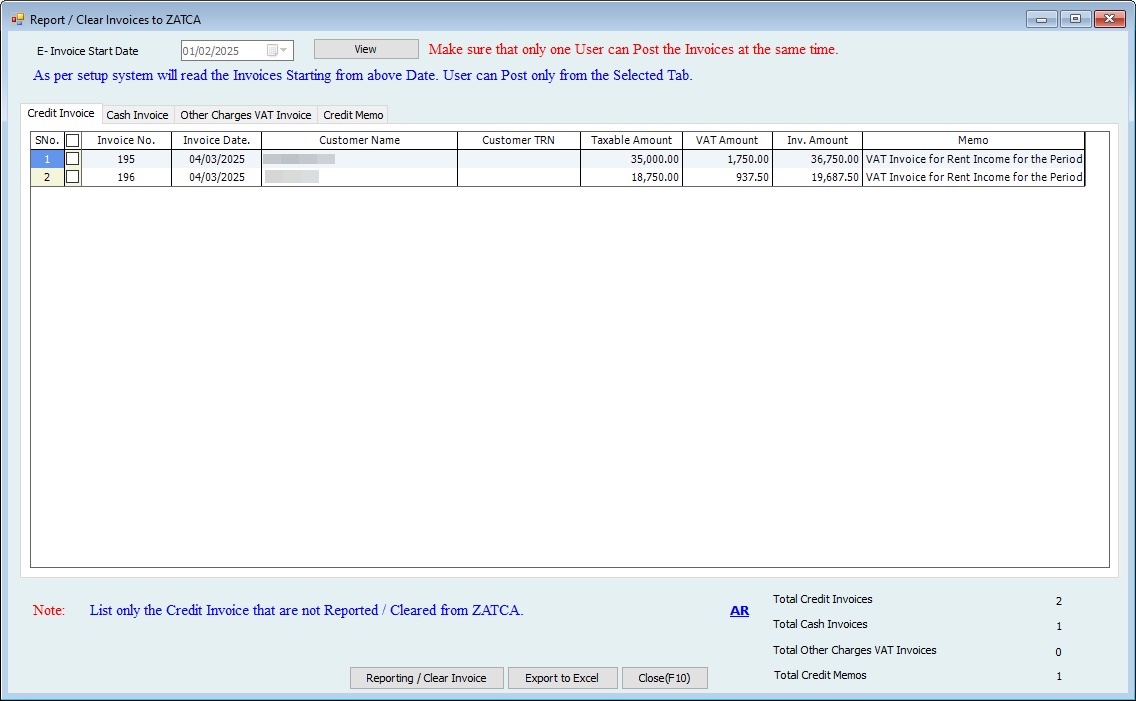

The system will read the Invoices, Sales Receipts, Credit Memos, and Real Estate Lease Agreement Invoices from the E-Invoice Start Date.

Important:

Explorer Computer Sole Proprietorship L.L.C. will do this setting.

Users must not modify the settings.

If any changes are needed, please contact the Hinawi Software Customer Support team.

Remember: E-Invoicing Saudi Arabia and ZATCA Compliance.

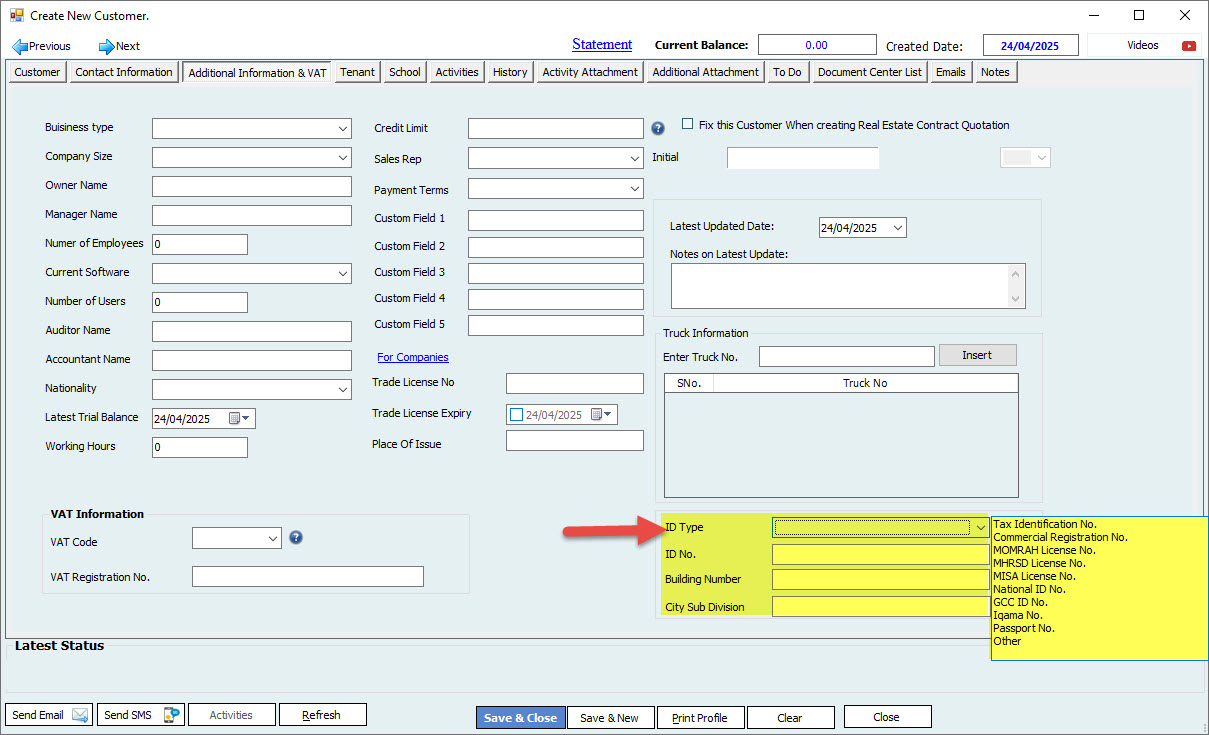

- Customer Information

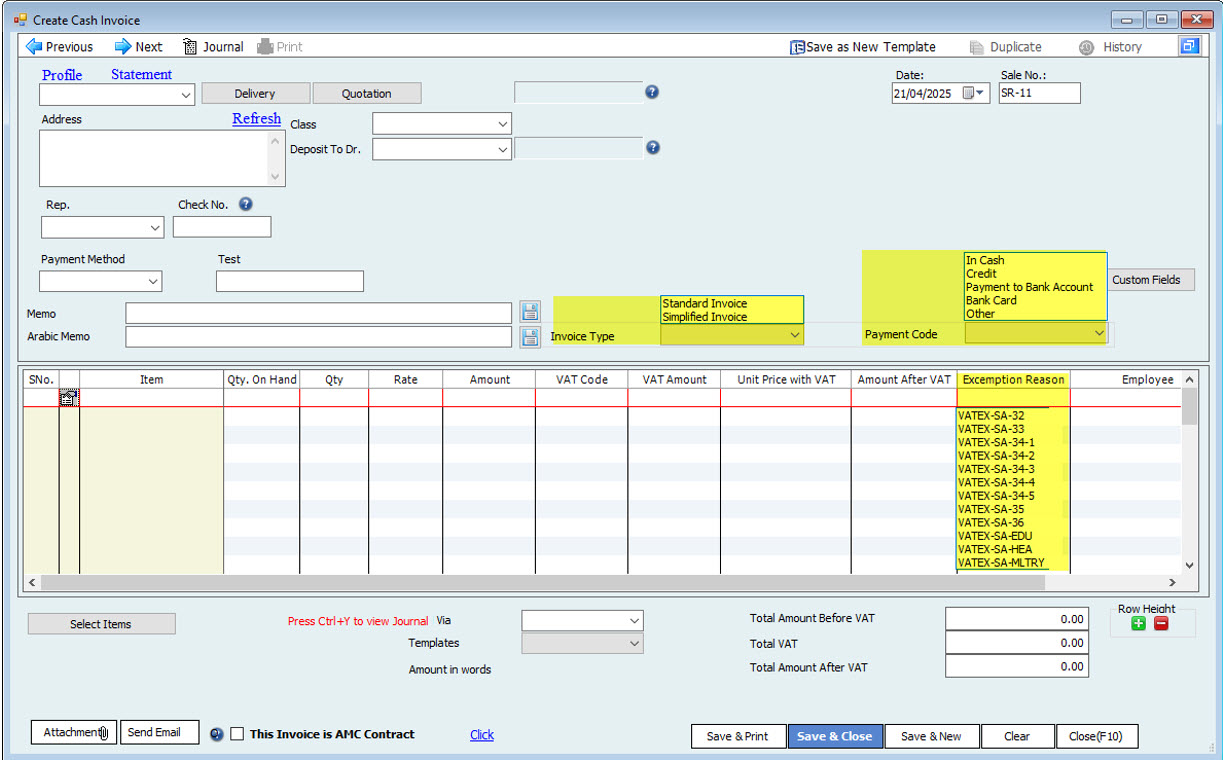

- Invoice Screens

Cash InvoiceIn the Cash Invoice, we have two extra fields that are mandatory

Invoice Type

Standard Invoice

Simplified Invoice

Payment Code

In Cash

Credit

Payment to Bank Account

Bank Card

Other

Exemption Reason (Mandatory if VAT Code is Zero or Exempted)

VATEX-SA-32

VATX-SA-33…

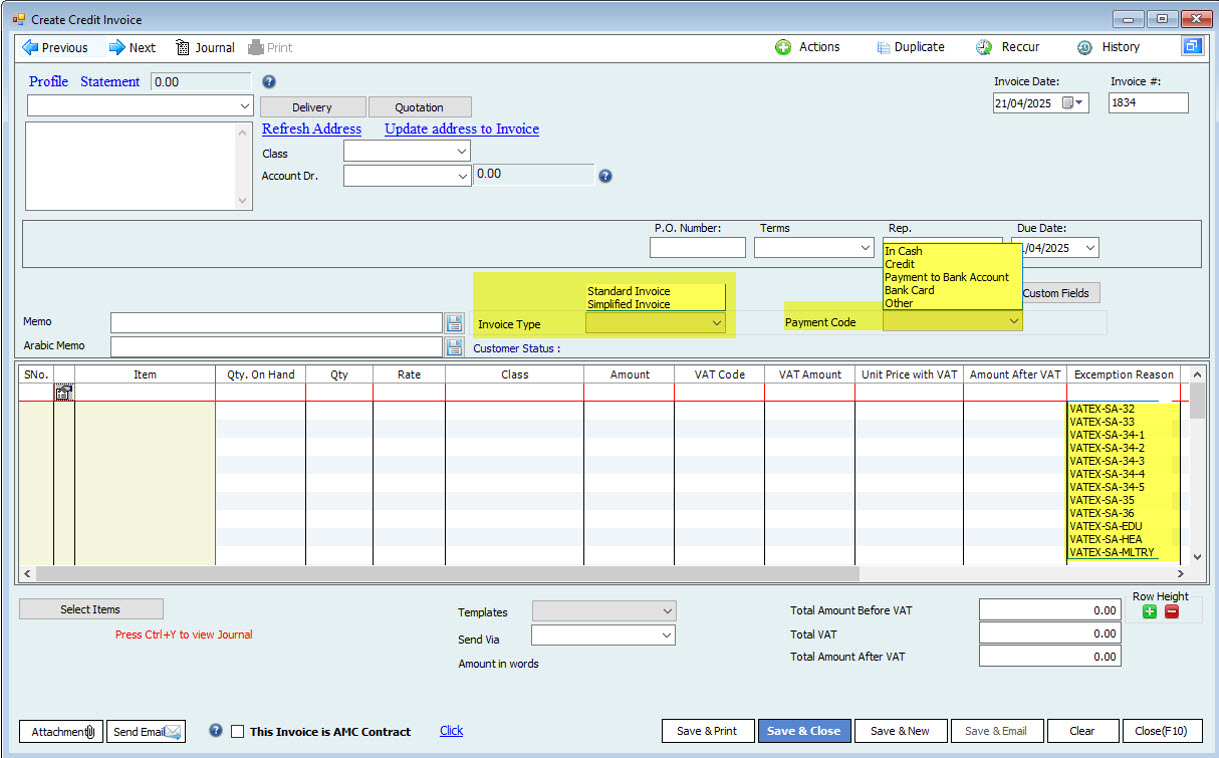

Credit Invoice

In the Credit Invoice Invoice, we have two extra mandatory fields

Invoice Type

Standard Invoice

Simplified Invoice

Payment Code

In Cash

Credit

Payment to Bank Account

Bank Card

Other

Exemption Reason (Mandatory if VAT Code is Zero or Exempted)

VATEX-SA-32

VATX-SA-33…

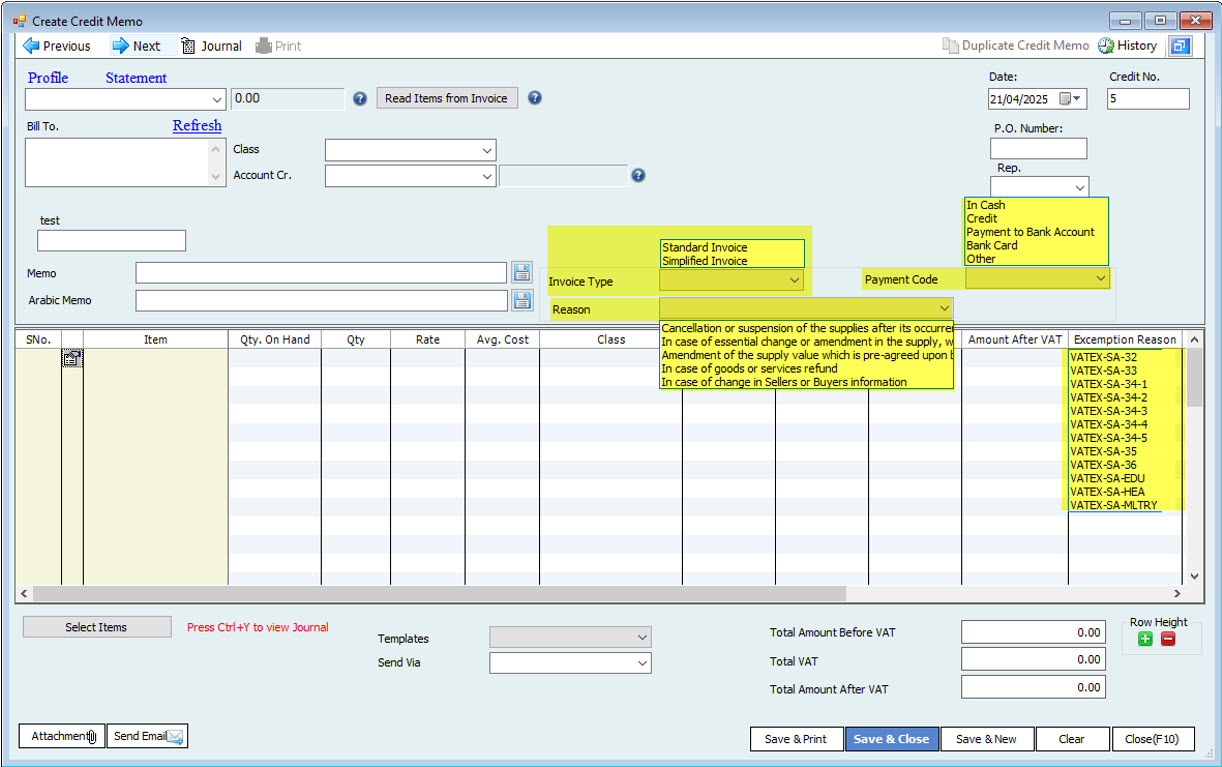

Credit Memo

In Credit Memo, selecting a cash Invoice or a Credit Invoice is mandatory.

In the Credit Memo, we have three extra fields that are mandatory

Invoice Type

Standard Invoice

Simplified Invoice

Payment Code

In Cash

Credit

Payment to Bank Account

Bank Card

Other

Reason (Reason for Return)

In Case of Goods or Services refund

In Case of a change in Seller or Buyer Information….

Exemption Reason (Mandatory if VAT Code is Zero or Exempted)

VATEX-SA-32

VATX-SA-33…

- Reporting Invoices to ZATCA Portal (User Screen for Posting)

The system will display all Invoices, Sales Receipts, Credit Memos, and Real Estate Lease Agreement Invoices from the E-Invoice Start Date.

The user will tick the Invoices and click Report / Clear Invoices.

compliant with ZATCA requirements, enabling seamless e-invoice reporting, tax compliance, and ERP integration.

Why E-Invoicing Saudi Arabia Compliance Matters

Compliance with E-Invoicing in Saudi Arabia is not optional. The Saudi ZATCA regulations require companies to issue, store, and report electronic invoices in a specific, structured format. Non-compliance may lead to penalties, operational disruptions, and audit risks.

Hinawi ERP is designed to support Saudi businesses by automating invoice generation, ensuring correct tax calculations, maintaining secure invoice records, and supporting future ZATCA integration phases. This allows finance teams to focus on accuracy and business growth instead of regulatory complexity.

For official regulations, refer to the ZATCA E-Invoicing guidelines:

https://zatca.gov.sa